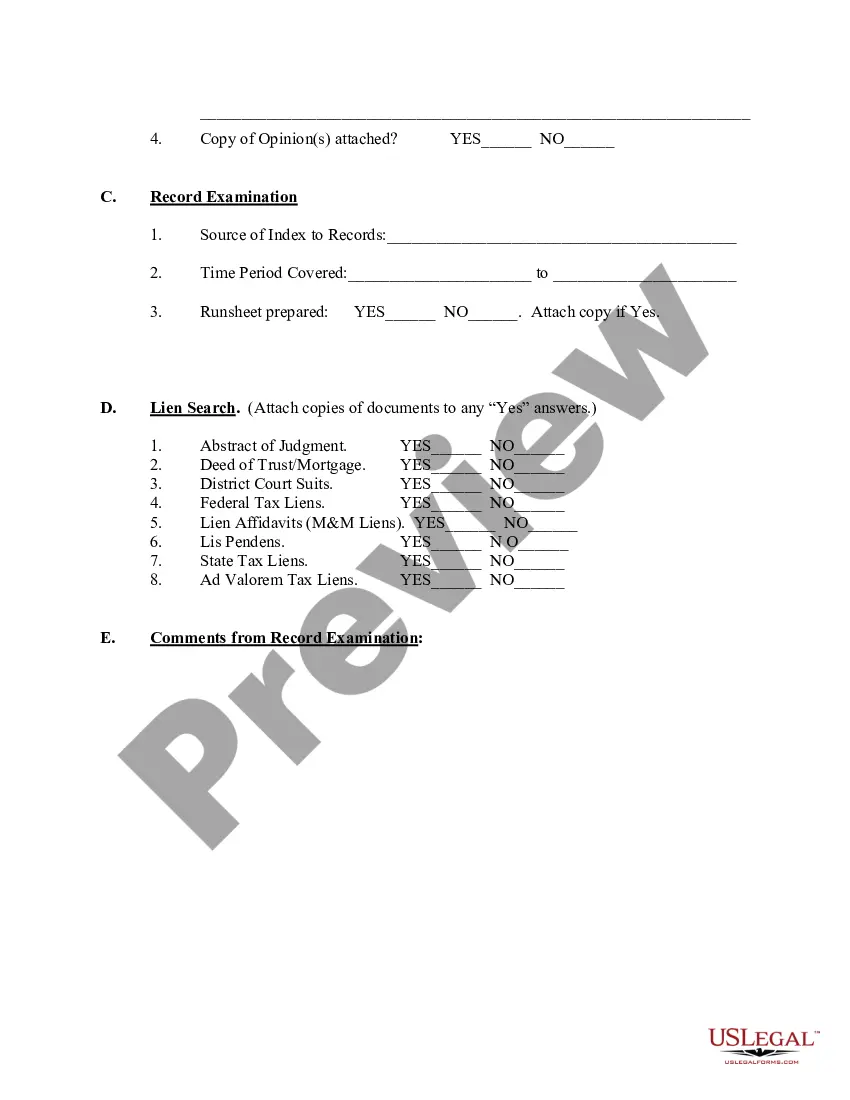

Alabama Due Diligence Field Review and Checklist

Description

How to fill out Due Diligence Field Review And Checklist?

Are you inside a situation where you require documents for either business or specific purposes nearly every working day? There are tons of legitimate document templates available online, but finding kinds you can trust is not easy. US Legal Forms gives a huge number of kind templates, much like the Alabama Due Diligence Field Review and Checklist, that are created to fulfill federal and state needs.

If you are previously informed about US Legal Forms web site and also have a free account, basically log in. After that, you may obtain the Alabama Due Diligence Field Review and Checklist template.

Should you not come with an account and would like to start using US Legal Forms, abide by these steps:

- Find the kind you require and ensure it is for that correct town/county.

- Use the Preview option to examine the shape.

- See the description to actually have selected the right kind.

- In case the kind is not what you`re searching for, make use of the Search discipline to obtain the kind that fits your needs and needs.

- Whenever you discover the correct kind, click on Get now.

- Choose the rates prepare you want, fill in the specified details to make your bank account, and pay money for an order making use of your PayPal or credit card.

- Select a hassle-free data file structure and obtain your backup.

Find all the document templates you possess purchased in the My Forms food selection. You can obtain a more backup of Alabama Due Diligence Field Review and Checklist any time, if needed. Just click on the necessary kind to obtain or printing the document template.

Use US Legal Forms, the most substantial variety of legitimate forms, to save lots of time and steer clear of blunders. The assistance gives professionally produced legitimate document templates which you can use for a variety of purposes. Make a free account on US Legal Forms and begin generating your way of life a little easier.

Form popularity

FAQ

Complete Due Diligence Documents Checklist Shareholder certificate documents. Local/state/federal business licenses. Occupational license. Building permits documents. Zonal and land use permits. Tax registration documents. Power of attorney documents. Previous or outstanding legal cases.

Across most industries, a comprehensive due diligence report should include the company's financial data, information about business operations and procurement, and a market analysis. It may also include data about employees and payroll, taxes, intellectual property, and the board of directors.

A due diligence questionnaire is a formal assessment made up of questions designed to outline the way a business complies with industry standards, implements cybersecurity initiatives, and manages its network.

The Four Due Diligence Requirements Complete and Submit Form 8867. (Treas. Reg. section 1.6695-2(b)(1)) ... Compute the Credits. (Treas. Reg. section 1.6695-2(b)(2)) ... Knowledge. (Treas. Reg. section 1.6695-2(b)(3)) ... Keep Records for Three Years.

Additionally, there are four due diligence requirements that paid tax preparers must meet when preparing returns for clients that claim certain tax benefits, which you can read more about on the IRS website.

However, a standard due diligence report should include the following components: Executive summary. Company overview. Purpose and objective of the diligence. Financial due diligence. Legal due diligence. Operational due diligence. Market and commercial due diligence. Risk assessment.

How To Prepare For Due Diligence - kagaar Introduction. ... Understanding Due Diligence. ... Defining Objectives and Scope. ... Assembling a Due Diligence Team. ... Organizing Documentation and Information. ... Financial Analysis and Documentation. ... Legal Review and Compliance. ... Operational Assessment.

Taxpayer's response 1 How long have you owned your business? 2 Do you have any documentation to substantiate your business? 3 Who maintains the business records for your business? 4 Do you have separate bank accounts for personal and business transactions?