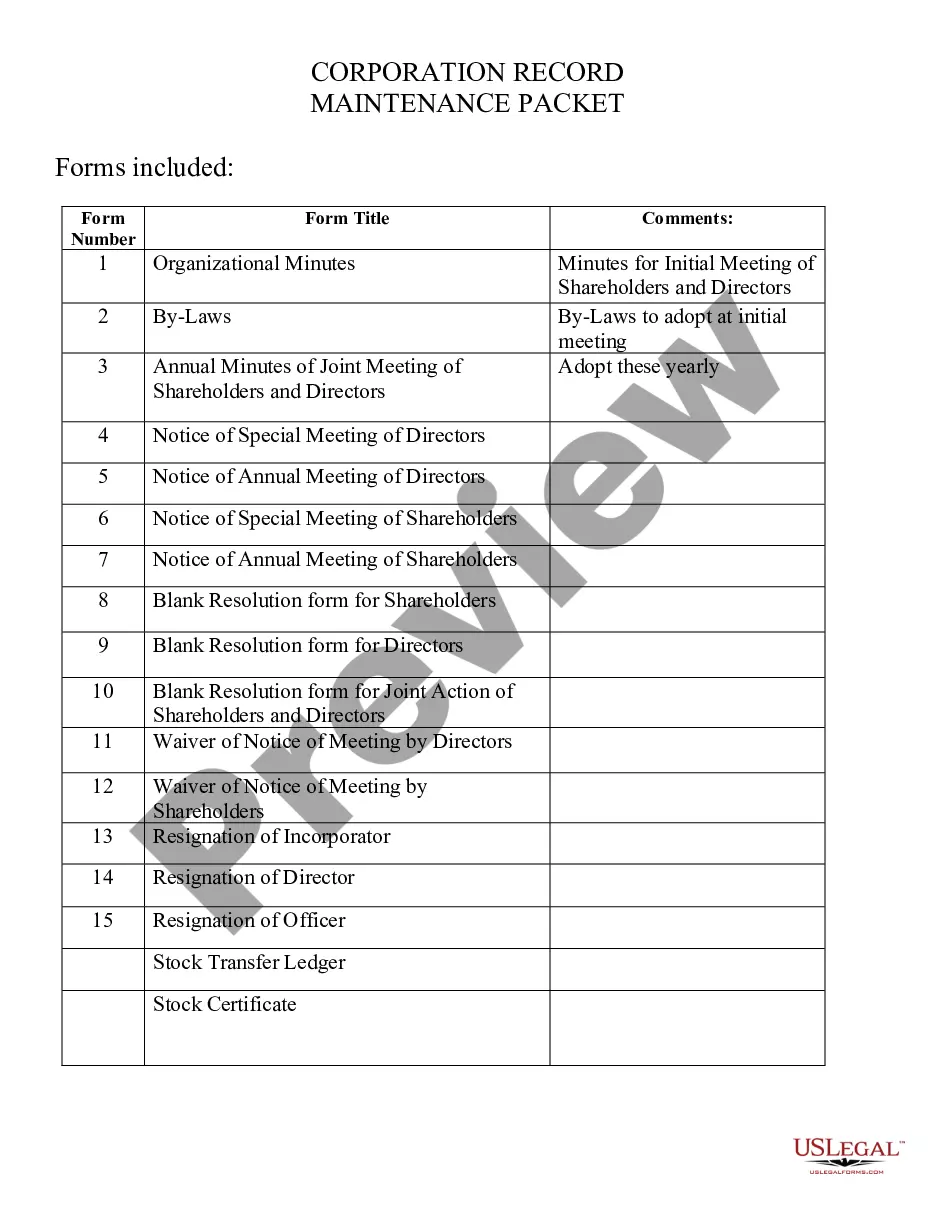

This Incorporation Package includes all forms needed to form a corporation in your state and a step by step guide to the incorporation process. The package also includes forms needed after incorporation, such as minutes, notices, and by-laws. Items Included: Steps to Incorporate, Articles or Certificate of Incorporation, By-Laws, Organizational Minutes, Annual Minutes, Notices, Resolutions, Stock Transfer Ledger, Simple Stock Certificate, IRS Form SS-4 to Apply for Tax Identification Number, and IRS Form 2553 to Apply for Subchapter S Tax Treatment.

