This form is a clause regarding additional rent element of an office lease providing for tax increases. The tax increases pertain to assessments and special assessments levied, assessed or imposed upon the building and/or the land under, including any land(s) dedicated to the use of, the building, by any governmental bodies or authorities.

Alabama Tax Increase Clause

Description

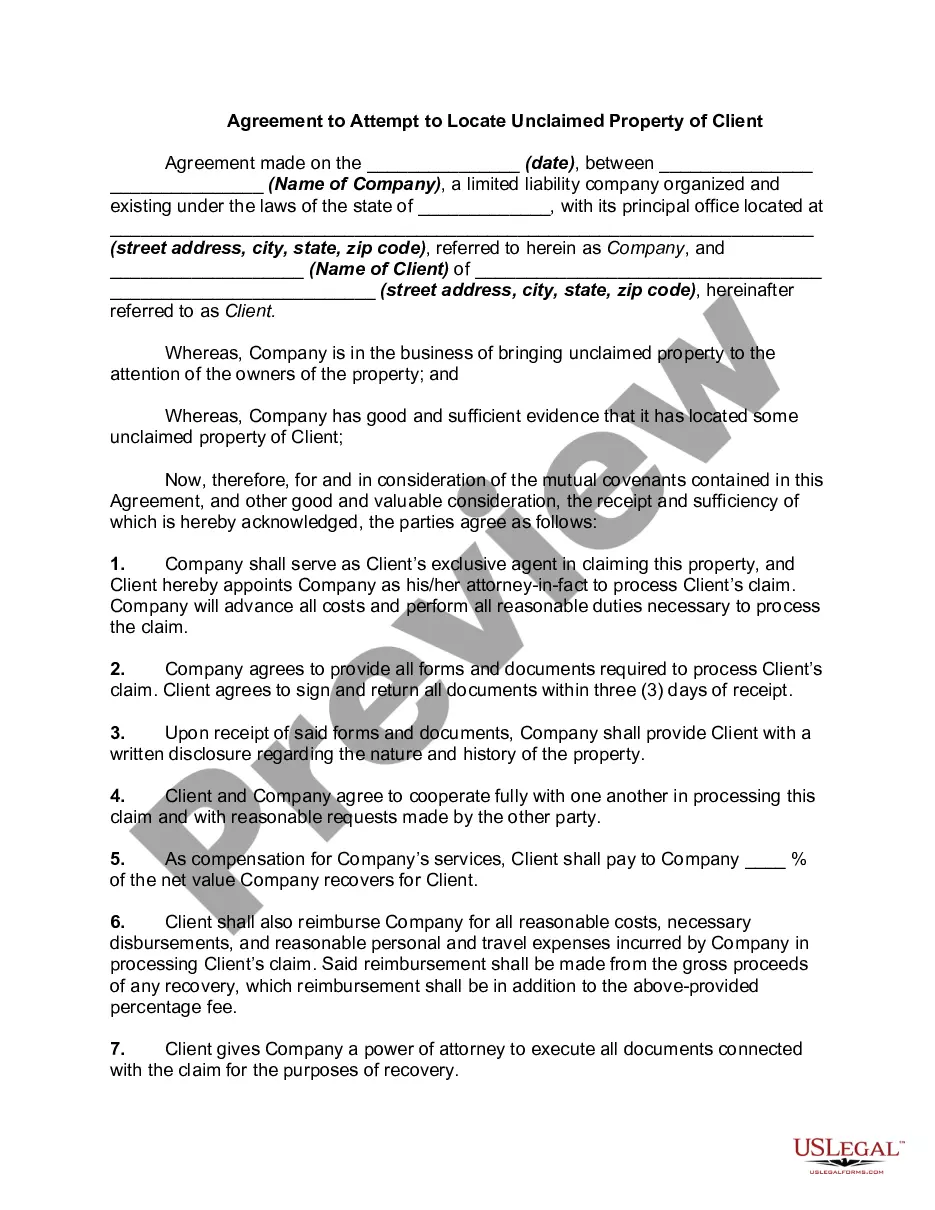

How to fill out Tax Increase Clause?

Are you currently in the position in which you need papers for either company or specific uses virtually every day time? There are a lot of authorized document web templates available online, but getting kinds you can depend on is not straightforward. US Legal Forms provides thousands of form web templates, like the Alabama Tax Increase Clause, which can be published to meet state and federal specifications.

When you are already acquainted with US Legal Forms website and also have a free account, just log in. After that, you can obtain the Alabama Tax Increase Clause template.

Unless you come with an profile and need to start using US Legal Forms, abide by these steps:

- Find the form you need and ensure it is to the appropriate area/area.

- Take advantage of the Review key to analyze the form.

- Look at the outline to actually have chosen the appropriate form.

- When the form is not what you`re looking for, use the Search discipline to discover the form that meets your needs and specifications.

- Whenever you obtain the appropriate form, simply click Purchase now.

- Pick the prices plan you want, fill out the desired information to make your bank account, and buy your order with your PayPal or charge card.

- Decide on a convenient file format and obtain your copy.

Find each of the document web templates you possess bought in the My Forms food selection. You can obtain a extra copy of Alabama Tax Increase Clause whenever, if needed. Just select the required form to obtain or print out the document template.

Use US Legal Forms, one of the most extensive collection of authorized forms, to conserve time and avoid blunders. The services provides expertly manufactured authorized document web templates which you can use for an array of uses. Produce a free account on US Legal Forms and commence producing your daily life easier.

Form popularity

FAQ

The biggest driver of Alabama's upside-down tax system is its heavy reliance on sales taxes to raise revenue for public services. That story is similar in many other states, but sales taxes in Alabama are particularly regressive because it is one of only three states with no tax break on groceries.

Beginning September 1, 2023, the state sales and use tax on food will drop to 3%. Local sales and use taxes will continue to apply. Alabama's food sales tax will be reduced again September 1, 2024, to 2% ? provided Alabama's Education Trust Fund meets a certain growth benchmark.

Alabama has a 6.50 percent corporate income tax rate. Alabama has a 4.00 percent state sales tax rate, a max local sales tax rate of 7.50 percent, and an average combined state and local sales tax rate of 9.25 percent. Alabama's tax system ranks 39th overall on our 2024 State Business Tax Climate Index.

Assessed Value fixed by Alabama Constitution Amendment 373 of the Constitution provides that all real and taxable personal property will be assessed at 20% of its fair market value. The combined state and local millage rate would then be applied to the assessed value.

The amended rule adds language excluding the entirety of overtime wages paid to full-time hourly employees from Alabama withholding tax and covers tax periods from Jan. 1, 2024, through June 30, 2025. The amended rule will not apply to "salaried or other alternate payment methods made to employees."

Partly because of the difficulty of raising property taxes, Alabama state and local governments have developed a heavy reliance on the sales tax. Alabama's rates are among the highest in the country. And unlike many other states, Alabama's sales tax applies to groceries and medications.

The state with the highest taxes is New York. New York is one of the states with highest income tax rates as well as high sales tax rates, high property taxes, and high excise taxes.

If you are over 65 years of age, or permanent and totally disabled (regardless of age), or blind (regardless of age), you are exempt from the state portion of property tax. County taxes may still be due. Please contact your local taxing official to claim your homestead exemption.