The Alabama Transfer Agreement between Deutsche Telecom AG and NAB Nordamerika Beteiligungs Holding GMB His a legally binding document that outlines the terms and conditions for the transfer of shares from one company to its qualified subsidiaries in Alabama, USA. This agreement ensures a smooth and transparent transfer process, protecting the interests of both parties involved. Keywords: Alabama Transfer Agreement, Deutsche Telecom AG, NAB Nordamerika Beteiligungs Holding GmbH, Transfer of Shares, Qualified Subsidiaries. There may be different types of Alabama Transfer Agreements between Deutsche Telecom AG and NAB Nordamerika Beteiligungs Holding GmbH regarding the transfer of shares to one or more qualified subsidiaries. These types might include: 1. Single-Share Transfer Agreement: This type of agreement involves the transfer of a specific number of shares from Deutsche Telecom AG to one qualified subsidiary in Alabama. It outlines the details of the transfer, such as the number of shares, their valuation, and any conditions or restrictions associated with the transfer. 2. Multiple-Share Transfer Agreement: In this type of agreement, Deutsche Telecom AG transfers shares to more than one qualified subsidiary in Alabama. The agreement specifies the allocation of shares among the subsidiaries, taking into account factors like the subsidiaries' financial standing, business potential, and strategic alignment with the parent company's objectives. 3. Gradual Transfer Agreement: This type of agreement involves the phased transfer of shares to qualified subsidiaries. It allows Deutsche Telecom AG to gradually transfer ownership and control to one or more subsidiaries, maintaining stability and minimizing disruption to the business operations. The agreement outlines the timeline, conditions, and criteria for each phase of the transfer. 4. Locked-in Transfer Agreement: A locked-in transfer agreement restricts the qualified subsidiaries from selling or transferring the acquired shares for a specified period. It ensures that the subsidiaries retain the shares for a defined duration, protecting the parent company's investment and aligning their long-term interests. 5. Reverse Transfer Agreement: In some cases, a reverse transfer agreement may be considered, where the shares of the qualified subsidiaries are transferred back to Deutsche Telecom AG. This type of agreement might arise if there is a change in business strategy or if the subsidiaries fail to meet certain performance criteria specified in the initial agreement. These are just some potential types of Alabama Transfer Agreements, personalized to the transfer of shares between Deutsche Telecom AG and NAB Nordamerika Beteiligungs Holding GmbH. The actual agreement would specify the exact terms, conditions, and provisions relevant to the specific transaction.

Alabama Transfer Agreement between Deutsche Telecom AG and NAB Nordamerika Beteiligungs Holding GMBH regarding Transfer of Shares to One or More Qualified Subsidiaries