Arkansas Business Incorporation Package to Incorporate Corporation

Description

How to fill out Arkansas Business Incorporation Package To Incorporate Corporation?

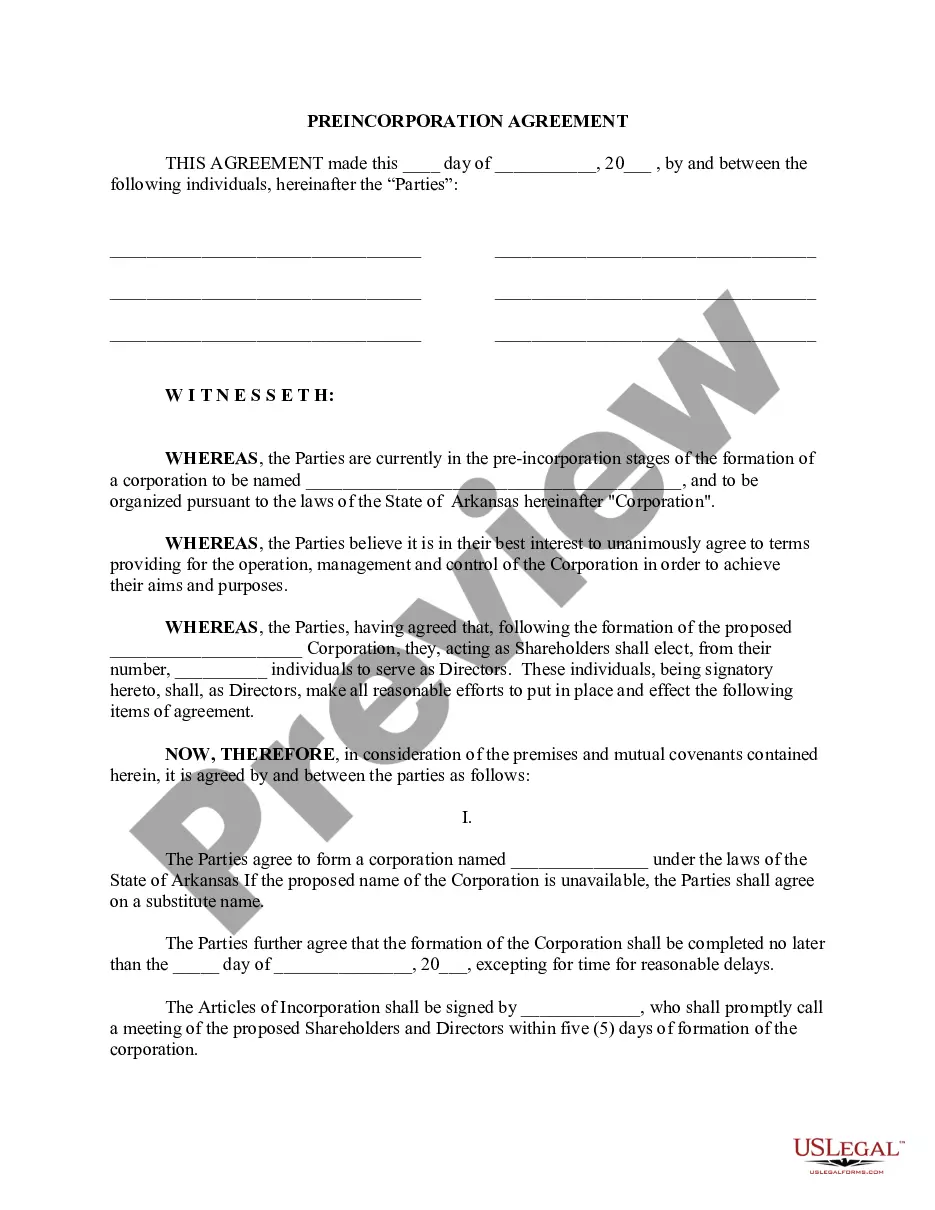

Utilizing the Arkansas Business Incorporation Package to establish a corporation examples crafted by professional attorneys provides you the chance to sidestep complications when filling out forms.

Simply download the template from our site, complete it, and request an attorney to review it. Doing this will save you significantly more time and effort than asking a lawyer to create a document tailored to your needs from scratch.

