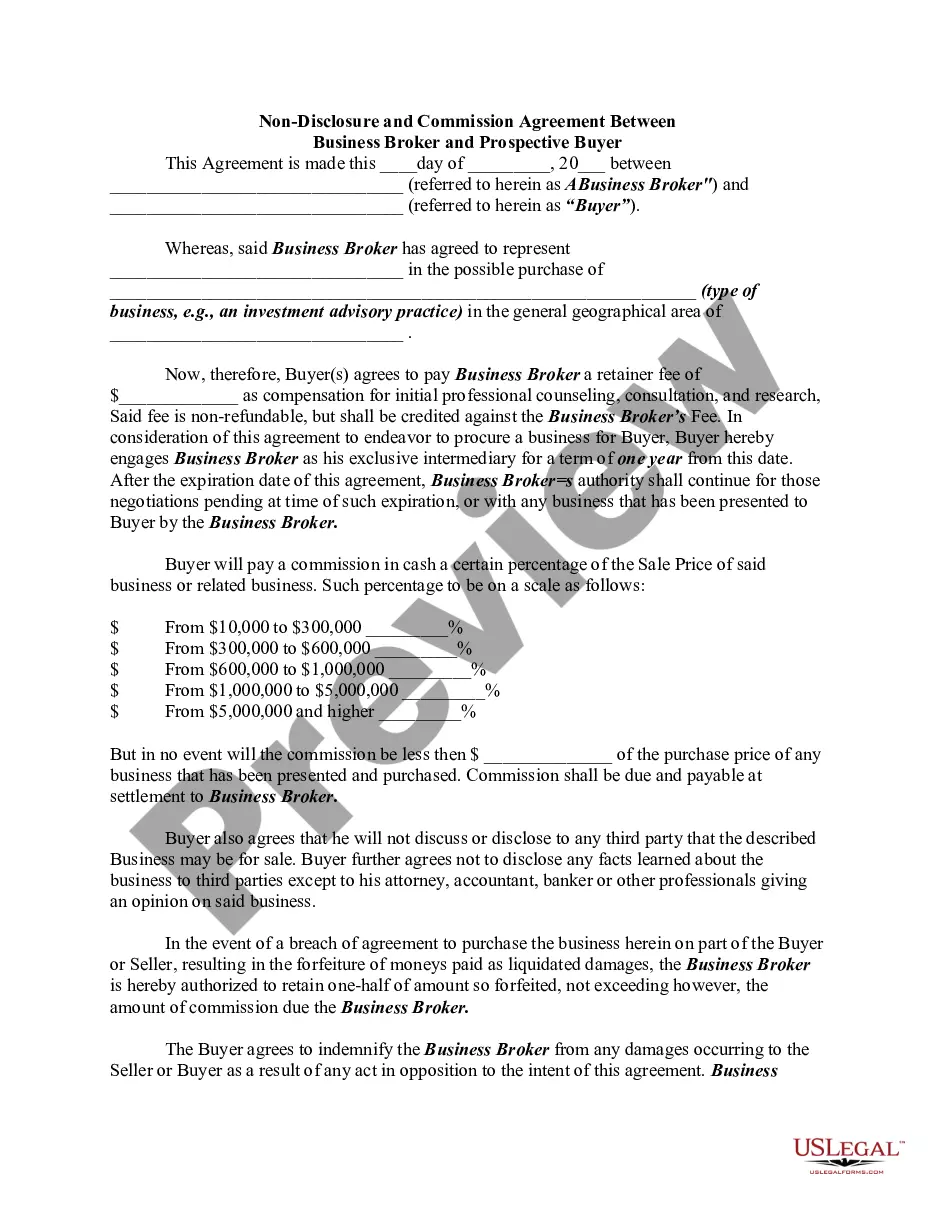

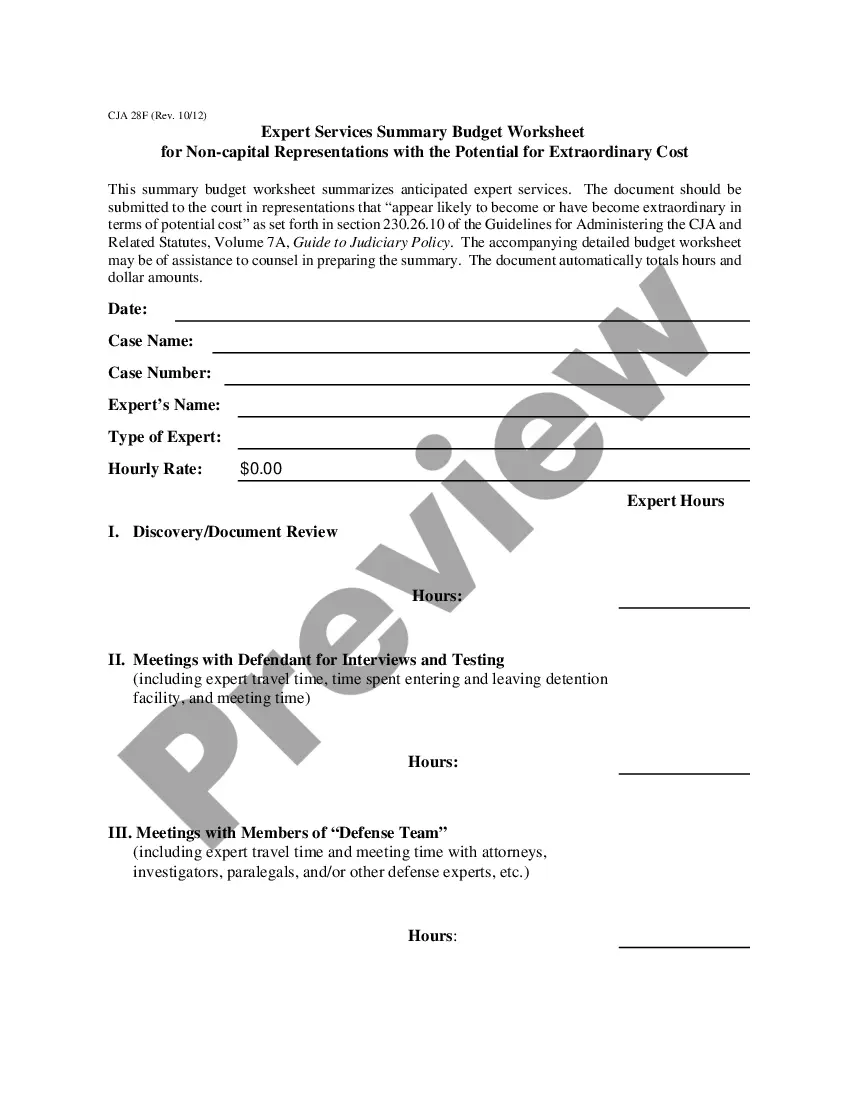

Alabama Interest Verification is a process used to verify the accuracy and legitimacy of individuals' financial information in the state of Alabama. It helps to ensure that businesses, financial institutions, and government agencies have access to reliable data when making informed decisions. One type of Alabama Interest Verification is through the Alabama Department of Revenue (ODOR), specifically for taxpayers. Individuals who file taxes in Alabama may be subject to interest on underpaid amounts or entitled to interest on overpaid amounts. To verify the interest calculations on tax returns, taxpayers can contact the ODOR or visit their official website for accurate and up-to-date information. Another type of Alabama Interest Verification is performed by financial institutions, such as banks or credit unions, to validate personal financial data for various purposes. These institutions may use interest verification as part of their loan application process to determine an individual's creditworthiness and assess the risk involved in granting a loan. Additionally, interest verification may be essential in verifying an individual's financial stability or credibility when opening new accounts, making large transactions, or addressing potential fraudulent activities. Real estate transactions in Alabama may also involve interest verification. Property buyers or sellers might seek verification to confirm the legitimacy of interest rates, loan terms, and associated fees related to mortgage transactions. This process ensures transparency and helps individuals make well-informed decisions regarding their property investments or refinancing options. Furthermore, government agencies in Alabama may conduct interest verification to assess eligibility for certain benefits or programs. For instance, when applying for unemployment benefits, the state agency may verify an individual's previous employment history and earnings to determine the appropriate interest to be paid during the benefit period. Overall, Alabama Interest Verification plays a crucial role in maintaining financial accuracy, protecting consumers, and facilitating fair transactions within the state. It enables reliable decision-making processes for taxpayers, financial institutions, real estate stakeholders, and government agencies, helping to build trust and ensure the integrity of financial transactions in Alabama.

Alabama Interest Verification

Description

How to fill out Alabama Interest Verification?

