Alabama Complex Will — Maximum Unified Credit to Spouse: A Comprehensive Guide Introduction: An Alabama Complex Will grants individuals the ability to distribute their assets and ensure their spouse receives the maximum unified credit for estate tax purposes. By utilizing this legal instrument, residents of Alabama can optimize their estate planning strategy, minimize tax liability, and ensure their loved ones are adequately provided for after their passing. In this guide, we will explore the key aspects of an Alabama Complex Will, including its definition, purpose, and potential variations. Definition: An Alabama Complex Will is a legal document executed by an individual (the testator) that outlines the distribution of their assets upon their demise. This specific type of will is commonly utilized in Alabama to maximize the amount of the unified credit available to the surviving spouse for estate tax purposes. Purpose: The primary purpose of an Alabama Complex Will is to minimize estate tax liability, maximize the inheritance provided to the surviving spouse, and preserve the testator's estate for future generations. By incorporating various estate planning strategies, such as trust provisions and the utilization of the maximum unified credit, this type of will offers a comprehensive approach to estate preservation and asset distribution. Key Features: 1. Trust Provisions: An Alabama Complex Will often includes provisions for establishing trusts, such as bypass trusts and marital trusts. These trusts can provide the surviving spouse with income or allow the testator's assets to bypass their estate, thus lowering the potential tax burden. 2. Unified Credit: The unified credit refers to the amount exempted from federal estate taxes. By structuring an Alabama Complex Will to take full advantage of the unified credit, the surviving spouse can inherit a considerable amount while minimizing estate tax liabilities. Types of Alabama Complex Will — Maximum Unified Credit to Spouse: 1. Simple Alabama Complex Will: This variation includes essential provisions for asset distribution, testamentary trusts, and maximizing the unified credit to the surviving spouse. 2. Alabama Complex Will with Testamentary Trusts: This type of will designate specific trusts to hold assets for the benefit of the surviving spouse, allowing for income and principal distributions while minimizing estate tax liability. 3. Alabama Complex Will with Qualified Personnel Residence Trust (PRT): In this variation, a PRT is established to transfer the primary residence or vacation home to the surviving spouse while reducing estate tax value. This maximizes the unified credit available to other assets. Conclusion: An Alabama Complex Will — Maximum Unified Credit to Spouse offers individuals in Alabama the opportunity to strategically plan their estate, minimize estate tax liabilities, and provide substantial assets to their surviving spouse. Through various trust provisions and utilization of the unified credit, this type of will ensures a comprehensive approach to estate planning, asset protection, and generational wealth preservation. Consultation with an experienced estate planning attorney is essential to customize an Alabama Complex Will to individual circumstances and goals.

