The Alabama Notice of Violation of Fair Debt Act — Improper Document Appearance is a legal notice issued to inform debt collectors or creditors that they have violated the Fair Debt Collection Practices Act (FD CPA) by providing misleading or improper documents related to a debt. This notice is designed to protect consumers from unfair and deceptive debt collection practices. The FD CPA is a federal law that sets guidelines for how debt collectors should behave when attempting to collect debts from individuals. It ensures that debtors are treated fairly and are provided with accurate and truthful information regarding their debts. When a debt collector or creditor fails to adhere to the FD CPA's provisions, such as presenting false or deceptive documents during the debt collection process, the Alabama Notice of Violation of Fair Debt Act — Improper Document Appearance can be used to alert them of their noncompliance. By issuing this notice, the debtor or their legal representative aims to hold the creditor accountable for their actions and seek proper resolution. This notice highlights the specific violation of improper document appearance as outlined in the FD CPA. It emphasizes that the debt collector or creditor has presented documents that are misleading, inaccurate, or falsely represent the amount owed, the terms of the debt, or the legal consequences if the debt is not paid. Types of Alabama Notice of Violation of Fair Debt Act — Improper Document Appearance may include: 1. Misleading debt validation letters: Debt collectors are required to send a written notice within five days of the initial communication to verify the debt. If the validation letter is improperly designed or worded to mislead the debtor or obscure their rights, it constitutes a violation. 2. False affidavits or sworn statements: Debt collectors sometimes submit sworn statements or affidavits along with collection letters to support their claims. If these documents contain false information or are not properly executed, it violates the FD CPA. 3. Incorrect account statements: Debt collectors might provide account statements that misrepresent the debtor's payment history or inflate the amount owed. In such cases, the debtor can issue the notice to address the improper document appearance. 4. Forged or unauthorized documents: If a debt collector or creditor submits forged or unauthorized documents, such as fraudulent promissory notes or assignment agreements, it is considered a violation of the FD CPA. It is crucial for debtors to understand their rights and actively monitor the information provided by debt collectors. If they suspect any violation of the Fair Debt Collection Practices Act, including improper document appearance, they should consult with a legal professional and consider issuing an Alabama Notice of Violation of Fair Debt Act — Improper Document Appearance to safeguard their rights and seek appropriate remedies.

