Are you in the placement the place you will need files for possibly enterprise or person purposes almost every working day? There are plenty of authorized file web templates accessible on the Internet, but finding versions you can trust isn`t easy. US Legal Forms delivers 1000s of kind web templates, just like the Alabama Business Incorporation Questionnaire, that are created to satisfy federal and state specifications.

In case you are presently acquainted with US Legal Forms website and get your account, simply log in. Next, it is possible to download the Alabama Business Incorporation Questionnaire design.

Should you not have an account and need to begin using US Legal Forms, follow these steps:

- Find the kind you need and ensure it is for that appropriate area/county.

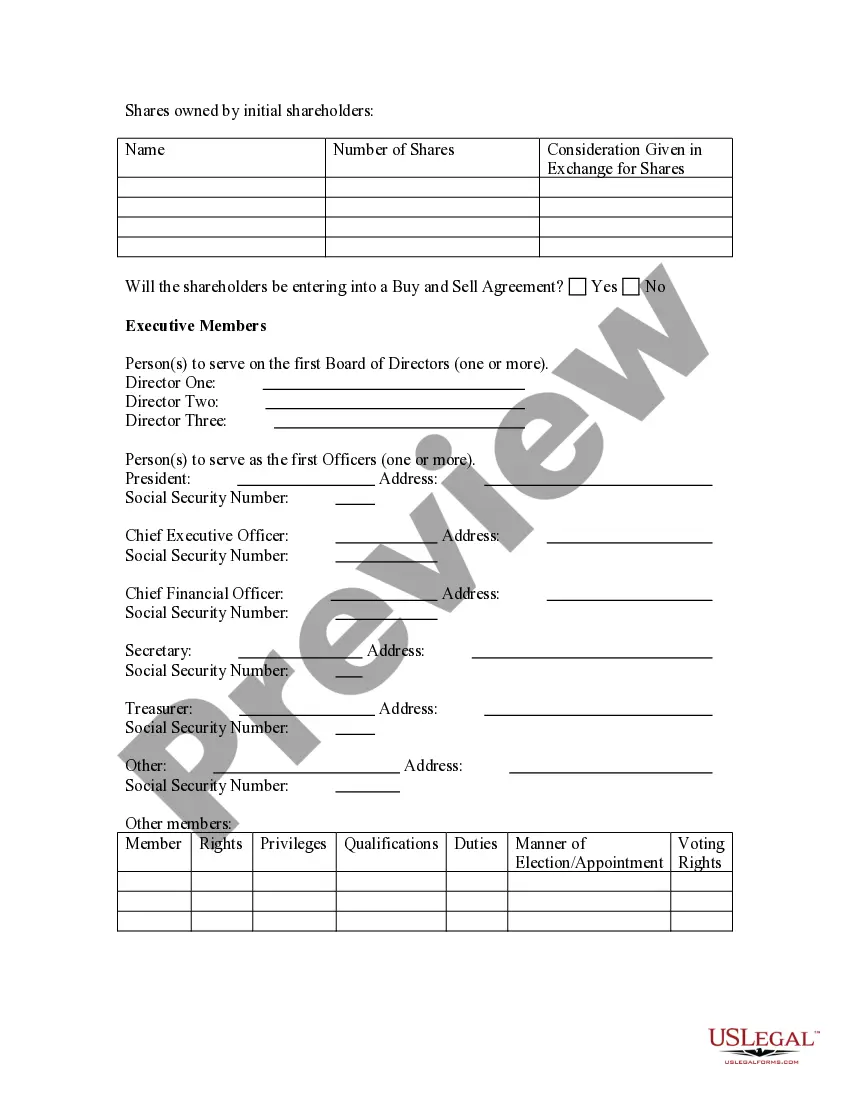

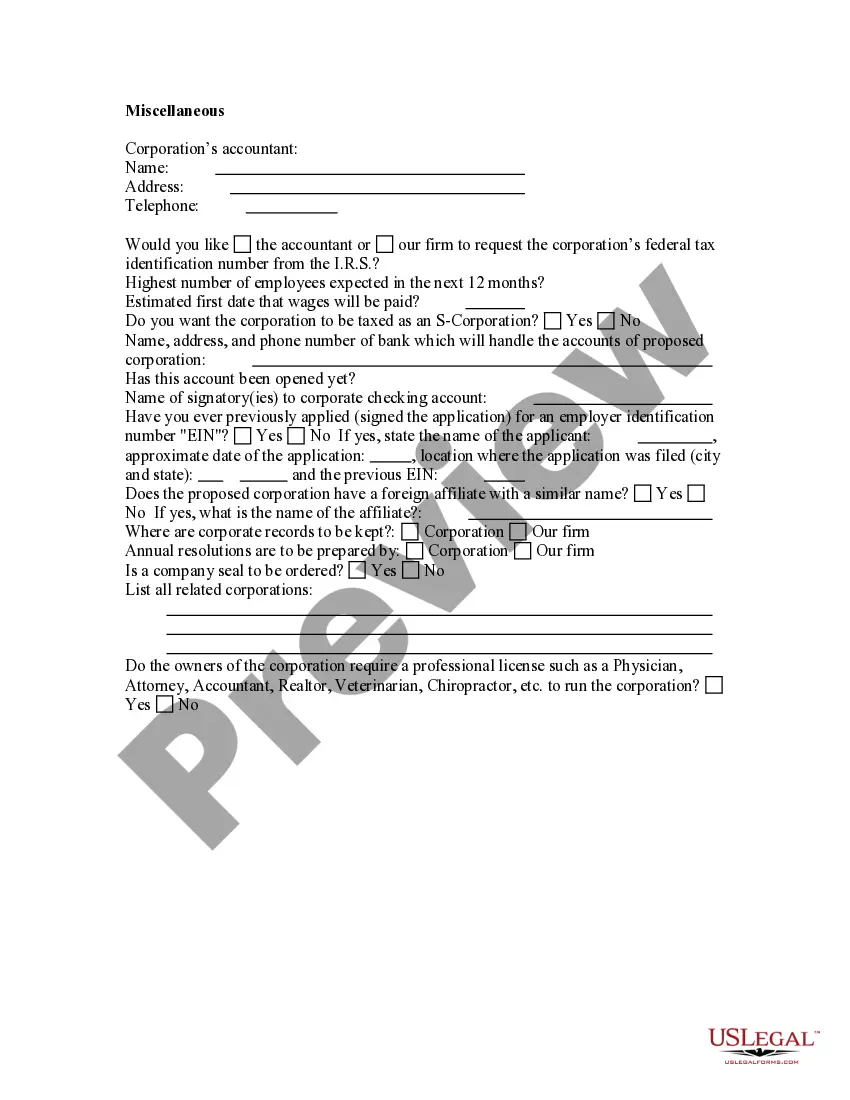

- Make use of the Preview switch to analyze the shape.

- Read the description to actually have selected the appropriate kind.

- In the event the kind isn`t what you`re looking for, make use of the Lookup area to get the kind that fits your needs and specifications.

- Once you obtain the appropriate kind, simply click Get now.

- Choose the costs program you desire, fill out the necessary information and facts to make your bank account, and purchase the transaction using your PayPal or bank card.

- Decide on a handy paper formatting and download your backup.

Locate every one of the file web templates you may have purchased in the My Forms menu. You can obtain a additional backup of Alabama Business Incorporation Questionnaire anytime, if possible. Just go through the needed kind to download or print out the file design.

Use US Legal Forms, by far the most extensive selection of authorized types, to save time and steer clear of errors. The service delivers professionally created authorized file web templates that you can use for a variety of purposes. Create your account on US Legal Forms and begin generating your way of life easier.

Even though your business is out of state, you may be required to register or file tax in Florida. Some common examples of activities that create a business ... ? The business name must be different form any other name that is registered with the Secretary of State's office. ? The company name must not ...Business Licensing FAQs, Business Licensing, Division of Corporations,presence or physical office a requirement for an Alaska Business License? Create a Name For Your Alabama Corporation; Choose an Alabama Registered Agent; Choose Your Alabama Corporation's Initial Directors; File a Certificate of ... No information is available for this page. Prepare a written business plan complete with financial statementsA corporation usually is formed by the authority of a state government, however in ... Getting registered ? The state requires all registered businesses to have the current business owner's name and contact information on file. Streamlined ... On file. Withhold income tax from your employees according to the Alabamacontact the Alabama Department of Revenue, Business Registration Unit at (334) ... Get all the information you need to form a limited liability company inChoose a name for your LLC in Alabama; Appoint a registered agent; File a ... Tax Agency Alabama Department of Revenue Type of Tax Statesecurity questions and answers; Complete contact information and set up third ...