A self-employed independent welder in Alabama provides welding services to various industries and clients. To ensure a smooth and professional working relationship, it is essential to have a well-defined contract in place. The Alabama Self-Employed Independent Welder Services Contract is a legal agreement that outlines the terms and conditions between the welder and their client. This comprehensive contract covers various aspects, including the scope of work, payment terms, project timeline, responsibilities of both parties, and any specific requirements or specifications. It ensures that both the welder and the client have a clear understanding of their obligations and expectations. The Alabama Self-Employed Independent Welder Services Contract may include different types based on the nature of the welding services being provided. Some common variations could be: 1. General Welding Services Contract: This type of contract covers a wide range of welding services, such as fabrication, repairs, and metalwork for various industries, including construction, manufacturing, oil and gas, and automotive. 2. Structural Welding Services Contract: Designed specifically for welders specializing in structural welding, this contract focuses on the welding of structural components like steel beams, columns, and trusses used in building construction. 3. Pipe Welding Services Contract: This contract is tailored for welders specialized in welding pipes for industries like oil and gas, plumbing, and manufacturing. It includes welding and fitting pipes of different materials and specifications. 4. Custom Welding Services Contract: For welders offering unique and customized welding services, this contract allows them to define specific requirements, materials, processes, and project expectations according to the client's needs. The Alabama Self-Employed Independent Welder Services Contract aims to protect the interests of both the welder and the client involved in the welding project. It establishes clear guidelines, ensures timely payment, clarifies liability issues, and safeguards intellectual property rights if applicable. While it is always advisable to seek legal counsel and customize the contract to fit individual circumstances, having a comprehensive and professionally-drafted Alabama Self-Employed Independent Welder Services Contract is crucial for establishing a successful and mutually beneficial working relationship between the welder and their clients.

Alabama Self-Employed Independent Welder Services Contract

Description

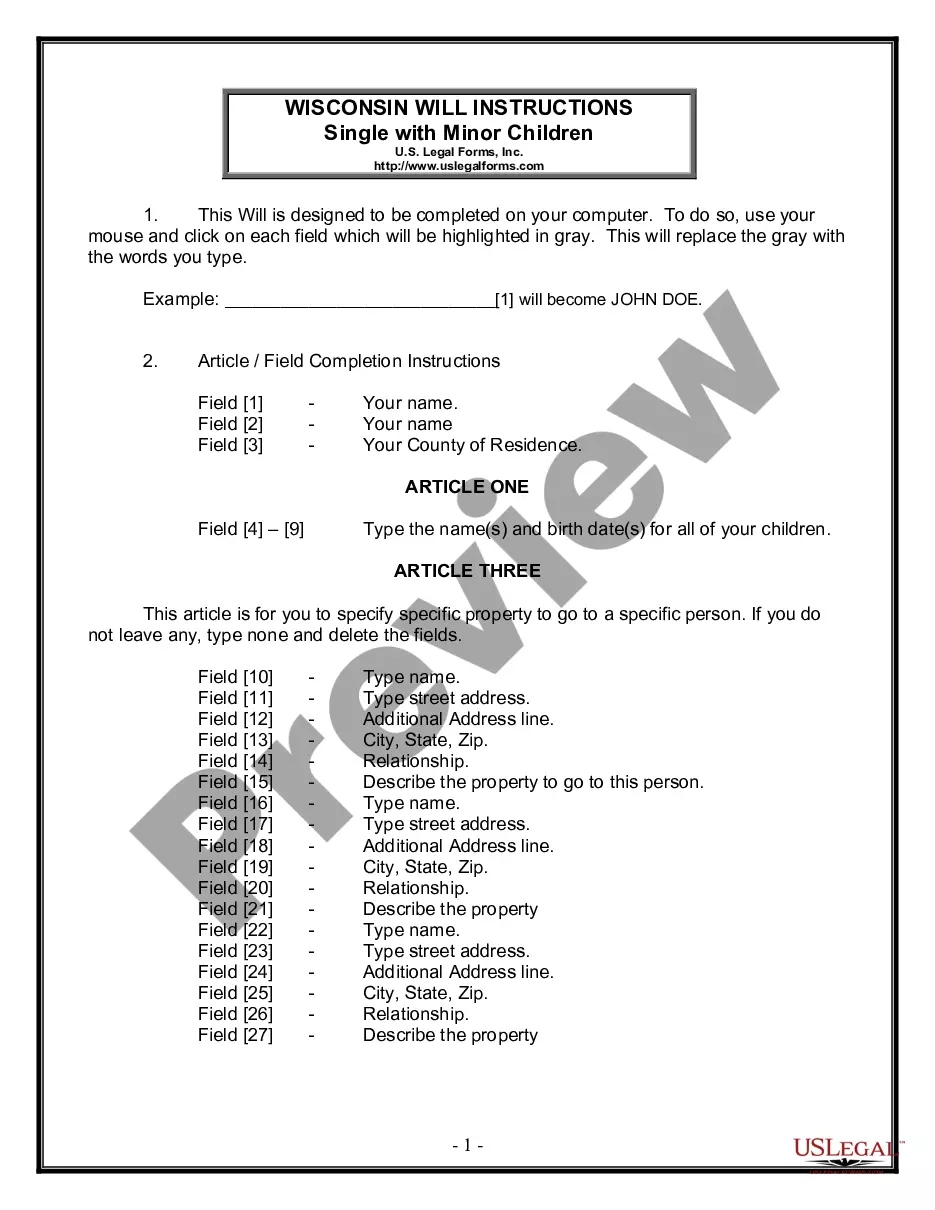

How to fill out Alabama Self-Employed Independent Welder Services Contract?

