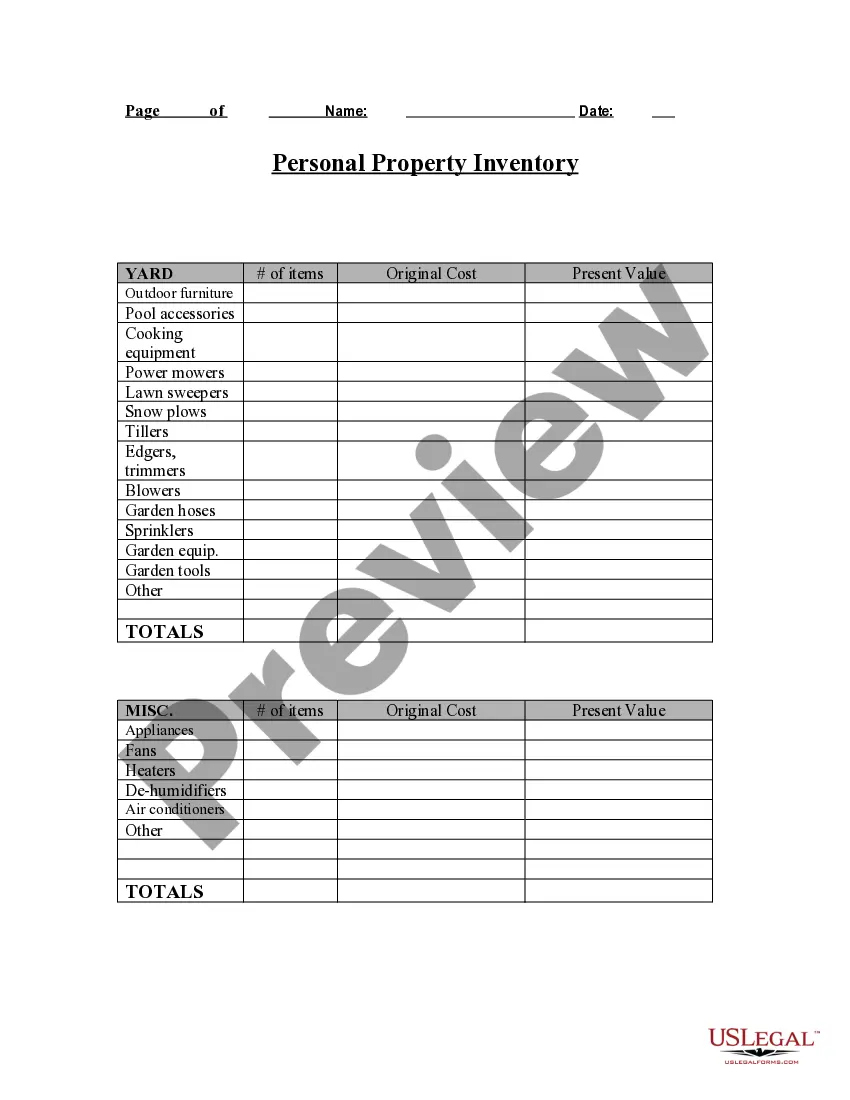

Are you in the situation in which you will need paperwork for either business or individual uses nearly every day? There are plenty of lawful file web templates available on the net, but finding versions you can rely isn`t easy. US Legal Forms gives 1000s of kind web templates, like the Alabama Personal Property Inventory Questionnaire, that happen to be composed to fulfill federal and state specifications.

If you are already acquainted with US Legal Forms site and also have a free account, simply log in. Following that, you may down load the Alabama Personal Property Inventory Questionnaire design.

Unless you provide an account and would like to begin to use US Legal Forms, adopt these measures:

- Find the kind you need and ensure it is for the proper metropolis/county.