If you’ve already obtained a US Legal Forms subscription, just Log In to your account and navigate back to the sample page. Locate the Download button adjacent to the templates you're examining. After downloading a document, your saved samples can be found under the My documents section.

Choose a file format and download your document. Once you have completed all the above steps, you will be able to fill out, print, and sign the Arkansas Business Incorporation Package to establish a corporation template. Remember to double-check all entered details for accuracy prior to submission or mailing. Minimize the time you spend on filling out documents with US Legal Forms!

- If you lack a subscription, don’t worry. Just follow the instructions below to create an account online, obtain, and fill out your Arkansas Business Incorporation Package to establish a corporation template.

- Verify and ensure you’re downloading the correct state-specific form.

- Utilize the Preview option and review the description (if available) to determine if you require this specific template, and if so, click Buy Now.

- Search for another sample using the Search bar if necessary.

- Choose a subscription that aligns with your needs.

- Begin by using your credit card or PayPal.

Form popularity

FAQ

Both types of entities have the significant legal advantage of helping to protect assets from creditors and providing an extra layer of protection against legal liability. In general, the creation and management of an LLC are much easier and more flexible than that of a corporation.

The Government fee for incorporation is $275.00 plus the cost of a NUANS search. Corporate Registry offices throughout the Province will also have an additional administrative fee that is approximately $225.00, making the total cost of incorporation over $500.00.

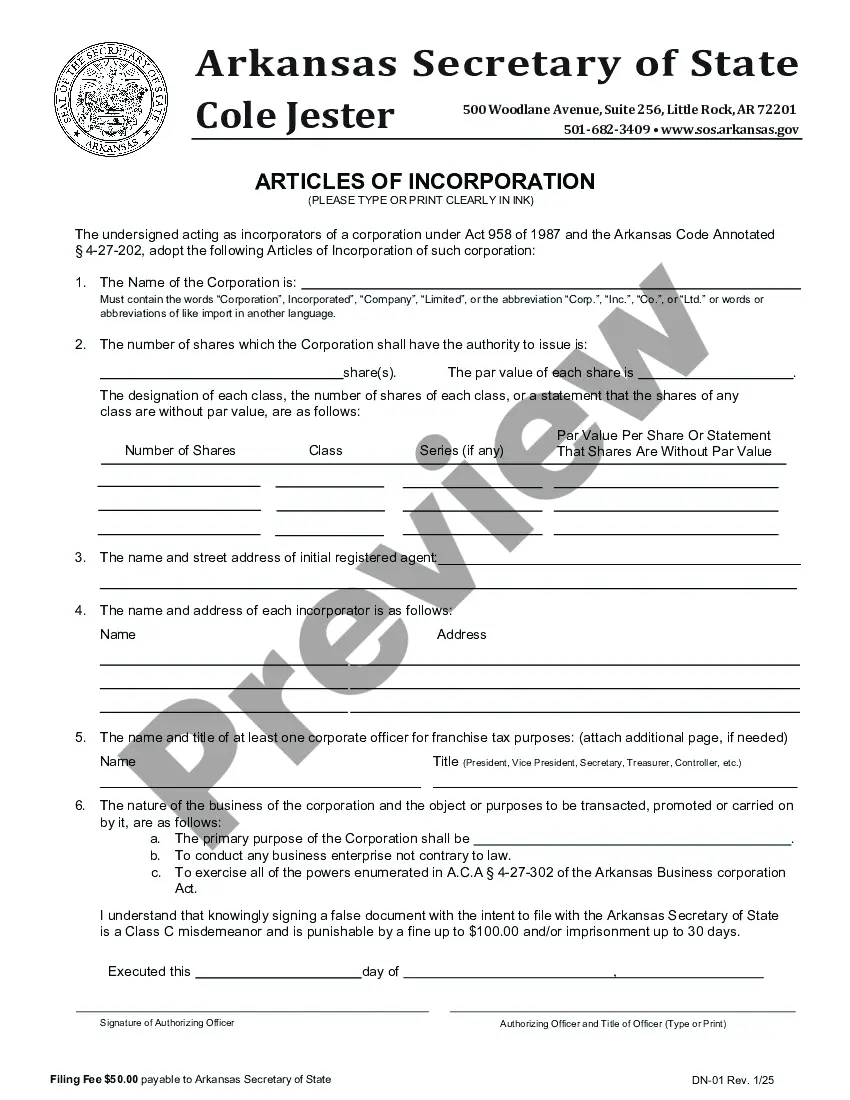

The online state filing fee for Arkansas Articles of Incorporation is a super affordable $45. If you mail your Articles, the filing fee jumps to $50. Once filed with the state, the Articles of Incorporation formally creates your Arkansas corporation.