Alabama Notice of Violation of Fair Debt Act - Improper Document Appearance

Description

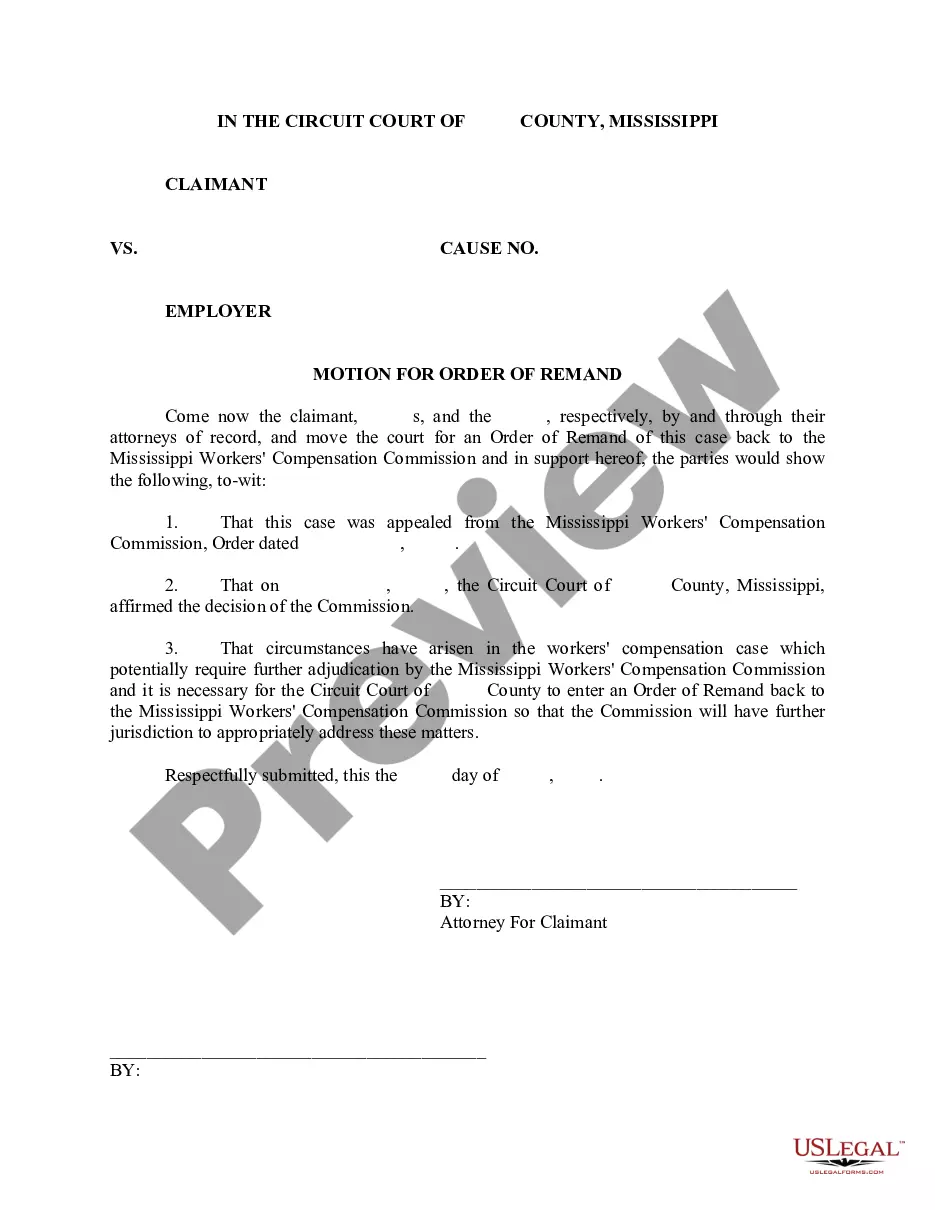

How to fill out Alabama Notice Of Violation Of Fair Debt Act - Improper Document Appearance?

US Legal Forms - one of many most significant libraries of legitimate varieties in the USA - offers a wide array of legitimate papers layouts you can obtain or print. While using website, you can find 1000s of varieties for organization and specific reasons, categorized by categories, claims, or key phrases.You will find the most recent models of varieties just like the Alabama Notice of Violation of Fair Debt Act - Improper Document Appearance within minutes.

If you have a subscription, log in and obtain Alabama Notice of Violation of Fair Debt Act - Improper Document Appearance in the US Legal Forms catalogue. The Acquire switch will show up on each type you view. You have access to all earlier downloaded varieties within the My Forms tab of the account.

In order to use US Legal Forms the first time, listed here are simple guidelines to obtain started out:

- Be sure you have selected the correct type for your personal metropolis/region. Go through the Review switch to review the form`s content material. Read the type information to ensure that you have chosen the right type.

- When the type does not suit your demands, take advantage of the Lookup industry at the top of the monitor to obtain the one which does.

- Should you be satisfied with the shape, affirm your option by clicking the Purchase now switch. Then, select the costs plan you like and supply your references to sign up for the account.

- Approach the purchase. Make use of Visa or Mastercard or PayPal account to accomplish the purchase.

- Select the formatting and obtain the shape on your own gadget.

- Make modifications. Fill out, edit and print and sign the downloaded Alabama Notice of Violation of Fair Debt Act - Improper Document Appearance.

Each design you put into your money does not have an expiration day and is your own forever. So, if you want to obtain or print another backup, just visit the My Forms section and click on on the type you need.

Get access to the Alabama Notice of Violation of Fair Debt Act - Improper Document Appearance with US Legal Forms, probably the most extensive catalogue of legitimate papers layouts. Use 1000s of expert and status-particular layouts that satisfy your business or specific needs and demands.

Form popularity

FAQ

A debt validation letter should include the name of your creditor and how much you owe, The letter will include information about when you need to pay the debt and how to dispute it.

Harassment of the debtor by the creditor ? More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.

I am writing in regards to the above-referenced debt to inform you that I am disputing this debt. Please verify the debt as required by the Fair Debt Collection Practices Act. I am disputing this debt because I do not owe it. Because I am disputing this debt, you should not report it to the credit reporting agencies.

If you feel you've been contacted in error, send a letter disputing a debt in writing. Ask the agency to stop contacting you. If the agency can't provide proof, you owe the money, by law, they must stop collection efforts. If you don't owe the bill, don't pay anything ? ever.

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

§ 807. (1) The false representation or implication that the debt collector is vouched for, bonded by, or affiliated with the United States or any State, including the use of any badge, uniform, or facsimile thereof.

Debt settlement, also called debt relief or debt adjustment, is the process of resolving outstanding debt for far less than the amount you owe by promising the lender a substantial lump-sum payment. Depending on the situation, debt settlement offers might range from 10% to 50% of what you owe.