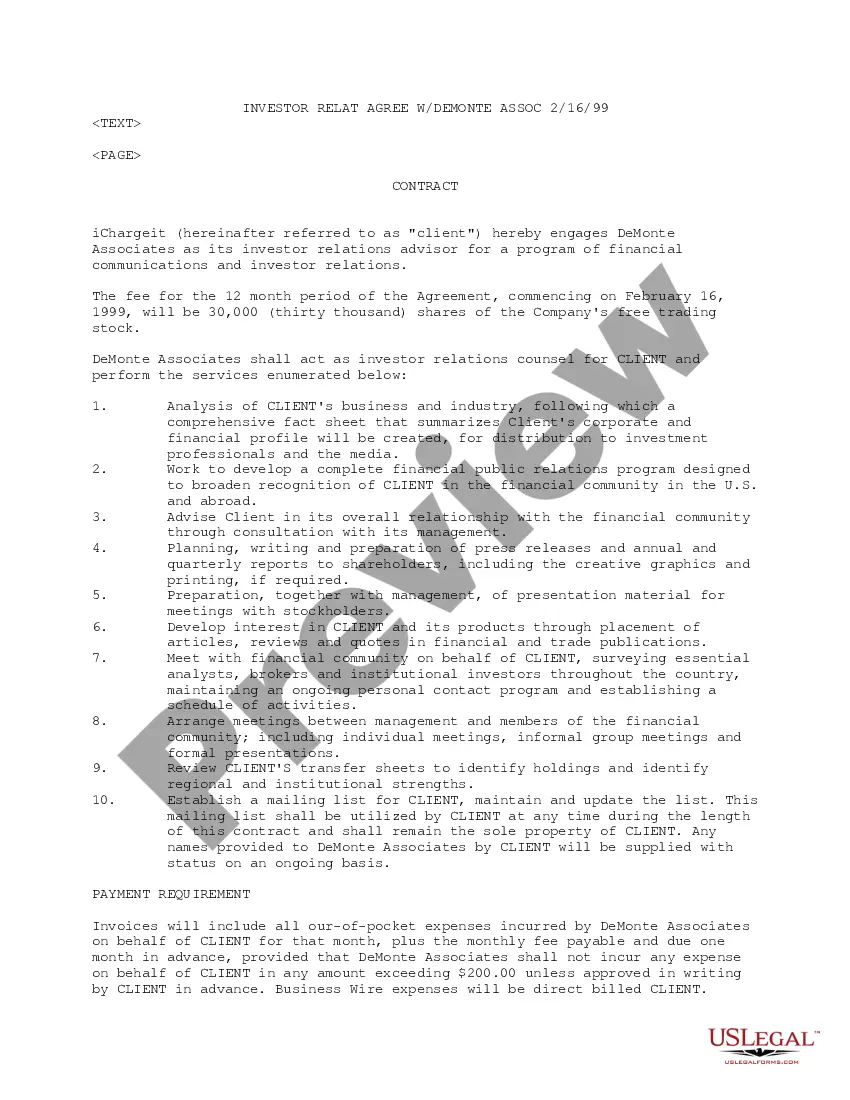

Alabama Investor Relations Agreement regarding Advisor for a Program of Financial Communications and Investor Relations

Description

How to fill out Investor Relations Agreement Regarding Advisor For A Program Of Financial Communications And Investor Relations?

