Alabama Summary of Terms of Proposed Private Placement Offering

Description

How to fill out Summary Of Terms Of Proposed Private Placement Offering?

Discovering the right lawful document template can be a struggle. Needless to say, there are a lot of web templates accessible on the Internet, but how would you discover the lawful kind you want? Make use of the US Legal Forms website. The services delivers 1000s of web templates, like the Alabama Summary of Terms of Proposed Private Placement Offering, that can be used for enterprise and personal needs. Each of the types are examined by pros and meet state and federal demands.

Should you be already registered, log in in your profile and click on the Download button to obtain the Alabama Summary of Terms of Proposed Private Placement Offering. Use your profile to appear from the lawful types you possess acquired previously. Go to the My Forms tab of your profile and get yet another version of the document you want.

Should you be a brand new end user of US Legal Forms, here are straightforward recommendations so that you can comply with:

- Initial, ensure you have selected the appropriate kind for your city/state. It is possible to look through the form while using Review button and look at the form explanation to ensure this is the best for you.

- In case the kind will not meet your preferences, make use of the Seach industry to obtain the appropriate kind.

- Once you are positive that the form is suitable, click on the Purchase now button to obtain the kind.

- Choose the costs program you want and enter in the essential details. Design your profile and purchase the transaction utilizing your PayPal profile or Visa or Mastercard.

- Select the submit file format and download the lawful document template in your gadget.

- Total, change and print and indication the obtained Alabama Summary of Terms of Proposed Private Placement Offering.

US Legal Forms may be the most significant collection of lawful types where you can see different document web templates. Make use of the company to download appropriately-created documents that comply with status demands.

Form popularity

FAQ

To calculate ppm, you must first determine the mass or volume of solute per unit volume of solution, then multiply that amount by 1 million. For example, if you had 5g of salt dissolved in 500ml of water, you would divide 5g/500ml to get 0.01g/ml and then multiply 0.01g/mL by 1 million to calculate 10,000PPM.

What Is a Private Placement? A private placement is a sale of stock shares or bonds to pre-selected investors and institutions rather than publicly on the open market. It is an alternative to an initial public offering (IPO) for a company seeking to raise capital for expansion.

