Title: Alabama Loan Agreement: Detailed Description and Types with Lacked Gas Co., Mercantile Bank National Assoc., Bank of America, and Credit Suisse First Boston Introduction: A Loan Agreement is a legally binding document that outlines the terms and conditions under which one party (usually a borrower) agrees to repay a certain amount of money to another party (usually a lender). This article provides a thorough description of the Alabama Loan Agreement between Lacked Gas Co., Mercantile Bank National Assoc., Bank of America, and Credit Suisse First Boston, highlighting its key components, intent, and potential types of such agreements. Keywords: Alabama, Loan Agreement, Lacked Gas Co., Mercantile Bank National Assoc., Bank of America, Credit Suisse First Boston. I. Alabama Loan Agreement — An Overview: The Alabama Loan Agreement refers to the contractual arrangement between Lacked Gas Co., Mercantile Bank National Assoc., Bank of America, and Credit Suisse First Boston (the parties involved). This agreement establishes the terms and conditions governing a loan transaction in the state of Alabama. It typically delineates the loan amount, repayment terms, interest rate, collateral, and other essential aspects. II. Key Components of an Alabama Loan Agreement: 1. Parties Involved: The Loan Agreement involves Lacked Gas Co. (borrower), Mercantile Bank National Assoc., Bank of America, and Credit Suisse First Boston (lenders). 2. Loan Amount: This section specifies the principal amount provided by the lenders to the borrower. 3. Purpose of the Loan: It elucidates the intended use of the borrowed funds, often including working capital, expansion, refinancing, or debt consolidation. 4. Repayment Terms: The repayment terms describe how the borrower will repay the loan, including repayment schedule, installment amounts, interest calculations, and any penalties for late payments. 5. Interest Rate: This section outlines the interest rate charged on the loan, which can be either fixed or variable. 6. Collateral: In many loan agreements, the borrower provides collateral, such as real estate, equipment, or other assets, to secure the loan. This safeguards the lenders' interests in case of default or non-repayment. 7. Prepayment and Default Provisions: The agreement may include clauses that address prepayment penalties, early repayment options, and consequences for default, such as additional fees, legal actions, or seizure of collateral. III. Types of Alabama Loan Agreement: 1. Secured Loan Agreement: In a secured loan agreement, the borrower pledges collateral to the lenders, providing an added layer of security. This collateral could be in the form of real estate, equipment, inventory, etc. 2. Unsecured Loan Agreement: An unsecured loan agreement lacks collateral, relying solely on the borrower's creditworthiness. In such cases, the lenders carry higher risk and may charge a higher interest rate. 3. Revolving Line of Credit Agreement: A revolving line of credit agreement provides the borrower with a pre-approved credit limit that they can access as needed. It offers flexibility in borrowing and repaying, similar to a credit card. Conclusion: The Alabama Loan Agreement between Lacked Gas Co., Mercantile Bank National Assoc., Bank of America, and Credit Suisse First Boston encompasses various types of loan agreements. These agreements establish the terms and conditions for borrowing and lending in the state of Alabama. Understanding the key components and types of loan agreements enables businesses to make informed decisions while acquiring financial assistance.

Alabama Loan Agreement between Laclede Gas Co., Mercantile Bank National Assoc., Bank of America and Credit Suisse First Boston

Description

How to fill out Alabama Loan Agreement Between Laclede Gas Co., Mercantile Bank National Assoc., Bank Of America And Credit Suisse First Boston?

US Legal Forms - one of many most significant libraries of legal types in the United States - gives an array of legal papers web templates you can obtain or produce. Making use of the website, you will get thousands of types for enterprise and personal purposes, sorted by classes, suggests, or search phrases.You can get the latest variations of types like the Alabama Loan Agreement between Laclede Gas Co., Mercantile Bank National Assoc., Bank of America and Credit Suisse First Boston in seconds.

If you already have a registration, log in and obtain Alabama Loan Agreement between Laclede Gas Co., Mercantile Bank National Assoc., Bank of America and Credit Suisse First Boston from the US Legal Forms library. The Down load option can look on each form you look at. You gain access to all previously saved types in the My Forms tab of the accounts.

