Alabama Accredited Investor Suitability

Description

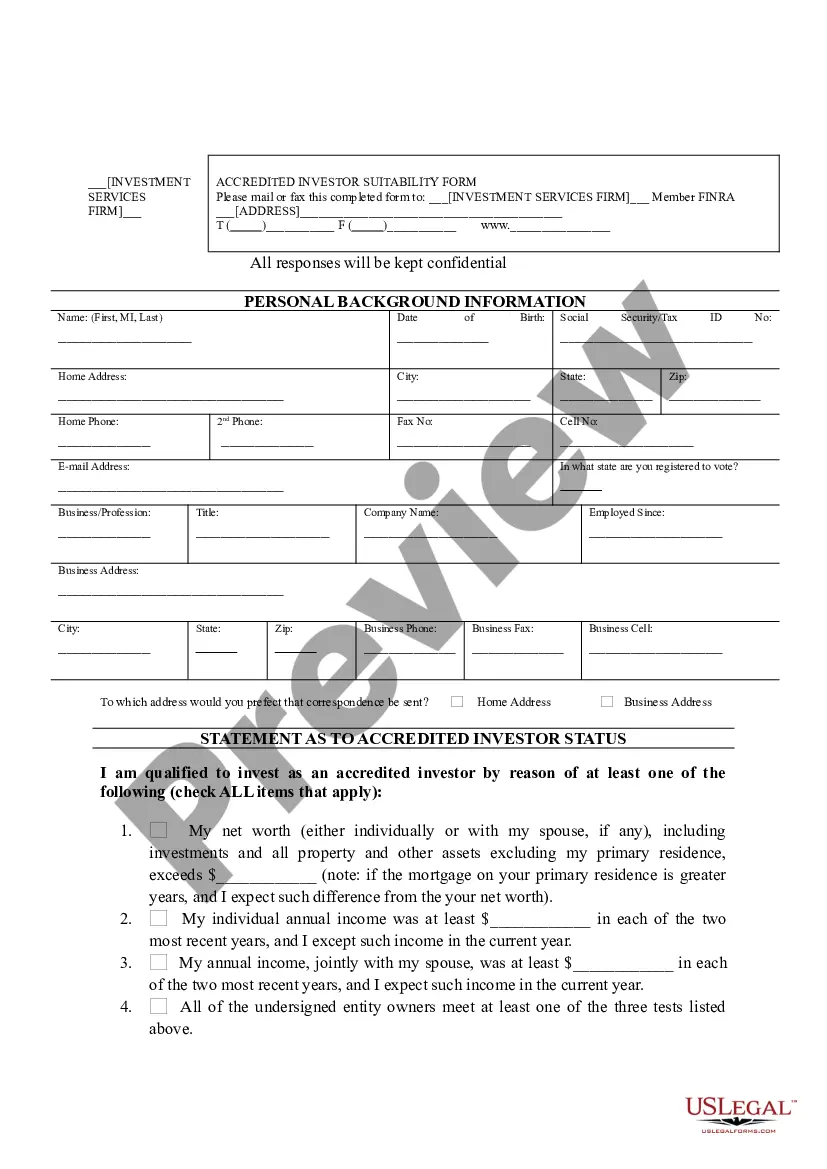

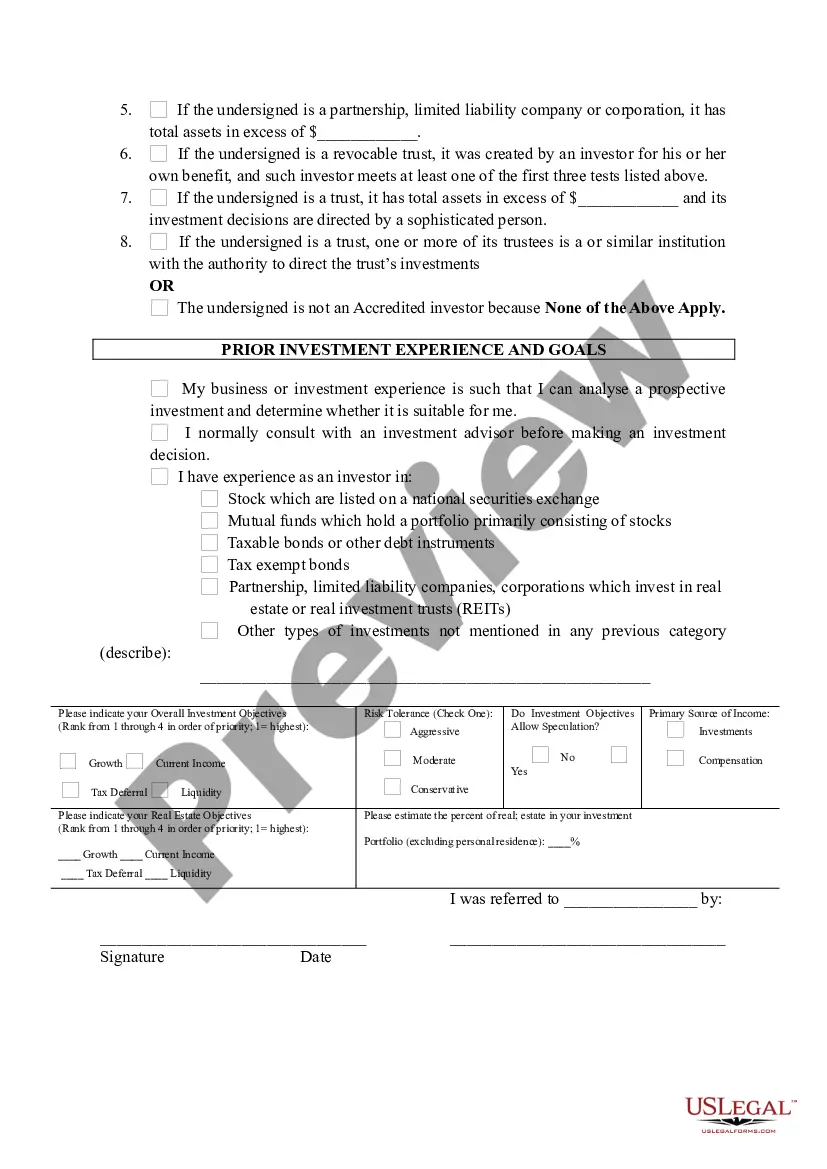

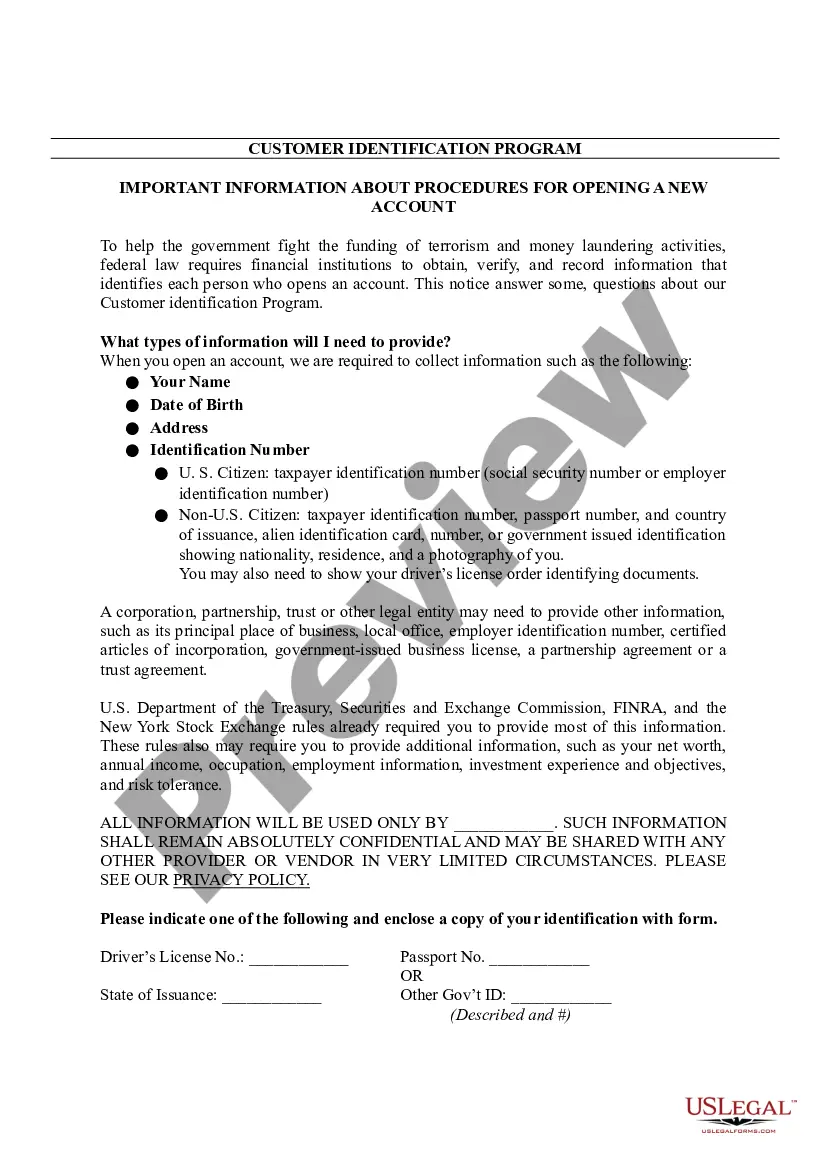

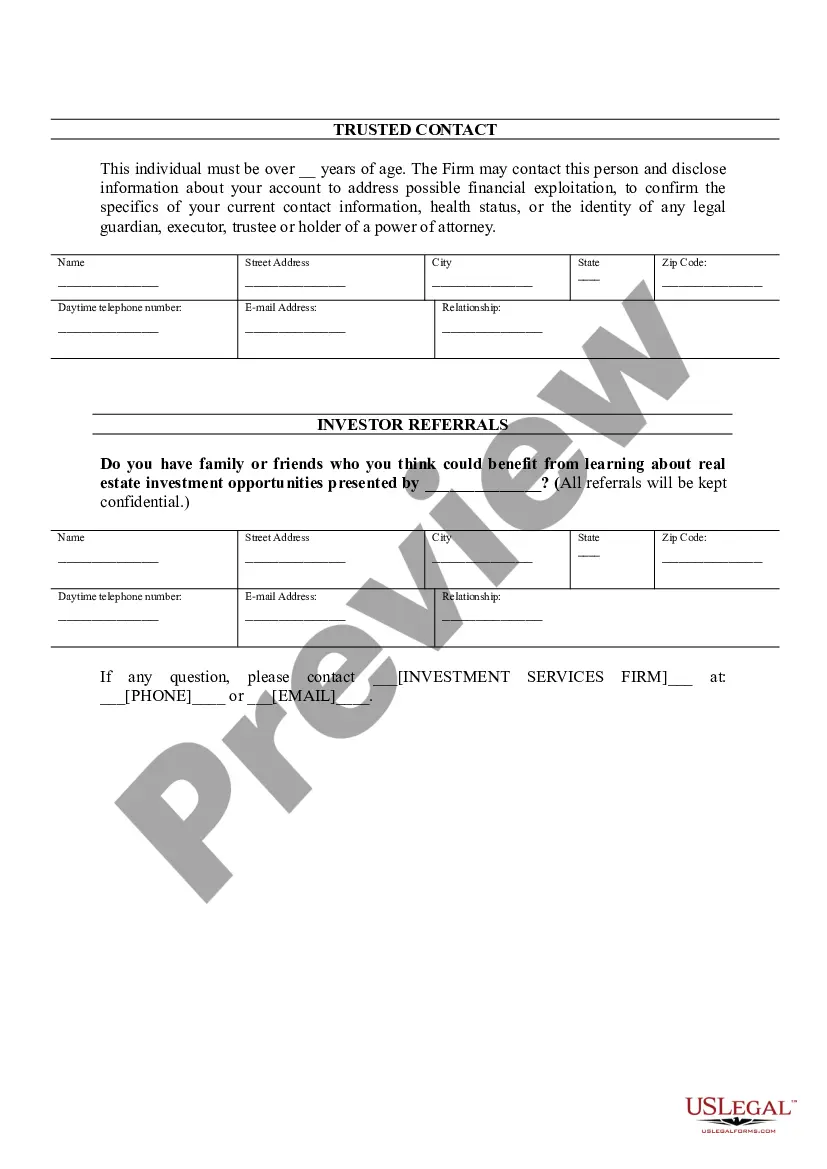

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Accredited Investor Suitability?

Finding the right legitimate file web template might be a struggle. Needless to say, there are tons of web templates available online, but how do you get the legitimate type you need? Take advantage of the US Legal Forms internet site. The support delivers 1000s of web templates, such as the Alabama Accredited Investor Suitability, that you can use for business and personal demands. All of the types are checked by specialists and fulfill federal and state needs.

If you are presently signed up, log in in your accounts and then click the Acquire key to find the Alabama Accredited Investor Suitability. Utilize your accounts to check throughout the legitimate types you may have bought previously. Go to the My Forms tab of your respective accounts and get one more copy of the file you need.