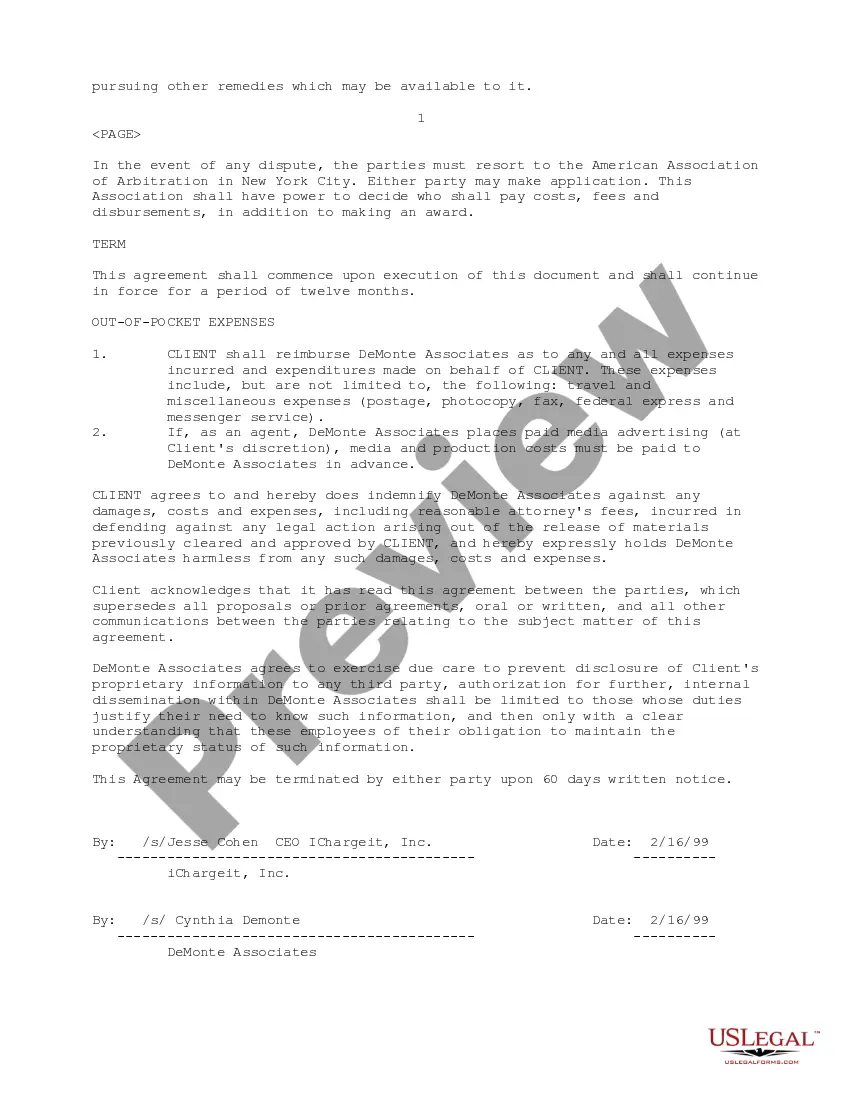

If you need to full, obtain, or produce legitimate document layouts, use US Legal Forms, the largest selection of legitimate forms, which can be found on the Internet. Utilize the site`s easy and convenient look for to discover the documents you require. Various layouts for enterprise and personal uses are sorted by classes and claims, or key phrases. Use US Legal Forms to discover the Alabama Investor Relations Agreement regarding Advisor for a Program of Financial Communications and Investor Relations within a number of click throughs.

When you are presently a US Legal Forms client, log in to your accounts and then click the Obtain option to obtain the Alabama Investor Relations Agreement regarding Advisor for a Program of Financial Communications and Investor Relations. You may also accessibility forms you earlier delivered electronically within the My Forms tab of your own accounts.

If you work with US Legal Forms initially, follow the instructions below:

- Step 1. Be sure you have chosen the shape to the correct city/country.

- Step 2. Take advantage of the Review solution to look over the form`s articles. Do not neglect to read through the outline.

- Step 3. When you are unhappy using the form, use the Look for field at the top of the display to find other types in the legitimate form template.

- Step 4. After you have identified the shape you require, click on the Get now option. Choose the pricing program you choose and put your accreditations to register for an accounts.

- Step 5. Procedure the financial transaction. You can utilize your credit card or PayPal accounts to accomplish the financial transaction.

- Step 6. Select the file format in the legitimate form and obtain it on the device.

- Step 7. Total, edit and produce or indicator the Alabama Investor Relations Agreement regarding Advisor for a Program of Financial Communications and Investor Relations.

Each and every legitimate document template you purchase is the one you have forever. You have acces to each and every form you delivered electronically in your acccount. Go through the My Forms portion and pick a form to produce or obtain again.

Be competitive and obtain, and produce the Alabama Investor Relations Agreement regarding Advisor for a Program of Financial Communications and Investor Relations with US Legal Forms. There are many expert and condition-certain forms you can use to your enterprise or personal needs.

Form popularity

FAQ

An investor relations plan is a strategy that helps businesses to manage their relationships with investors. It is an important tool for companies to ensure that their investors are informed and engaged, and that their investments are well-managed. Investor Relations Plan Template - Cascade Strategy cascade.app ? templates ? investor-relations-... cascade.app ? templates ? investor-relations-...

There are principally four types of investor relations public relations, investor relations, commercial dispatches, and marketing. Public relations are the most common type, and it's generally conducted by a company's external PR establishment. Types of Investor Relations - Medium medium.com ? types-of-investor-relations-ef4c45... medium.com ? types-of-investor-relations-ef4c45...

Core Differences A central difference between IR and PR is that IR deals with internal relationships while PR is a communication activity between the company and the public. Similarly, IR involves managers and employees, while PR impacts other stakeholders, including customers, communities and business associates. Differences Between IR & PR - Small Business - Chron.com chron.com ? differences-between-ir-... chron.com ? differences-between-ir-...

The investor relations (IR) department is a division of a business, usually a public company, whose job it is to provide investors with an accurate account of company affairs. This helps private and institutional investors make informed decisions on whether to invest in the company.

What steps should you take to build a business' IR function from scratch? Learn Your Company's Story. ... Assess Available Resources. ... Create a Comprehensive Investor Relations Plan. ... Centralize Your IR Data and Contacts. How to Start an In-House Investor Relations Function - Irwin getirwin.com ? blog ? in-house-investor-rela... getirwin.com ? blog ? in-house-investor-rela...

Investor relations (or IR) is a specific sub-discipline of public relations that revolves around how a company communicates with investors, shareholders, government authorities and the financial community.

International Public Relations (IPR) is a relatively new field that deals with managing communications between an organization and the global public. PR professionals use various techniques to generate positive publicity, including local media, press releases, and occasions.

The key difference between public relations and corporate communications is that corporate communication is focused on communications within an organisation, while public relations is focused on communications with the public.