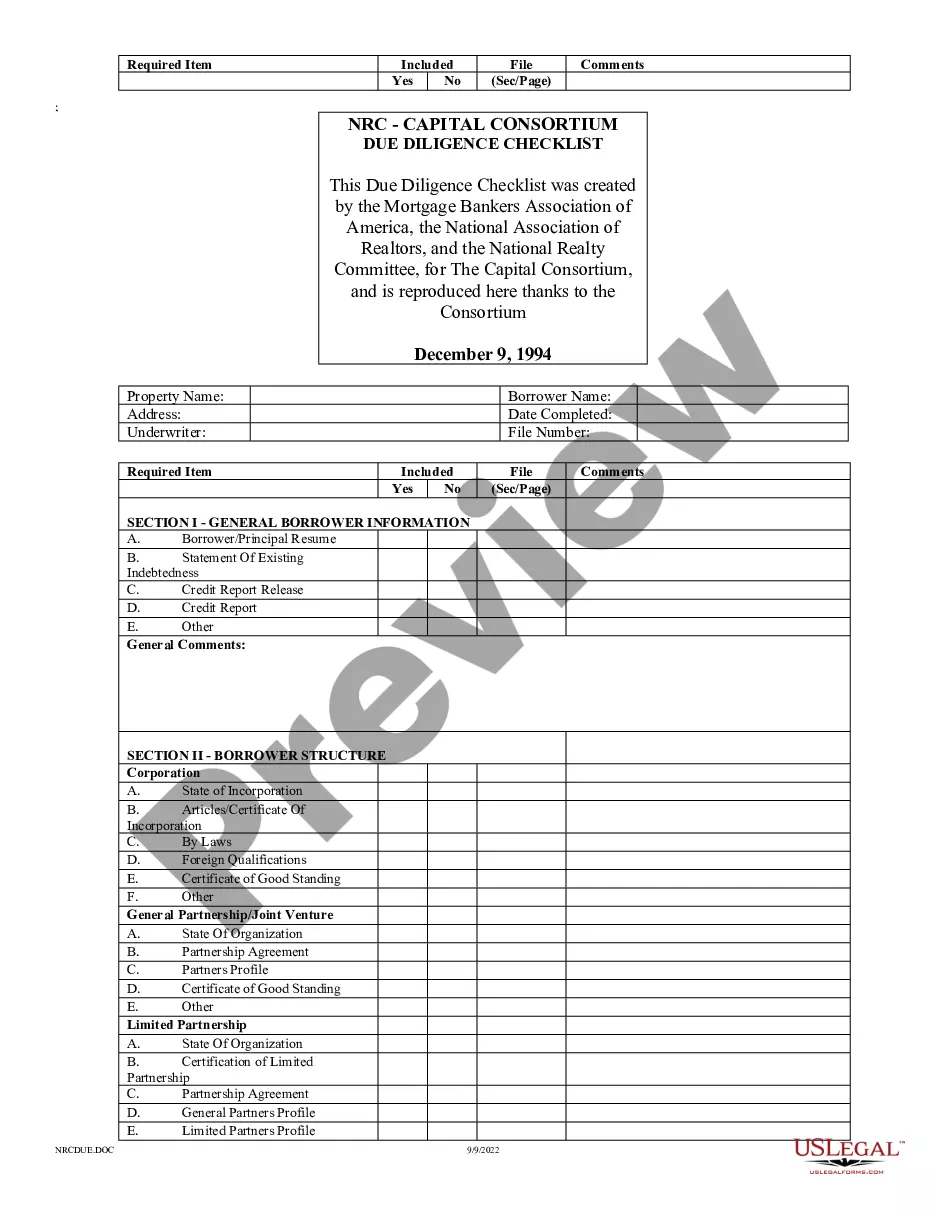

"Capital Consortium Due Diligence Checklist" is a American Lawyer Media form. This form is a checklist that was created by the Mortgage Bankers Association of America, the National Association of Realtors, and the National Realty Committee, for The Capital Consortium.