If you want to use US Legal Forms initially, listed below are basic recommendations to help you started:

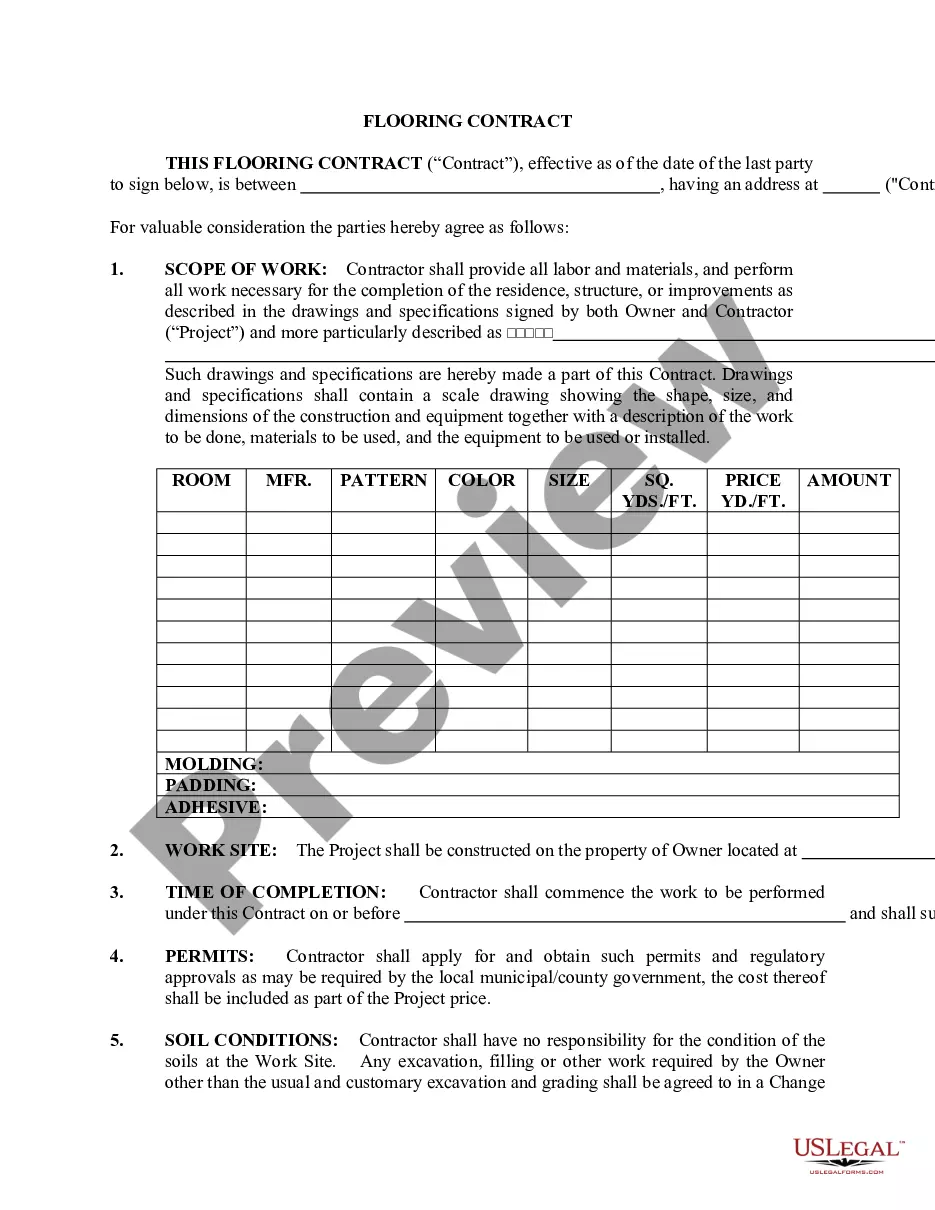

- Be sure you have picked out the best form for your personal city/state. Click on the Review option to review the form`s content material. Read the form information to ensure that you have chosen the right form.

- In case the form does not fit your specifications, use the Search industry near the top of the display to discover the one who does.

- When you are content with the shape, confirm your decision by simply clicking the Get now option. Then, opt for the prices program you like and give your accreditations to register to have an accounts.

- Method the purchase. Make use of bank card or PayPal accounts to finish the purchase.

- Pick the format and obtain the shape in your system.

- Make alterations. Fill up, revise and produce and indication the saved Alabama Loan Agreement between Laclede Gas Co., Mercantile Bank National Assoc., Bank of America and Credit Suisse First Boston.

Every design you put into your account lacks an expiry date and is also your own for a long time. So, if you wish to obtain or produce another copy, just check out the My Forms section and then click about the form you need.

Obtain access to the Alabama Loan Agreement between Laclede Gas Co., Mercantile Bank National Assoc., Bank of America and Credit Suisse First Boston with US Legal Forms, one of the most comprehensive library of legal papers web templates. Use thousands of skilled and express-particular web templates that satisfy your business or personal requirements and specifications.