Arkansas Lump Sum Request/Respondent's Position

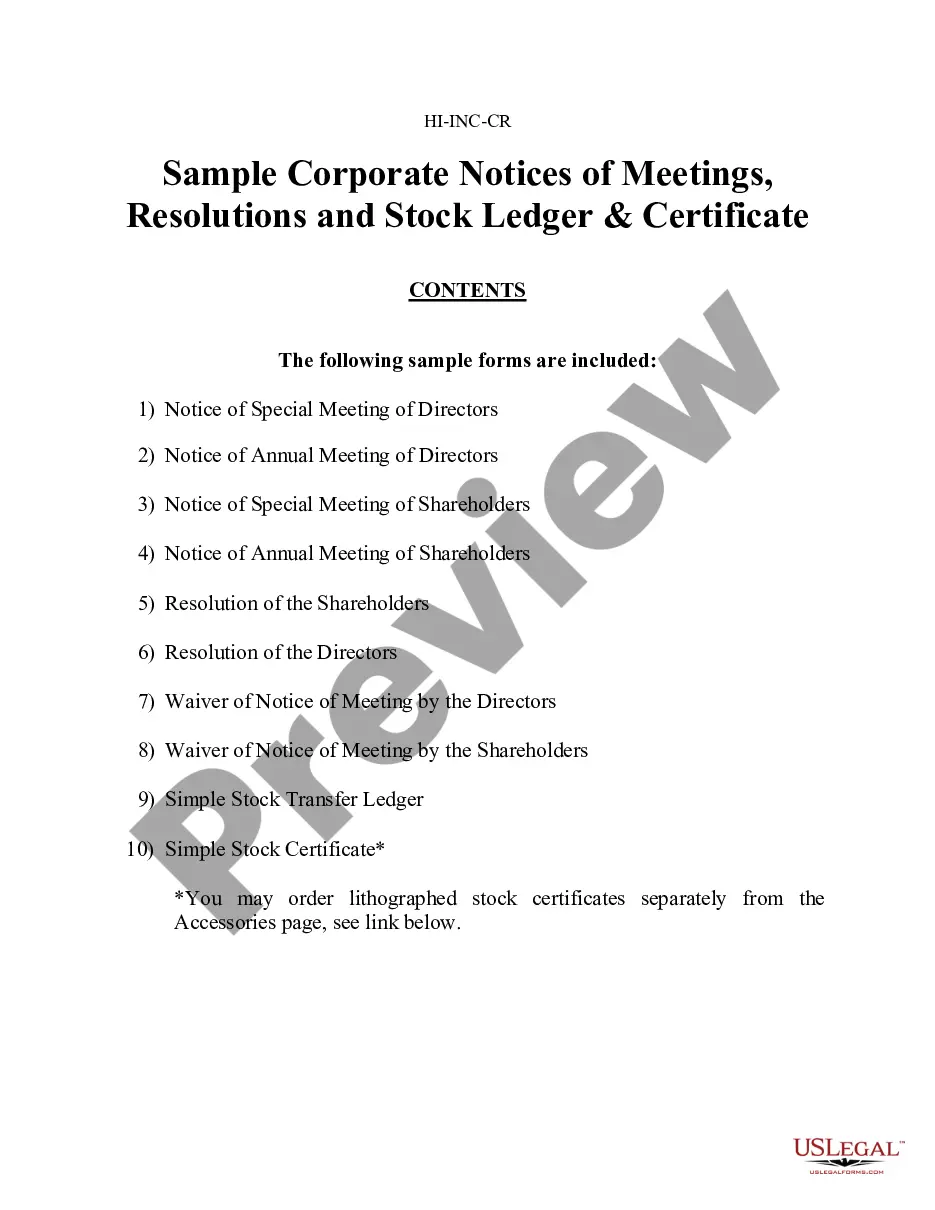

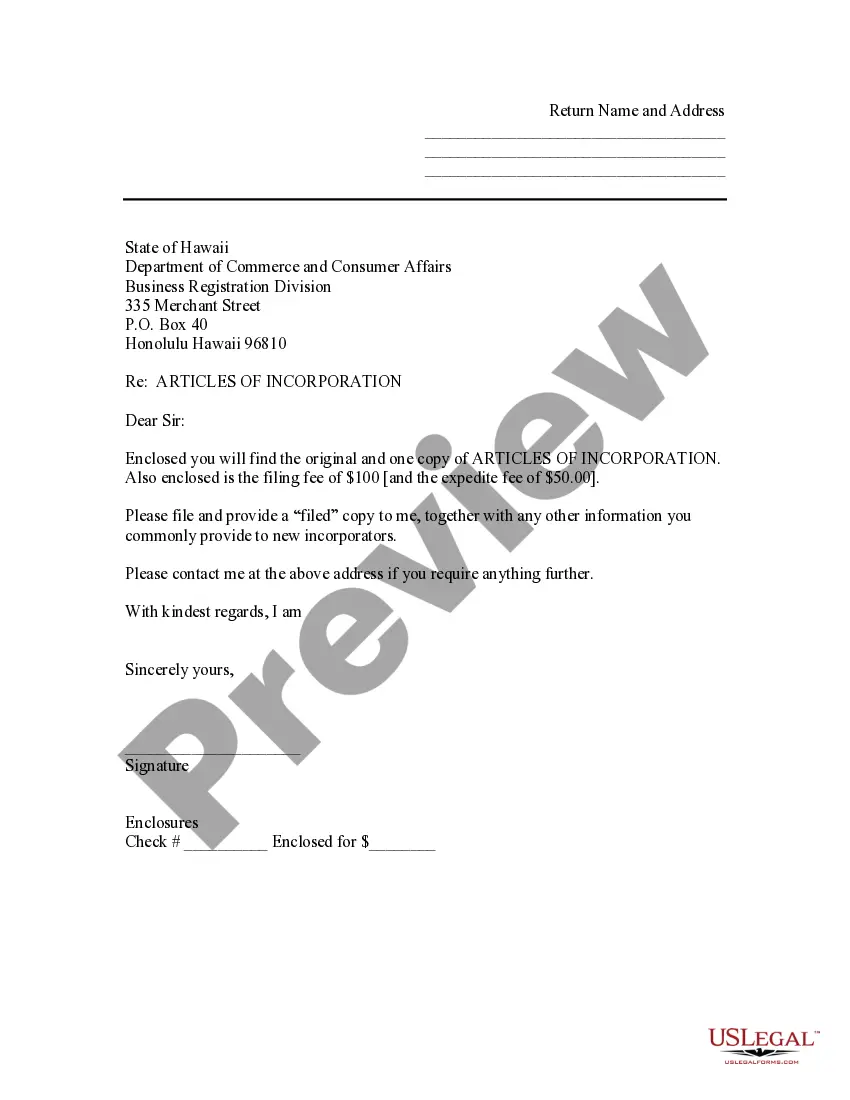

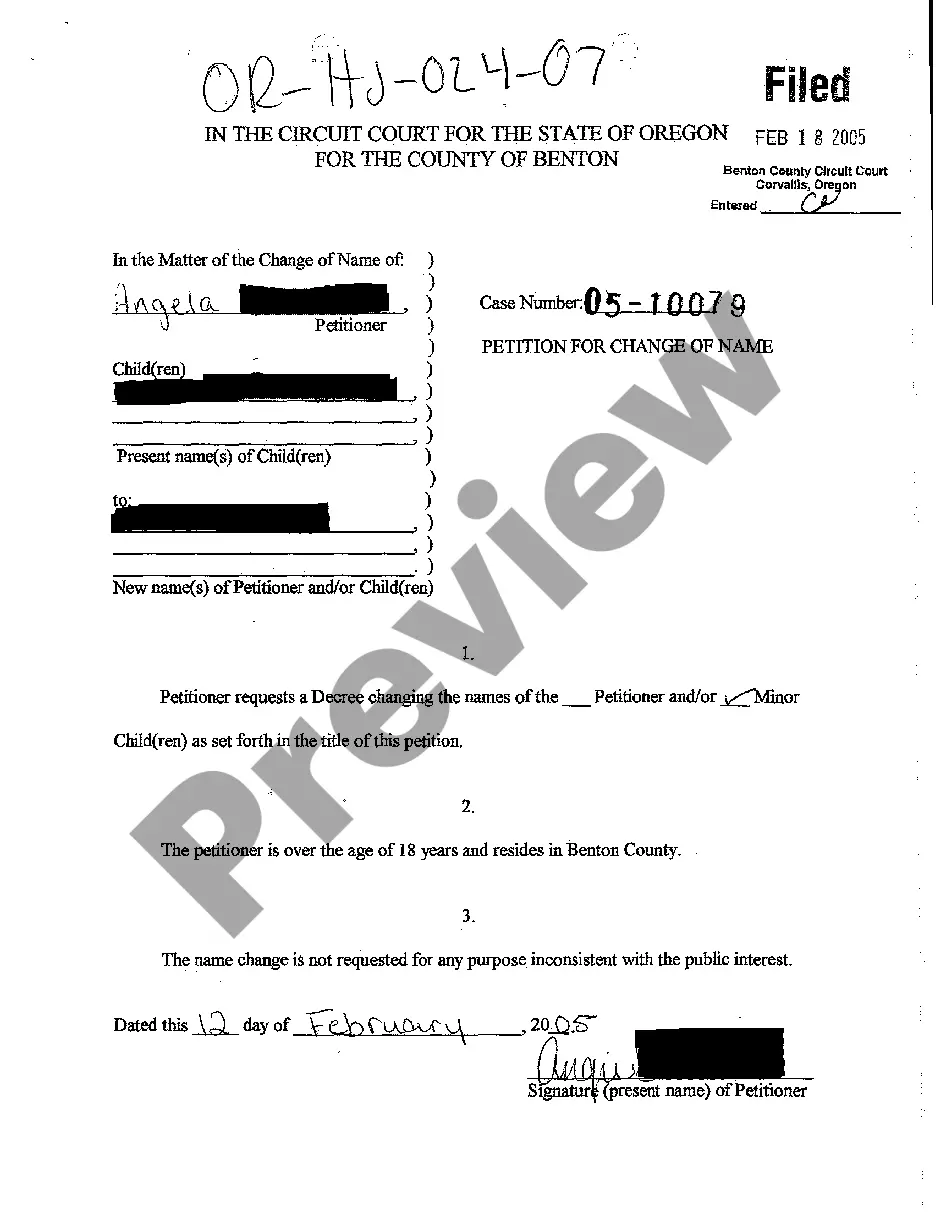

Description

How to fill out Arkansas Lump Sum Request/Respondent's Position?

Utilizing Arkansas Claimants Lump Sum Request/Respondents Position examples developed by experienced attorneys helps you avoid stress when filling out forms.

Simply download the sample from our site, complete it, and have a lawyer review it.

This approach will save you significantly more time and expenses than having an attorney draft a document entirely from the beginning for you.

Use the Preview feature and read the description (if present) to determine if you need this particular sample, and if so, click Buy Now. Search for another template using the Search field if necessary. Choose a subscription that suits your needs. Begin with your credit card or PayPal. Choose a file format and download your document. After completing all the above steps, you will be able to fill out, print, and sign the Arkansas Claimants Lump Sum Request/Respondents Position template. Ensure all entered information is accurate before submitting or mailing it. Save time when completing documents with US Legal Forms!

- If you currently hold a US Legal Forms subscription, simply Log In/">Log In to your account and navigate back to the form section.