If you have to comprehensive, acquire, or print authorized file themes, use US Legal Forms, the greatest variety of authorized forms, that can be found on-line. Take advantage of the site`s easy and handy lookup to find the paperwork you need. Numerous themes for business and person uses are categorized by categories and says, or search phrases. Use US Legal Forms to find the Alabama Self-Employed Independent Welder Services Contract in just a few click throughs.

In case you are currently a US Legal Forms consumer, log in to your accounts and click the Obtain key to find the Alabama Self-Employed Independent Welder Services Contract. You may also entry forms you earlier acquired within the My Forms tab of your accounts.

Should you use US Legal Forms initially, follow the instructions listed below:

- Step 1. Be sure you have chosen the form for your right area/land.

- Step 2. Take advantage of the Review option to examine the form`s information. Don`t forget about to learn the outline.

- Step 3. In case you are unhappy together with the kind, use the Research industry on top of the display to discover other versions of the authorized kind format.

- Step 4. When you have discovered the form you need, go through the Purchase now key. Choose the pricing program you choose and put your credentials to register on an accounts.

- Step 5. Process the purchase. You may use your charge card or PayPal accounts to accomplish the purchase.

- Step 6. Select the formatting of the authorized kind and acquire it in your system.

- Step 7. Comprehensive, change and print or signal the Alabama Self-Employed Independent Welder Services Contract.

Every single authorized file format you purchase is your own forever. You may have acces to every single kind you acquired in your acccount. Click the My Forms portion and choose a kind to print or acquire once again.

Be competitive and acquire, and print the Alabama Self-Employed Independent Welder Services Contract with US Legal Forms. There are millions of professional and state-certain forms you can utilize for your personal business or person requirements.

Form popularity

FAQ

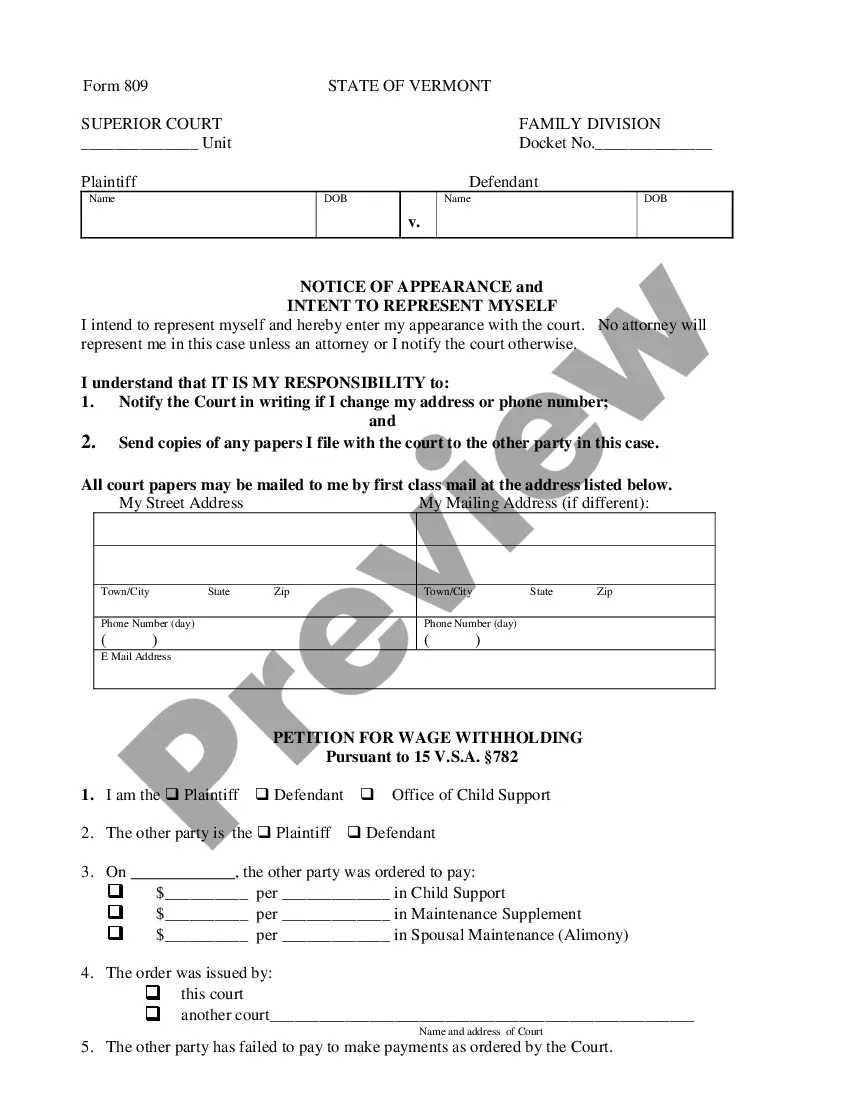

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.14-Feb-2022

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Contractors can also be self-employed, but they perform tasks on a contractual basis, rather than selling any products or rolling, bookable services. For example, a plumber would work for a client according to an agreed, one-off contract.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Here's what you need to know to start and build a successful business as a self-employed contractor.Be Sure You Want to Be Self-Employed.Get Financing in Place Beforehand.Create a Business Plan.Name, Register, and Insure Your Contracting Business.Market Your Business.Be Your Own Accountant, for Starters.More items...?

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.