This form is used when the Owners, by unanimous consent, desire to amend the Operating Agreement.

Alabama Amendment to Operating Agreement

Description

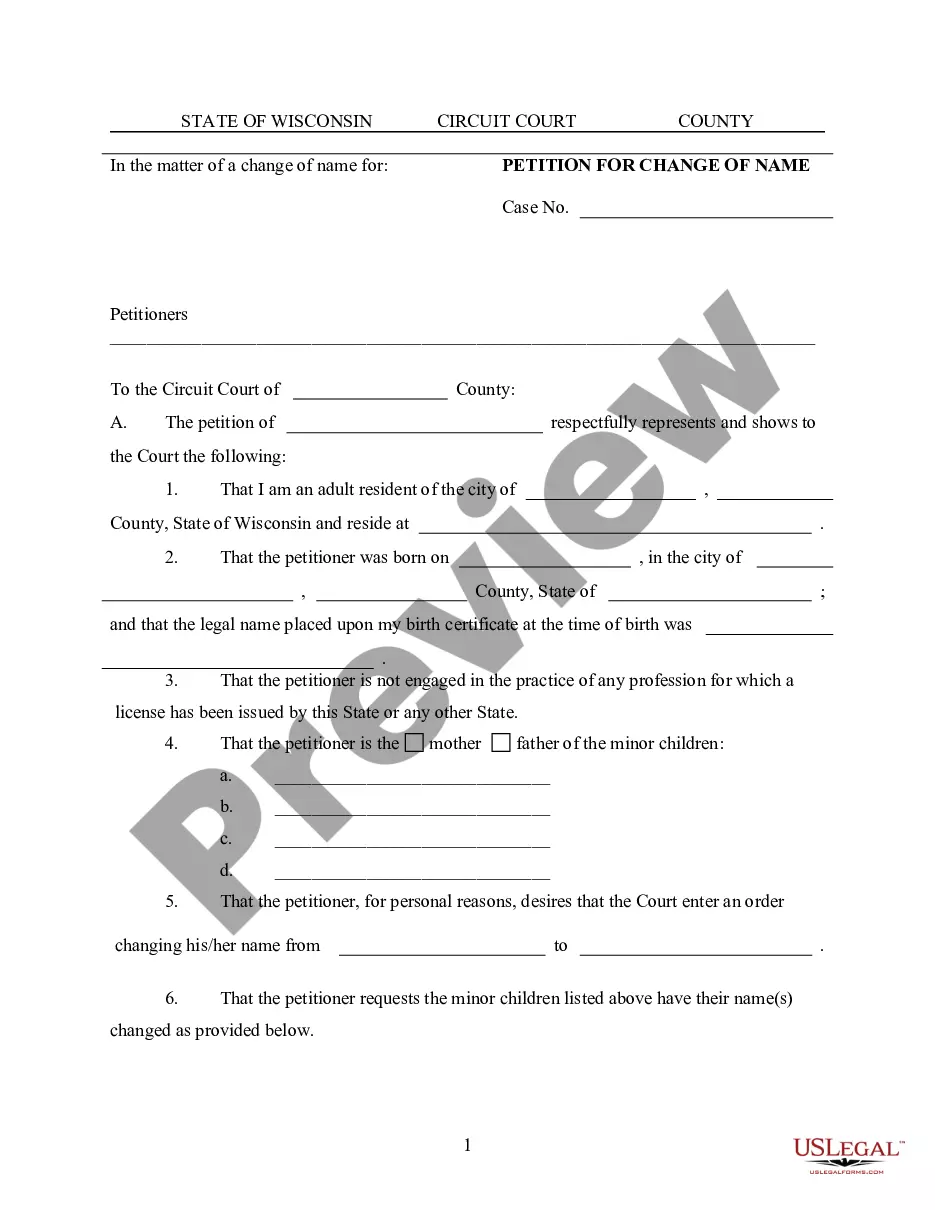

How to fill out Amendment To Operating Agreement?

US Legal Forms - one of many biggest libraries of legal varieties in the States - delivers an array of legal file layouts you can obtain or print out. Utilizing the site, you can get thousands of varieties for business and specific uses, sorted by types, claims, or keywords and phrases.You will discover the latest types of varieties just like the Alabama Amendment to Operating Agreement within minutes.

If you already have a membership, log in and obtain Alabama Amendment to Operating Agreement from the US Legal Forms local library. The Obtain option can look on each and every kind you see. You gain access to all previously delivered electronically varieties in the My Forms tab of your own account.

If you would like use US Legal Forms the first time, listed below are easy directions to get you started off:

- Be sure to have picked the correct kind for the town/region. Click on the Preview option to check the form`s information. Read the kind outline to actually have chosen the proper kind.

- When the kind does not suit your needs, use the Research field at the top of the display screen to get the one who does.

- If you are pleased with the shape, validate your choice by clicking on the Acquire now option. Then, pick the rates prepare you want and supply your accreditations to sign up on an account.

- Approach the deal. Use your bank card or PayPal account to finish the deal.

- Find the format and obtain the shape in your device.

- Make modifications. Complete, modify and print out and indication the delivered electronically Alabama Amendment to Operating Agreement.

Every single design you added to your account does not have an expiration day and is the one you have for a long time. So, if you would like obtain or print out an additional duplicate, just check out the My Forms portion and click on in the kind you need.

Get access to the Alabama Amendment to Operating Agreement with US Legal Forms, by far the most substantial local library of legal file layouts. Use thousands of skilled and state-certain layouts that meet your small business or specific requirements and needs.

Form popularity

FAQ

There is no State requirement in Alabama to have an operating agreement, however, it is still highly recommended to have one in order to state the purpose of the business as well as the ownership interest of the members (if a multi-member LLC).

If you are merely changing the mailing address or a location address, log into your My Alabama Taxes (MAT) account and click on the blue ?Address? hyperlink midway the page and follow the prompts. A web request will be sent to the Entity Registration (ERU).

To change your registered agent in Alabama, you must complete and file a Change of Registered Agent form with the Business Services Division of the Alabama Secretary of State. The Alabama Change of Registered Agent form costs $100 to file, plus any credit card processing or expediting fees if applicable.

If you are merely changing the mailing address or a location address, log into your My Alabama Taxes (MAT) account and click on the blue ?Address? hyperlink midway the page and follow the prompts. A web request will be sent to the Entity Registration (ERU).

PURPOSE: In order to amend a Limited Liability Company's (LLC) Certificate of Formation under Section 10A-5A-2.02 of the Code of Alabama 1975, this Certificate of Amendment and the appropriate filing fees must be filed with the Office of the Secretary of State.

The process of adding a member to a Alabama LLC may involve amending the company's articles of organization to include the new member. Depending on the terms in the agreement, current LLC members may need to vote on it for the amendment to pass.

Alabama requires a combined Business Privilege Tax Return and annual report to be filed 2.5 months after the LLC is formed and once per taxable year after that. You must pay a minimum of $100 per year as an Alabama LLC.