Arkansas Registration of Foreign Corporation

Description

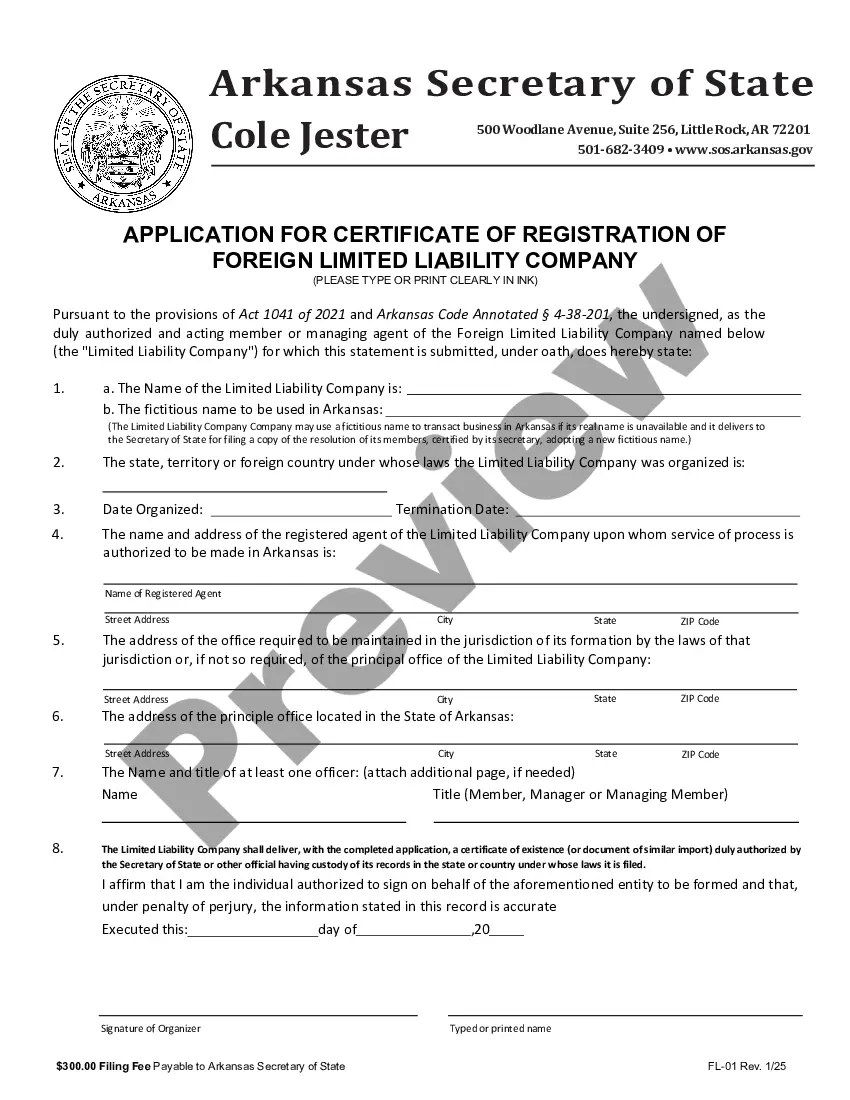

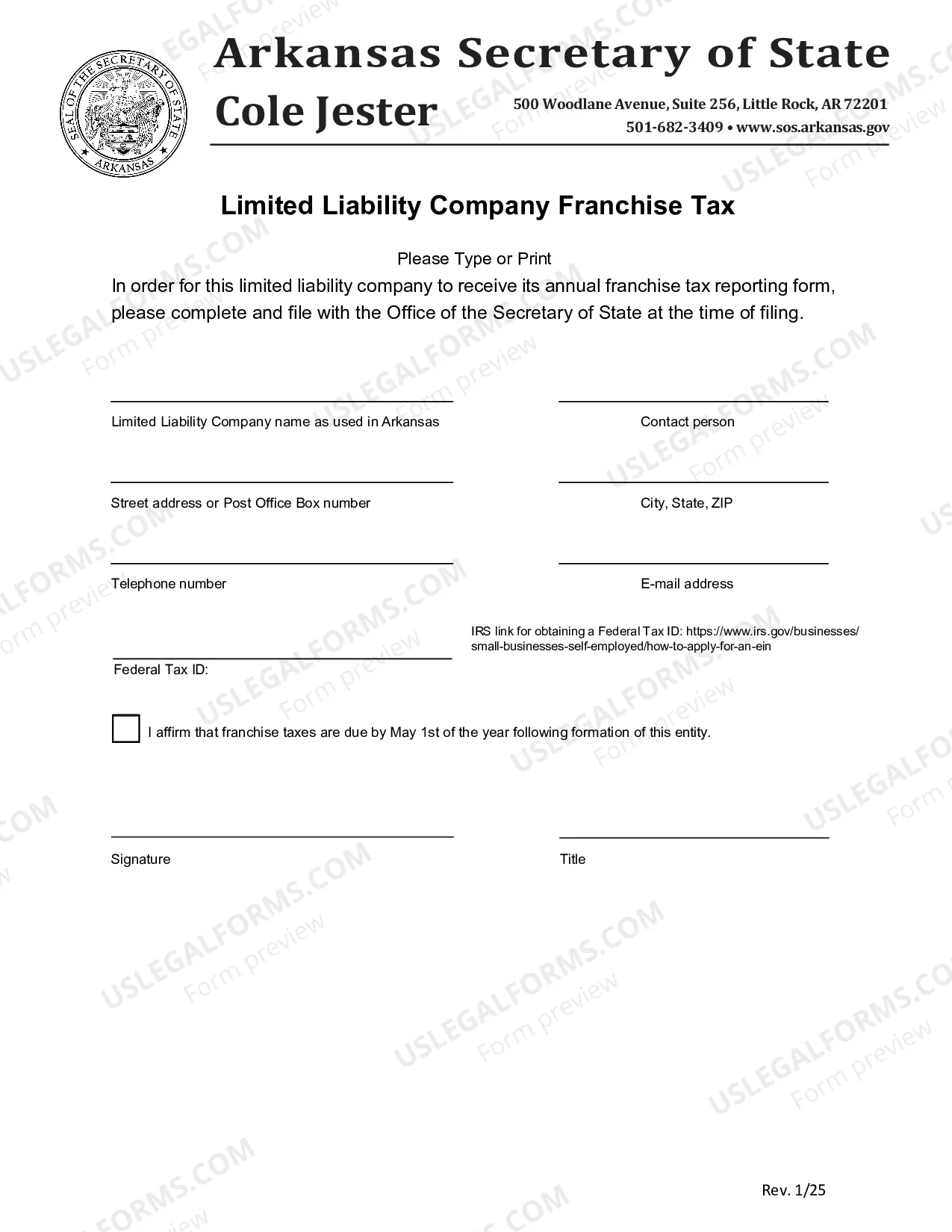

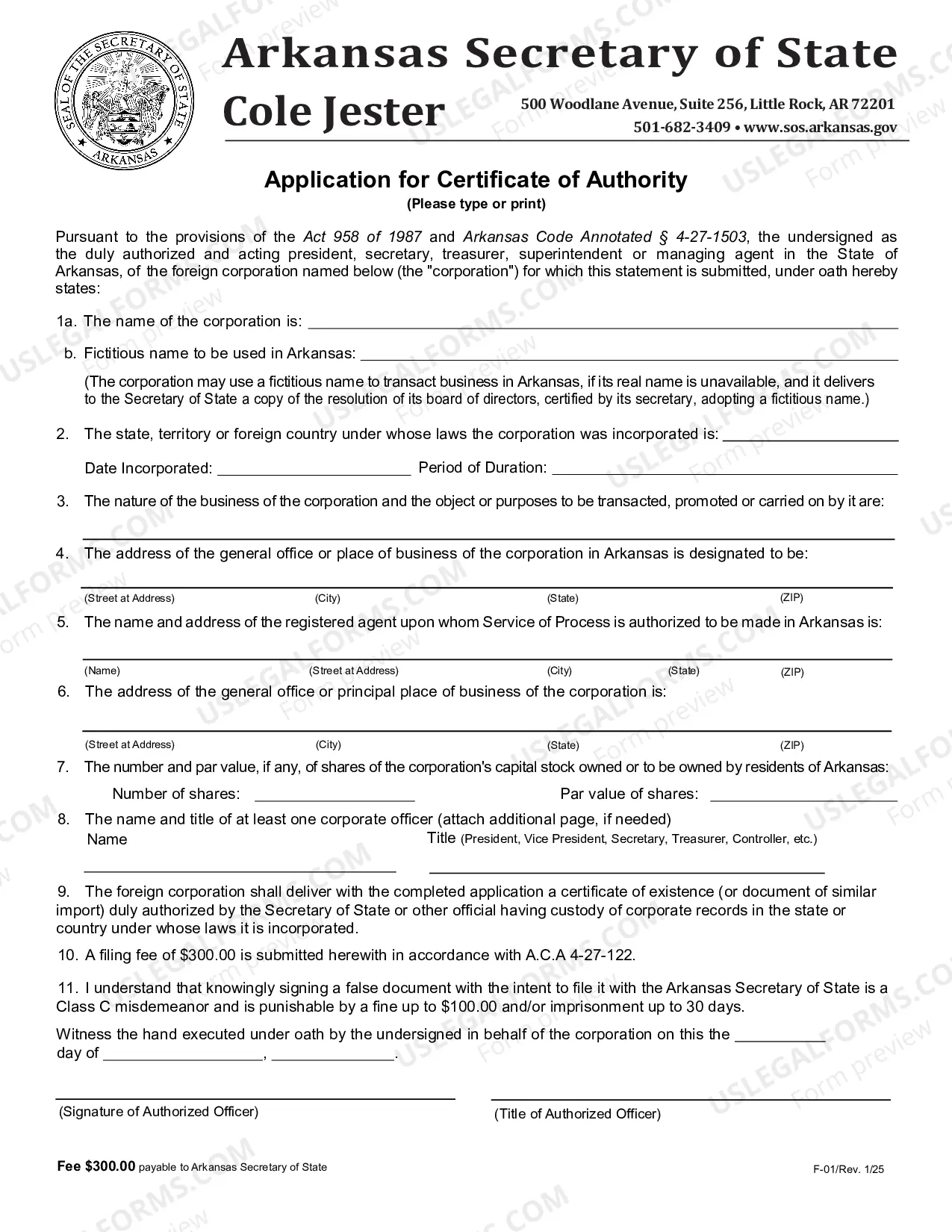

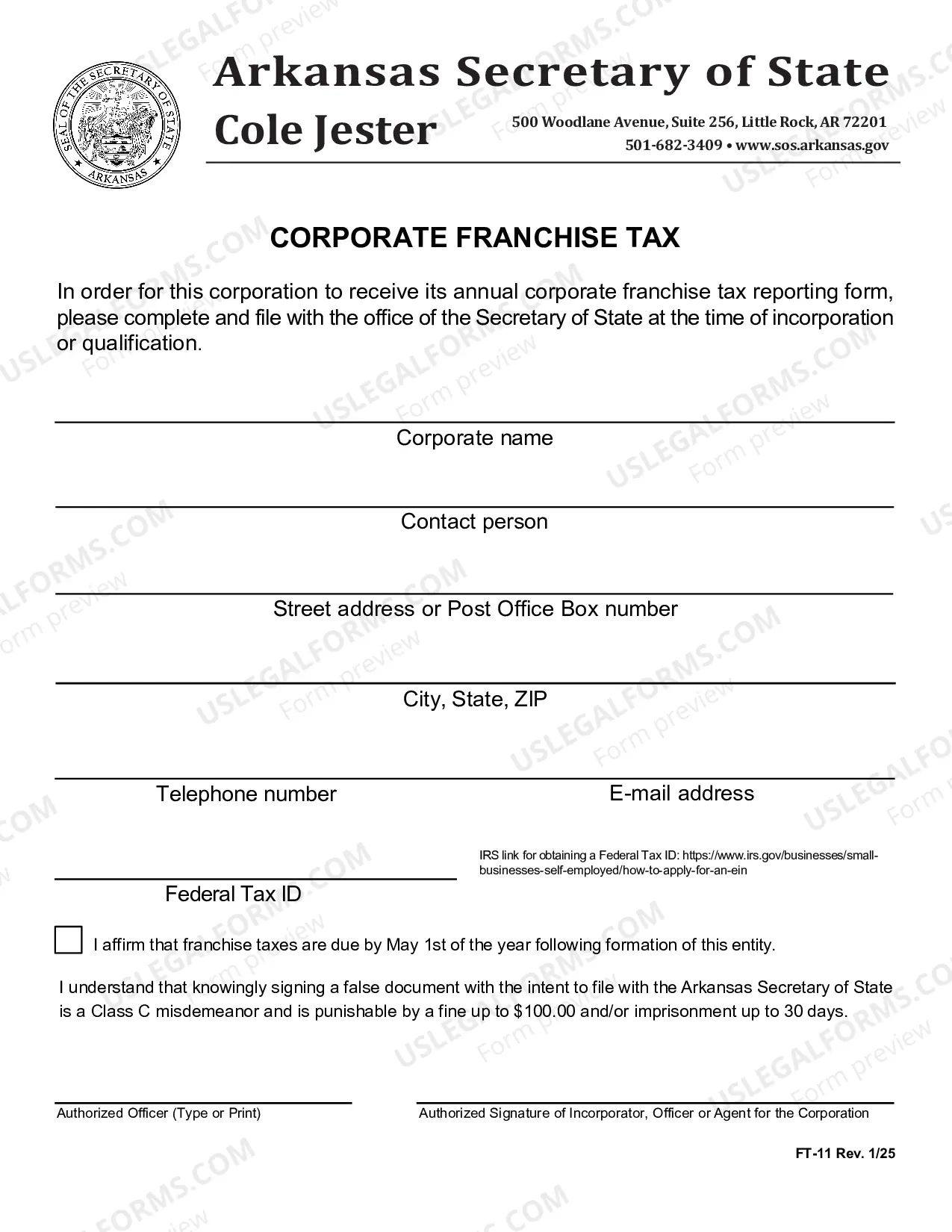

How to fill out Arkansas Registration Of Foreign Corporation?

Employing Arkansas Registration of Foreign Corporation templates designed by adept attorneys provides you the chance to evade troubles when filling out documents.

Simply download the example from our site, complete it, and request a legal expert to verify it.

Doing so can assist you in saving considerably more time and expenses than asking for legal advice to create a file from scratch tailored to your needs would.

Streamline the time you spend on document creation with US Legal Forms!

- If you possess a US Legal Forms subscription, just Log In to your account and return to the sample webpage.