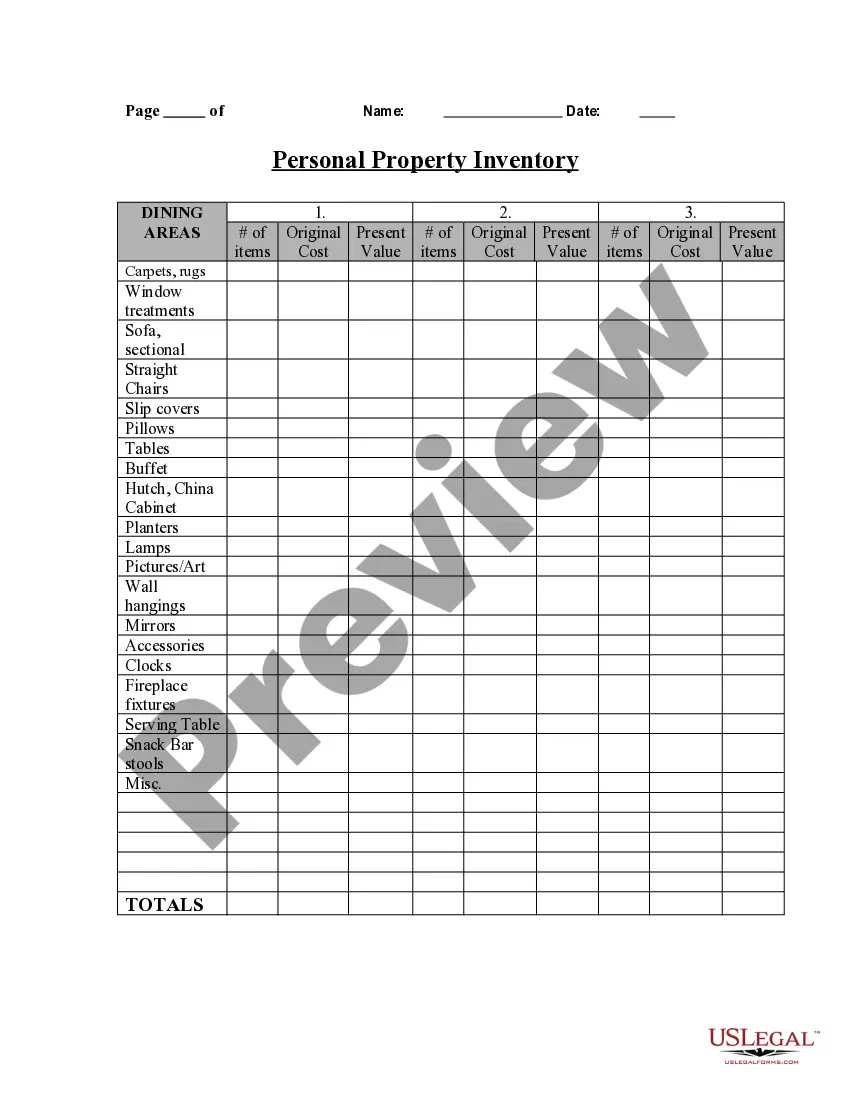

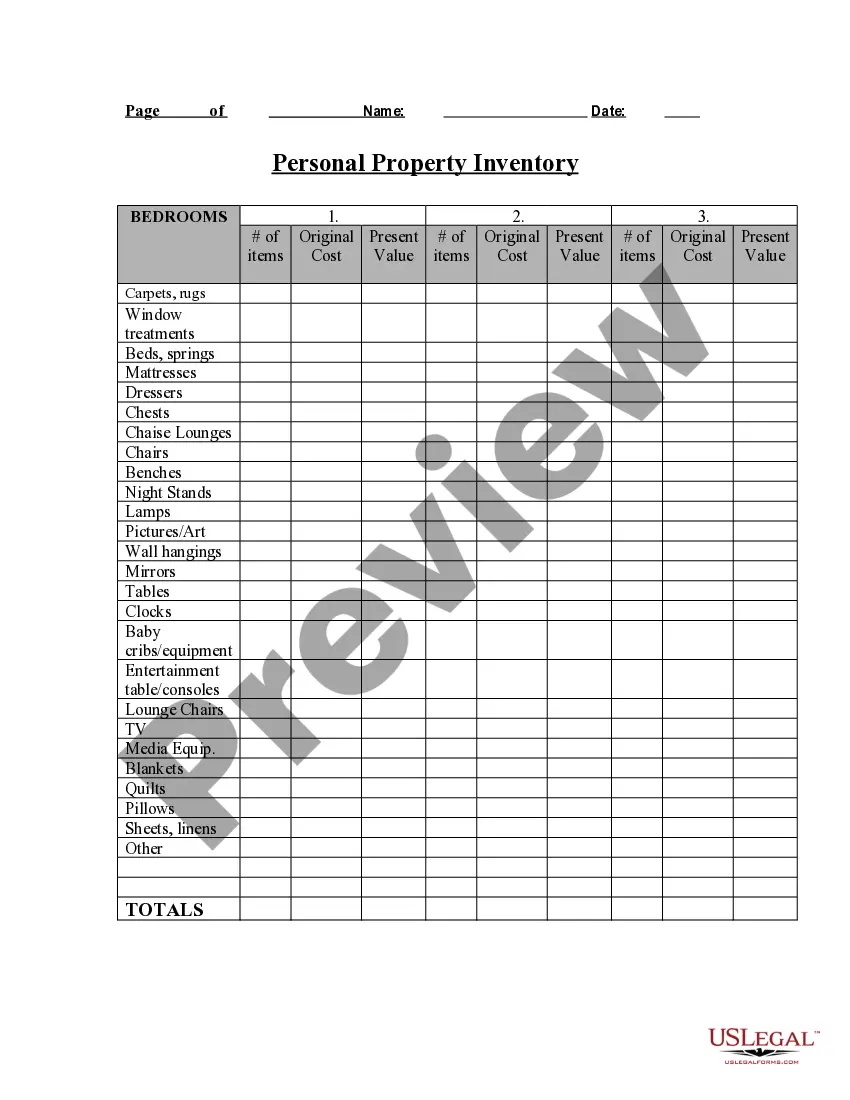

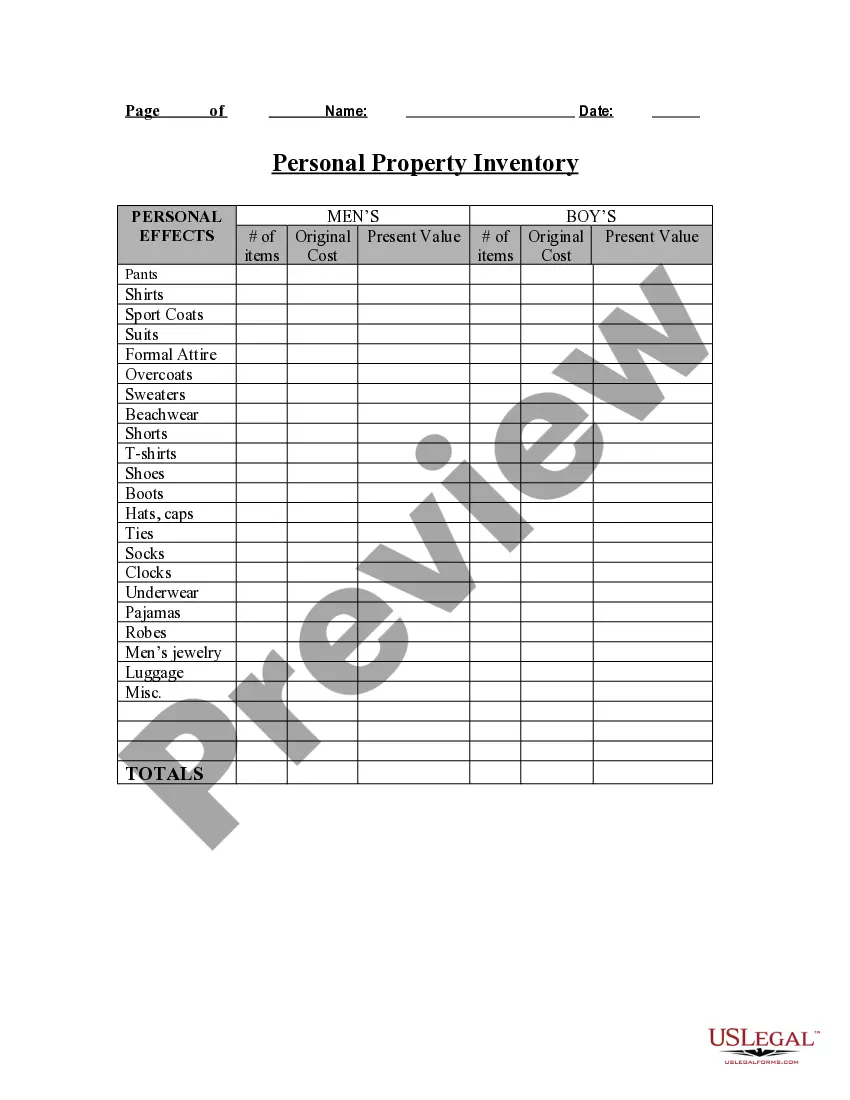

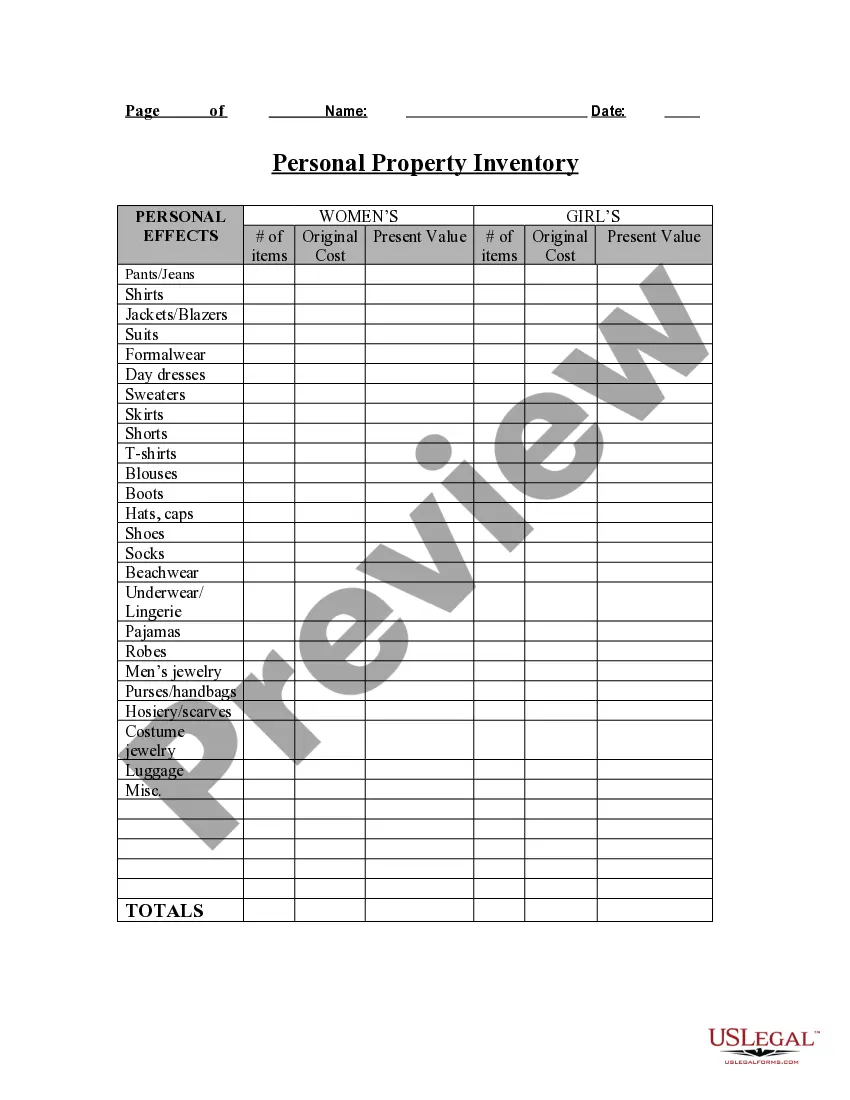

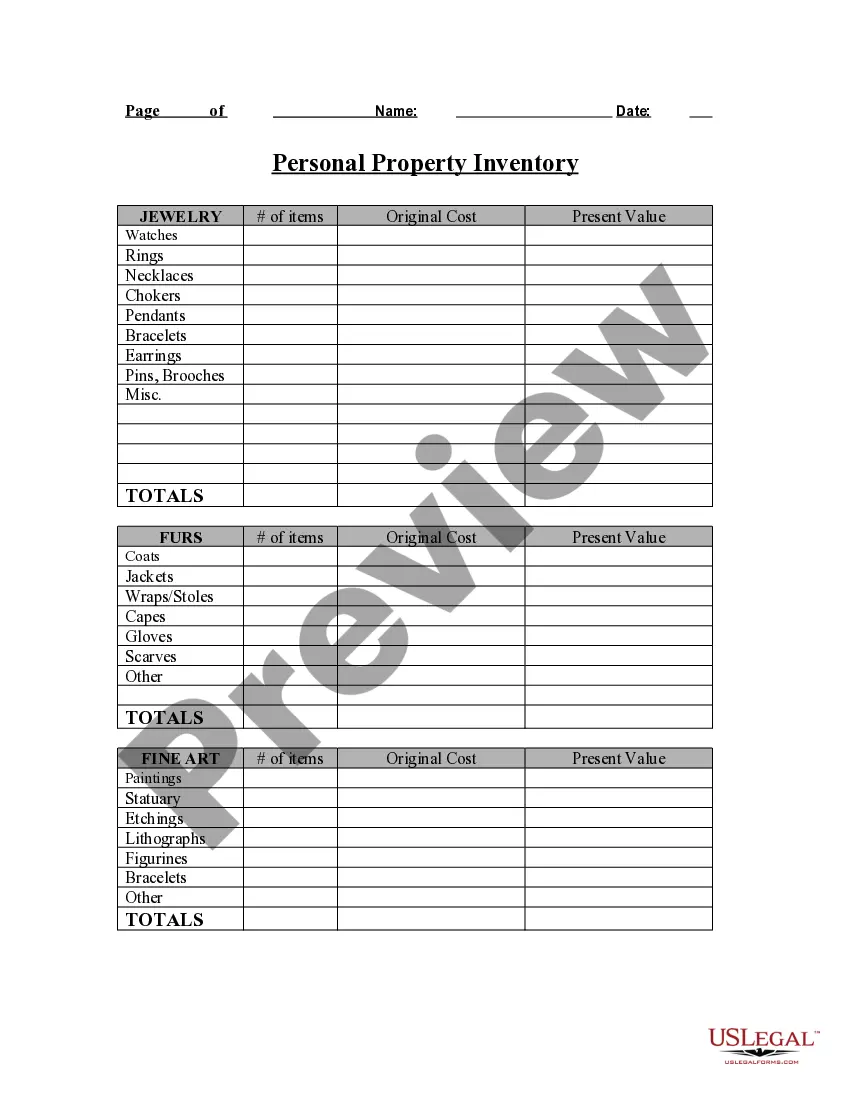

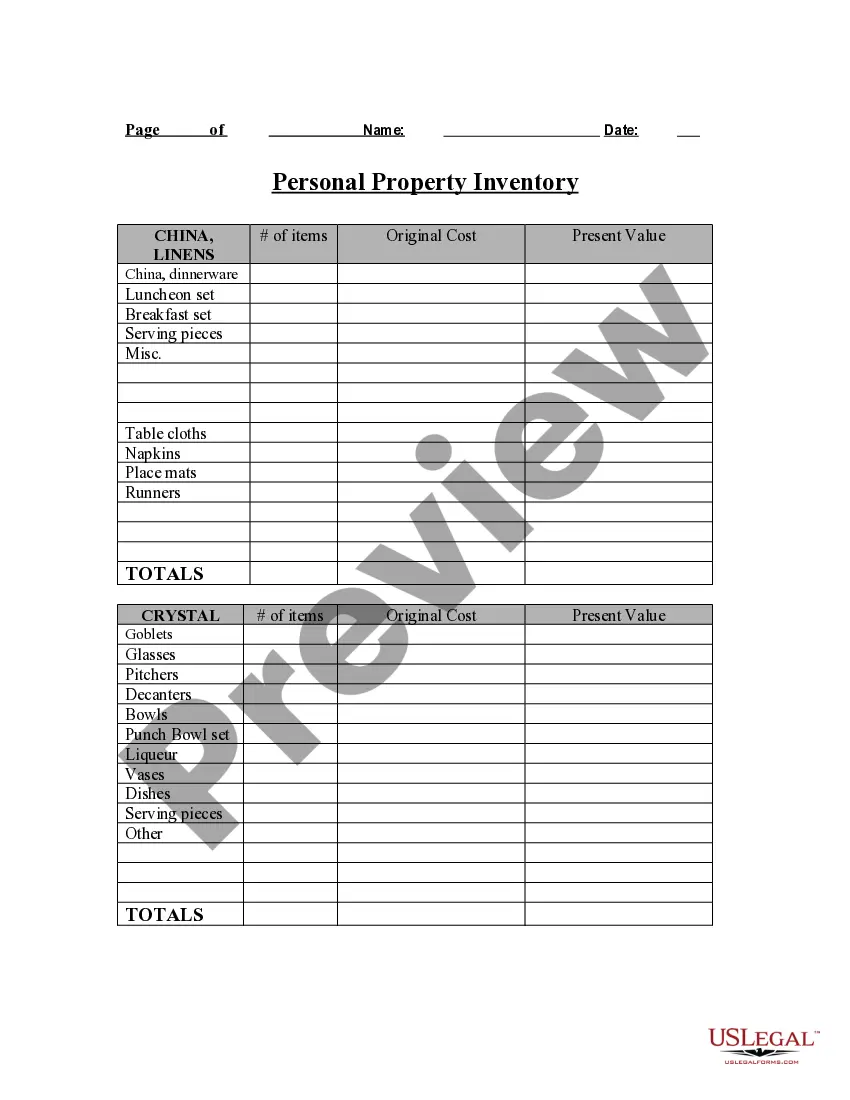

