Information Request Form used to procure filings and other notices for a Debtor (as designated in the form) on file with the Alabama filing office.

Alabama UCC11 Information Request

Description

How to fill out Alabama UCC11 Information Request?

Utilizing Alabama UCC11 Information Request templates designed by experienced attorneys helps you avoid stress when completing paperwork.

Simply download the template from our site, complete it, and have a lawyer review it.

This approach can save you significantly more time and expense compared to hiring an attorney to draft a document tailored to your requirements.

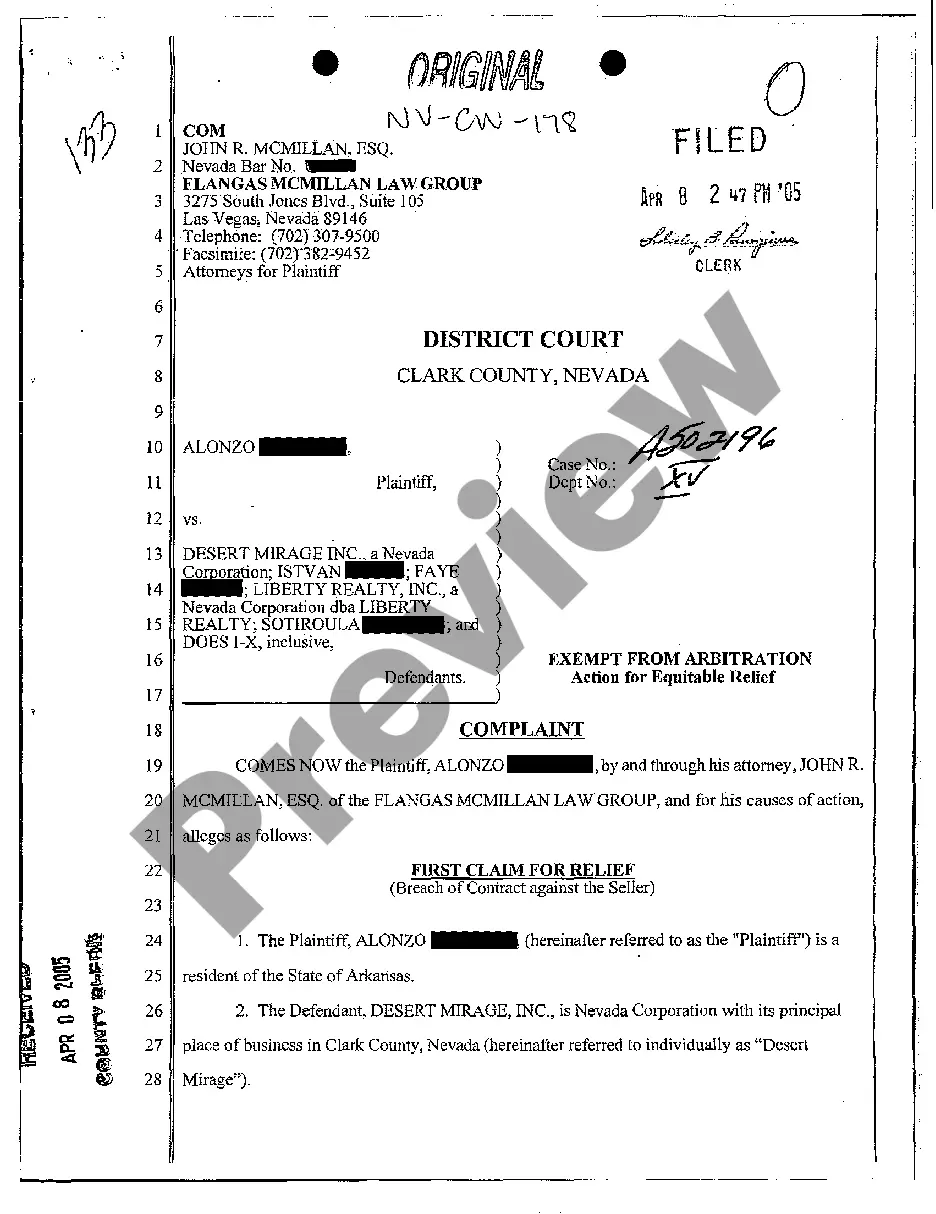

Utilize the Preview feature and examine the description (if available) to determine if you need this particular sample, and if you do, simply click Buy Now.

- If you currently possess a US Legal Forms subscription, just Log In to your account and navigate back to the form webpage.

- Locate the Download button adjacent to the template you are reviewing.

- Once you’ve downloaded a document, you will find all of your stored samples in the My documents section.

- If you don't have a subscription, that's perfectly fine.

- Just adhere to the following step-by-step instructions to create your account online, acquire, and complete your Alabama UCC11 Information Request template.

- Verify that you’re downloading the correct state-specific form.

Form popularity

FAQ

In all cases, you should file a UCC-1 with the secretary of state's office in the state where the debtor is incorporated or organized (if a business), or lives (if an individual).

Filer Information. Name and phone number of contact at filer. Email contact at filer. Debtor Information. Organization or individual's name. Mailing address. Secured Party Information. Organization or individual's name. Mailing address. Collateral Information. Description of collateral.

UCC-1 Financing Statements do not have to be signed by either the Debtor or Secured Party; however, they must be authorized.Although the UCC-1 Financing Statement does not require signatures, any attachment such as the legal description or special terms and conditions may require the signature of the Debtor.

You can always check the status of UCC filings against your business through your business credit report or searching UCC lien public records.

Searching Secretary of State Records Online. Locate the correct secretary of state's website. UCC financing statement forms must be filed in the state where the borrower is located. Most states have online directories of UCC filings available on the secretary of state's website.

A UCC filing is a legal notice a lender files with the secretary of state when they have a security interest against one of your assets. It gives notice that the lender has an interest, or lien, against the asset being used by you to secure the financing. The term UCC filing comes from the uniform commercial code.

UCC liens filed with Secretary of State offices act as a public notice by the "creditor" of the creditor's interest in the property.

A UCC-1 financing statement (an abbreviation for Uniform Commercial Code-1) is a legal form that a creditor files to give notice that it has or may have an interest in the personal property of a debtor (a person who owes a debt to the creditor as typically specified in the agreement creating the debt).

A UCC filing ensures you are a secured creditor and therefore in the best possible position to get paid. In addition, a Purchase Money Security Interest filing provides the priority right of repossession of your inventory or equipment at default or bankruptcy. You define default in your security agreement.