Alabama Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II

Description

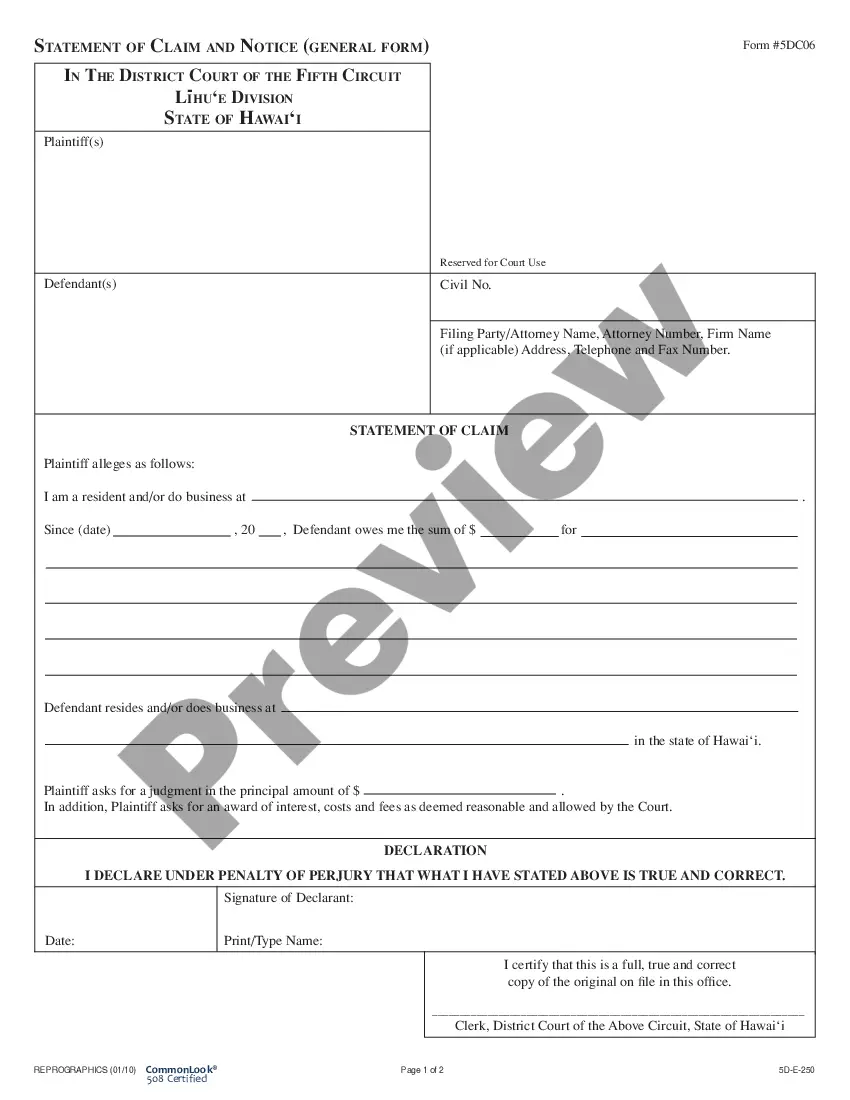

How to fill out Class C Distribution Plan And Agreement Between Putnam Mutual Funds Corp And Putnam High Yield Trust II?

If you need to full, acquire, or print out lawful file web templates, use US Legal Forms, the largest variety of lawful types, which can be found on the Internet. Use the site`s basic and convenient look for to get the files you will need. Numerous web templates for company and individual purposes are categorized by types and states, or search phrases. Use US Legal Forms to get the Alabama Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II with a number of clicks.

When you are currently a US Legal Forms buyer, log in for your profile and click on the Down load button to find the Alabama Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II. You can even gain access to types you formerly delivered electronically from the My Forms tab of your profile.

If you use US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have chosen the form for that right metropolis/region.

- Step 2. Make use of the Preview option to look over the form`s information. Don`t neglect to read the information.

- Step 3. When you are unhappy with all the develop, utilize the Look for field towards the top of the display to locate other variations of the lawful develop web template.

- Step 4. Upon having found the form you will need, select the Purchase now button. Pick the pricing program you favor and put your qualifications to sign up on an profile.

- Step 5. Method the financial transaction. You should use your credit card or PayPal profile to perform the financial transaction.

- Step 6. Choose the structure of the lawful develop and acquire it on your own gadget.

- Step 7. Total, revise and print out or indication the Alabama Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II.

Each and every lawful file web template you buy is yours eternally. You might have acces to every develop you delivered electronically within your acccount. Select the My Forms portion and choose a develop to print out or acquire once more.

Contend and acquire, and print out the Alabama Class C Distribution Plan and Agreement between Putnam Mutual Funds Corp and Putnam High Yield Trust II with US Legal Forms. There are thousands of expert and state-certain types you may use for your company or individual requires.

Form popularity

FAQ

Request a prospectus, a summary prospectus if available, or an offering statement from your financial representative, by calling Putnam at 1-800-225-1581, or click on the prospectus section.

Putnam is an active asset manager providing investment advice across all asset classes to individuals and institutions worldwide through separately managed accounts and pooled investment funds. Based in Boston, Putnam also has offices in Europe, Asia and Australia.

History. The firm was founded in 1937 by George Putnam, who established one of the first balanced mutual funds: The George Putnam Fund of Boston. Lawrence Lasser joined the company in 1969, and it became "one of the largest managers of mutual funds."

Putnam Investment has more than 100 mutual funds and 60 institutional strategies across a range of asset classes and investment styles.

Putnam is headquartered in Boston, Massachusetts and has offices in London, Tokyo, Frankfurt, Sydney, and Singapore.

Putnam Investments ? ETFs, Mutual Funds, Institutional, and 529. Putnam is the only fund family ranked in the top 10 by Barron's across all time periods. Barron's list of Best Fund Families, 2023.

The fixed income strategy includes funds with municipal bonds and tax-exempt bonds. Putnam Investment has more than 100 mutual funds and 60 institutional strategies across a range of asset classes and investment styles.

Founded in 1937, Putnam is a global asset management firm with $136 billion3 in AUM as of April 2023. Putnam has offices in Boston, London, Munich, Tokyo, Singapore and Sydney.