If you are a whole new user of US Legal Forms, listed here are straightforward instructions for you to stick to:

- Initial, make sure you have chosen the appropriate type for your personal area/state. You can examine the form using the Review key and look at the form information to make sure it is the right one for you.

- If the type is not going to fulfill your preferences, take advantage of the Seach area to discover the appropriate type.

- When you are certain that the form is proper, select the Acquire now key to find the type.

- Choose the costs strategy you would like and type in the required information. Make your accounts and purchase the order utilizing your PayPal accounts or charge card.

- Choose the file format and download the legitimate file web template in your system.

- Total, edit and print and signal the acquired Alabama Accredited Investor Suitability.

US Legal Forms may be the most significant catalogue of legitimate types in which you will find numerous file web templates. Take advantage of the service to download professionally-produced documents that stick to status needs.

Form popularity

FAQ

1975, § 8-6-11(a)(9), any offer or sale of securities which is made in compliance with the following requirements of this rule will be deemed to be an exempt transaction and Code of Ala.

Accredited investor questionnaires are used to determine whether potential investors meet the suitability requirements of Regulation D of the Securities Act of 1933, which may eliminate the need for the offering or issuance of such securities to be registered with the Securities and Exchange Commission.

Section 8-6-17 - Prohibited Acts Regarding Offer, Sale, or Purchase of Securities. Prohibited acts regarding offer, sale, or purchase of securities. (3) Engage in any act, practice or course of business which operates or would operate as a fraud or deceit upon any person.

This requires a securities license and registration with the Alabama Securities Commission, which means passing either the FINRA Series 6 or Series 7 exam as well as state securities law exams. Continuing education requirements of both the Alabama Department of Insurance and FINRA apply to variable annuity agents.

To form an RIA, investment advisors must pass the Series 65 exam (or equivalent). RIAs must register with the SEC or state authorities, depending on the amount of money they manage. Applying to become an RIA includes filing a Form ADV, which includes a disclosure document that is also distributed to all clients.

At a minimum, you'll need the following: FINRA entitlement. Form ADV filing. Form U4. Investment Management Agreement. Privacy Policy. Compliance Manual & Code of Ethics. Business Continuity Plan. Information Security Policy.

In order to file a registered investment adviser application with the state of Alabama, one must first apply to the Financial Industry Regulatory Authority (FINRA) for an account (Entitlement) to their WebCRD/IARD on-line system (the web application for the registration of RIA's and their representatives).

RIA firms can choose to establish themselves as a sole proprietorship, partnership, corporation or limited liability company (LLC). Your choice is dependent on a number of factors, including liability protection, tax implications and ease of formation.