Alabama Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files

Description

How to fill out Liens, Mortgages/Deeds Of Trust, UCC Statements, Bankruptcies, And Lawsuits Identified In Seller's Files?

If you wish to full, obtain, or print lawful document themes, use US Legal Forms, the most important assortment of lawful types, that can be found on the web. Use the site`s easy and practical search to get the documents you will need. Different themes for enterprise and person functions are categorized by categories and claims, or keywords. Use US Legal Forms to get the Alabama Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files in a handful of clicks.

In case you are already a US Legal Forms client, log in in your account and then click the Down load key to obtain the Alabama Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files. Also you can entry types you earlier saved within the My Forms tab of the account.

Should you use US Legal Forms the very first time, refer to the instructions below:

- Step 1. Ensure you have chosen the shape for that right city/nation.

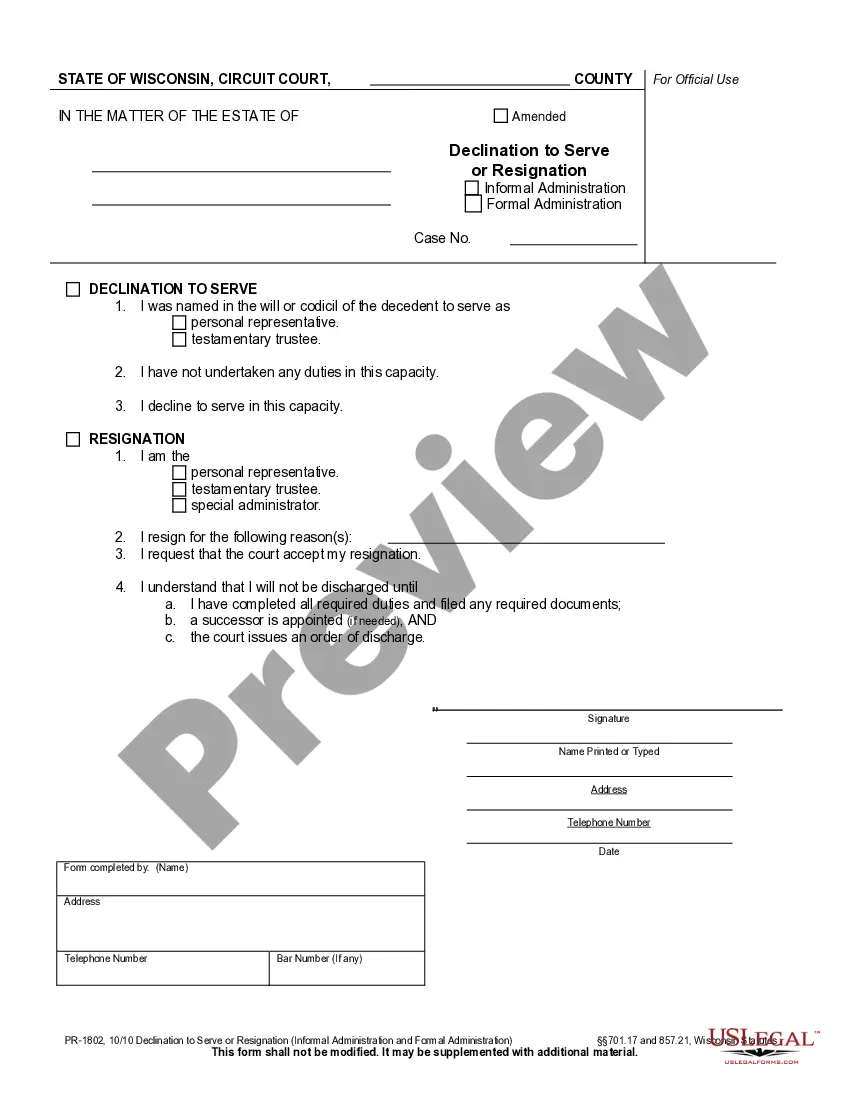

- Step 2. Utilize the Preview choice to look through the form`s information. Don`t forget to learn the description.

- Step 3. In case you are unhappy using the type, utilize the Search discipline near the top of the screen to locate other versions of the lawful type design.

- Step 4. Once you have identified the shape you will need, go through the Acquire now key. Pick the rates prepare you choose and put your references to register for an account.

- Step 5. Procedure the financial transaction. You can utilize your charge card or PayPal account to finish the financial transaction.

- Step 6. Select the structure of the lawful type and obtain it on the product.

- Step 7. Total, change and print or indicator the Alabama Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files.

Every single lawful document design you purchase is your own property eternally. You possess acces to each and every type you saved inside your acccount. Select the My Forms area and pick a type to print or obtain yet again.

Remain competitive and obtain, and print the Alabama Liens, Mortgages/Deeds of Trust, UCC Statements, Bankruptcies, and Lawsuits Identified in Seller's Files with US Legal Forms. There are millions of professional and status-specific types you can use for your personal enterprise or person demands.

Form popularity

FAQ

A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor's personal property. This personal property is being used as collateral in some type of secured transaction, usually a loan or a lease.

?UCC? stands for Uniform Commercial Code. The Uniform Commercial Code is a uniform law that governs commercial transactions, including sales of goods, secured transactions and negotiable instruments. The Uniform Commercial Code is a comprehensive set of statutes created to provide consistency among the states.

If you need to remove a UCC filing form your credit report, ask the lender to file for its removal. In order to do this, they need to file a UCC-3 Financing Statement Amendment. You can also just wait it out. Depending on how long you have been with the lender, the filing may be removed within a few months.

However, generally speaking, the primary ways for a secured party to perfect a security interest are: by filing a financing statement with the appropriate public office. by possessing the collateral. by "controlling" the collateral; or. it's done automatically when the security interest attaches.

The UCC filing establishes a lien against the collateral the borrower uses to secure the loan ? giving the lender the right to claim that collateral as repayment in the case of default. However, in many cases, the terms UCC lien and UCC filing are used interchangeably.

A rule of thumb when filing a UCC record is to file at the central filing office of the state where the debtor is located. However, there are exceptions, such as when the UCC records is filed as a fixture filing. It's important to keep state filing turnaround times in mind when you're filing a UCC record.

However, the main purpose of a UCC is to perfect the secured interest of the secured party in personal property collateral. UCC1: This form is for initial filings of all types (except FARM) and can be filled out on your. computer and then printed. Online filing is also available.

So, to sum it up: the title is like a certificate of ownership, while the UCC 1 financing statement is like a public notice of a security interest. It's kind of like saying, "I own this thing, but I owe someone else money for it, so don't mess with it unless you want to deal with them too!"