Title: Alabama Plan of Merger: Combining Forces of Food Lion, Inc., Hanna ford Brothers Company, and FL Acquisition Sub, Inc. Keywords: Alabama Plan of Merger, Food Lion Inc., Hanna ford Brothers Company, FL Acquisition Sub Inc., strategic alliance, acquisition, grocery retail market, synergy, expansion, growth, consumer base Introduction: The Alabama Plan of Merger marks a significant milestone in the grocery retail market, bringing together the powerhouse companies Food Lion, Inc., Hanna ford Brothers Company, and FL Acquisition Sub, Inc. through a strategic alliance. This intricate plan paves the way for a mutually beneficial merger, fostering growth, expanded market reach, and enhanced services for millions of consumers. 1. Merger of Equals: The Alabama Plan of Merger laid the groundwork for a merger of equals between Food Lion, Inc., and Hanna ford Brothers Company. This form of merger ensures that both companies maintain significant input in the newly formed entity, combining their respective strengths and resources for maximum efficiency and market domination. 2. FL Acquisition Sub, Inc.: FL Acquisition Sub, Inc. plays a pivotal role in the Alabama Plan of Merger, serving as a subsidiary or acquisition vehicle. It acts as the bridge that brings Food Lion, Inc., and Hanna ford Brothers Company together, facilitating the smooth transition and integration of operations between the two entities. 3. Synergy-driven Growth Strategy: The Alabama Plan of Merger reflects a joint commitment to capitalizing on synergies to drive growth. By combining resources, expertise, and market presence, Food Lion, Inc., Hanna ford Brothers Company, and FL Acquisition Sub, Inc. collectively aim to achieve enhanced operational efficiencies, economies of scale, and an expanded consumer base. 4. Market Expansion and Regional Dominance: Through this merger, the combined entity seeks to solidify its position as a leading force in the grocery retail market, particularly in Alabama. The Alabama Plan of Merger opens doors for increased market presence, allowing the new entity to serve a larger customer base and offer a wider range of products and services. 5. Shared Vision and Values: The Alabama Plan of Merger reinforces the shared vision and values of the merging entities, emphasizing their dedication to delivering quality, value, and excellent customer experiences. By aligning their strategic objectives, the companies aim to strengthen their competitive edge and create a unified brand with unparalleled customer satisfaction. Conclusion: The Alabama Plan of Merger between Food Lion, Inc., Hanna ford Brothers Company, and FL Acquisition Sub, Inc. exemplifies a groundbreaking initiative in the grocery retail sector. This well-thought-out merger of equals, with FL Acquisition Sub, Inc. acting as the catalyst, sets the stage for exceptional growth, heightened market presence, and improved consumer offerings. By leveraging synergies and combining their strengths, the merging companies strive to redefine industry standards, solidify market dominance, and achieve unparalleled success in Alabama and beyond.

Alabama Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc.

