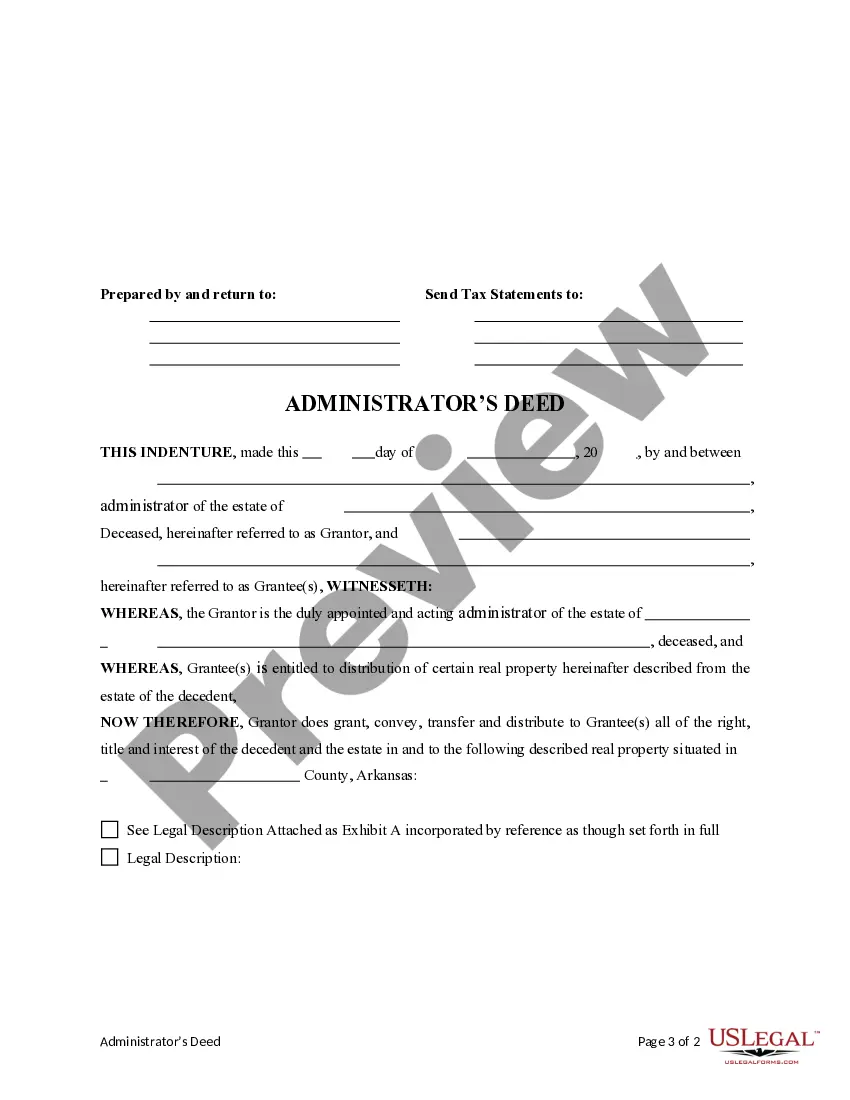

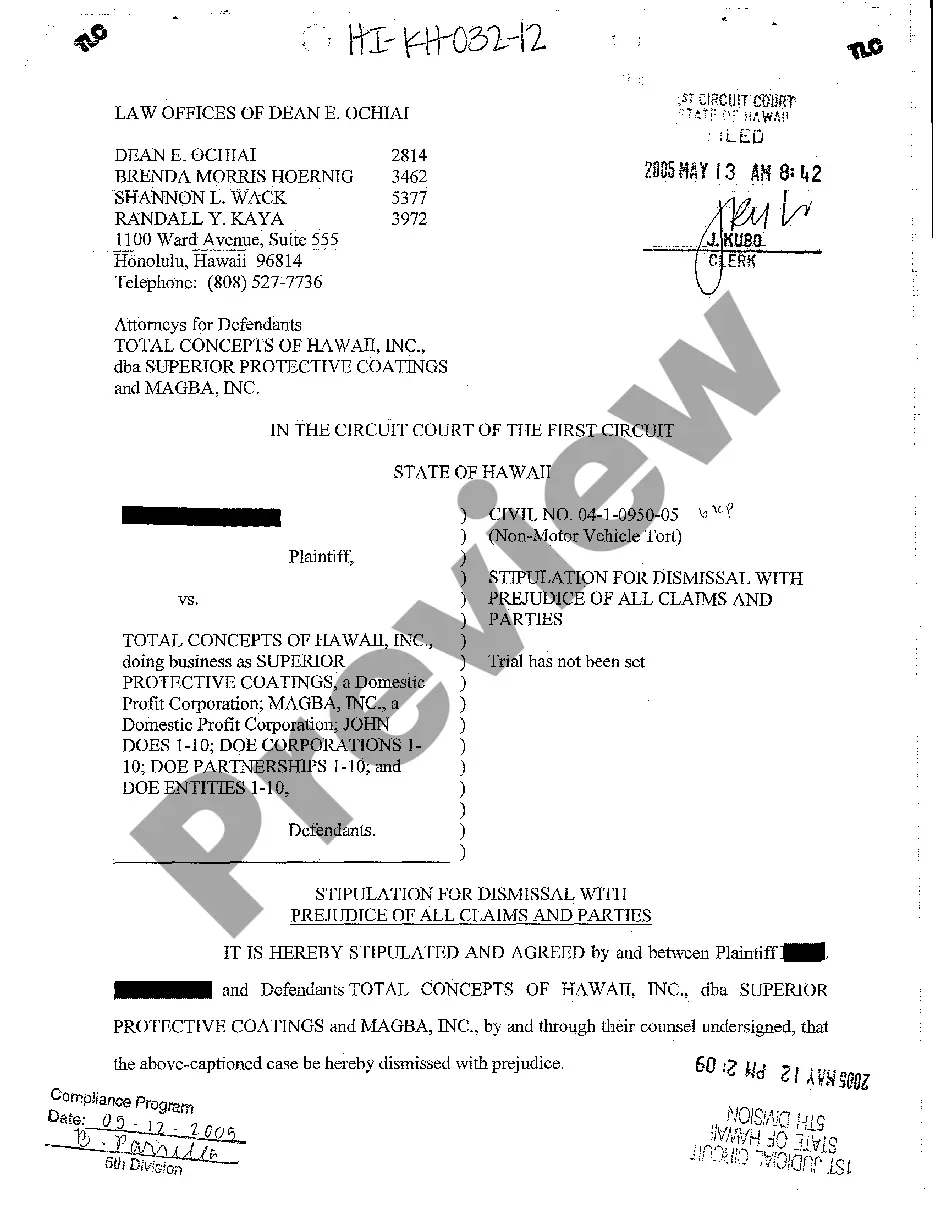

This form is an Administrator's Deed where the Grantor is the appointed administrator or administratrix of an estate and the Grantee(s) are the beneficiaries entitled to receive the property from the estate. Grantor conveys the described property to the Grantee(s). The Grantor transfers all interest in the property from the decedent and the estate to the Grantee(s). This deed complies with all state statutory laws.

Arkansas Administrator's Deed Distributing Real Property to Beneficiaries of Estate

Description Administrator's Deed Form

How to fill out Arkansas Property Estate?

Employing Arkansas Administrator's Deed Allocating Real Estate to Heirs of Estate templates produced by experienced attorneys enables you to evade complications when finalizing paperwork.

Just download the example from our site, complete it, and have a legal expert review it.

This can save you significantly more time and expenses than having a lawyer draft a document from scratch tailored to your needs.

- If you possess a US Legal Forms subscription, simply Log In to your account and navigate back to the form webpage.

- Locate the Download button adjacent to the templates you are examining.

- Once a template is downloaded, your saved examples can be found in the My documents tab.

- If you do not have a subscription, do not worry. Follow the instructions below to create an account online, obtain, and complete your Arkansas Administrator's Deed Allocating Real Estate to Heirs of Estate template.

- Verify and ensure that you are downloading the correct state-specific form.

- Make use of the Preview option and examine the description (if available) to determine if this specific sample is required; if yes, just click Buy Now.

- If necessary, search for another sample using the Search field.

- Select a subscription that fits your needs.

- Start with your credit card or PayPal.

- Choose a file format and download your document.

- After executing all the steps above, you will be able to complete, print, and sign the Arkansas Administrator's Deed Allocating Real Estate to Heirs of Estate template.

- Remember to double-check all entered information for accuracy before submitting or sending it out.

- Reduce the time spent on document creation with US Legal Forms!

Arkansas Administrator Deed Form popularity