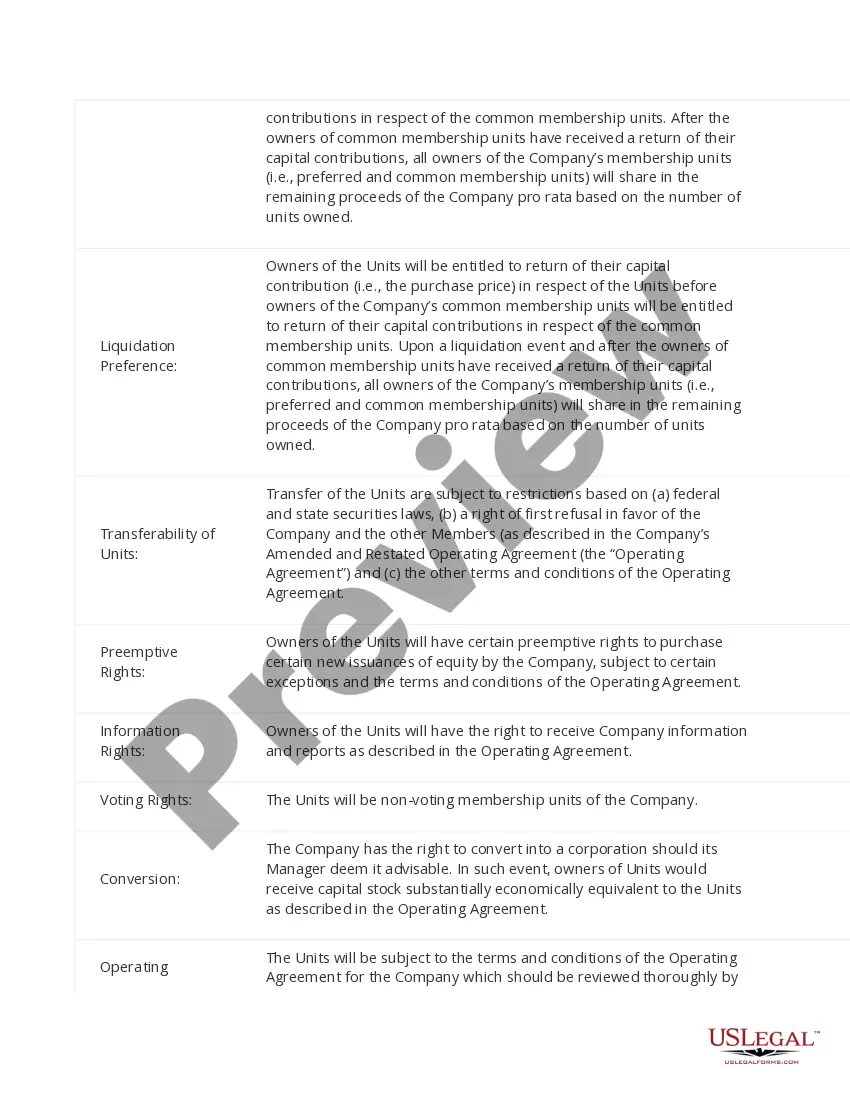

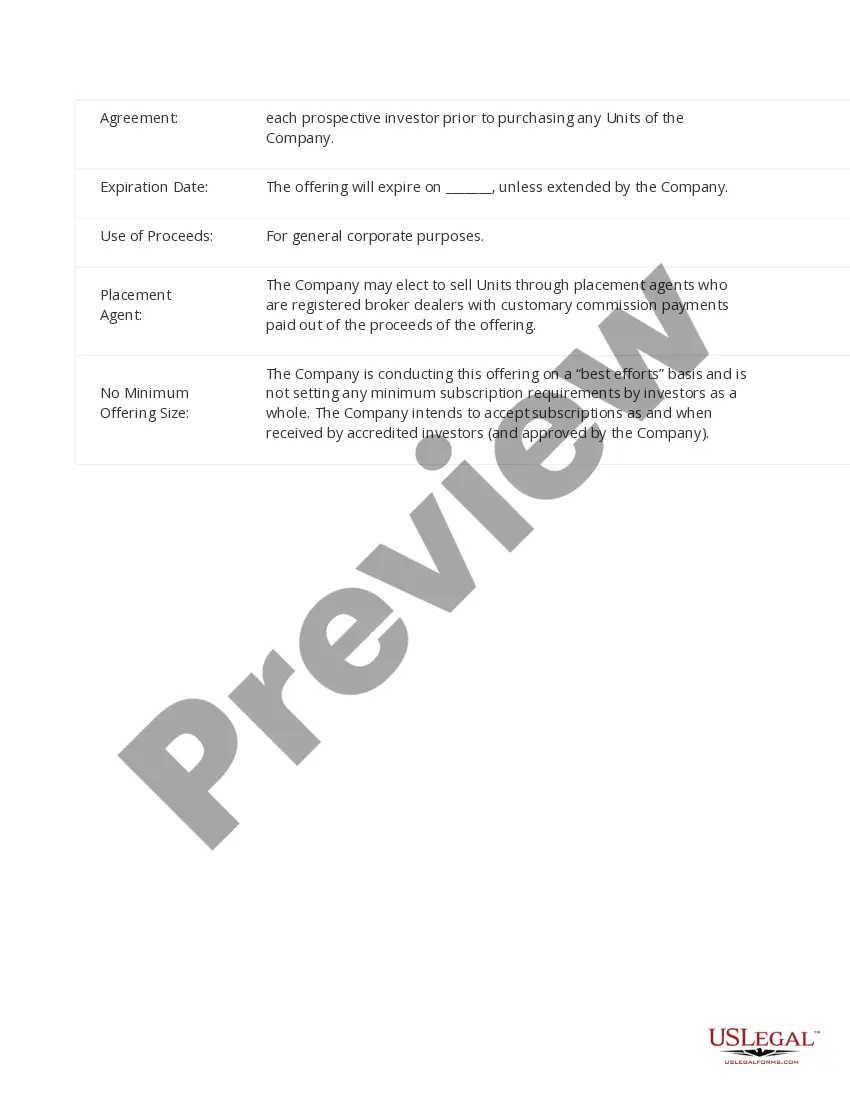

The following are among the key sections of a PPM: Summary of Offering Terms. ... Risk Factors. ... Estimated Use of Proceeds/Expenses Disclosures. ... Description of the Securities. ... Business & Management Section. ... Other Offering Documents.

An offering memorandum, also known as a private placement memorandum (PPM), is used by business owners of privately held companies to attract a specific group of outside investors. For these select investors, an offering memorandum is a way for them to understand the investment vehicle.

Planned preventative Maintenance (PPM Contracts) is a term used to describe scheduled maintenance or planned maintenance. This type of maintenance is performed regularly on an asset, such as a piece of equipment, a property, or an element of a property.

Typically PPMs contain: a complete description of the security offered for sale, the terms of the sales, and fees; capital structure and historical financial statements; a description of the business; summary biographies of the management team; and the numerous risk factors associated with the investment.

The Private Placement Memorandum (PPM) itself doesn't represent the actual ?offering.? Instead, it serves as a disclosure document that comprehensively describes the offering, encompassing its structure, strategies, regulation, financing, use of funds, business plan, services, risks, and management.

A Private Placement Memorandum (PPM) is a securities disclosure document used by a company (issuer) that is engaged in a private offering of securities. A PPM serves as a single, comprehensive document outlining the material details about the offering.