The Alabama Plan of Complete Liquidation and Dissolution refers to a legal process followed by a company or organization in Alabama to wind up its affairs, sell its assets, pay off debts, distribute remaining assets to shareholders or owners, and finally dissolve the entity. This plan outlines the steps and procedures to be followed during this process, ensuring a smooth and orderly liquidation. Key terms and concepts associated with the Alabama Plan of Complete Liquidation and Dissolution include: 1. Liquidation: The process of converting a company's assets into cash to pay off any outstanding debts or obligations. This includes selling off assets such as properties, equipment, inventory, or stocks. 2. Dissolution: The formal legal termination of a company or organization's existence. Once all assets are liquidated, debts are settled, and remaining assets are distributed, the entity ceases to exist legally. 3. Shareholders: Individuals or entities who own shares or stock in a company. In the liquidation process, the remaining assets may be distributed among shareholders based on their ownership percentages. 4. Debts and Obligations: Any outstanding financial liabilities, such as loans, unpaid invoices, employee wages, or taxes, that need to be settled during the liquidation process. 5. Allocation of Assets: The distribution of remaining assets to creditors and shareholders, following a predetermined priority order. Creditors with secured claims are typically paid first, followed by unsecured creditors and shareholders. 6. Articles of Dissolution: A legal document filed with the Alabama Secretary of State's office to formally dissolve a company or organization. It includes information about the company, its officers, and the reason for dissolution. 7. Notice to Creditors: A requirement to inform all known creditors about the liquidation and dissolution process, giving them an opportunity to submit any outstanding claims before the final distribution of assets. Different types or variations of the Alabama Plan of Complete Liquidation and Dissolution may exist depending on the nature of the business, size of the organization, or specific circumstances. Some common variations may include: 1. Voluntary Liquidation: This occurs when the company's directors or shareholders make a conscious decision to initiate the liquidation process and wind up the affairs voluntarily. 2. Involuntary Liquidation: In some cases, a company may be forced into liquidation by external parties, such as a court order or a creditor's petition, due to insolvency or other legal issues. 3. Members' Voluntary Liquidation: This type of liquidation is initiated when the members or shareholders of a solvent company decide to wind up the business, usually because they have achieved their goals or want to retire. 4. Creditors' Voluntary Liquidation: When a company is unable to pay its debts as they become due, the creditors may initiate this type of liquidation, aiming to maximize the recovery of their outstanding debts. It is essential for companies or organizations in Alabama considering the Plan of Complete Liquidation and Dissolution to seek professional advice from legal and financial experts to ensure compliance with the relevant laws and regulations.