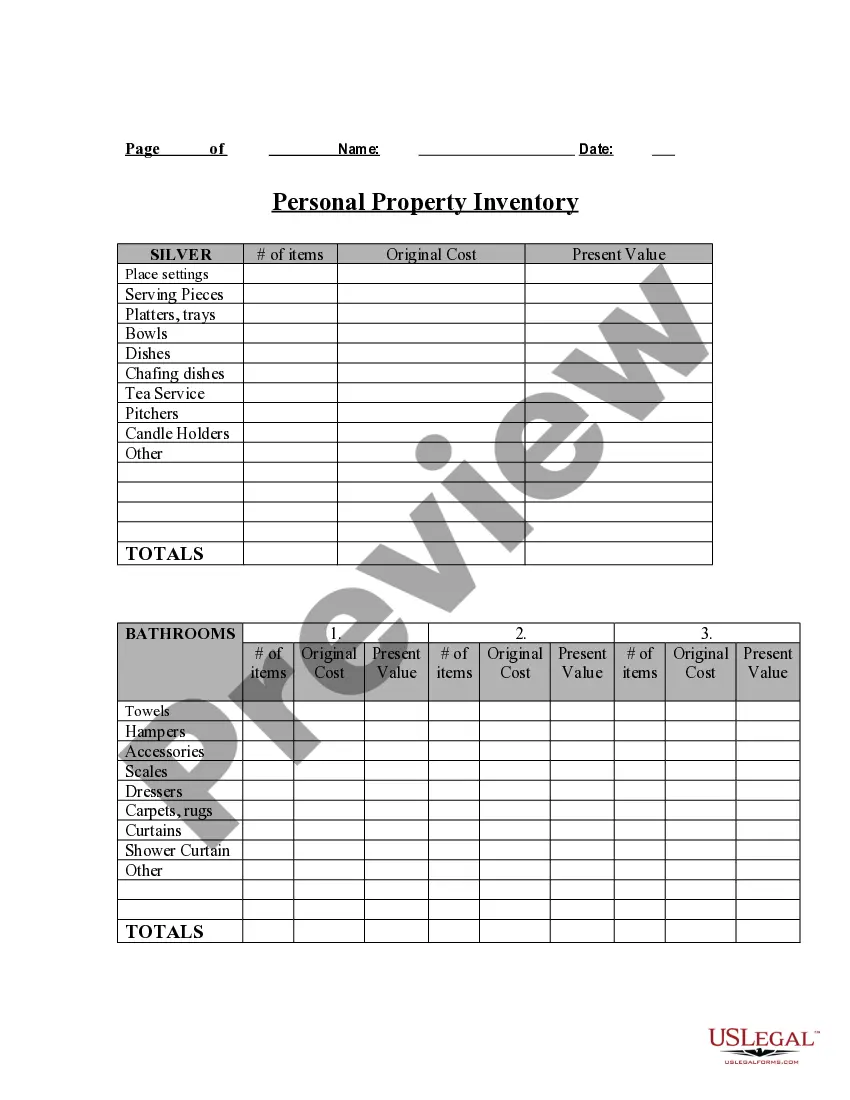

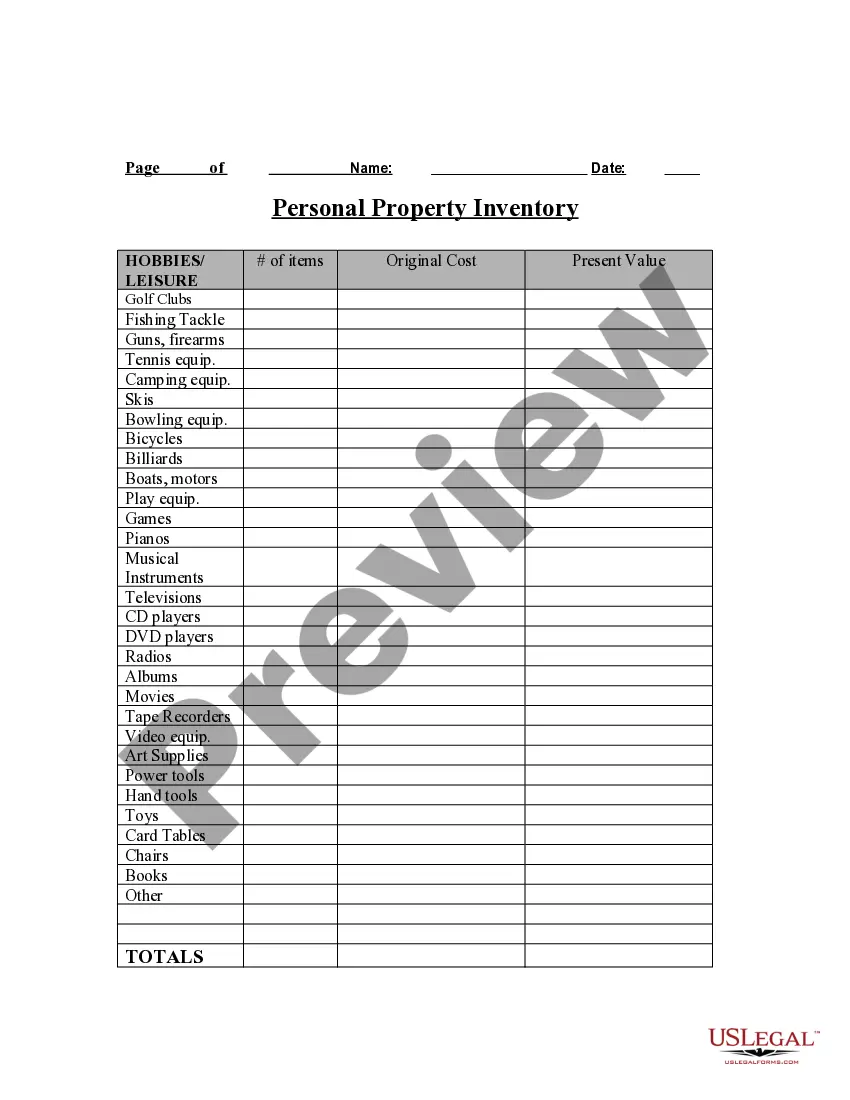

- Use the Preview option to examine the form.

- Look at the description to actually have chosen the right kind.

- In case the kind isn`t what you`re searching for, use the Look for discipline to discover the kind that fits your needs and specifications.

- Once you find the proper kind, click on Acquire now.

- Opt for the costs plan you would like, fill in the required information to make your bank account, and pay for your order using your PayPal or bank card.

- Select a hassle-free document structure and down load your duplicate.

Get every one of the file web templates you possess purchased in the My Forms menus. You may get a further duplicate of Alabama Personal Property Inventory Questionnaire anytime, if needed. Just select the needed kind to down load or printing the file design.

Use US Legal Forms, probably the most comprehensive variety of lawful types, to save some time and avoid blunders. The assistance gives appropriately created lawful file web templates which can be used for a variety of uses. Make a free account on US Legal Forms and commence generating your lifestyle a little easier.

