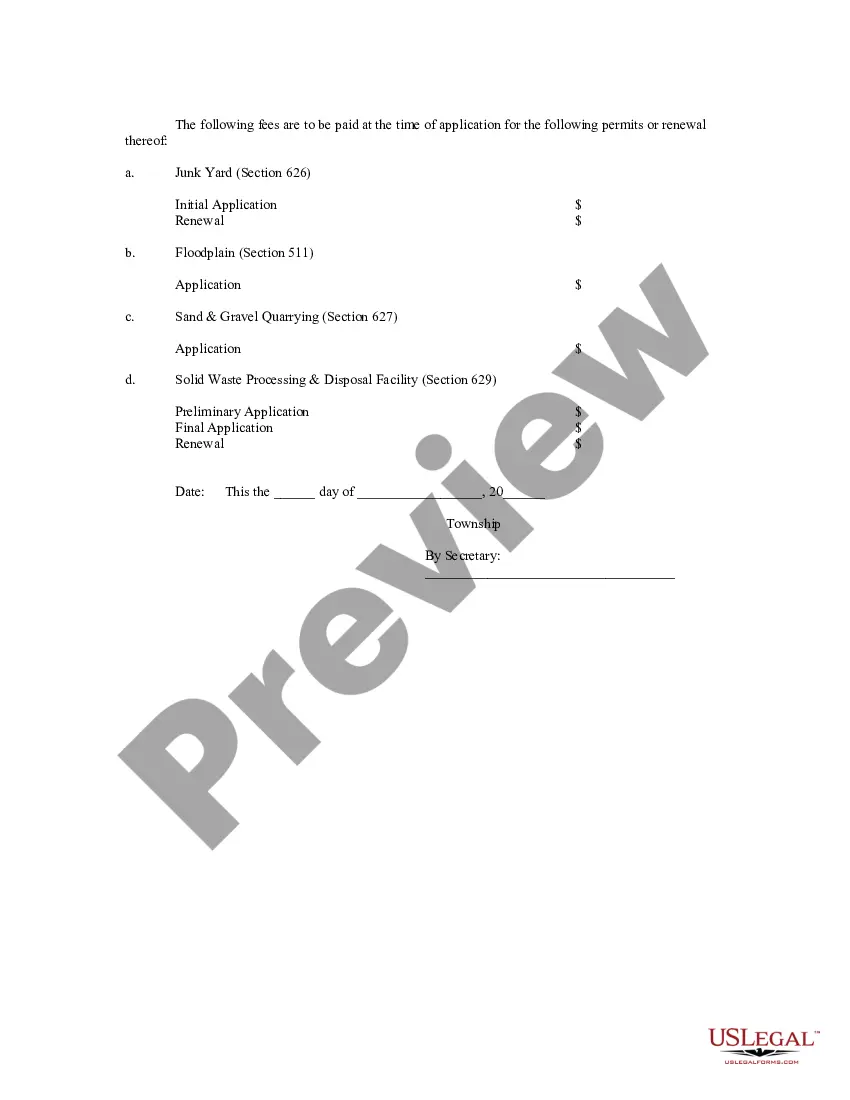

Alabama Schedule of Fees is a comprehensive document that outlines the various charges and costs associated with certain services, permits, licenses, and activities in the state of Alabama. It serves as a guideline and reference for individuals, businesses, and organizations to understand the financial obligations they have to fulfill when availing specific services or engaging in particular activities within the state. The Alabama Schedule of Fees is categorized into different types, each pertaining to a specific area or sector. These include: 1. Business Licenses: This section of the schedule outlines the fees and charges involved in obtaining a business license in Alabama. It covers various types of businesses, such as retail, professional services, construction, and more. The fees may vary depending on the nature and size of the business. 2. Professional Licensing: Alabama Schedule of Fees also includes the fees related to obtaining professional licenses in fields such as medicine, law, engineering, teaching, and others. These fees are essential for professionals to practice their respective disciplines within the state. 3. Permits and Certifications: This category encompasses charges associated with permits and certifications required for specific activities. It includes fees for building permits, environmental permits, food service permits, liquor licenses, and more. The fees serve as a means to ensure compliance with regulations and standards set by relevant authorities. 4. State Park and Recreation Fees: Alabama is known for its natural beauty and extensive park system. The Schedule of Fees also lists charges for entrance to state parks, camping permits, hiking permits, boat launch fees, and other recreational activities. These fees contribute to the upkeep and maintenance of these outdoor spaces. 5. Motor Vehicle and Driver-related Fees: Alabama Schedule of Fees covers charges related to motor vehicle registrations, driver's licenses, learner's permits, title transfers, and other vehicle-related transactions. These fees are crucial for maintaining safe roadways and ensuring compliance with traffic laws. 6. Court and Legal Fees: This section outlines the fees associated with various court-related services, including filing documents, court appearances, obtaining copies of legal records, and more. These charges contribute to the functioning and administration of the judicial system in Alabama. It is important for individuals and businesses to review the specific Alabama Schedule of Fees relevant to their needs, as the fees and charges can vary according to the type of service, permit, license, or activity being pursued. Staying informed about the applicable fees helps individuals and entities plan and meet their financial obligations while engaging in lawful practices within the state of Alabama.