Alabama Plan of complete liquidation and dissolution

Description

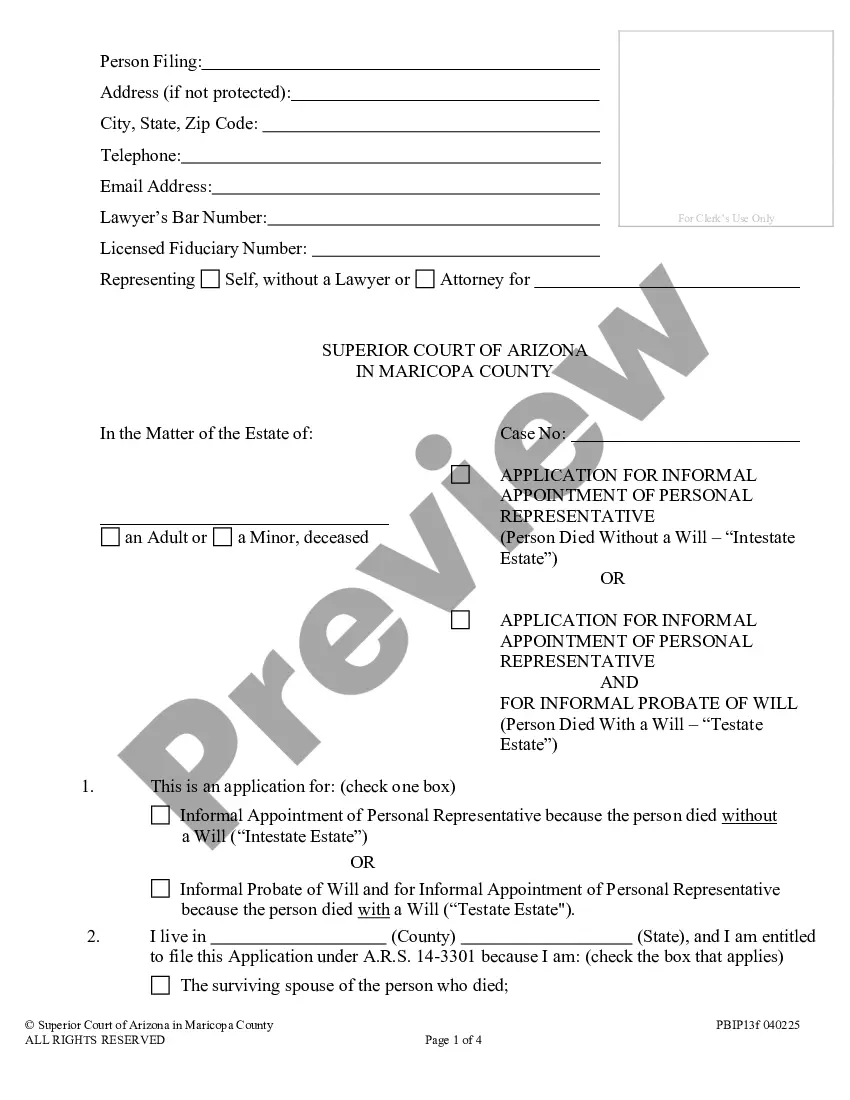

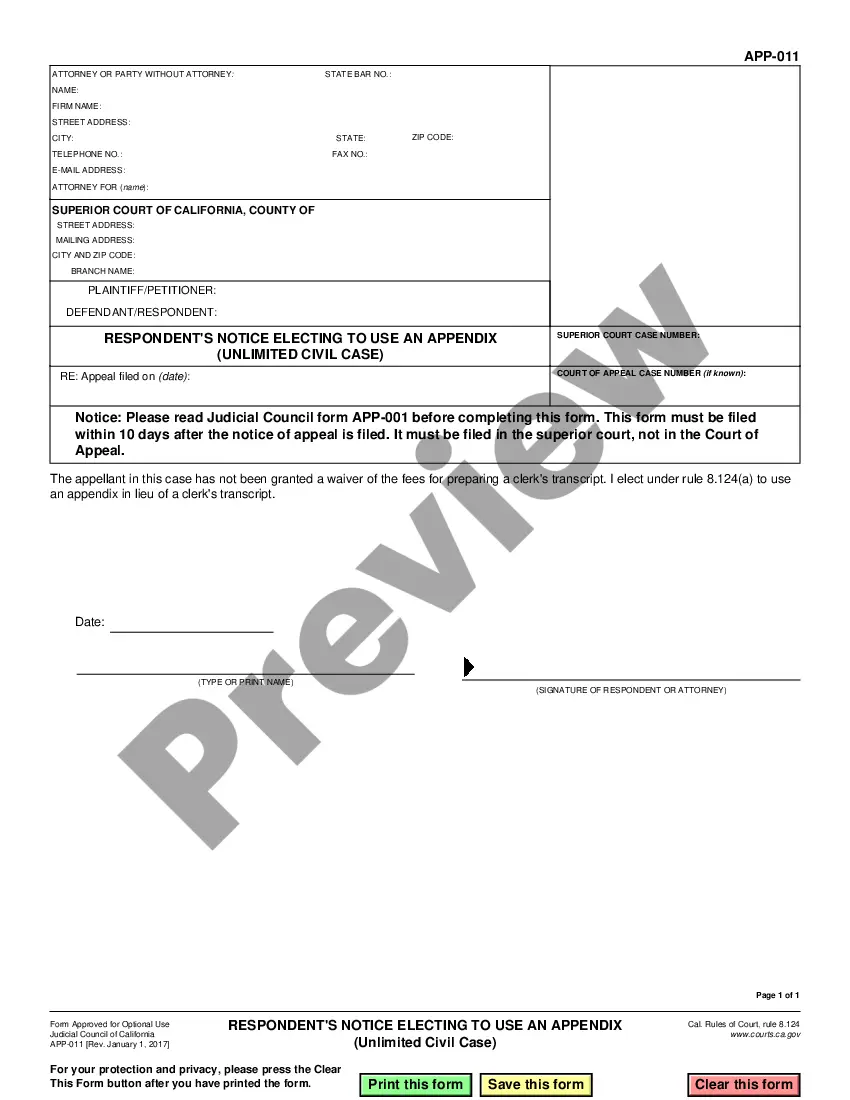

How to fill out Alabama Plan Of Complete Liquidation And Dissolution?

If you have to full, acquire, or print legitimate file layouts, use US Legal Forms, the greatest variety of legitimate forms, which can be found on the Internet. Make use of the site`s basic and practical research to find the files you need. Numerous layouts for enterprise and person purposes are categorized by types and states, or search phrases. Use US Legal Forms to find the Alabama Plan of complete liquidation and dissolution with a handful of clicks.

If you are currently a US Legal Forms buyer, log in in your account and click the Download key to find the Alabama Plan of complete liquidation and dissolution. Also you can accessibility forms you previously delivered electronically within the My Forms tab of your own account.

If you use US Legal Forms the first time, follow the instructions below:

- Step 1. Ensure you have selected the shape for the proper town/region.

- Step 2. Use the Review choice to look through the form`s content material. Never neglect to read through the description.

- Step 3. If you are unsatisfied together with the kind, take advantage of the Lookup discipline towards the top of the screen to get other types of the legitimate kind template.

- Step 4. Once you have discovered the shape you need, select the Get now key. Choose the pricing strategy you favor and put your references to register for the account.

- Step 5. Method the purchase. You can utilize your credit card or PayPal account to finish the purchase.

- Step 6. Choose the file format of the legitimate kind and acquire it on your gadget.

- Step 7. Full, change and print or indication the Alabama Plan of complete liquidation and dissolution.

Each legitimate file template you buy is the one you have permanently. You possess acces to each and every kind you delivered electronically with your acccount. Click on the My Forms portion and pick a kind to print or acquire once more.

