The Alabama Underwriting Agreement between print, Inc. is a legally binding contract that outlines the terms and conditions for the issue and sale of shares of common stock in the state of Alabama. This agreement serves as a crucial document in the process of raising capital for the company through the public offering of its shares. The primary objective of the Alabama Underwriting Agreement is to ensure a successful underwriting process by establishing a clear arrangement between print, Inc. and the underwriting group. The underwriting group, often consisting of investment banks or financial institutions, agrees to purchase and distribute the shares of common stock to potential investors. The agreement typically includes key provisions such as the number of shares to be issued, the offering price, the underwriting fee, and the timeframe for the offering. It also defines the responsibilities and obligations of both parties, establishing guidelines for the marketing and distribution of the shares. In cases where print, Inc. issues shares through an initial public offering (IPO), the underwriting agreement may differ slightly from other types of agreements. An IPO underwriting agreement details the specific terms and conditions unique to the company's debut on the public market. Additionally, there may be variations of the Alabama Underwriting Agreement depending on the nature of the offering. These could include firm commitment underwriting, the best efforts underwriting, or standby underwriting. In a firm commitment underwriting, the underwriting group agrees to purchase all the shares being offered by print, Inc., even if they are unable to sell them to investors. This type of agreement provides a high level of certainty to the company in terms of raising the desired capital. In the best efforts underwriting, the underwriting group commits to making its best efforts to sell the shares, but there is no guarantee of a specific amount being sold. The company assumes more risk in this scenario, as it may not achieve the desired capital raising target if the underwriters are unable to fully sell the shares. A standby underwriting agreement is often utilized in rights offerings. The underwriters guarantee to purchase any remaining shares that current shareholders do not exercise their rights to purchase. This arrangement provides assurance to the company that it will secure the anticipated funds even if existing shareholders do not fully participate. In conclusion, the Alabama Underwriting Agreement between print, Inc. is a comprehensive and essential document that governs the issue and sale of shares of common stock within the state. By determining the terms of the underwriting process, including the duties, responsibilities, and potential risks of both parties involved, this agreement plays a vital role in facilitating the successful funding and growth of print, Inc.

Alabama Underwriting Agreement between iPrint, Inc. regarding the Issue and Sale of Shares of Common Stock

Description

How to fill out Alabama Underwriting Agreement Between IPrint, Inc. Regarding The Issue And Sale Of Shares Of Common Stock?

If you wish to comprehensive, acquire, or produce legitimate papers layouts, use US Legal Forms, the biggest variety of legitimate types, that can be found online. Take advantage of the site`s easy and handy look for to discover the documents you require. Different layouts for company and personal uses are sorted by types and suggests, or keywords and phrases. Use US Legal Forms to discover the Alabama Underwriting Agreement between iPrint, Inc. regarding the Issue and Sale of Shares of Common Stock with a couple of click throughs.

Should you be presently a US Legal Forms client, log in to the bank account and click on the Download button to get the Alabama Underwriting Agreement between iPrint, Inc. regarding the Issue and Sale of Shares of Common Stock. You can even access types you earlier downloaded from the My Forms tab of your respective bank account.

If you work with US Legal Forms the very first time, follow the instructions listed below:

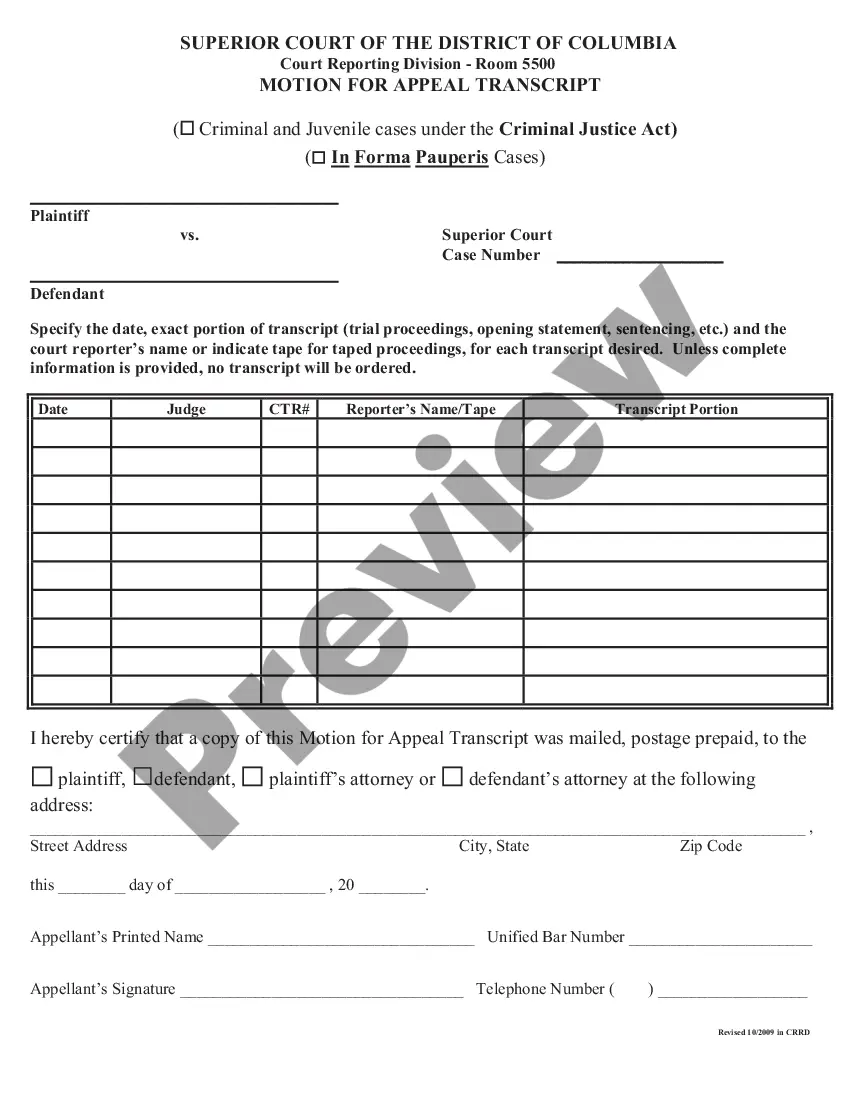

- Step 1. Be sure you have selected the form for the right metropolis/country.

- Step 2. Take advantage of the Preview method to look over the form`s information. Never overlook to read the description.

- Step 3. Should you be not satisfied with all the kind, utilize the Research field near the top of the display screen to find other types in the legitimate kind format.

- Step 4. When you have identified the form you require, go through the Buy now button. Opt for the costs program you like and include your references to register on an bank account.

- Step 5. Approach the purchase. You should use your charge card or PayPal bank account to complete the purchase.

- Step 6. Pick the file format in the legitimate kind and acquire it in your system.

- Step 7. Complete, edit and produce or indicator the Alabama Underwriting Agreement between iPrint, Inc. regarding the Issue and Sale of Shares of Common Stock.

Every legitimate papers format you acquire is the one you have eternally. You possess acces to every kind you downloaded within your acccount. Go through the My Forms area and decide on a kind to produce or acquire again.

Be competitive and acquire, and produce the Alabama Underwriting Agreement between iPrint, Inc. regarding the Issue and Sale of Shares of Common Stock with US Legal Forms. There are many skilled and state-specific types you can utilize to your company or personal requires.