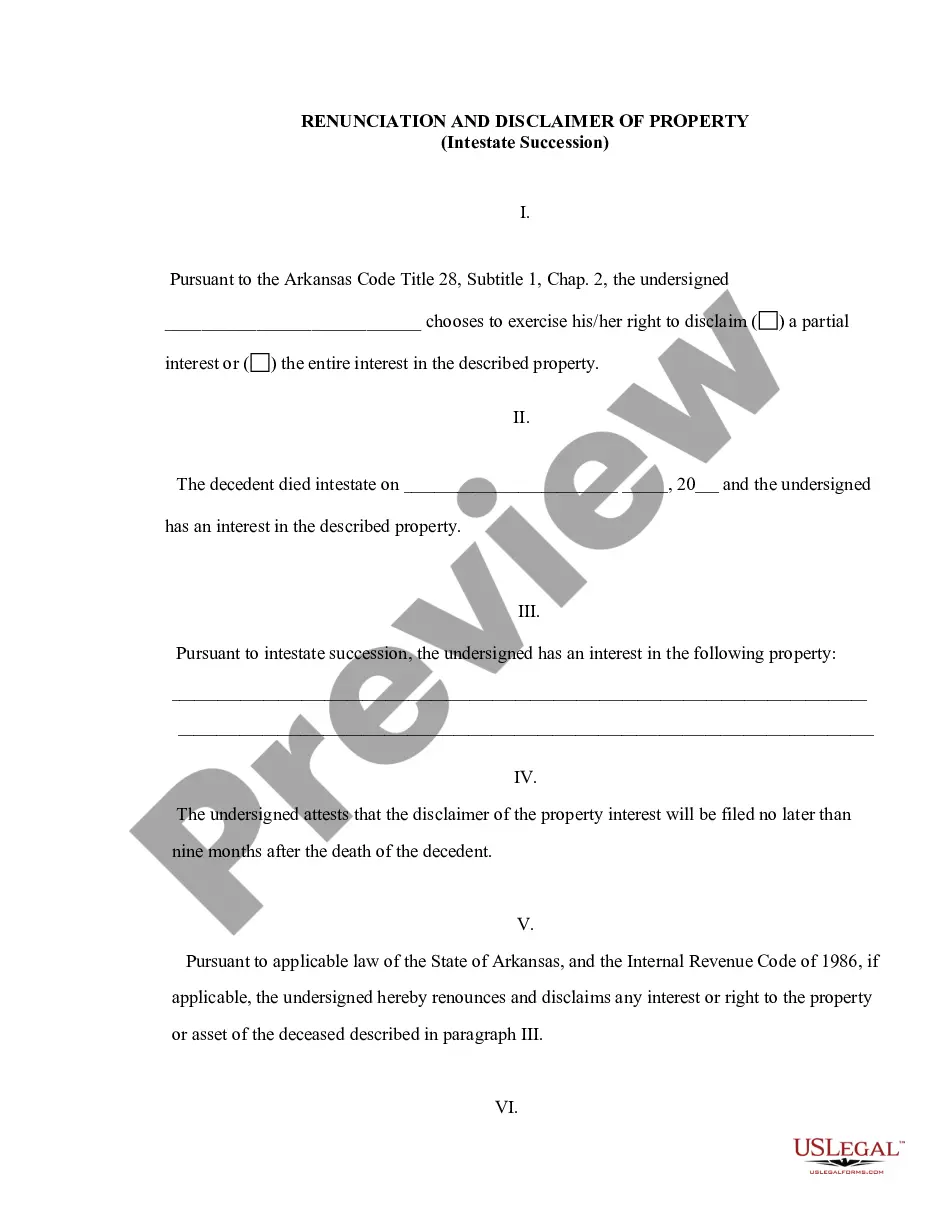

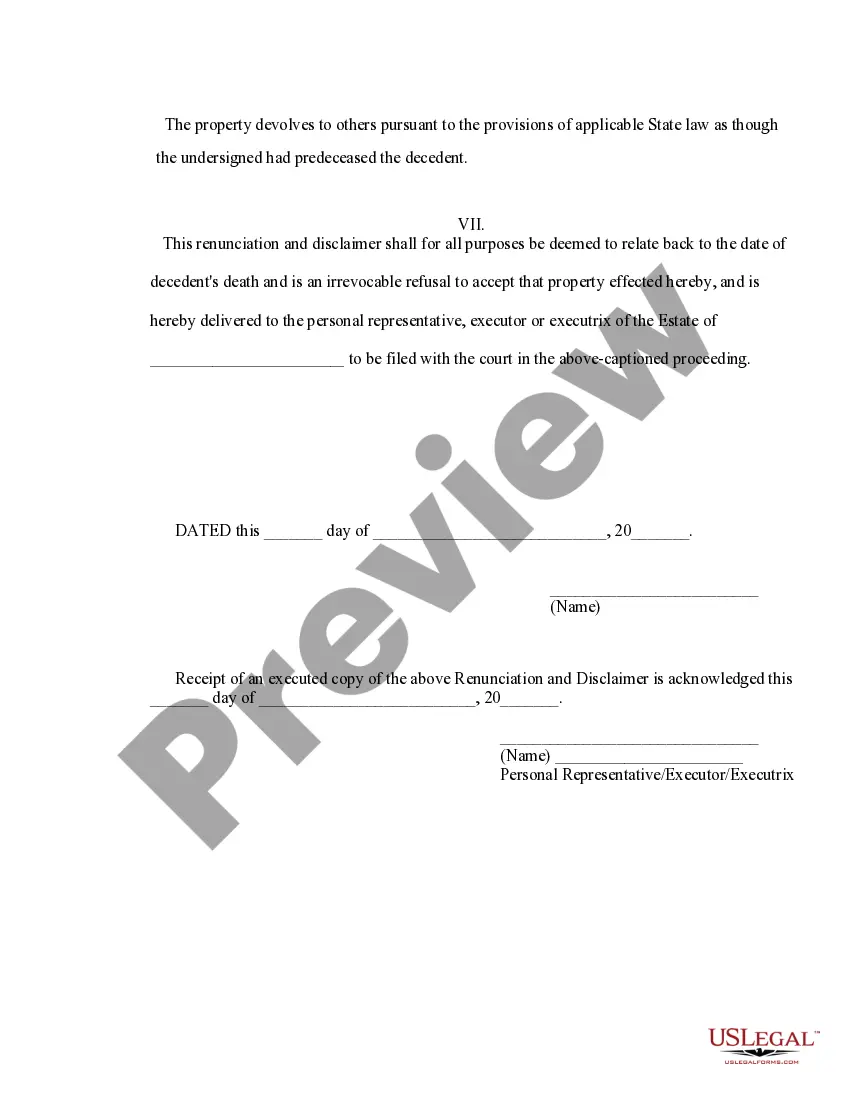

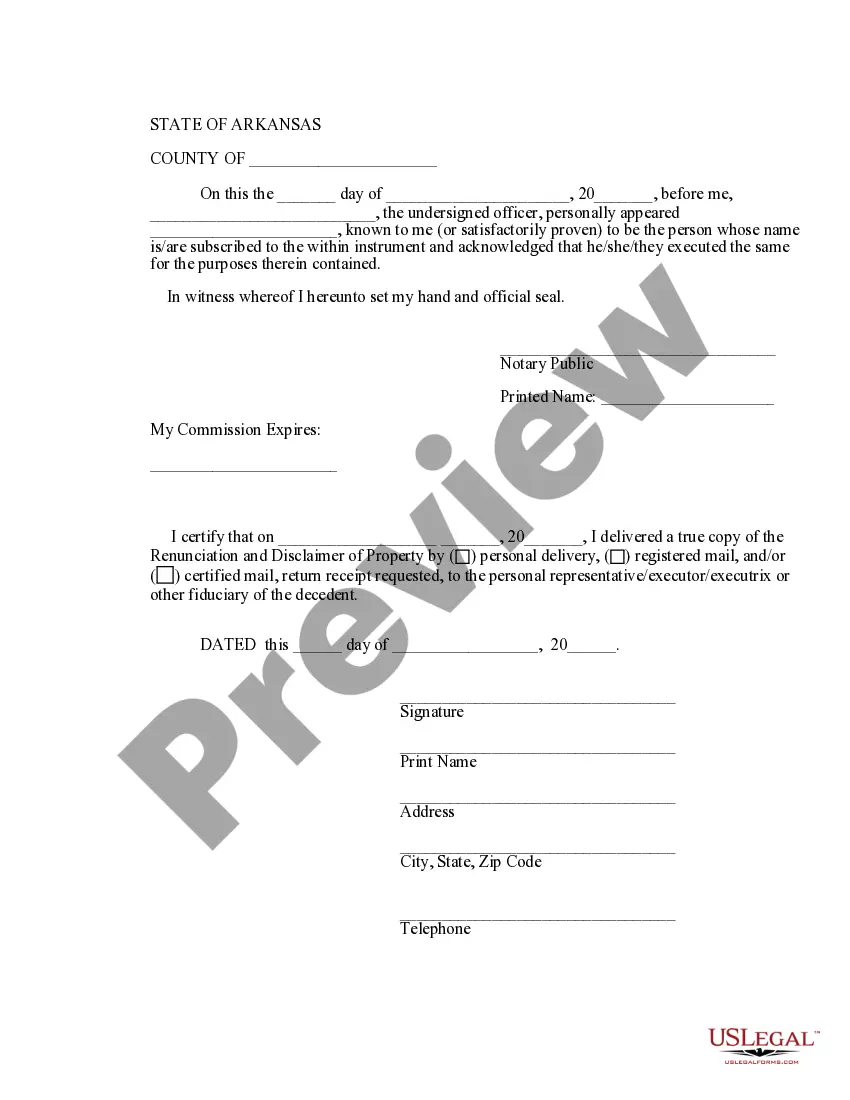

This form is a Renunciation and Disclaimer of Property granted to the beneficiary through intestate succession. The decedent died intestate and the beneficiary gained an interest in the described property. The beneficiary has chosen to disclaim a portion of or the entire interest he/she has in the property. Based upon the Arkansas Code Title 28, Subtitle 1, Chap. 2 the beneficiary is entitled to disclaim the property and submit a copy of the disclaimer to the decedent's personal representative. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Arkansas Renunciation and Disclaimer of Property received by Intestate Succession

Description Intestate Succession Law

How to fill out Renunciation Disclaimer Arkansas?

Utilizing Arkansas Renunciation and Disclaimer of Property acquired through Intestate Succession illustrations crafted by expert attorneys allows you to avert complications when completing paperwork.

Simply download the example from our site, complete it, and request legal advice to verify it.

This can assist you in conserving considerably more time and expenses than searching for a legal expert to create a document from scratch that meets your requirements would.

Utilize the Preview feature and peruse the description (if applicable) to determine if you need this exact template and if so, just click Buy Now. Find an alternative document using the Search bar if required. Select a subscription that suits your preferences. Begin with your credit card or PayPal. Choose a file format and download your document. Once