Administrator Deed Printable Other Form Names

Administrator Deed Sample FAQ

Children (or grandchildren if children have died) Parents. Siblings (or nieces and nephews over 18 if siblings have died) Half-siblings (or nieces and nephews over 18 if half-siblings have died) Grandparents. Aunts or uncles.

When the executor has paid off the debts, filed the taxes and sold any property needed to pay bills, he can submit a final estate accounting to the probate court. Once the probate court approves the accounting, he can distribute assets to you and other beneficiaries according to the terms of the will.

An administrator will take title legally on the estate's assets, and has legal responsibility to file all tax returns and pay all related taxes.In certain cases, the administrator may have personal liability for any unpaid tax amounts due for the estate.

The executor can sell property without getting all of the beneficiaries to approve.The administrator will come in with a buyer and a contract and if someone else in court wants to pay more for the property than that contract price then the judge will allow that.

Those requirements are: That the estate assets are distributed at least 6 months after the deceased's date of death; That the executor has published a 30 day notice of his/her intent to distribute the estate; and. That the time specified in the notice has expired.

If an Executor breaches this duty, then they can be held personally financially liable for their mistakes, and the financial claim that is made against them can be substantial. In an extreme example of this, one Personal Representative failed to settle the Inheritance Tax bill before distributing the Estate.

If there's enough money in the estate account, an interim payment can be made to beneficiaries, with executors holding back some money to cover potential costs. These payments should be recorded by asking the beneficiaries to sign a written receipt.

Q: How Long Does an Executor Have to Distribute Assets From a Will? A: Dear Waiting: In most states, a will must be executed within three years of a person's death.

What is probate?If no executors are named, or none of the executors is prepared to act, a beneficiary of the will can apply to the probate registry for a 'grant of letters of administration (with will annexed)'. If there is no will, a relative can apply for a 'grant of letters of administration'.