If you have to total, acquire, or printing legitimate record themes, use US Legal Forms, the greatest collection of legitimate varieties, which can be found on-line. Use the site`s easy and practical lookup to discover the papers you want. Numerous themes for business and specific uses are sorted by groups and suggests, or search phrases. Use US Legal Forms to discover the Alabama Interest Verification with a handful of mouse clicks.

Should you be already a US Legal Forms client, log in to your bank account and click the Obtain option to obtain the Alabama Interest Verification. You can also accessibility varieties you previously downloaded within the My Forms tab of the bank account.

If you are using US Legal Forms initially, follow the instructions below:

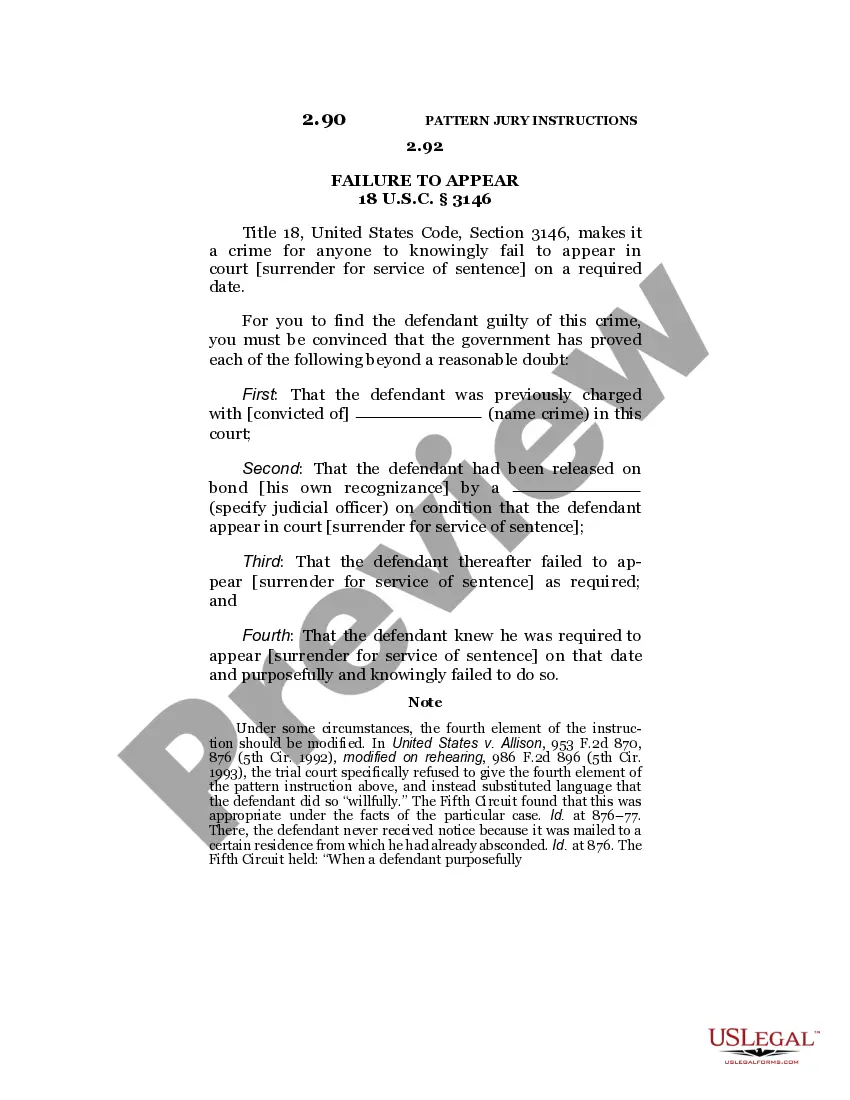

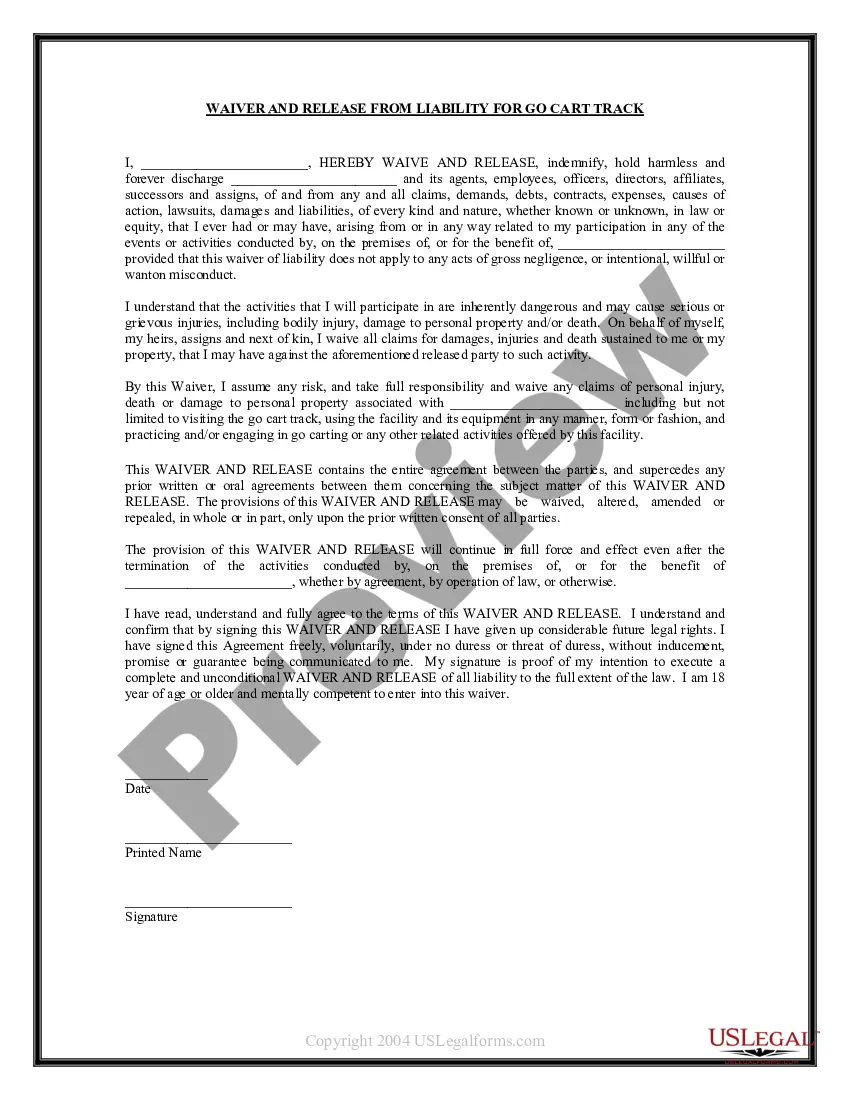

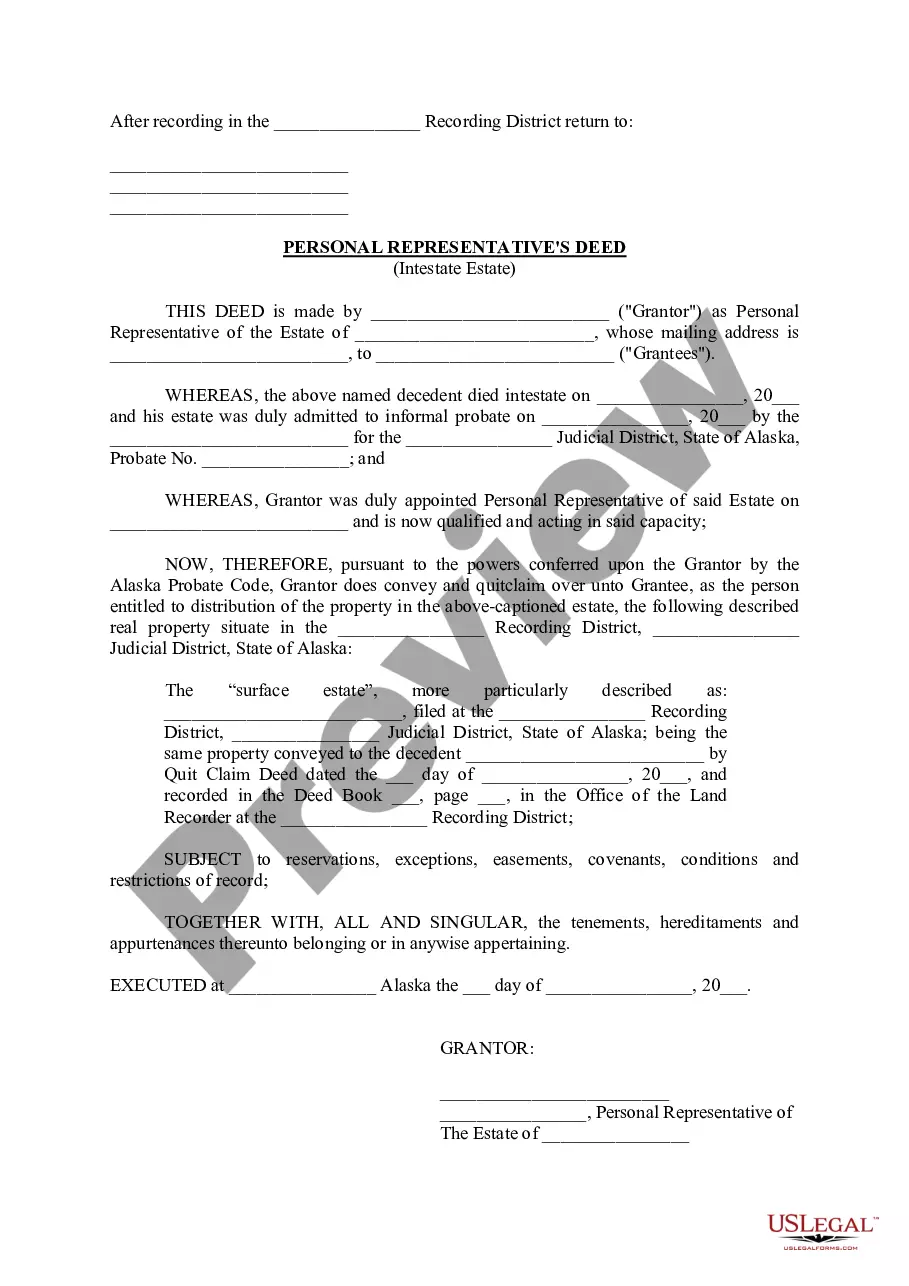

- Step 1. Ensure you have selected the shape to the appropriate town/nation.

- Step 2. Utilize the Preview method to look over the form`s content material. Don`t forget about to read through the explanation.

- Step 3. Should you be unsatisfied with the form, take advantage of the Look for discipline towards the top of the screen to locate other variations of your legitimate form design.

- Step 4. After you have located the shape you want, click on the Acquire now option. Choose the pricing program you choose and put your references to register for the bank account.