- Locate the Download button adjacent to the template you are inspecting.

- Upon downloading a document, you will find all your saved samples in the My documents area.

- If you lack a subscription, there's no need to worry.

- Just adhere to the steps outlined below to register for an online account, obtain, and finalize your Arkansas Claimants Lump Sum Request/Respondents Position template.

- Verify and confirm that you are acquiring the correct state-specific form.

Form popularity

FAQ

Mandatory Withholding Mandatory income tax withholding of 20% applies to most taxable distributions paid directly to you in a lump sum from employer retirement plans even if you plan to roll over the taxable amount within 60 days.

A large amount of money one spends at once, especially to make a large purchase. For example, if a house costs $175,000, and the buyer pays the total amount up front, the buyer is said to make a lump sum payment.

When comparing taking lifetime income instead of a lump sum for your pension, one isn't universally better than the other. The best choice depends on your individual circumstances. A lump sum gives you more flexibility and control, but also more responsibility for managing the proceeds.

So anytime a lump-sum distribution is considered, it's important to know that the distribution income will be taxed at your highest marginal tax bracket. This is something to think about when looking at a withdrawal of retirement accounts in order to pay-off debt, buy a house, etc...

Transfer or Rollover Options You may be able to defer tax on all or part of a lump-sum distribution by requesting the payer to directly roll over the taxable portion into an individual retirement arrangement (IRA) or to an eligible retirement plan.

If you take a lump sum available to about a quarter of private-industry employees covered by a pension you run the risk of running out of money during retirement. But if you choose monthly payments and you die unexpectedly early, you and your heirs will have received far less than the lump-sum alternative.

Whatever your plans for retirement, paying a lump sum into your pension is a great way to help you get there.If you are a higher-rate tax payer, you will need to claim any additional tax relief yourself through your self-assessment tax return.

The formula to calculate compound interest for a lump sum is A = P (1+r/n)^nt where A is future value, P is present value or principal amount, r is the interest rate, t is the number of years the money is deposited for and n is the number of periods the interest is compounded each year.

A lump-sum payment is an amount paid all at once, as opposed to an amount that is divvied up and paid in installments. A lump-sum payment is not the best choice for every beneficiary; for some, it may make more sense for the funds to be annuitized as periodic payments.