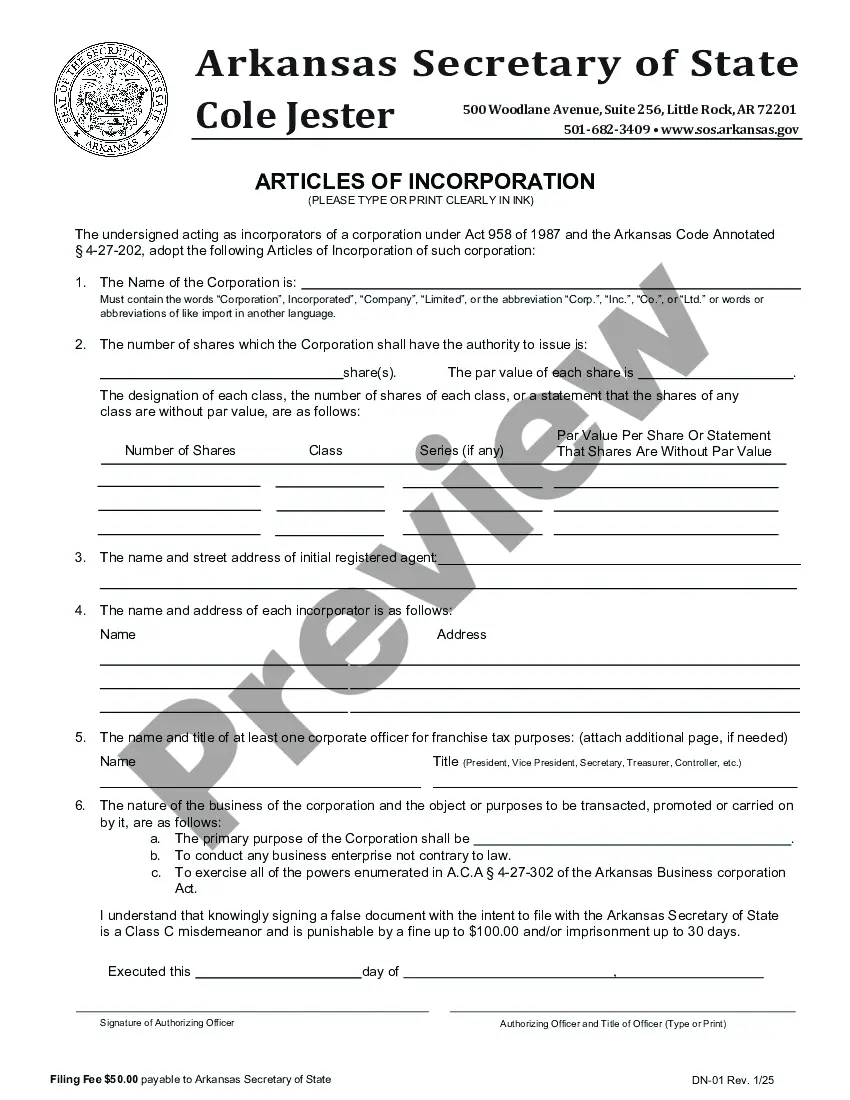

This state-specific form must be filed with the appropriate state agency in compliance with state law in order to create a new non-profit corporation. The form contains basic information concerning the corporation, normally including the corporate name