Description

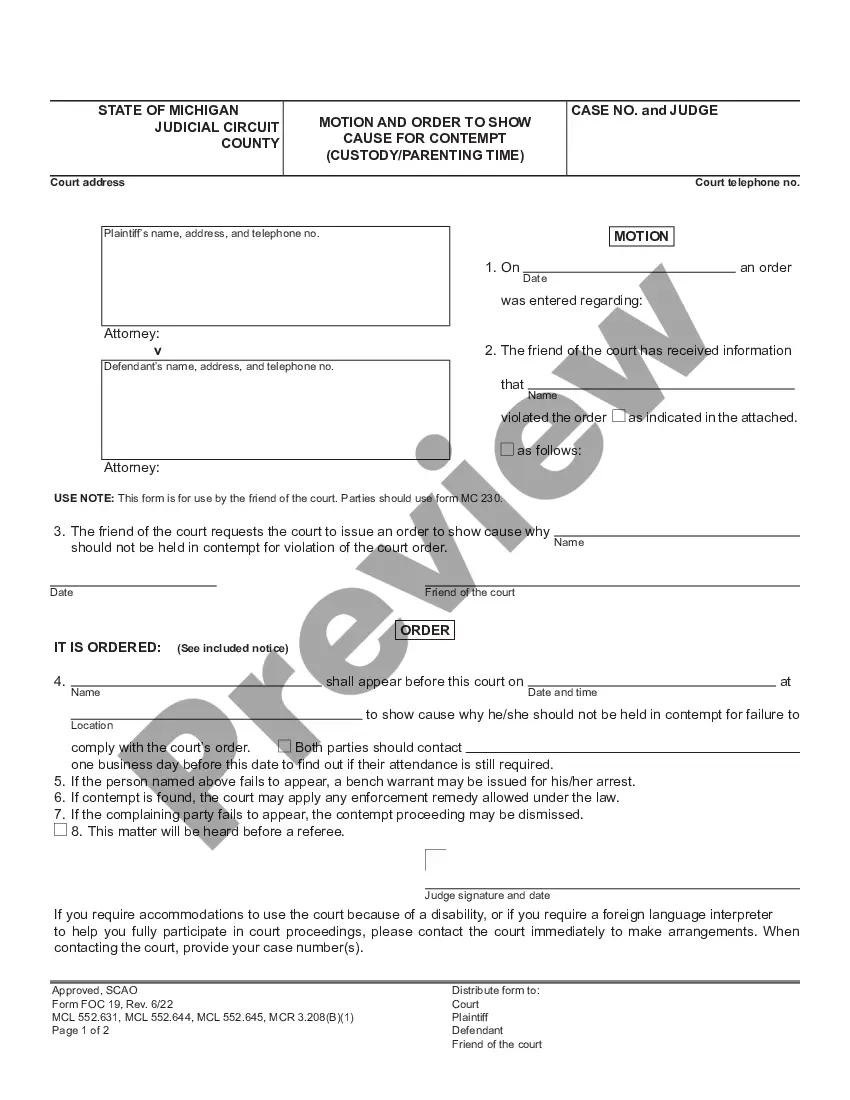

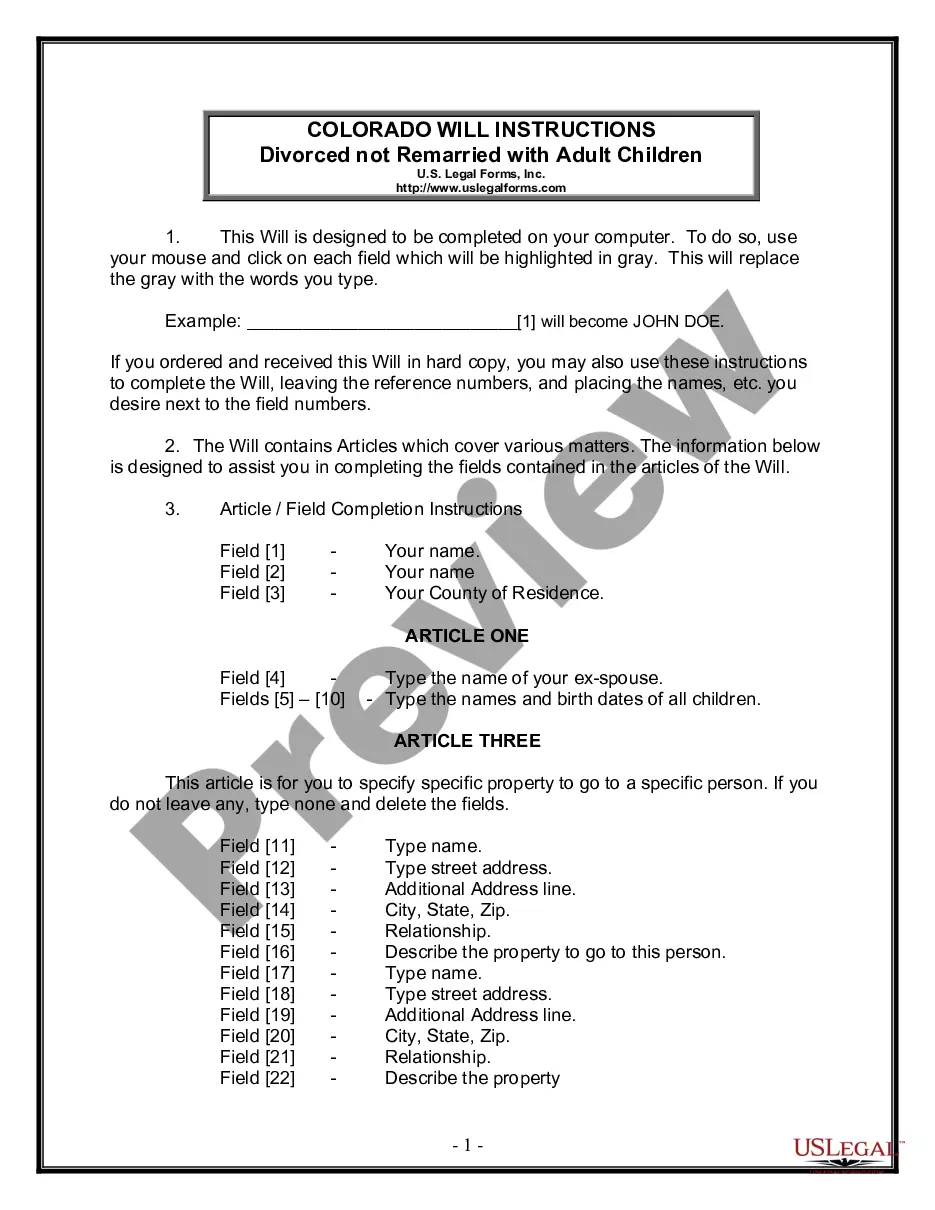

How to fill out Alabama Transfer Agreement Between Deutsche Telecom AG And NAB Nordamerika Beteiligungs Holding GMBH Regarding Transfer Of Shares To One Or More Qualified Subsidiaries?

If you wish to full, acquire, or printing lawful papers templates, use US Legal Forms, the most important collection of lawful kinds, that can be found on-line. Use the site`s basic and hassle-free lookup to find the paperwork you need. Various templates for organization and person reasons are sorted by categories and claims, or keywords and phrases. Use US Legal Forms to find the Alabama Transfer Agreement between Deutsche Telecom AG and NAB Nordamerika Beteiligungs Holding GMBH regarding Transfer of Shares to One or More Qualified Subsidiaries in a handful of click throughs.

In case you are currently a US Legal Forms client, log in to your bank account and click on the Acquire button to obtain the Alabama Transfer Agreement between Deutsche Telecom AG and NAB Nordamerika Beteiligungs Holding GMBH regarding Transfer of Shares to One or More Qualified Subsidiaries. Also you can access kinds you formerly saved inside the My Forms tab of your own bank account.

Should you use US Legal Forms initially, follow the instructions beneath:

- Step 1. Ensure you have selected the shape to the correct area/region.

- Step 2. Make use of the Review choice to examine the form`s content. Do not forget to learn the information.

- Step 3. In case you are unhappy with all the type, utilize the Research industry near the top of the display screen to get other models of the lawful type web template.

- Step 4. After you have found the shape you need, go through the Buy now button. Select the rates plan you favor and add your credentials to sign up to have an bank account.

- Step 5. Process the transaction. You can utilize your charge card or PayPal bank account to accomplish the transaction.

- Step 6. Select the formatting of the lawful type and acquire it on your own gadget.

