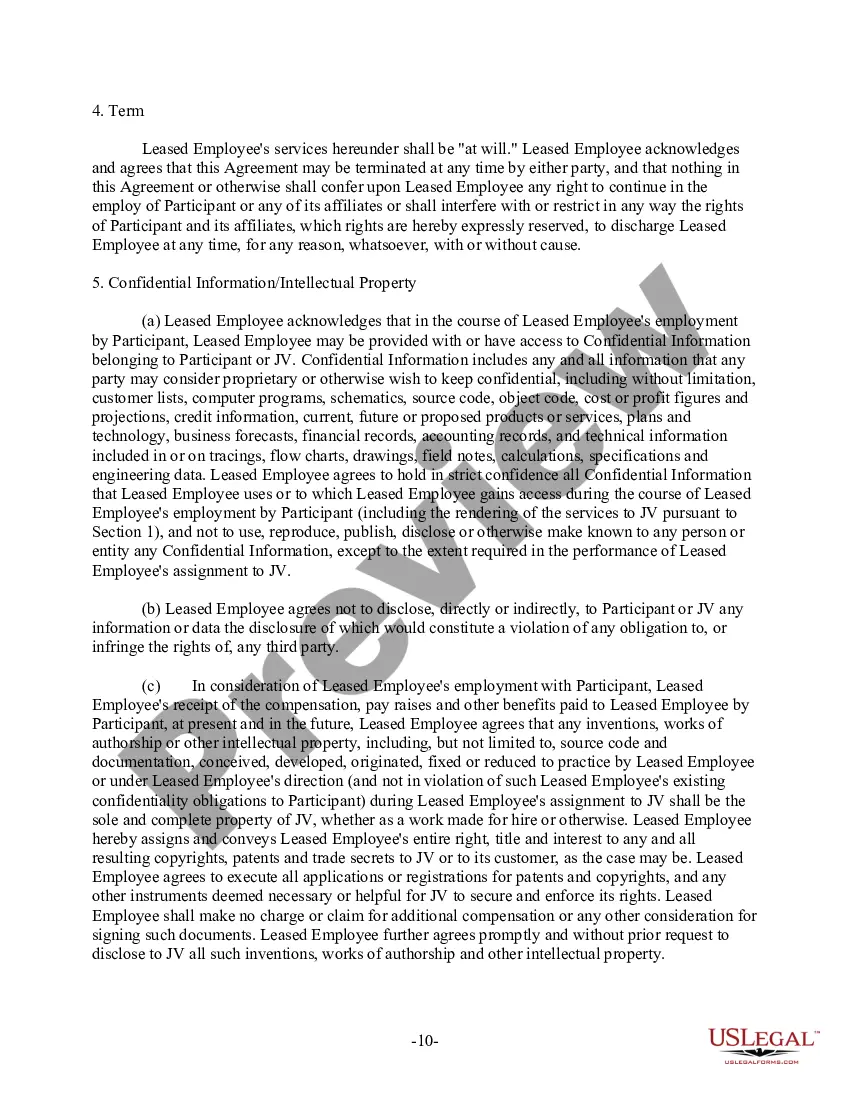

Alabama Services and Employee Leasing Agreement

Description

How to fill out Services And Employee Leasing Agreement?

Are you presently inside a position the place you require documents for either organization or individual reasons virtually every working day? There are tons of legitimate papers themes available online, but locating ones you can rely on isn`t easy. US Legal Forms provides a huge number of develop themes, like the Alabama Services and Employee Leasing Agreement, which can be written to fulfill state and federal demands.

Should you be currently familiar with US Legal Forms internet site and have a free account, basically log in. Following that, you can acquire the Alabama Services and Employee Leasing Agreement format.

If you do not have an account and need to begin to use US Legal Forms, follow these steps:

- Get the develop you need and ensure it is to the right city/state.

- Utilize the Review switch to analyze the form.

- Read the explanation to ensure that you have selected the correct develop.

- When the develop isn`t what you`re looking for, take advantage of the Look for area to find the develop that meets your requirements and demands.

- When you obtain the right develop, just click Buy now.

- Pick the prices prepare you need, complete the specified details to make your account, and pay for the order with your PayPal or bank card.

- Select a handy paper structure and acquire your copy.

Find each of the papers themes you might have purchased in the My Forms menus. You can get a further copy of Alabama Services and Employee Leasing Agreement anytime, if necessary. Just select the needed develop to acquire or print out the papers format.

Use US Legal Forms, probably the most comprehensive variety of legitimate varieties, to save lots of time as well as stay away from mistakes. The assistance provides professionally produced legitimate papers themes that you can use for a selection of reasons. Produce a free account on US Legal Forms and start creating your life a little easier.

Form popularity

FAQ

The professional employer organization and the recipient company officially employ a leased employee, but the professional performs work for only the recipient company. Depending on the state, government agencies may consider the PEO and recipient company to be "co-employers" for the leased employee.

Reduced administrative burden: With employee leasing, the leasing firm will manage payroll, unemployment insurance, compliance with state and federal regulations, W-2 forms, and other paperwork. That way, you or other personnel who manage your workforce can be freed up to work on other, more strategic activities.

Temporary employees are a type of leased employee, that work on a temporary basis. Whether you are employed through a temporary agency or an employee leasing firm, it is important to understand how your classification affects your rights, access to resources, and coverage under employment laws.

A leased employee earns either a salary or an hourly wage, depending on their position and the company policy. They are paid through the leasing agency. An independent contractor is usually paid per project/task completed. Leased employees are provided with all of the benefits (retirement plans, medical benefits, etc.)

Temporary employees are a type of leased employee, that work on a temporary basis. Whether you are employed through a temporary agency or an employee leasing firm, it is important to understand how your classification affects your rights, access to resources, and coverage under employment laws.

For example, leased employees are official employees for the PEO that manages them, while independent contractors operate independently of any employer, and they typically provide a service to a client who pays them directly for those services.

Employee leasing is an arrangement between a business and a staffing firm, who supplies workers on a project-specific or temporary basis. These employees work for the client business, but the leasing agency pays their salaries and handles all of the HR administration associated with their employment.

Employee leasing is an arrangement between a business and a staffing firm, who supplies workers on a project-specific or temporary basis. These employees work for the client business, but the leasing agency pays their salaries and handles all of the HR administration associated with their employment.