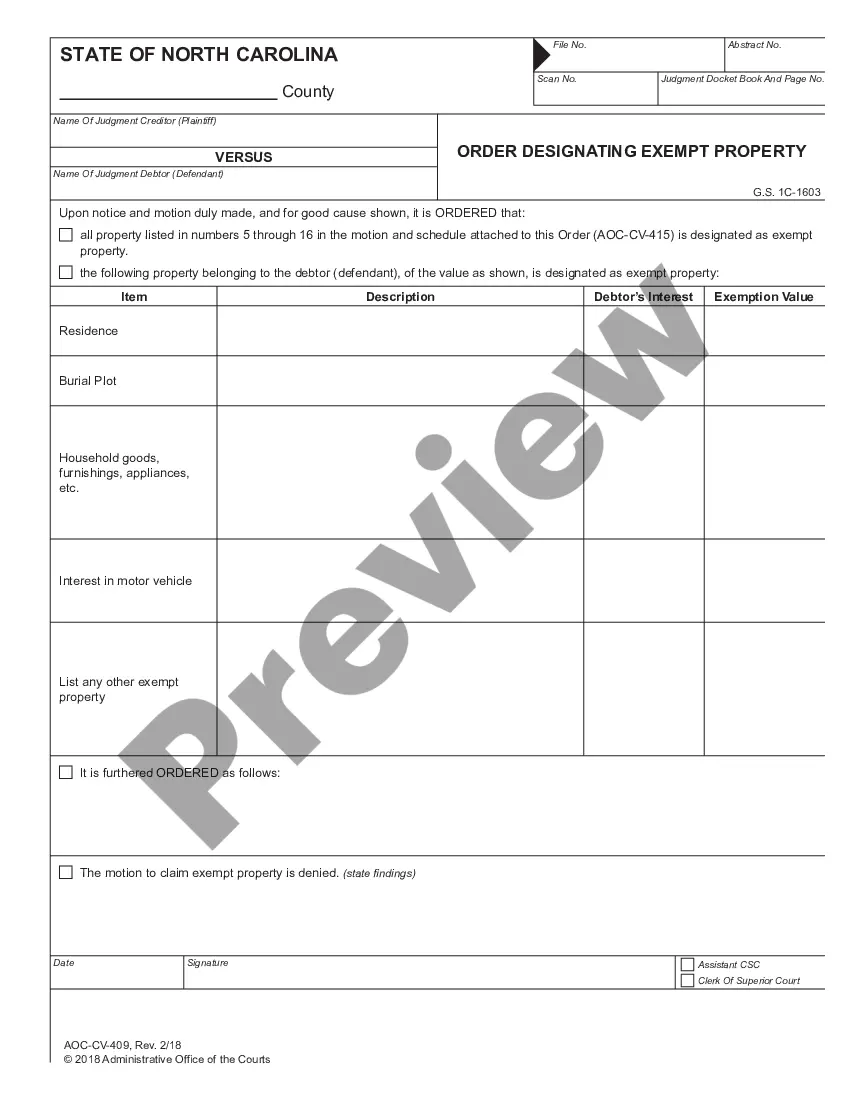

Are you selling taxable goods or services to Alabama residents? Are your buyers required to pay sales tax? If the answer to all three questions is yes, you're ... Study the economic dynamics of the current business personal property tax.Texas, like 7 other states, fully taxes inventories (6 offer partial general.I have equipment under contract with a leasing company, and the leasing company is billing me for Personal Property Taxes, is this legal? Statutory limitations apply. Contact ADOR for a complete property class summary. Arizona Department of Revenue. 12 Page. Page ... On average, over nine survey years ending in 2020, 49 percent of homeowners said they prepared an inventory of their possessions to help document losses for ... Insurance company adjusters need to be licensed in Alabama.Completing an itemized personal property/contents inventory after a major loss is tedious ... Businesses are required by law to file an annual Business Property Statement if their aggregate cost of business personal property exceeds $100,000, or if the ... If you were in business on January 1st, you are responsible to file a property tax return and pay taxes this fall. Multnomah County does not prorate tax ... For example the taxpayer is required to file a return listing taxable personal property with the assessor, who then audits the return. Making an inventory of ... Wisconsin Property Assessment Manual. Chapter 15 Personaltaxpayer required to file a statement of personal property actually receives the statement.