- Step 7. Complete, edit and printing or sign the Alabama Transfer Agreement between Deutsche Telecom AG and NAB Nordamerika Beteiligungs Holding GMBH regarding Transfer of Shares to One or More Qualified Subsidiaries.

Every lawful papers web template you get is the one you have for a long time. You possess acces to every type you saved with your acccount. Select the My Forms section and select a type to printing or acquire once again.

Contend and acquire, and printing the Alabama Transfer Agreement between Deutsche Telecom AG and NAB Nordamerika Beteiligungs Holding GMBH regarding Transfer of Shares to One or More Qualified Subsidiaries with US Legal Forms. There are millions of skilled and state-specific kinds you may use for your organization or person needs.

Form popularity

FAQ

Data Transfer Agreements (DTAs) are used to transfer human subject data from one institution to another for research purposes.

A DTA is a contract between the providing and recipient institutions that governs the legal obligations and restrictions, as well as compliance with applicable laws and regulations, related to the transfer of such data between the parties.

A Material Transfer Agreement (MTA) is a contract that documents the transfer of materials from one researcher to another. A Data Use Agreement (DUA) is a contract that documents the transfer of certain types of data from one researcher to another.

Data use agreements (DUA)?also referred to as data sharing agreements or data use licenses?are documents that describe what data are being shared, for what purpose, for how long, and any access restrictions or security protocols that must be followed by the recipient of the data.

The most common types of agreements are Data Transfer Agreements (DTAs) or Material Transfer Agreements (MTAs). Sometimes the contract is referred to as a Data Use Agreement (DUA), though a DUA is actually a different kind of agreement with a Limited Data Set.

DUAs are subject to HIPAA regulations and usually require IRB approval. A Data Transfer Agreement (DTA) is a legal contract governing the transfer of non-human subject data or completely de-identified human subject data.