Alabama Contract Administrator Agreement - Self-Employed Independent Contractor

Description

How to fill out Alabama Contract Administrator Agreement - Self-Employed Independent Contractor?

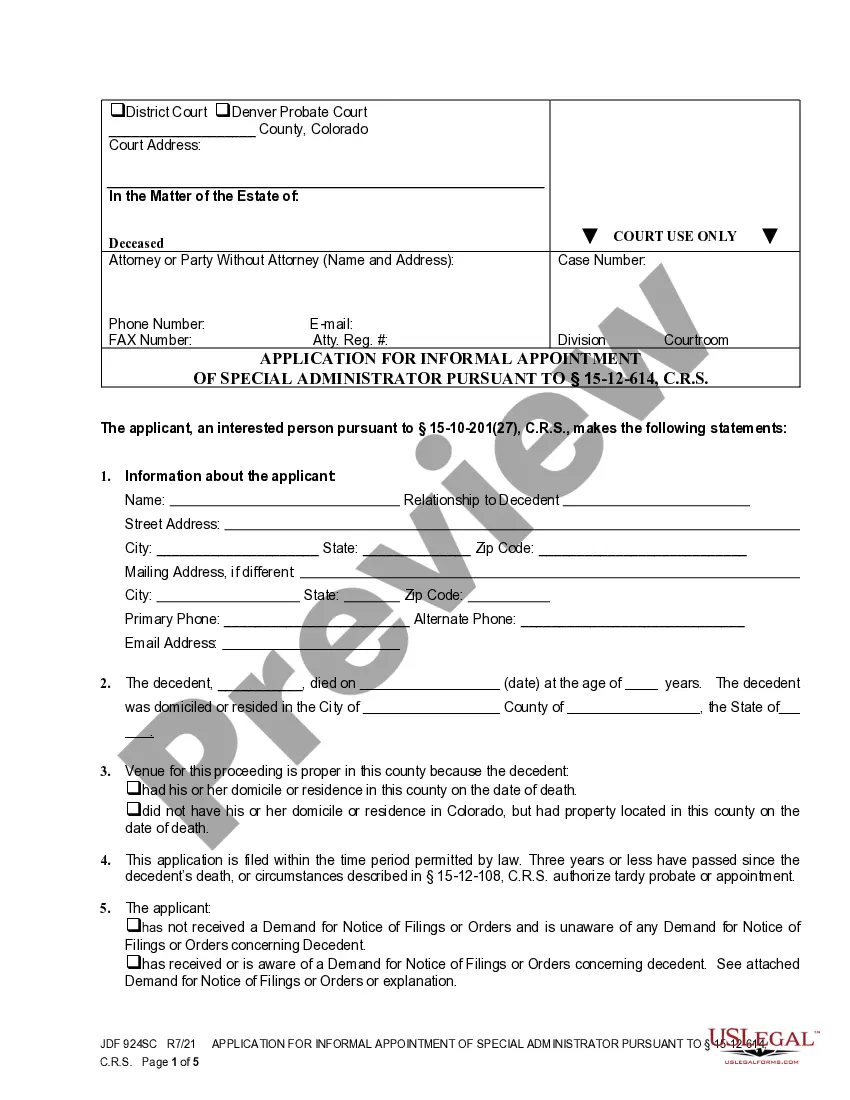

Choosing the best legal file format might be a battle. Obviously, there are tons of layouts available on the Internet, but how do you discover the legal kind you need? Make use of the US Legal Forms website. The support offers a huge number of layouts, for example the Alabama Contract Administrator Agreement - Self-Employed Independent Contractor, that you can use for company and private demands. All of the kinds are checked by pros and meet up with federal and state requirements.

In case you are previously signed up, log in for your profile and click on the Download option to have the Alabama Contract Administrator Agreement - Self-Employed Independent Contractor. Use your profile to check through the legal kinds you have ordered previously. Proceed to the My Forms tab of the profile and have one more copy from the file you need.

In case you are a new end user of US Legal Forms, allow me to share simple guidelines that you can adhere to:

- Initial, ensure you have chosen the correct kind for your personal metropolis/area. You may examine the form utilizing the Review option and read the form explanation to guarantee it is the right one for you.

- If the kind does not meet up with your expectations, use the Seach area to find the correct kind.

- When you are positive that the form is acceptable, click on the Buy now option to have the kind.

- Select the rates plan you would like and enter the necessary details. Create your profile and pay money for the transaction using your PayPal profile or Visa or Mastercard.

- Opt for the data file format and obtain the legal file format for your system.

- Full, modify and print out and indicator the acquired Alabama Contract Administrator Agreement - Self-Employed Independent Contractor.

US Legal Forms will be the most significant library of legal kinds for which you will find a variety of file layouts. Make use of the company to obtain expertly-created paperwork that adhere to condition requirements.

Form popularity

FAQ

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Some of the common characteristics of an independent contractor include:Furnishes equipment and has control over that equipment.Submits bids for jobs, contracts, or fixes the price in advance.Has the capacity to accept or refuse an assignment or work.Pay relates more to completion of a job.More items...

The IRS says that someone is self-employed if they meet one of these conditions:Someone who carries on a trade or business as a sole proprietor or independent contractor,A member of a partnership that carries on a trade or business, or.Someone who is otherwise in business for themselves, including part-time business.

Remember, the contractor does not have a contract with the contract administrator, so if the latter acts unfairly he is not liable under any contract. And, unless the contract administer is guilty of fraud, it is almost impossible for the contractor to sue him in tort.

When deciding whether you can safely treat a worker as an independent contractor, there are two separate tests you should consider: The common law test; and The reasonable basis test. The common law test: IRS examiners use the 20-factor common law test to measure how much control you have over the worker.

A business may pay an independent contractor and an employee for the same or similar work, but there are important legal differences between the two. For the employee, the company withholds income tax, Social Security, and Medicare from wages paid. For the independent contractor, the company does not withhold taxes.

These factors are: (1) the kind of occupation, with reference to whether the work usually is done under the direction of a supervisor or is done by a specialist without supervision; (2) the skill required in the particular occupation; (3) whether the employer or the individual in question furnishes the equipment used

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

The role of the contract administrator may be undertaken by a range of individuals, these include architects, engineers, building surveyors, quantity surveyors or any agent of the employer. In theory, the employer, contractor or a director or employee of either party can act as contract administrator.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.