Arkansas Articles of Incorporation for Domestic Nonprofit Corporation

Description

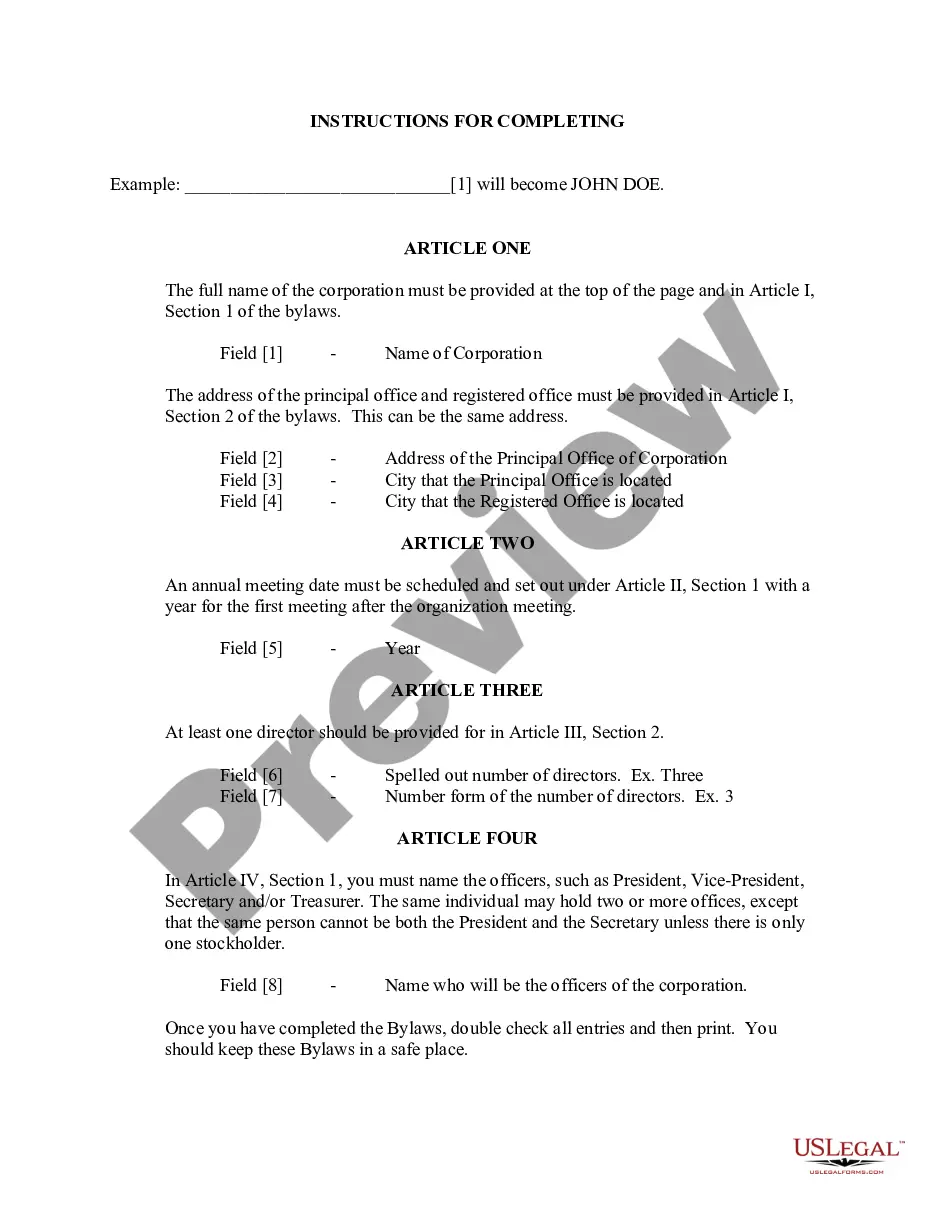

How to fill out Arkansas Articles Of Incorporation For Domestic Nonprofit Corporation?

Utilizing Arkansas Articles of Incorporation for Domestic Nonprofit Corporation samples created by professional attorneys allows you to avoid stress when completing paperwork. Simply retrieve the example from our site, fill it in, and have an attorney validate it. This approach will save you significantly more time and expenses compared to asking a lawyer to draft a document entirely from the ground up tailored to your specifications.

If you’ve previously purchased a US Legal Forms subscription, simply Log In to your account and navigate back to the form page. Locate the Download button next to the templates you are reviewing. After downloading a template, you will find your stored examples in the My documents section.

If you do not have a subscription, that’s not an issue. Just follow the instructions below to register for an account online, acquire, and complete your Arkansas Articles of Incorporation for Domestic Nonprofit Corporation template.

Once you have completed all the steps outlined above, you'll be able to fill out, print, and sign the Arkansas Articles of Incorporation for Domestic Nonprofit Corporation sample. Remember to verify all entered information for accuracy before finalizing or sending it out. Minimize the time you spend on document completion with US Legal Forms!

- Verify that you’re downloading the correct state-specific form.

- Use the Preview feature and review the description (if present) to determine if you require this specific sample, and if so, just click Buy Now.

- Search for another sample using the Search field if needed.

- Select a subscription that fits your needs.

- Begin with your credit card or PayPal.

- Choose a file format and download your document.

Form popularity

FAQ

Nonprofit incorporation usually involves these steps: Choose a business name that is legally available in your state and file for an EIN (Employment Identification Number) Prepare and file your articles of incorporation with your state's corporate filing office, and pay a filing fee.

Name Your Organization. Recruit Incorporators and Initial Directors. Appoint a Registered Agent. Prepare and File Articles of Incorporation. File Initial Report. Obtain an Employer Identification Number (EIN) Store Nonprofit Records. Establish Initial Governing Documents and Policies.

Legal Name of the Organization (Not taken by other companies in your State) Address of the Organization (Should be in the Incorporating State) Incorporator of the Nonprofit Organization.

Both the IRS and the nonprofit corporation are required to disclose the information they provide on Form 990 to the public. This means that nonprofits must make their records available for public inspection during regular business hours at their principal office.

Any company registered in Arkansas can order certified copies of its official formation documents from the Arkansas Secretary of State. Processing time is typically 1 business day plus mailing time.

The name of your corporation. your corporation's principal place of business. the name and address of your corporation's registered agent. a statement of the corporation's purpose. the corporation's duration. information about the number of shares and classes of stock the corporation is authorized to issue.

In order to form a nonprofit corporation, you must file articles of incorporation (sometimes called a "certificate of incorporation" or "charter document" or "articles of organization") with the state and pay a filing fee.

All states require nonprofit corporations to have a registered agent in the state of formation. The registered agent is responsible for receiving legal and tax documents, must have a physical address (no P.O.Note that supplying the nonprofit's principal office address is optional in many states, but some require it.

Broadly, articles of incorporation should include the company's name, type of corporate structure, and number and type of authorized shares. Bylaws work in conjunction with the articles of incorporation to form the legal backbone of the business.