Alabama Capital Consortium Due Diligence Checklist is an essential tool used during the evaluation and assessment process of potential investment opportunities within the state of Alabama. Conducting due diligence is crucial to ensure that investors have a comprehensive understanding of the risks and opportunities associated with their investment decisions. This checklist serves as a structured framework encompassing crucial areas that require careful examination. By following this checklist, investors can thoroughly analyze various aspects of the investment to make informed decisions and mitigate potential risks. Below, we outline the key components typically covered in the Alabama Capital Consortium Due Diligence Checklist: 1. Legal and Regulatory Compliance: This section emphasizes the need to ensure that the investment opportunity complies with all relevant laws, regulations, and licensing requirements in Alabama. It includes examining permits, licenses, contracts, and any potential legal disputes. 2. Financial Analysis: Assessing the financial health of the investment opportunity is paramount. Relevant considerations encompass examining financial statements, cash flow projections, debt obligations, profitability, and financial trends over time. 3. Market Analysis: Evaluating the target market and its potential demand for the product or service offered by the investment is critical. This includes analyzing market size, growth dynamics, competition, trends, and the overall industry landscape. 4. Management Evaluation: Thoroughly analyzing the management team is essential to assess their competence and experience. This section may include an examination of key personnel, their backgrounds, track records, and their aptitude for successfully executing the investment strategy. 5. Operational Assessment: Evaluating the operational aspects of the investment opportunity helps determine its efficiency and effectiveness. This involves considering factors such as production processes, supply chain, technology infrastructure, scalability, and any potential operational risks. 6. Risk Assessment: Identifying and understanding potential risks associated with the investment opportunity is crucial. This section covers an assessment of market risks, competition risks, regulatory risks, financial risks, and any other risks specifically relevant to the investment. Different types of Alabama Capital Consortium Due Diligence Checklists may exist depending on the specific nature of the investment opportunity. For instance, there could be separate checklists for evaluating startups, real estate projects, manufacturing plants, or infrastructure investments. Each checklist would focus on the unique attributes and risks associated with the specific investment category. In conclusion, the Alabama Capital Consortium Due Diligence Checklist provides a comprehensive and structured approach for evaluating investment opportunities within Alabama. By following this checklist, investors can conduct thorough due diligence and make informed decisions while mitigating risks associated with their investments.Alabama Capital Consortium Due Diligence Checklist is an essential tool used during the evaluation and assessment process of potential investment opportunities within the state of Alabama. Conducting due diligence is crucial to ensure that investors have a comprehensive understanding of the risks and opportunities associated with their investment decisions. This checklist serves as a structured framework encompassing crucial areas that require careful examination. By following this checklist, investors can thoroughly analyze various aspects of the investment to make informed decisions and mitigate potential risks. Below, we outline the key components typically covered in the Alabama Capital Consortium Due Diligence Checklist: 1. Legal and Regulatory Compliance: This section emphasizes the need to ensure that the investment opportunity complies with all relevant laws, regulations, and licensing requirements in Alabama. It includes examining permits, licenses, contracts, and any potential legal disputes. 2. Financial Analysis: Assessing the financial health of the investment opportunity is paramount. Relevant considerations encompass examining financial statements, cash flow projections, debt obligations, profitability, and financial trends over time. 3. Market Analysis: Evaluating the target market and its potential demand for the product or service offered by the investment is critical. This includes analyzing market size, growth dynamics, competition, trends, and the overall industry landscape. 4. Management Evaluation: Thoroughly analyzing the management team is essential to assess their competence and experience. This section may include an examination of key personnel, their backgrounds, track records, and their aptitude for successfully executing the investment strategy. 5. Operational Assessment: Evaluating the operational aspects of the investment opportunity helps determine its efficiency and effectiveness. This involves considering factors such as production processes, supply chain, technology infrastructure, scalability, and any potential operational risks. 6. Risk Assessment: Identifying and understanding potential risks associated with the investment opportunity is crucial. This section covers an assessment of market risks, competition risks, regulatory risks, financial risks, and any other risks specifically relevant to the investment. Different types of Alabama Capital Consortium Due Diligence Checklists may exist depending on the specific nature of the investment opportunity. For instance, there could be separate checklists for evaluating startups, real estate projects, manufacturing plants, or infrastructure investments. Each checklist would focus on the unique attributes and risks associated with the specific investment category. In conclusion, the Alabama Capital Consortium Due Diligence Checklist provides a comprehensive and structured approach for evaluating investment opportunities within Alabama. By following this checklist, investors can conduct thorough due diligence and make informed decisions while mitigating risks associated with their investments.