Alabama Retainer Agreement

Description

How to fill out Retainer Agreement?

Are you currently within a placement in which you need documents for both enterprise or individual purposes just about every day time? There are a variety of legal papers web templates available on the net, but discovering versions you can depend on is not easy. US Legal Forms gives a large number of develop web templates, much like the Alabama Retainer Agreement, that are created to fulfill state and federal demands.

In case you are previously knowledgeable about US Legal Forms web site and possess your account, just log in. Following that, it is possible to download the Alabama Retainer Agreement web template.

Unless you provide an accounts and want to begin to use US Legal Forms, follow these steps:

- Find the develop you want and ensure it is for the correct town/region.

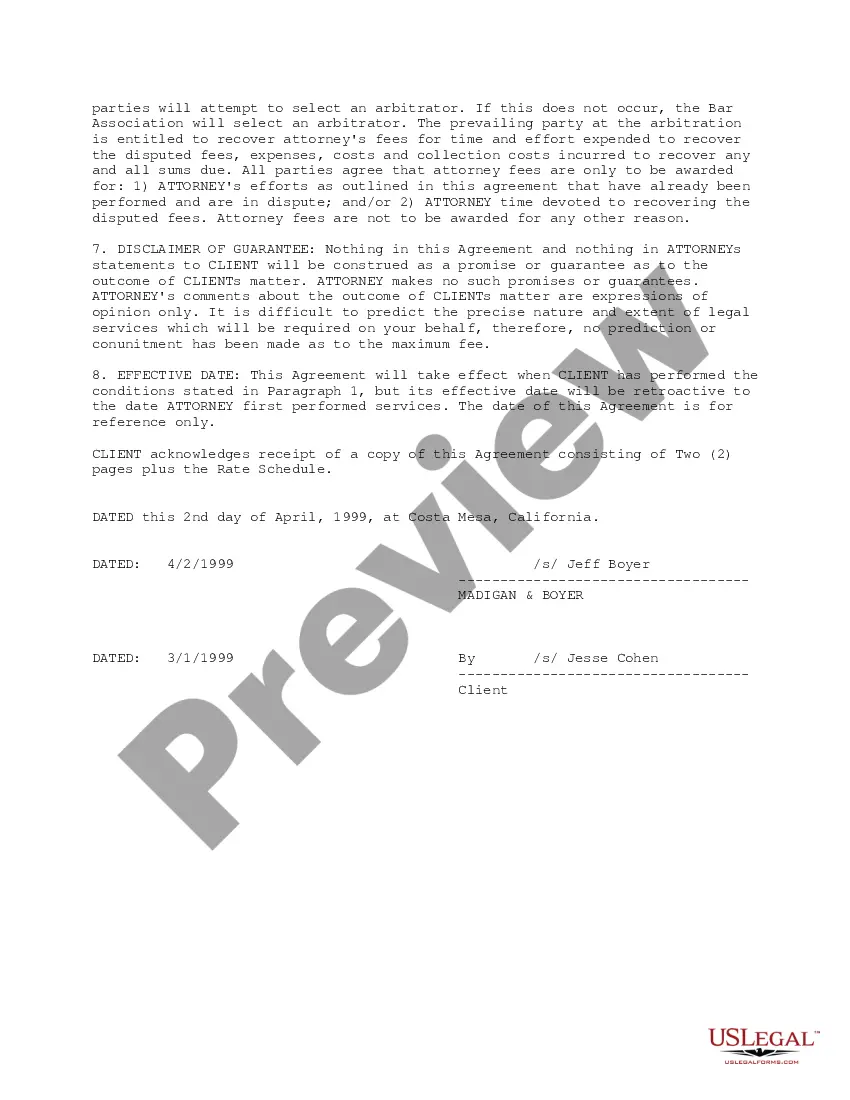

- Utilize the Review key to examine the shape.

- Look at the information to ensure that you have chosen the proper develop.

- In the event the develop is not what you`re seeking, utilize the Lookup industry to get the develop that fits your needs and demands.

- If you get the correct develop, simply click Purchase now.

- Choose the pricing strategy you would like, submit the required info to create your account, and buy your order with your PayPal or bank card.

- Select a hassle-free paper formatting and download your duplicate.

Discover every one of the papers web templates you have bought in the My Forms menus. You may get a additional duplicate of Alabama Retainer Agreement at any time, if possible. Just click on the necessary develop to download or print out the papers web template.

Use US Legal Forms, the most considerable variety of legal forms, to conserve some time and stay away from mistakes. The support gives professionally manufactured legal papers web templates which can be used for a variety of purposes. Generate your account on US Legal Forms and start making your way of life a little easier.

Form popularity

FAQ

A retainer fee is an advance payment a client makes to a professional, and it is considered a down payment on the future services rendered by that professional. Regardless of occupation, the retainer fee funds the initial expenses of the working relationship. Retainer Fee Meaning, Uses, How It Works, and Example - Investopedia investopedia.com ? terms ? retainer-fee investopedia.com ? terms ? retainer-fee

A retainer is a fee paid to a lawyer or law firm in advance of services being rendered, and the law firm should hold it in a trust account until the services are provided. It gets booked to the balance sheet as a prepaid expense (which is an asset).

Accounting for a Retainer Fee If the firm is using the accrual basis of accounting, retainers are recognized as a liability upon receipt of the cash, and are recognized as revenue only after the associated work has been performed.

The retainer or deposit is treated as a liability to show that, although your business is holding the money from a deposit or retainer, it doesn't belong to you until it's used to pay for services. When you invoice the customer and receive payment against it, you'll turn that liability into income.

A retainer fee is an advance payment a client makes to a professional, and it is considered a down payment on the future services rendered by that professional. Regardless of occupation, the retainer fee funds the initial expenses of the working relationship.

The essential parts of the agreement include: Scope and nature of the work. What is the attorney expected to do for the client? ... Retainer fee. The retainer fee is the amount charged to the client. ... Client expenses. The client typically pays for some expenses, especially filing-related expenses, and travel costs. When to Use a Retainer Agreement and When to Avoid It copyrighted.com ? blog ? retainer-agreement copyrighted.com ? blog ? retainer-agreement

A retainer is a fee paid to a lawyer or law firm in advance of services being rendered, and the law firm should hold it in a trust account until the services are provided. It gets booked to the balance sheet as a prepaid expense (which is an asset). How Should Bookkeepers Account For Legal Retainers? kruzeconsulting.com ? blog ? how-to-account-for... kruzeconsulting.com ? blog ? how-to-account-for...

Make sure all the following details make it into your retainer contract: The amount you're to receive each month. The date you're to be paid by. Any invoicing procedures you're expected to follow. Exactly how much work and what type of work you expect to do. When your client needs to let you know about the month's work by. How to Set Up a Retainer Agreement: Earn More From Your Best Clients bidsketch.com ? blog ? sales ? freelance-reta... bidsketch.com ? blog ? sales ? freelance-reta...