The Alabama Underwriting Agreement of ABCs Mortgage Loan Trust 1999-4 and Prudential Securities, Inc. is a legally binding contract that outlines the terms and conditions for the underwriting of mortgage loans by Prudential Securities, Inc. on behalf of ABCs Mortgage Loan Trust 1999-4 in the state of Alabama. Underwriting agreements play a crucial role in the mortgage loan market as they determine the responsibilities, obligations, and compensation of the underwriter. Prudential Securities, Inc. acts as the underwriter, taking on the task of selling the mortgage-backed securities issued by ABCs Mortgage Loan Trust 1999-4 to investors in Alabama. This specific agreement centers around the specific mortgage loans included in ABCs Mortgage Loan Trust 1999-4. It details the characteristics and terms of these loans, such as interest rates, repayment terms, and the amount of principal to be repaid. This information is critical for potential investors to make informed decisions about investing in the mortgage-backed securities. Additionally, the Alabama Underwriting Agreement of ABCs Mortgage Loan Trust 1999-4 and Prudential Securities, Inc. specifies the obligations of both parties involved. Prudential Securities, Inc. agrees to use its best efforts to underwrite and sell the mortgage-backed securities, while ABCs Mortgage Loan Trust 1999-4 provides accurate and complete information regarding the mortgage loans. The agreement also covers the compensation of the underwriter. Prudential Securities, Inc. receives a fee or commission based on the value or volume of mortgage loans underwritten and successfully sold to investors. This ensures that the underwriter has an incentive to actively promote and market the mortgage-backed securities. It is important to note that different types of underwriting agreements may exist within the realm of ABCs Mortgage Loan Trust 1999-4 and Prudential Securities, Inc. These variations could include agreements specific to different regions within Alabama, different asset classes, or differing terms and conditions. The details and specifics of these various underwriting agreements would depend on the individual circumstances and needs of the parties involved. In summary, the Alabama Underwriting Agreement of ABCs Mortgage Loan Trust 1999-4 and Prudential Securities, Inc. is a legally binding contract that governs the underwriting and sale of mortgage-backed securities in Alabama. It outlines the responsibilities, compensation, and obligations of both parties, ensuring transparency and accountability in the mortgage loan market.

Alabama Underwriting Agreement of ABFS Mortgage Loan Trust 1999-4 and Prudential Securities, Inc.

Description

How to fill out Alabama Underwriting Agreement Of ABFS Mortgage Loan Trust 1999-4 And Prudential Securities, Inc.?

Choosing the best legal file format can be a battle. Needless to say, there are a lot of web templates available online, but how would you discover the legal type you need? Use the US Legal Forms web site. The service delivers thousands of web templates, for example the Alabama Underwriting Agreement of ABFS Mortgage Loan Trust 1999-4 and Prudential Securities, Inc., which you can use for organization and private needs. All the forms are examined by pros and meet federal and state requirements.

In case you are currently listed, log in for your account and click on the Down load button to have the Alabama Underwriting Agreement of ABFS Mortgage Loan Trust 1999-4 and Prudential Securities, Inc.. Make use of account to search through the legal forms you possess ordered previously. Check out the My Forms tab of your respective account and obtain an additional backup in the file you need.

In case you are a fresh customer of US Legal Forms, allow me to share easy guidelines so that you can stick to:

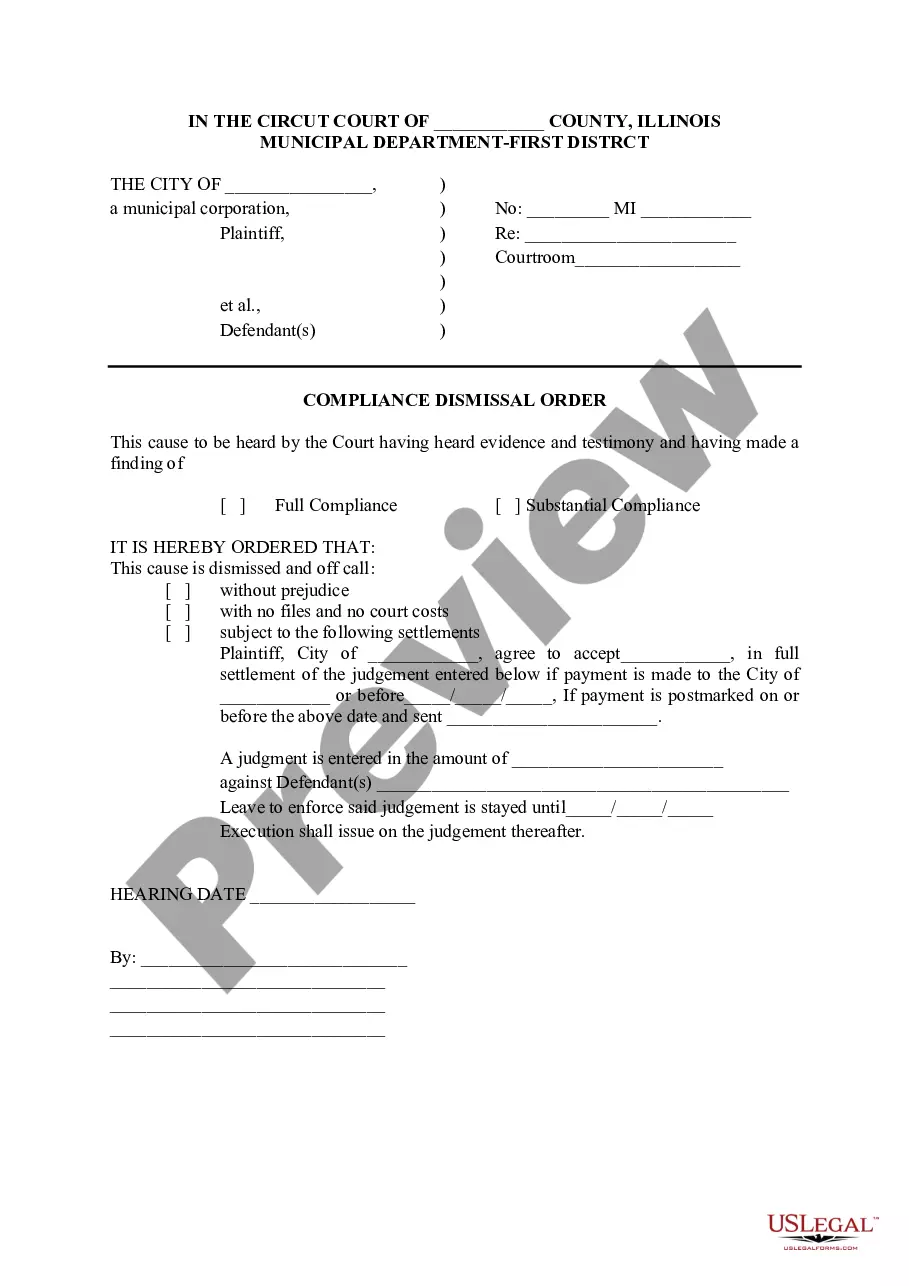

- Initial, ensure you have selected the correct type for the city/county. It is possible to examine the shape using the Preview button and read the shape outline to make certain it is the best for you.

- When the type will not meet your requirements, take advantage of the Seach industry to obtain the proper type.

- Once you are sure that the shape is proper, click the Buy now button to have the type.

- Opt for the rates plan you want and enter in the needed details. Create your account and pay for the order using your PayPal account or credit card.

- Pick the file formatting and acquire the legal file format for your gadget.

- Total, modify and print and indication the received Alabama Underwriting Agreement of ABFS Mortgage Loan Trust 1999-4 and Prudential Securities, Inc..

US Legal Forms is definitely the biggest library of legal forms that you can see a variety of file web templates. Use the company to acquire expertly-created paperwork that stick to status requirements.