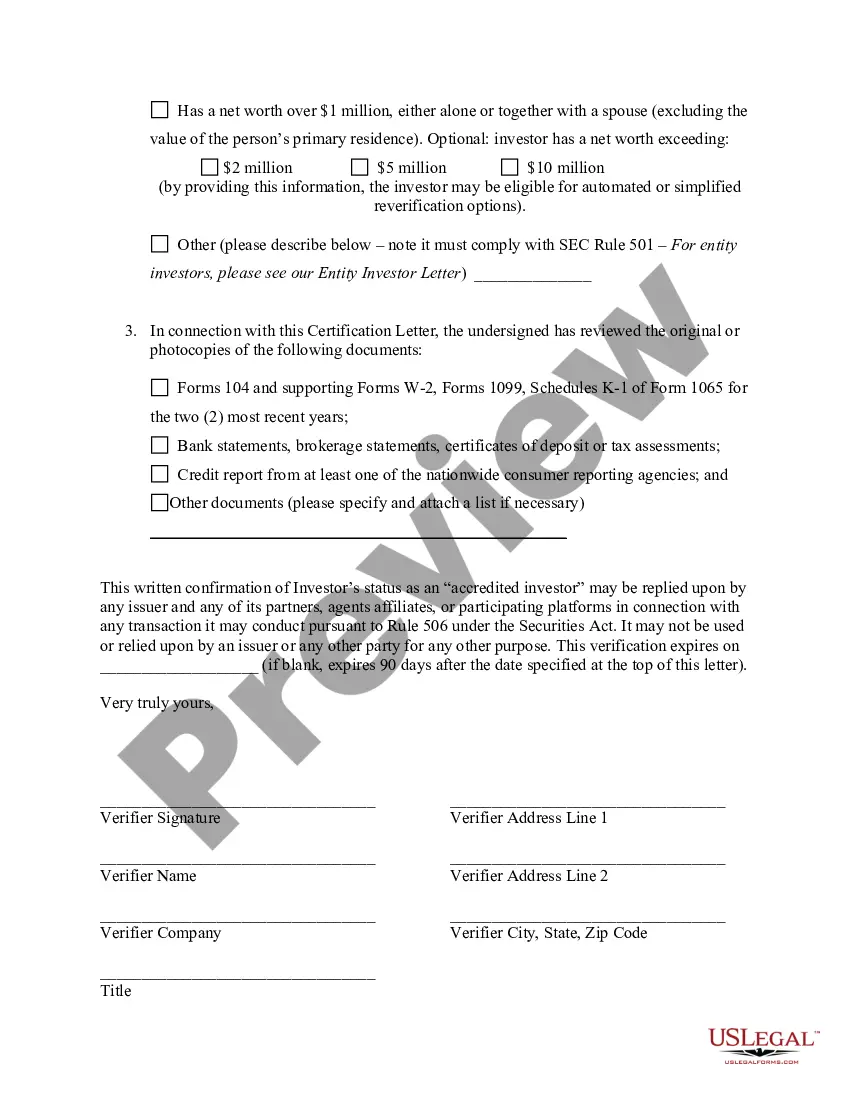

The Alabama Accredited Investor Verification Letter — Individual Investor is an essential document required for validating an individual's status as an accredited investor in the state of Alabama. This letter serves as proof that an individual meets specific financial criteria to invest in certain private securities offerings. In Alabama, the verification process ensures that potential investors possess the necessary financial sophistication and resources to understand and handle the risks associated with investment opportunities that are typically limited to accredited investors. Types of Alabama Accredited Investor Verification Letters — Individual Investor: 1. Basic Alabama Accredited Investor Verification Letter: This type of letter verifies that an individual meets the minimum income or net worth requirements to be considered an accredited investor, as defined by the Securities and Exchange Commission (SEC). 2. Alabama Accredited Investor Verification Letter — Income-Based: This variation of the verification letter focuses primarily on an individual's income to determine their eligibility as an accredited investor. It requires providing detailed information regarding the individual's annual income, such as salary, bonuses, investment returns, and other revenue sources. 3. Alabama Accredited Investor Verification Letter — Net Worth Based: This type of verification letter concentrates on an individual's net worth, which includes the value of their assets (e.g., home, vehicles, investments) minus their liabilities (e.g., mortgages, loans). Individuals who meet the minimum net worth criteria set by the SEC are eligible to receive this accreditation. 4. Alabama Accredited Investor Verification Letter — Joint Income or Net Worth: This variation of the verification letter caters to couples or individuals who combine their income or net worth when applying for accredited investor status. It requires providing comprehensive information on both partners' financial situations. 5. Alabama Accredited Investor Verification Letter — Professional Designation: Some individuals, although they may not meet the income or net worth criteria, can still be considered accredited investors if they hold specific professional certifications, licenses, or designations. This type of verification letter focuses on confirming the individual's professional credentials. Each Alabama Accredited Investor Verification Letter — Individual Investor should contain essential details, including the investor's full name, contact information, type of verification (e.g., income-based, net worth-based), supporting documentation (e.g., tax returns, bank statements, property appraisals), and a statement from a qualified third party attesting to the investor's status. It is crucial to note that specific requirements and formats for the Alabama Accredited Investor Verification Letter may vary, depending on the issuing organization or private securities offering. Investors should consult with legal professionals or financial advisors to ensure compliance with relevant regulations and to obtain the appropriate verification documentation for their investment activities.

Alabama Accredited Investor Veri?cation Letter - Individual Investor

Description

How to fill out Alabama Accredited Investor Veri?cation Letter - Individual Investor?

If you need to full, download, or print lawful document web templates, use US Legal Forms, the largest selection of lawful kinds, that can be found on-line. Take advantage of the site`s simple and easy handy research to obtain the papers you require. Numerous web templates for business and personal reasons are categorized by classes and claims, or keywords. Use US Legal Forms to obtain the Alabama Accredited Investor Veri?cation Letter - Individual Investor within a couple of clicks.

In case you are currently a US Legal Forms customer, log in in your accounts and then click the Acquire switch to find the Alabama Accredited Investor Veri?cation Letter - Individual Investor. You can also access kinds you in the past acquired within the My Forms tab of your accounts.

If you work with US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Make sure you have chosen the form for the proper city/region.

- Step 2. Make use of the Preview choice to check out the form`s content. Do not neglect to read through the description.

- Step 3. In case you are not satisfied with the kind, use the Look for area towards the top of the display to find other models in the lawful kind web template.

- Step 4. After you have identified the form you require, click the Buy now switch. Choose the costs prepare you prefer and add your accreditations to sign up on an accounts.

- Step 5. Approach the financial transaction. You should use your Мisa or Ьastercard or PayPal accounts to accomplish the financial transaction.

- Step 6. Find the formatting in the lawful kind and download it on your own device.

- Step 7. Full, modify and print or indication the Alabama Accredited Investor Veri?cation Letter - Individual Investor.

Each lawful document web template you acquire is the one you have for a long time. You have acces to each kind you acquired within your acccount. Click on the My Forms segment and decide on a kind to print or download again.

Compete and download, and print the Alabama Accredited Investor Veri?cation Letter - Individual Investor with US Legal Forms. There are thousands of expert and status-particular kinds you can utilize for your business or personal needs.