Alabama Self-Employed Lighting Services Contract

Description

How to fill out Alabama Self-Employed Lighting Services Contract?

You are able to invest several hours on the Internet attempting to find the legal papers web template that fits the federal and state demands you will need. US Legal Forms provides thousands of legal types which are examined by professionals. It is possible to obtain or printing the Alabama Self-Employed Lighting Services Contract from the support.

If you already have a US Legal Forms account, you may log in and then click the Obtain option. Following that, you may comprehensive, revise, printing, or signal the Alabama Self-Employed Lighting Services Contract. Every single legal papers web template you get is your own property eternally. To get one more backup of any acquired kind, go to the My Forms tab and then click the related option.

If you use the US Legal Forms web site the first time, adhere to the straightforward instructions beneath:

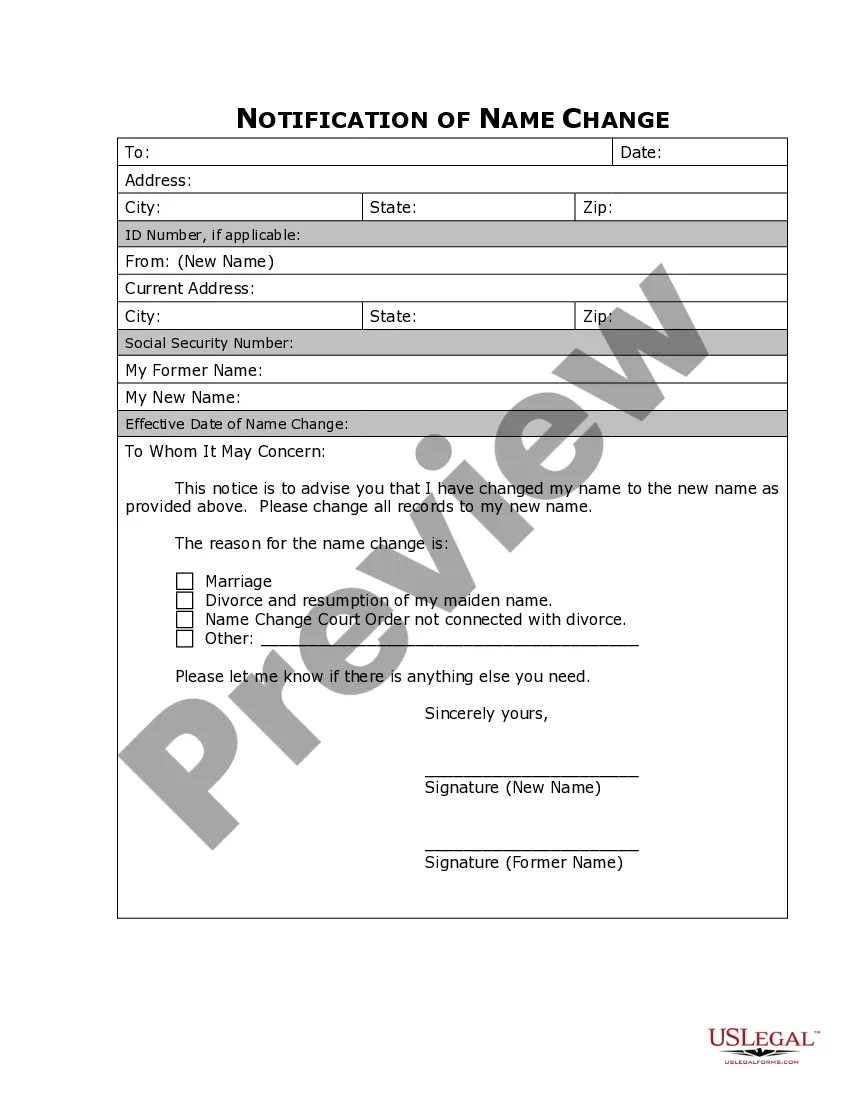

- First, be sure that you have chosen the best papers web template for your county/town that you pick. Read the kind information to ensure you have picked out the appropriate kind. If available, make use of the Preview option to look with the papers web template at the same time.

- If you would like locate one more version in the kind, make use of the Lookup field to get the web template that meets your needs and demands.

- After you have found the web template you desire, just click Purchase now to continue.

- Pick the prices strategy you desire, type in your accreditations, and sign up for a merchant account on US Legal Forms.

- Full the financial transaction. You should use your Visa or Mastercard or PayPal account to purchase the legal kind.

- Pick the formatting in the papers and obtain it in your system.

- Make adjustments in your papers if possible. You are able to comprehensive, revise and signal and printing Alabama Self-Employed Lighting Services Contract.

Obtain and printing thousands of papers templates utilizing the US Legal Forms website, that provides the most important assortment of legal types. Use skilled and condition-specific templates to tackle your organization or person requirements.