Alabama How to Request a Home Affordable Modification Guide

Description

How to fill out Alabama How To Request A Home Affordable Modification Guide?

If you have to comprehensive, acquire, or produce lawful record templates, use US Legal Forms, the largest collection of lawful forms, which can be found on the Internet. Utilize the site`s basic and handy search to discover the documents you will need. A variety of templates for company and specific uses are categorized by categories and states, or key phrases. Use US Legal Forms to discover the Alabama How to Request a Home Affordable Modification Guide in just a few mouse clicks.

When you are presently a US Legal Forms buyer, log in to your bank account and click the Acquire switch to obtain the Alabama How to Request a Home Affordable Modification Guide. Also you can access forms you formerly downloaded within the My Forms tab of your own bank account.

If you are using US Legal Forms initially, follow the instructions under:

- Step 1. Ensure you have selected the shape for your right city/country.

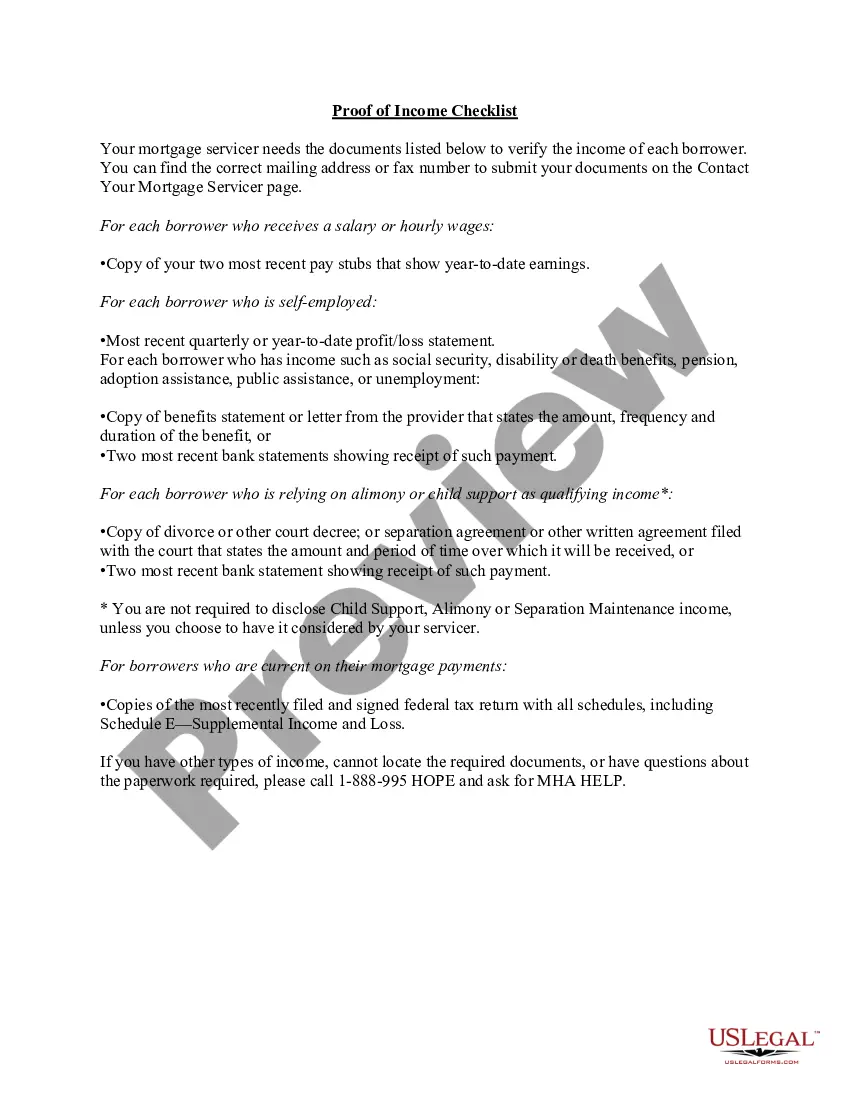

- Step 2. Utilize the Preview choice to look over the form`s content material. Don`t forget about to see the description.

- Step 3. When you are not happy using the type, make use of the Lookup field near the top of the display to get other types of the lawful type design.

- Step 4. When you have discovered the shape you will need, select the Get now switch. Opt for the prices prepare you favor and add your accreditations to sign up for an bank account.

- Step 5. Process the transaction. You should use your charge card or PayPal bank account to complete the transaction.

- Step 6. Find the format of the lawful type and acquire it on the gadget.

- Step 7. Full, change and produce or indication the Alabama How to Request a Home Affordable Modification Guide.

Every lawful record design you acquire is your own property for a long time. You might have acces to each type you downloaded within your acccount. Click the My Forms portion and pick a type to produce or acquire again.

Be competitive and acquire, and produce the Alabama How to Request a Home Affordable Modification Guide with US Legal Forms. There are millions of professional and status-specific forms you may use for the company or specific requires.

Form popularity

FAQ

A property became eligible if the analysis showed a lender or investor currently holding the loan would make more money by modifying the loan rather than foreclosing. Other than the requirement that a homeowner prove financial hardship, the home had to be habitable and have an unpaid principal balance under $729,750.

The long-term credit impact may be positive or negative depending on how your lender reports it to the credit bureaus. A loan modification can result in an initial drop in your credit score, but at the same time, it's going to have a far less negative impact than a foreclosure, bankruptcy or a string of late payments.

HAMP works by encouraging participating mortgage servicers to modify mortgages so struggling homeowners can have lower monthly payments and avoid foreclosure. It has specific eligibility requirements for homeowners and includes strict guidelines for servicers.

Qualifying for a Loan ModificationYou have to be suffering a financial hardship.You have to show you cannot afford your current mortgage payments.You have to be able to show that you can stay current on a modified payment schedule.The property has to be your primary residence to qualify for a HAMP modification.

Most lenders agree to modifications only if you're at immediate risk of foreclosure. A loan modification can also help you change the terms of your loan if your home loan is underwater. Contact your lender if you think you qualify for a modification.

A loan modification can relieve some of the financial pressure you feel by lowering your monthly payments and stopping collection activity. But loan modifications are not foolproof. They could increase the cost of your loan and add derogatory remarks to your credit report.

The U.S. Department of the Treasury (Treasury) retained Fannie Mae as its financial agent to administer the HAMP and retained Freddie Mac to serve as the Program's compliance agent. Participating servicers will follow the program guidelines and supplemental directives to modify residential loans.

Generally, the simplest way to calculate a debt to income ratio for loan modification is simply to take total monthly debt obligations and divide it by total monthly gross household income. Anything over about 60-70% is pretty good for loan modification purposes.

FHA-Home Affordable Modification Program (FHA-HAMP) Allows homeowners to modify their FHA-insured mortgages to reduce monthly mortgage payments and avoid foreclosure.

Technically, a loan modification should not have any negative impact on your credit score. That's because you and the lender have agreed to new terms for paying off your loan, so if you continue to meet those terms, there shouldn't be anything negative to report.