Alabama Schedule of Fees

Description

How to fill out Alabama Schedule Of Fees?

US Legal Forms - one of many largest libraries of legitimate varieties in the States - offers an array of legitimate file layouts you are able to acquire or print out. While using site, you will get thousands of varieties for company and person uses, sorted by classes, suggests, or keywords.You can get the latest models of varieties such as the Alabama Schedule of Fees within minutes.

If you already possess a monthly subscription, log in and acquire Alabama Schedule of Fees in the US Legal Forms catalogue. The Down load key can look on every form you see. You get access to all previously acquired varieties within the My Forms tab of your account.

If you wish to use US Legal Forms initially, listed here are easy directions to help you get started out:

- Be sure you have picked out the proper form to your town/county. Click on the Review key to review the form`s information. See the form outline to ensure that you have selected the correct form.

- In the event the form doesn`t match your requirements, take advantage of the Lookup field at the top of the monitor to get the the one that does.

- Should you be pleased with the shape, confirm your decision by clicking the Buy now key. Then, choose the rates strategy you prefer and give your credentials to register for an account.

- Approach the financial transaction. Use your credit card or PayPal account to perform the financial transaction.

- Find the formatting and acquire the shape on your product.

- Make alterations. Fill up, edit and print out and sign the acquired Alabama Schedule of Fees.

Each format you included in your account does not have an expiration date and it is your own property eternally. So, in order to acquire or print out another copy, just visit the My Forms segment and click on the form you will need.

Get access to the Alabama Schedule of Fees with US Legal Forms, one of the most substantial catalogue of legitimate file layouts. Use thousands of specialist and status-particular layouts that satisfy your organization or person requires and requirements.

Form popularity

FAQ

The annual report filing fee costs $100. However, remember that filing also means you will be filing your annual tax form. There could be taxes due at this time which may change the total amount that you owe. All taxes and filing fees must be paid out together by the deadline.

Payout amounts of permanent impairment ratings Permanent Impairment RatingPayout Amount0% ? 10%$011% ? 15%$24,810 ? $37,77016% ? 20%$41,010 ? $53,97021% ? 25%$57,210 ? $70,1708 more rows

WEEKLY COMPENSATION BENEFITS - Weekly compensation benefits for injury and death claims are computed as follows: For injury claims, multiply the employee's average weekly earnings for 52 weeks prior to injury by 66 2/3%. Benefits cannot exceed maximum benefits in effect on date of injury.

Permanent partial disability benefits can be paid to an injured worker without affecting their work status or ending their Medical Award (which will remain open for the Injured Worker to use for needed future medical care related to the injury). A settlement, on the other hand, closes a claim.

The Short Term Disability benefit replaces a portion of your predisability earnings, less the income that was actually paid to you during the same Disability from other sources1 (e.g., state disability benefits, no- fault auto laws, sick pay, etc.).

The minimum starting cost to form an LLC in Alabama is $225 ($236 online or by credit card). This cost includes the $25 fee to reserve your LLC name and the $200 fee to file the Certificate of Formation with the Alabama Secretary of State.

Permanent Partial Disability (PPD) For scheduled injuries, it is 2/3 of AWW x Percentage of disability for the number of weeks for which compensation is due per schedule, with a maximum of $220 per week. For BAW, it is 2/3 of AWW for 300 weeks, less any weeks of TTD, also capped at $220 per week.

How much does an LLC in Alabama cost per year? All Alabama LLCs need to pay $50 per year for the Annual Report and Alabama Business Privilege Tax. These state fees are paid to the Department of Revenue. And this is the only state-required annual fee.