License. The application fee for obtaining a business license will vary between $50 to more than $1,000 depending on the type of business and amount and kind of inventory. Generally, business licenses are renewed annually.

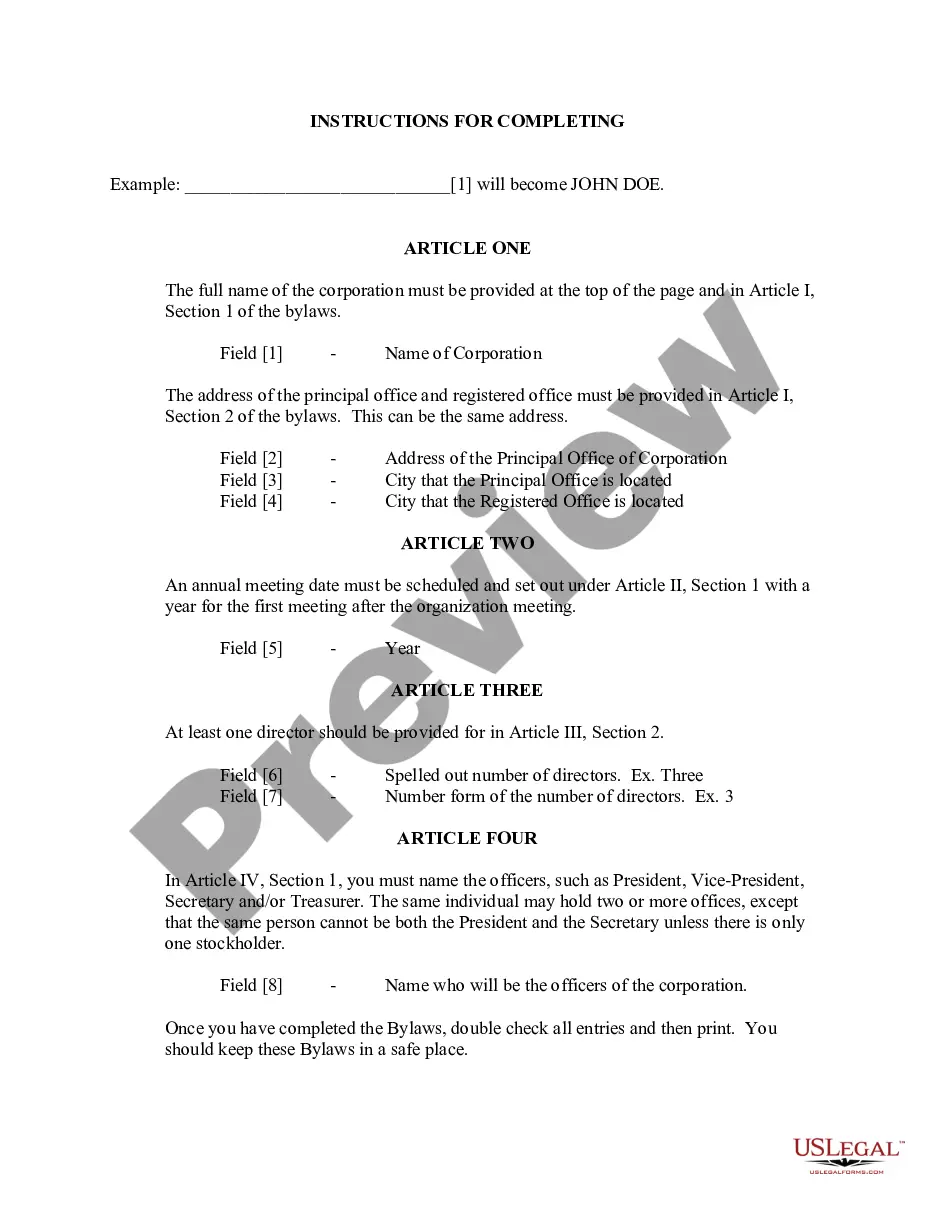

Business Name Reservation Form (Corps and LLCs) Articles of Incorporation (Corps only) Articles of Organization (LLCs only) Corporate Bylaws (Corps only) Operating Agreement (LLCs only)

One of the main reasons to form a corporation or LLC for a small business is to avoid personal liability for the business' debts. As we mentioned earlier, corporations and LLCs have their own legal existence. It's the corporation or LLC that owns the business, its assets, debts, and liabilities.