you have completed all of the above steps, you will be able to fill out, print, and sign the Arkansas Renunciation and Disclaimer of Property received by Intestate Succession sample. Remember to carefully verify all entered information for accuracy before submitting it or sending it out. Reduce the time you spend on filling documents with US Legal Forms!

- If you possess a US Legal Forms membership, merely Log In to your profile and navigate back to the form page.

- Locate the Download button close to the templates you are reviewing.

- Following the download of a template, you can find all your saved examples in the My documents section.

- If you don't have a subscription, that's perfectly fine.

- Just adhere to the step-by-step instructions below to register for an online account, obtain, and complete your Arkansas Renunciation and Disclaimer of Property received through Intestate Succession template.

- Ensure to verify that you are downloading the correct state-specific form.

Disclaimer Form Contract Form popularity

Ar Property File Other Form Names

Renunciation Received Intestate FAQ

One way to avoid probate is to own property jointly with someone else. When you die with a right of surviorship, your share passes to the other owner automatically. What is on the deed or account controls and any statement in your will is ignored.

In Arkansas, whether or not you have a will when you die, your spouse will inherit property from you under a doctrine called dower and curtesy. Briefly, this is how it works: If you have children or other descendants. Your spouse has the right to use, for life, 1/3 of your real estate.

In Arkansas, the probate process is mandatory for any contested estate, if there are creditors (including a mortgage) and for any estate larger than $100,000. If a person provides written grounds for contest to the court, the will goes through the probate process.

Children - if there is no surviving married or civil partnerIf there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

The laws are different in every state, but if you're married and die without a will, your estate will probably go to your spouse if you both own it.If he passes away without a will, the law says his surviving spouse will inherit the first $50,000 of his personal assets (not any shared assets) plus half the balance.

Every state has their own established intestate process that determines whether a person's assets will be given to their spouse, children, parents or siblings. When someone dies without a will, their assets are frozen until the court system combs through every detail of their estate.

Dying Without a Will in Arkansas If there isn't a will, the court will appoint someone, usually an adult child or surviving spouse, to be the executor or personal representative. The executor or personal representative takes care of the estate of the decedent.

Who Gets What: The Basic Rules of Intestate Succession.Generally, only spouses, registered domestic partners, and blood relatives inherit under intestate succession laws; unmarried partners, friends, and charities get nothing. If the deceased person was married, the surviving spouse usually gets the largest share.

Children - if there is no surviving married or civil partner If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.