- Step 5. Process the financial transaction. You may use your charge card or PayPal bank account to perform the financial transaction.

- Step 6. Select the format of your legitimate form and acquire it in your device.

- Step 7. Full, revise and printing or indicator the Alabama Interest Verification.

Each legitimate record design you acquire is your own forever. You might have acces to each form you downloaded with your acccount. Click the My Forms section and decide on a form to printing or acquire again.

Contend and acquire, and printing the Alabama Interest Verification with US Legal Forms. There are millions of skilled and status-particular varieties you can utilize for your personal business or specific requires.

Form popularity

FAQ

Interest income taxable for federal purposes, including interest from loans and discounts, obligations of the United States Government, and State, county, and municipal interest income from loans and securities that is exempt for federal income tax purposes.

After you verify your identity and tax return information using this service, it may take up to nine weeks to complete the processing of the return. Visit Where's My Refund? or use the IRS2Go mobile app 2-3 weeks after using this service to check your refund status.

You can verify your return at My Alabama Taxes. Look for ?Enter a return verification code/Verify my return? under ?Individuals.? You are not required to log in to My Alabama Taxes to complete this task.

Why you received IRS Letter 5071C. The IRS fraud detection system flagged your tax return as a potential identity theft case. The IRS sends this notice to request that you provide documentation to prove your identity.

If the IRS suspects that a tax return with your name on it is potentially the result of identity theft, the agency will send you a special letter, called a 5071C Letter. This letter is to notify you that the agency received a tax return with your name and Social Security number that it believes may not be yours.

What does this letter mean to me? The IRS received your tax return and is verifying your income, income tax withholding, tax credits or business income based on the information reported to the IRS under your name and Social Security Number (SSN) by employers, banks, or other payers.

This letter is to notify you that the agency received a tax return with your name and Social Security number that it believes may not be yours. The letter asks you to take specific steps to verify your identity and confirm whether or not the return is actually yours.

What happens if I don't verify immediately? Until we hear from you, we won't be able to process your tax return, issue refunds, or credit any overpayments to your account.