The Alabama Bylaws of Bankers Trust Corporation serve as a comprehensive set of rules and regulations governing the operations and activities of this esteemed banking institution. These bylaws are designed to provide clarity and guidance in various areas, ensuring that the bank adheres to legal requirements and operates ethically and responsibly. One of the key aspects covered in the Alabama Bylaws is the establishment and organizational structure of Bankers Trust Corporation. It outlines the formation process, including the requirements for shareholders, directors, and officers. It also provides guidelines for the roles and responsibilities of each position, as well as the processes for their appointment, removal, and decision-making. Another crucial aspect addressed in the bylaws is the governance framework of Bankers Trust Corporation. It details the procedures for conducting board meetings, defining quorum requirements, and establishing voting rights. The bylaws also lay out the rules related to the election of directors, their terms of office, and the committee structure within the board. The Alabama Bylaws also govern the financial operations of Bankers Trust Corporation. They outline the procedures for capital allocations, dividend distributions, and the acquisition of other financial institutions. These bylaws also discuss the processes for auditing, reporting, and financial disclosure, ensuring transparency and accountability within the organization. Furthermore, the bylaws cover various compliance and legal matters pertaining to Bankers Trust Corporation. It provides guidelines on risk management, regulatory compliance, and ethical conduct. The bylaws also set forth rules for conflicts of interest, confidentiality, and the protection of sensitive information. It is worth mentioning that different types of Alabama Bylaws of Bankers Trust Corporation may exist, catering to distinct divisions or subsidiaries of the bank. For example, there may be separate bylaws for the retail banking division, corporate banking division, or investment banking division. These specialized bylaws would address specific operational aspects and guidelines relevant to each division, while still adhering to the overarching principles outlined in the main bylaws of the corporation. In summary, the Alabama Bylaws of Bankers Trust Corporation establish a framework that governs the establishment, organization, governance, financial operations, compliance, and legal matters of this prominent banking institution. Adhering to these bylaws ensures that the bank operates efficiently, ethically, and in compliance with all applicable laws and regulations.

Alabama Bylaws of Bankers Trust Corporation

Description

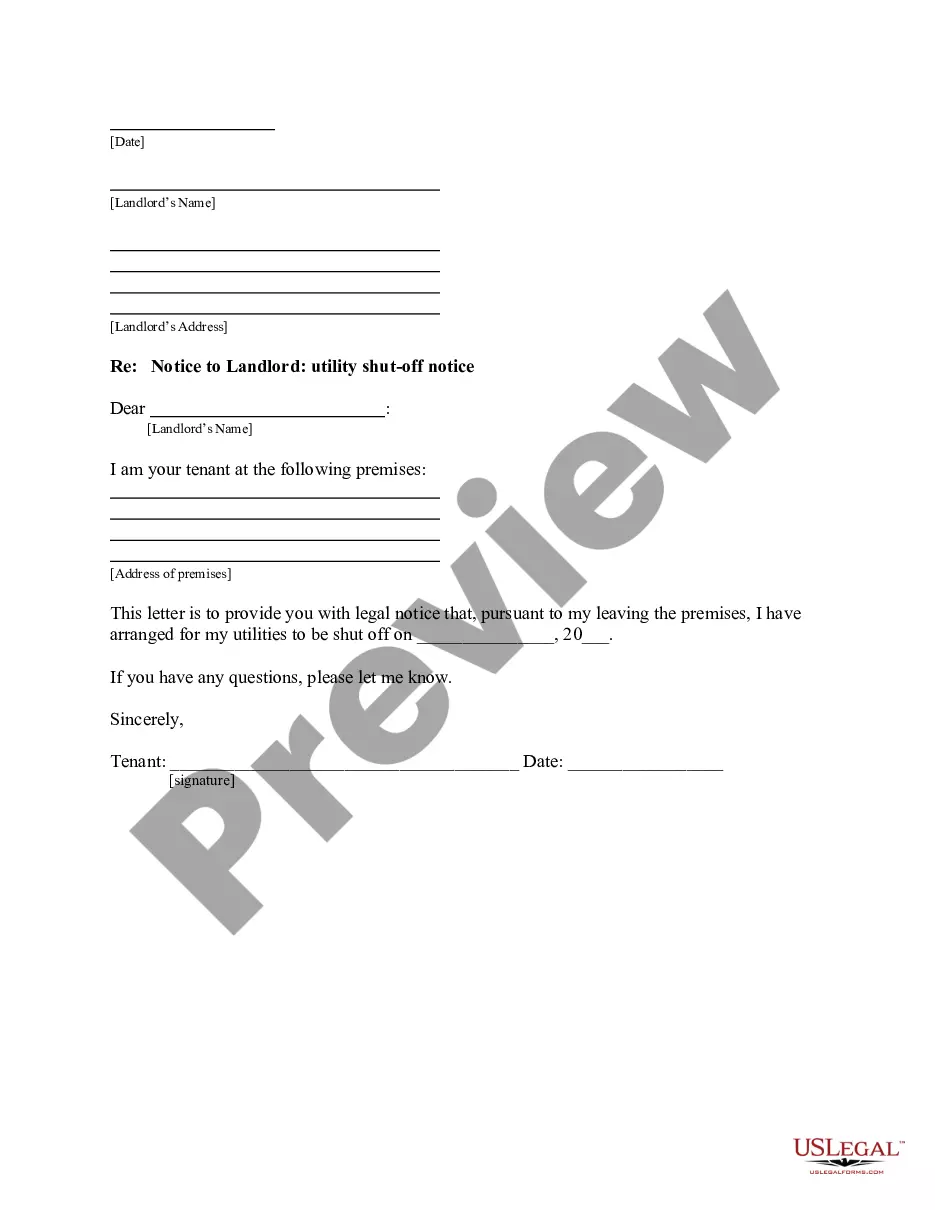

How to fill out Alabama Bylaws Of Bankers Trust Corporation?

US Legal Forms - one of many biggest libraries of lawful types in the USA - delivers a wide range of lawful file layouts you may download or print. Utilizing the web site, you can find thousands of types for company and specific uses, categorized by types, says, or keywords.You will find the most up-to-date types of types like the Alabama Bylaws of Bankers Trust Corporation within minutes.

If you currently have a subscription, log in and download Alabama Bylaws of Bankers Trust Corporation from the US Legal Forms collection. The Acquire switch can look on each type you see. You get access to all previously saved types from the My Forms tab of your own bank account.

If you would like use US Legal Forms the first time, here are straightforward recommendations to help you began:

- Be sure to have picked out the right type for your town/region. Select the Review switch to analyze the form`s content material. Read the type outline to actually have selected the proper type.

- If the type does not satisfy your needs, take advantage of the Research field on top of the display screen to discover the one who does.

- If you are satisfied with the shape, verify your option by clicking the Acquire now switch. Then, pick the costs prepare you want and give your qualifications to sign up for an bank account.

- Approach the purchase. Use your credit card or PayPal bank account to perform the purchase.

- Choose the file format and download the shape in your system.

- Make adjustments. Load, edit and print and signal the saved Alabama Bylaws of Bankers Trust Corporation.

Each and every template you included with your bank account lacks an expiry date and is also the one you have forever. So, if you would like download or print an additional backup, just proceed to the My Forms segment and click on on the type you need.

Get access to the Alabama Bylaws of Bankers Trust Corporation with US Legal Forms, one of the most considerable collection of lawful file layouts. Use thousands of professional and express-particular layouts that meet your business or specific demands and needs.