Description

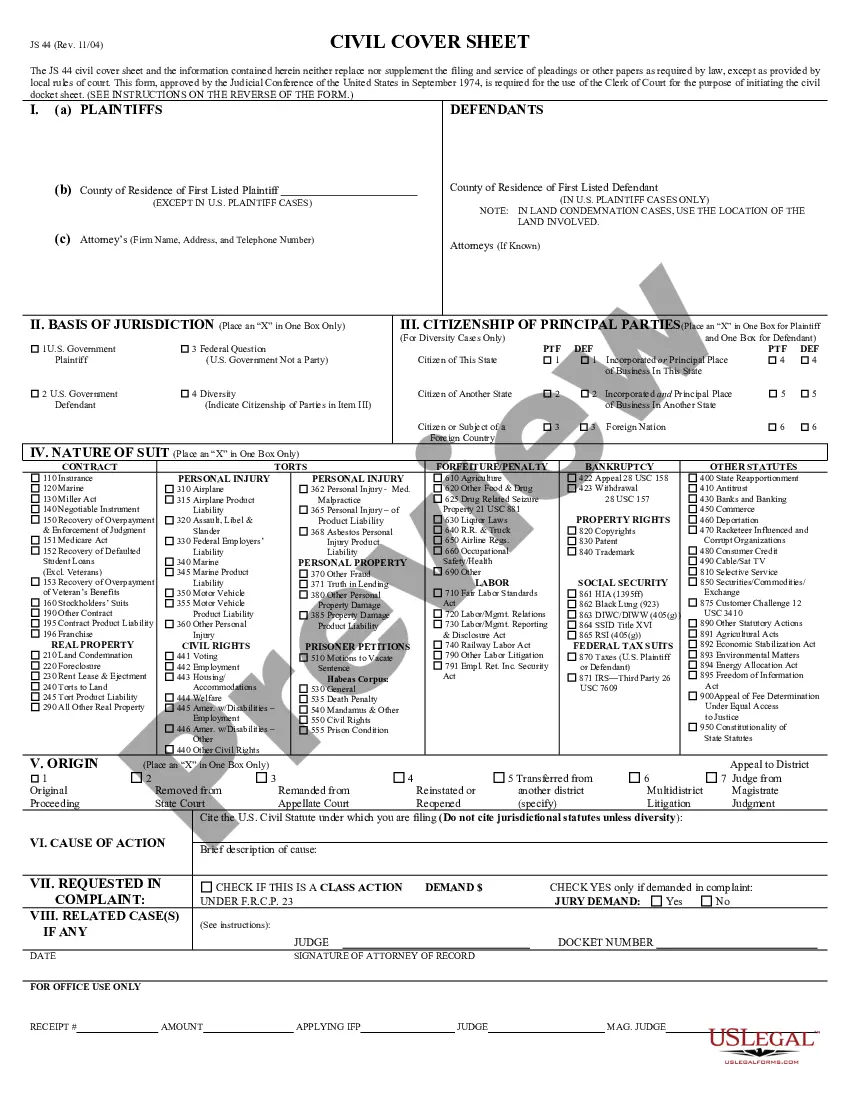

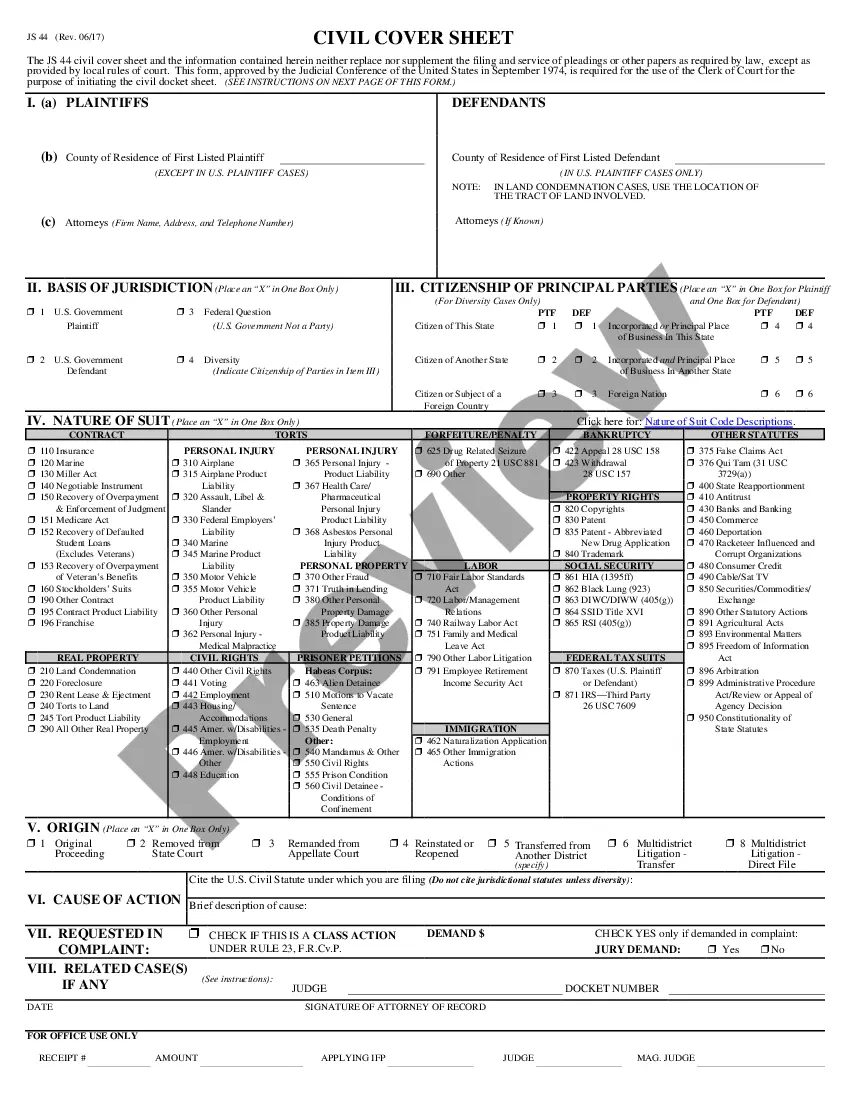

How to fill out Alabama Plan Of Merger Between Food Lion, Inc., Hannaford Brothers Company And FL Acquisition Sub, Inc.?

You can devote time on-line searching for the authorized record design which fits the state and federal requirements you need. US Legal Forms offers a huge number of authorized varieties which can be reviewed by specialists. You can actually download or print the Alabama Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc. from my support.

If you have a US Legal Forms accounts, you may log in and click on the Down load option. Following that, you may complete, change, print, or signal the Alabama Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc.. Each and every authorized record design you acquire is your own eternally. To get yet another copy of the purchased type, go to the My Forms tab and click on the corresponding option.

If you work with the US Legal Forms website the first time, adhere to the basic guidelines listed below:

- Initial, ensure that you have chosen the proper record design for the state/town of your liking. Read the type description to make sure you have selected the appropriate type. If available, utilize the Preview option to search throughout the record design also.

- If you would like find yet another variation of your type, utilize the Look for field to obtain the design that meets your requirements and requirements.

- When you have identified the design you need, simply click Purchase now to move forward.

- Choose the pricing program you need, enter your qualifications, and sign up for a merchant account on US Legal Forms.