Alabama Complex Will - Maximum Unified Credit to Spouse

Description

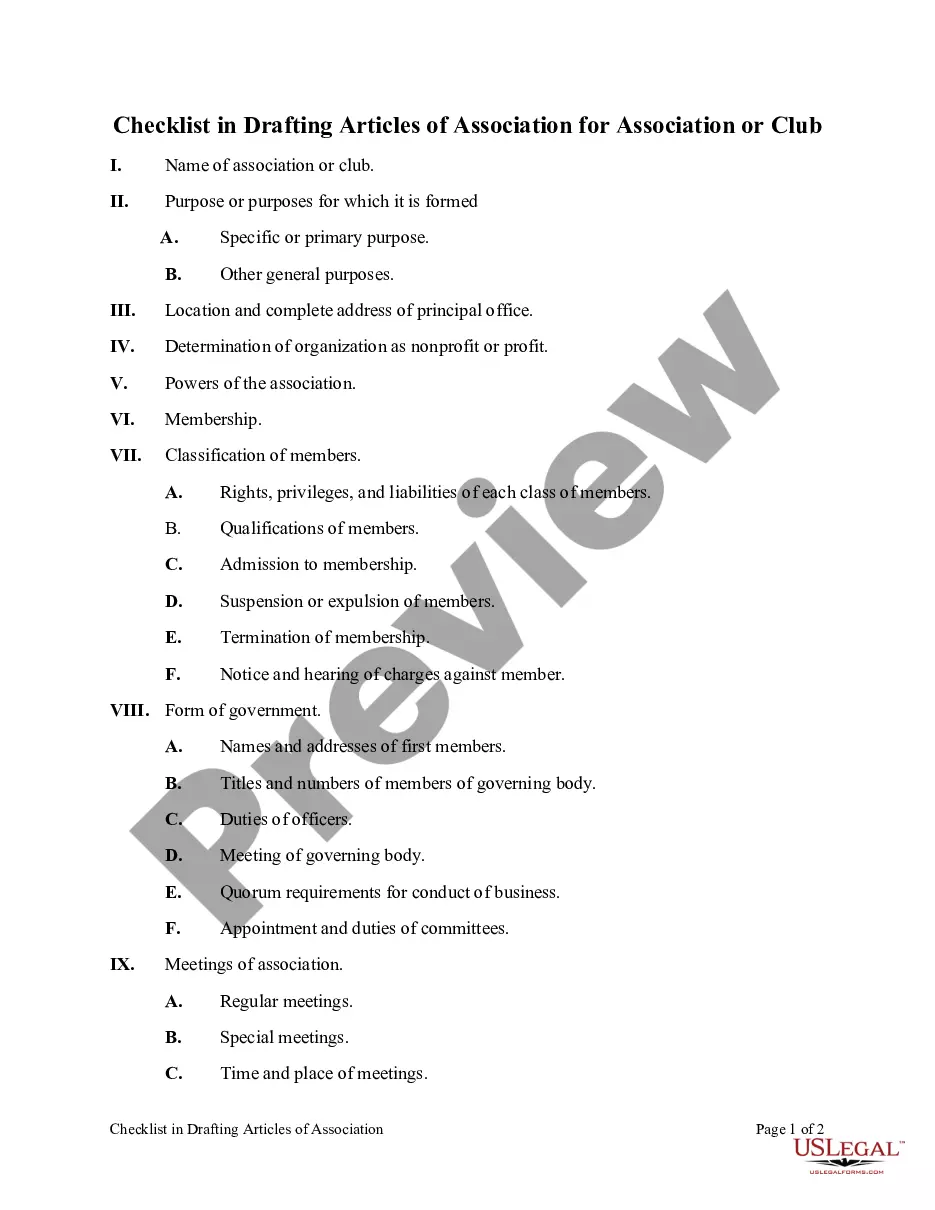

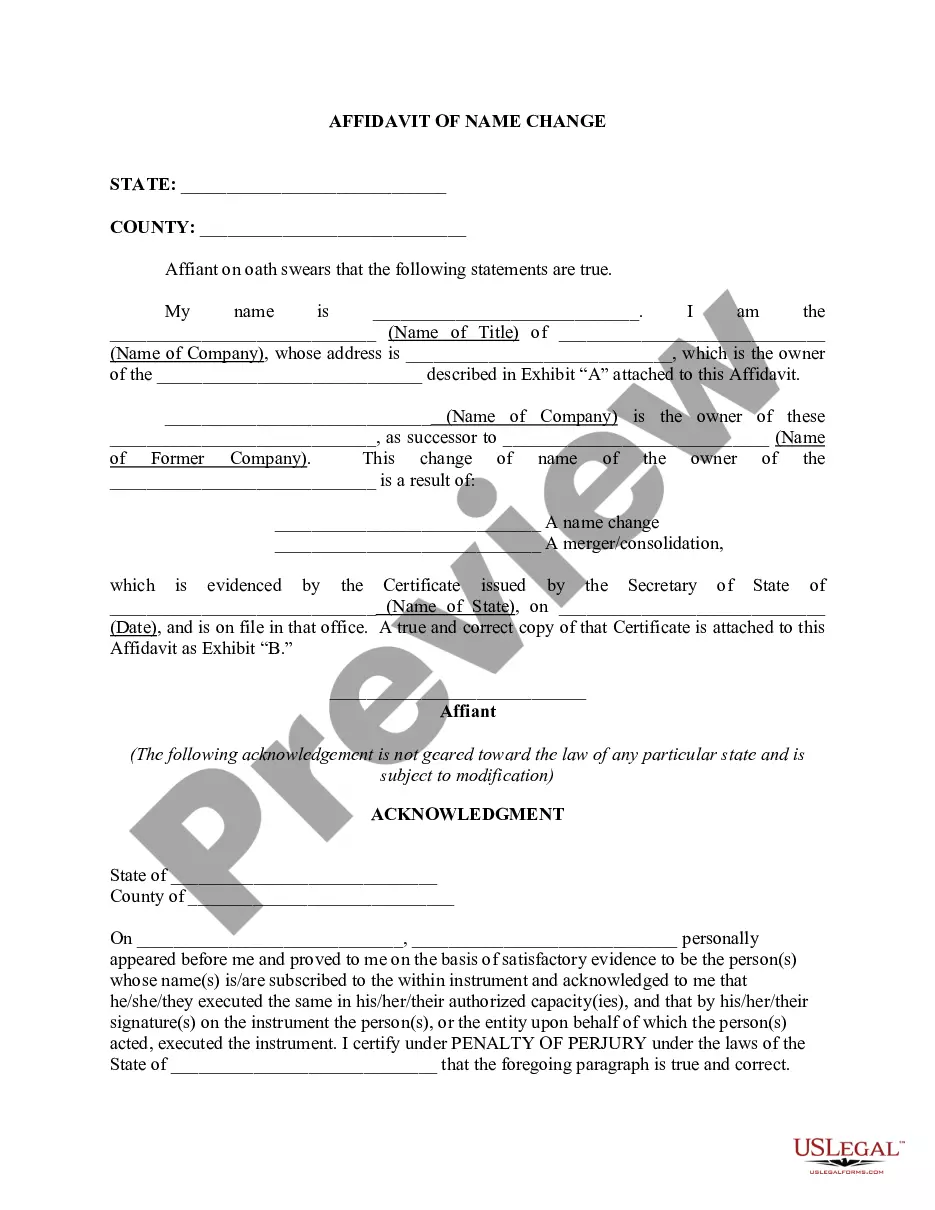

How to fill out Alabama Complex Will - Maximum Unified Credit To Spouse?

You can spend several hours online looking for the legitimate papers template that meets the state and federal demands you need. US Legal Forms offers a large number of legitimate kinds that are reviewed by experts. You can easily acquire or print the Alabama Complex Will - Maximum Unified Credit to Spouse from our assistance.

If you already have a US Legal Forms profile, it is possible to log in and click on the Acquire key. Next, it is possible to complete, revise, print, or indicator the Alabama Complex Will - Maximum Unified Credit to Spouse. Each legitimate papers template you get is yours eternally. To acquire yet another version for any bought form, check out the My Forms tab and click on the related key.

Should you use the US Legal Forms website the first time, stick to the simple instructions below:

- Initial, make sure that you have chosen the right papers template for that region/city of your choice. See the form information to ensure you have picked the correct form. If available, use the Review key to look through the papers template as well.

- In order to discover yet another version of the form, use the Search field to discover the template that suits you and demands.

- When you have discovered the template you need, click on Purchase now to move forward.

- Choose the rates prepare you need, type in your references, and register for an account on US Legal Forms.

- Full the deal. You can utilize your Visa or Mastercard or PayPal profile to purchase the legitimate form.

- Choose the structure of the papers and acquire it to your system.

- Make changes to your papers if possible. You can complete, revise and indicator and print Alabama Complex Will - Maximum Unified Credit to Spouse.