Remain competitive and acquire, and print the Alabama Plan of complete liquidation and dissolution with US Legal Forms. There are thousands of professional and express-particular forms you can use for the enterprise or person needs.

Form popularity

FAQ

Complete Articles of Dissolutions Form based on the entity type. Follow the instructions on the form pertaining to the type of entity you are dissolving. Provide any missing returns and payments as determined by ADOR staff, if found not to be in compliance to ADOR. Receive Certificate of Compliance from ADOR.

Complete Articles of Dissolutions Form based on the entity type. Follow the instructions on the form pertaining to the type of entity you are dissolving. Provide any missing returns and payments as determined by ADOR staff, if found not to be in compliance to ADOR. Receive Certificate of Compliance from ADOR.

A plan of dissolution is a written description of how an entity intends to dissolve, or officially and formally close the business. A plan of dissolution will include a description of how any remaining assets and liabilities will be distributed.

? Usually, it takes around three to four weeks to complete the whole process. However, this is not guaranteed. It will depend on how long one takes to complete all the necessary steps. The time frame for the state to process your company's Articles of Dissolution may also vary depending on their workload.

To dissolve your Alabama corporation, you must provide the completed original and two copies of the Domestic Business Corporation Articles of Dissolution form, to the Judge of Probate in the county where the original Certificate of Formation was recorded, by mail or in person. An original signature is required.

The process to dissolve your corporation in California is relatively straightforward. However, if you qualify for one of the special dissolution procedures, you might need additional help navigating the process.

*Include a check, money order, or credit card payment for the $100.00 processing fee. *The request is only accepted via mail or courier and will not be accepted via email. *You may file the dissolution online in the time it takes to type this request.