- Full the financial transaction. You may use your Visa or Mastercard or PayPal accounts to purchase the authorized type.

- Choose the format of your record and download it for your system.

- Make alterations for your record if necessary. You can complete, change and signal and print Alabama Plan of Merger between Food Lion, Inc., Hannaford Brothers Company and FL Acquisition Sub, Inc..

Down load and print a huge number of record themes making use of the US Legal Forms Internet site, that offers the largest assortment of authorized varieties. Use expert and condition-specific themes to handle your organization or individual requires.

Form popularity

FAQ

Founded and based in Salisbury, N.C., since 1957, Food Lion is a company of Ahold Delhaize USA, the U.S. division of Zaandam-based Ahold Delhaize. For more information, visit foodlion.com.

The Food Town chain was acquired by the Belgium-based Delhaize Group grocery company in 1974. The Food Lion name was adopted in 1983; as Food Town expanded into Virginia, the chain encountered several stores called Foodtown in the Richmond area.

In 2000, Delhaize America bought Hannaford; the purchase both eliminated an emerging competitor to its Food Lion chain in the Southeast and expanded Delhaize operations into the Northeast. Some Hannaford locations in North Carolina were sold to Lowes Foods upon the buyout by Delhaize while others were closed.

Food Lion's parent company is Ahold Delhaize, the same owners since 1974. Delhaize merged with Ahold in 2015 and holds a wide range of retail stores in 10 different countries. In the United States, they also own the popular online grocery service FreshDirect, as well as my beloved hometown grocery store Giant.