Alabama Survey Assistant Contract - Self-Employed

Description

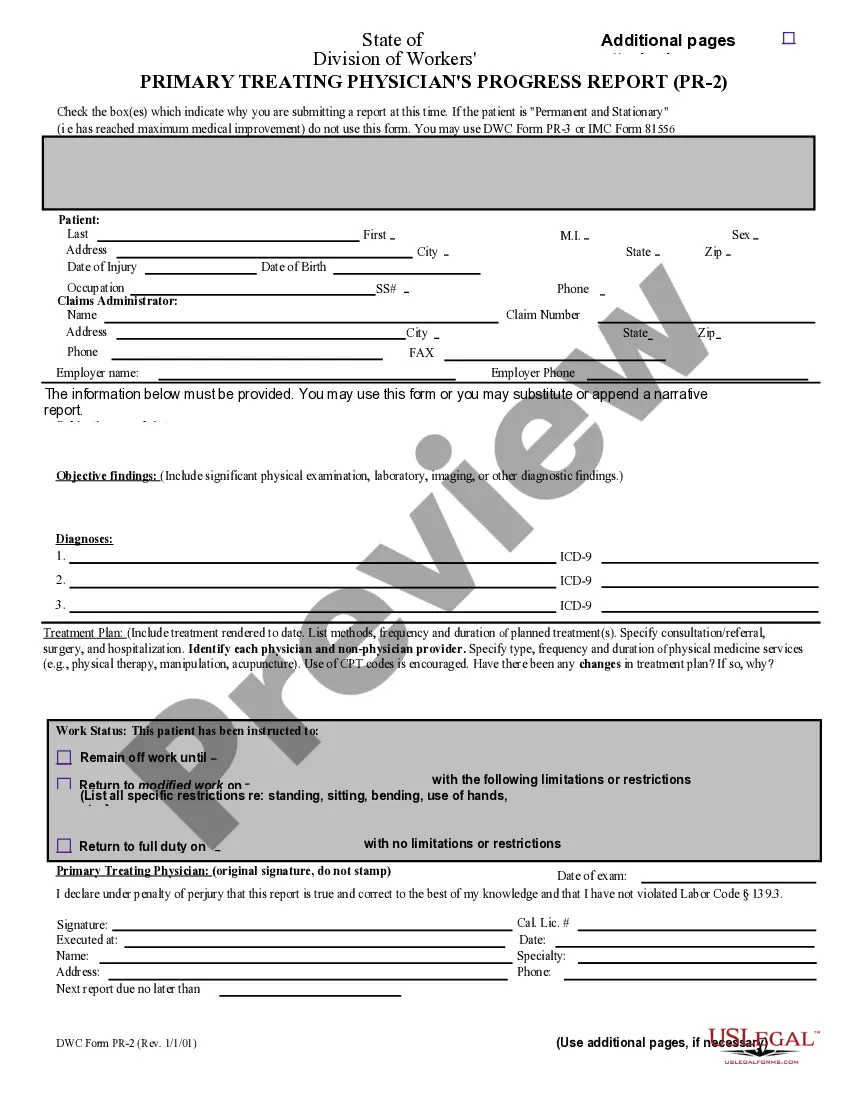

How to fill out Alabama Survey Assistant Contract - Self-Employed?

Are you within a placement in which you need paperwork for possibly enterprise or individual uses almost every working day? There are a variety of lawful papers templates available on the net, but getting kinds you can rely isn`t simple. US Legal Forms offers a large number of develop templates, such as the Alabama Survey Assistant Contract - Self-Employed, that happen to be composed to satisfy federal and state requirements.

When you are currently familiar with US Legal Forms web site and have a merchant account, merely log in. After that, you can acquire the Alabama Survey Assistant Contract - Self-Employed web template.

Unless you come with an account and would like to begin to use US Legal Forms, abide by these steps:

- Find the develop you want and make sure it is for that appropriate town/region.

- Make use of the Review option to check the shape.

- Browse the information to actually have selected the proper develop.

- In the event the develop isn`t what you are searching for, take advantage of the Research field to obtain the develop that meets your requirements and requirements.

- If you get the appropriate develop, just click Purchase now.

- Pick the costs prepare you need, fill out the required info to make your account, and pay money for an order making use of your PayPal or Visa or Mastercard.

- Decide on a convenient document formatting and acquire your backup.

Discover every one of the papers templates you may have bought in the My Forms menu. You may get a further backup of Alabama Survey Assistant Contract - Self-Employed any time, if required. Just go through the required develop to acquire or print the papers web template.

Use US Legal Forms, one of the most comprehensive selection of lawful varieties, in order to save time and steer clear of errors. The assistance offers skillfully manufactured lawful papers templates that can be used for a variety of uses. Create a merchant account on US Legal Forms and begin making your life easier.

Form popularity

FAQ

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

Start Soliciting ClientsContact local businesses that could utilize your contracting services. Ask to schedule a meeting with the person in charge of hiring contract workers. Present an informational package that highlights your strengths and services. Follow up with each company if you do not hear back from them.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Before you hire an independent contractor, you need to have three important documents: A W-9 form with the person's contact information and taxpayer ID number, A resume to verify the person's qualifications, and. A written contract showing the details of the agreement between you and the independent contractor.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.