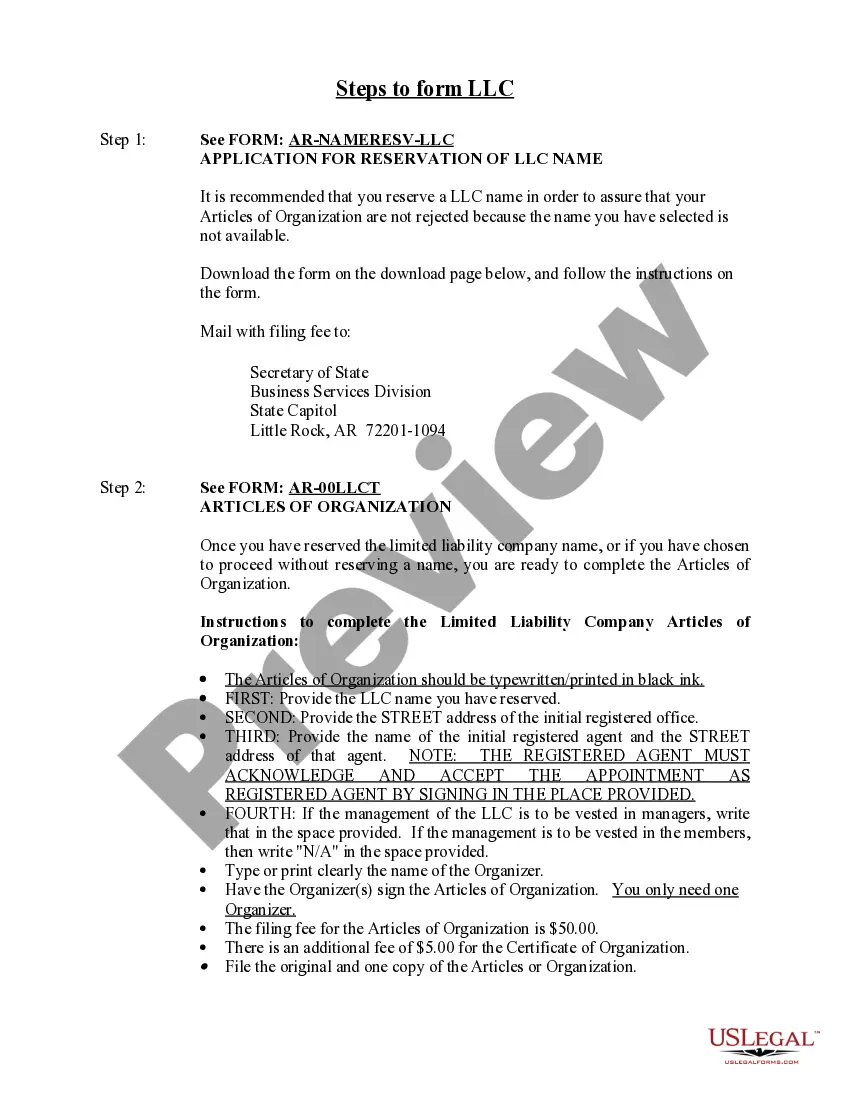

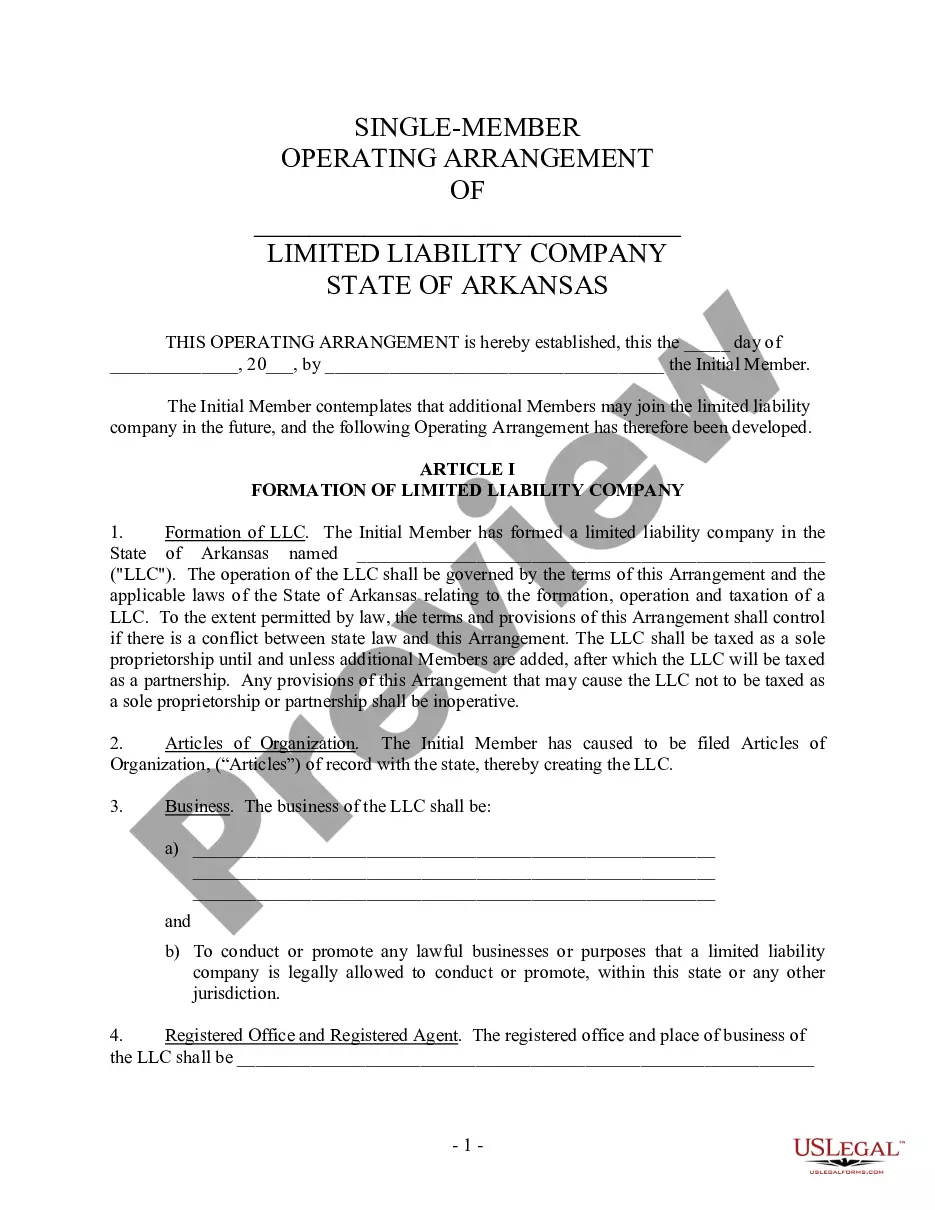

This Limited Liability Company LLC Formation Package includes Step by Step Instructions, Articles of Formation, Operating Agreement, Resolutions and other forms for formation of a Limited Liability Company in the State of Arkansas.

Arkansas Limited Liability Company LLC Formation Package

Description

How to fill out Arkansas Limited Liability Company LLC Formation Package?

Utilizing Arkansas Limited Liability Company LLC Formation Package templates designed by expert attorneys allows you to sidestep complications when filing documents.

Simply download the sample from our site, complete it, and have a legal expert review it.

This will save you significantly more time and effort than having an attorney create a document from the ground up to meet your requirements.

Verify once more that you are downloading the appropriate state-specific form. Use the Preview feature and examine the description (if accessible) to determine if you need this specific sample and if so, just click Buy Now. Search for another sample using the Search field if necessary. Select a subscription that fulfills your needs. Start with your credit card or PayPal. Choose a file format and download your document. Once you have completed all these steps, you will be able to fill out, print, and sign the Arkansas Limited Liability Company LLC Formation Package sample. Remember to double-check all entered information for accuracy prior to submission or dispatch. Decrease the time spent on preparing documents with US Legal Forms!

- If you possess a US Legal Forms subscription, just Log In to your profile and navigate back to the form page.

- Locate the Download button close to the template you are examining.

- After downloading a template, all your saved documents can be found in the My documents section.

- If you lack a subscription, it’s not a significant issue.

- Just follow the steps below to create your account online, acquire, and complete your Arkansas Limited Liability Company LLC Formation Package template.