What Is the Cheapest State to Incorporate? Delaware remains one of the more affordable states in which to form an LLC (14th lowest filing fee of 50 states). Delaware also ranks well for incorporation fees (17th lowest filing fee of 50 states).

How much does it cost to form an LLC in Arkansas? The Arkansas Secretary of State charges a $45 fee to file the Articles of Organization online and $50 if filed by mail. You can reserve your LLC name with the Arkansas SOS for $25 if filed by mail or $22.50 if filed online.

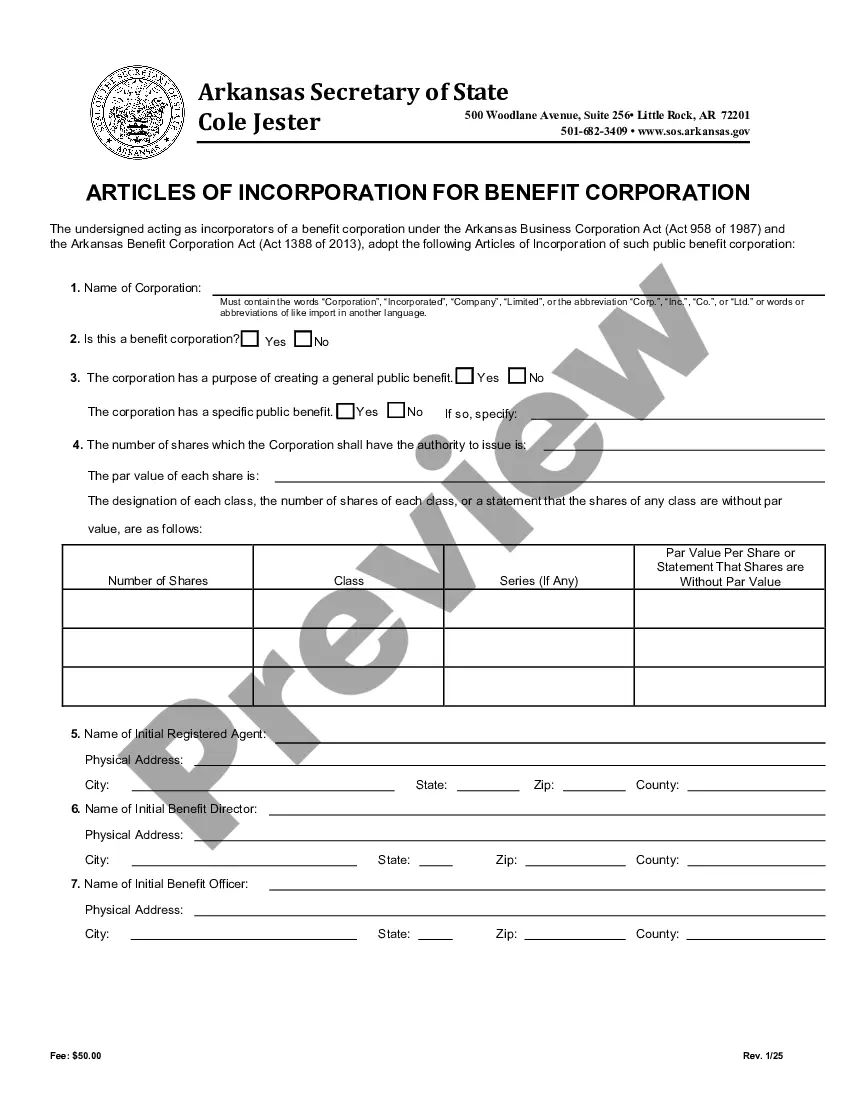

Step 1: Name Your Arkansas Corporation. Step 2: Choose a Registered Agent. Step 3: Hold an Organizational Meeting. Step 4: File the Articles of Incorporation. Step 5: Get an EIN.