Acquire and print a large number of papers themes making use of the US Legal Forms Internet site, which provides the largest variety of legitimate kinds. Use skilled and condition-specific themes to tackle your small business or specific requirements.

Form popularity

FAQ

The unlimited marital deduction allows spouses to transfer an unlimited amount of money to one another, including upon death, without penalty or tax. Any asset transferred to a surviving spouse can be included in the spouse's taxable estate.

The gift is treated as half from the taxpayer and half from the taxpayer's spouse. Because spouses may not file joint gift tax returns, each spouse would then report half the value of the gift on their respective Forms 709.

The unlimited marital deduction is a provision in the US estate tax law that allows a married individual to transfer an unlimited amount of assets to their spouse, both during life and at death, without incurring any federal estate or gift taxes.

The spouse exemption is unlimited if neither of the spouses or civil partners is UK domiciled or if a non-UK domiciled individual makes gifts to a UK domiciled spouse or civil partner. However, the spouse exemption is capped when a UK domiciled individual gives assets to a non-UK domiciled spouse or civil partner.

The Unified Transfer Tax System This unified exclusion amount exempts the first $12,920,000 of cumulative transfers through gifts and upon a taxpayer's death. Within a marriage, each spouse has a unified exclusion amount of $12,920,000.

If you're married, your spouse is entitled to give another $12.92 million (tax year 2023) in lifetime gifts without incurring a gift tax. You can give up to $17,000 (tax year 2023) per person per year to as many people as you like without those gifts counting against your $12.92 million lifetime gift tax exemption.

If you are married and your spouse dies, you may be able to take advantage of the marital exemption in probate. This exemption allows you to inherit your spouse's property without going through probate. In order to take advantage of the marital exemption, you must meet certain requirements.