Form popularity

FAQ

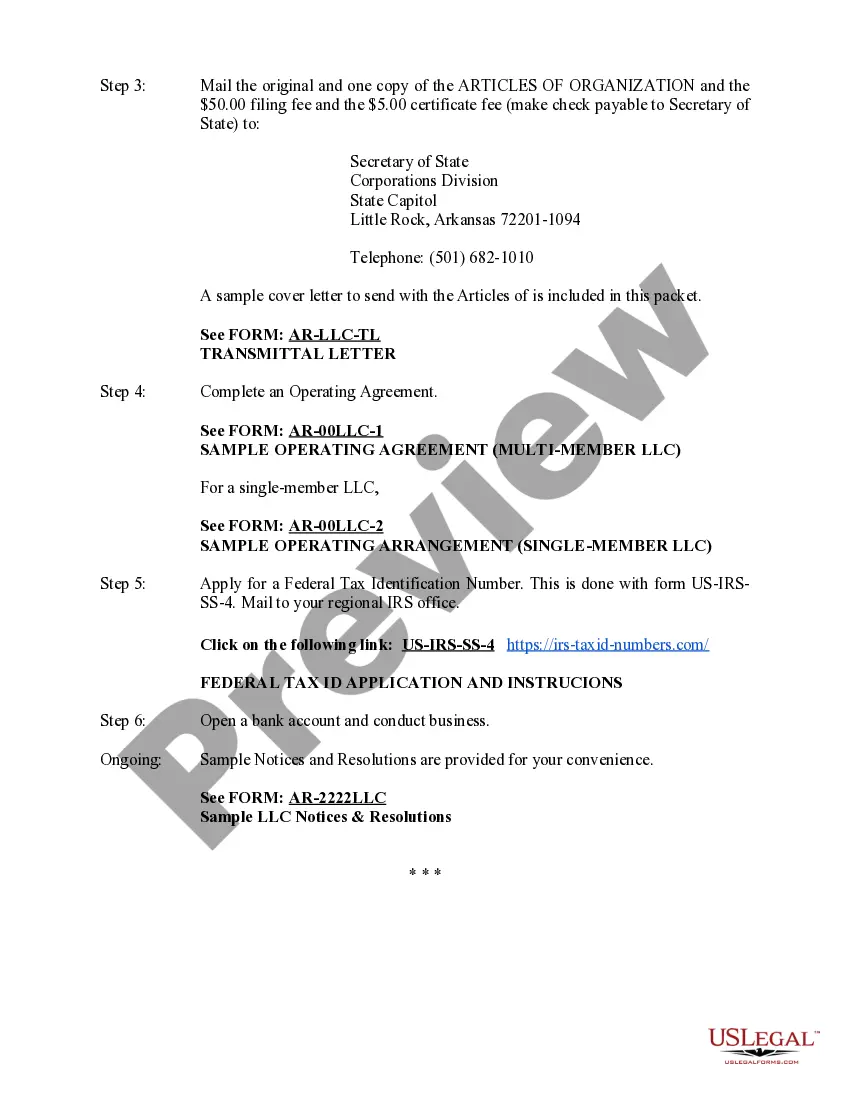

When you form a corporation or LLC, you need to pay a one-time filing fee to the state's secretary of state office. Arkansas, Colorado, Hawaii, Iowa, Oklahoma and Mississippi all boast the lowest corporation formation fee at $50. It costs $310 to incorporate in Texas.

Who Should Form an LLC? Any person starting a business, or currently running a business as a sole proprietor, should consider forming an LLC. This is especially true if you're concerned with limiting your personal legal liability as much as possible. LLCs can be used to own and run almost any type of business.

How much does it cost to form an LLC in Arkansas? The Arkansas Secretary of State charges a $45 fee to file the Articles of Organization online and $50 if filed by mail. You can reserve your LLC name with the Arkansas SOS for $25 if filed by mail or $22.50 if filed online.

The least expensive way to form your LLC is filing the forms yourself, although it will depend on the filing fees in your state. Incorporation statements for LLCs are typically the Articles of Organization.

How much does it cost to form an LLC in Arkansas? The Arkansas Secretary of State charges a $45 fee to file the Articles of Organization online and $50 if filed by mail. You can reserve your LLC name with the Arkansas SOS for $25 if filed by mail or $22.50 if filed online.

Business Name. Your LLC must have a name that is unique and is not the same or confusingly similar to another business. Registered Agent. Operating Agreement. Articles of Organization. Business Licenses and Permits. Statement of Information Form. Tax Forms.

Professional LLCs PLLCs offer the same benefits as LLCs. The main difference between a LLC and a PLLC is that only professionals recognized in a state through licensing, such as architects, medical practitioners and lawyers, can form PLLCs.

LLCs are formed by filing articles of organization with the secretary of state's office.Depending on the state, the filing fee varies, and the articles of organization may be referred to as a different name, like the certificate of formation.

Approval time is 2-3 days if you file online and 1-2 weeks if you file by mail. After your Arkansas LLC is approved, complete your Operating Agreement and get an EIN Number (aka Federal Tax ID Number) from the IRS. Then make sure to pay your Arkansas Annual Franchise Tax every year to keep your LLC in compliance.