- Locate the Download button near the template you are reviewing.

- After downloading a document, you will discover all your saved samples in the My documents tab.

- If you lack a subscription, that's not an issue.

- Just follow the instructions below to register for your account online, obtain, and complete your Arkansas Registration of Foreign Corporation template.

- Verify that you’re downloading the accurate state-specific form.

Form popularity

FAQ

Foreign entity registration is the process of registering your business in one state to do business in another state. The only state that your business is not foreign to is the original state you registered your business in.

Yes, a US LLC can be owned entirely by foreign persons.United States Tax laws require that foreigners pay taxes on any earnings made in the United States. Regardless of immigration status, the United States will allow foreigners to form a company as long as they have registered for a Taxpayer Identification Number.

This term is commonly used by all states to identify entities formed outside of their state. A foreign entity can obtain authority to transact business in, for example, Colorado by filing a Statement of Foreign Entity Authority with the Colorado Secretary of State.

When you formed your business, you had to do so in a specific state.Foreign entity registration is the process of registering your business in one state to do business in another state. The only state that your business is not foreign to is the original state you registered your business in.

Foreigner registration is a mandatory requirement by the Government of India under which all foreign nationals (excluding overseas citizens of India) visiting India on a long term visa (more than 180 days) are required to register themselves with a Registration Officer within 14 days of arriving in India.

A domestic corporation is one formed in the state in which it is doing business. A foreign corporation is one incorporated in another state or country and does business across state lines. The process of setting up a company in a foreign state is called foreign qualification.

Essentially, a foreign legal entity is similar to a foreign corporation. In America, it refers to an established corporation that is legally registered to operate in a state or jurisdiction outside of its original location.

Select a State. Name Your LLC. Hire a Registered Agent. File your LLC with the State. Create an LLC Operating Agreement. Get an EIN. Get a Physical US Mailing Address.