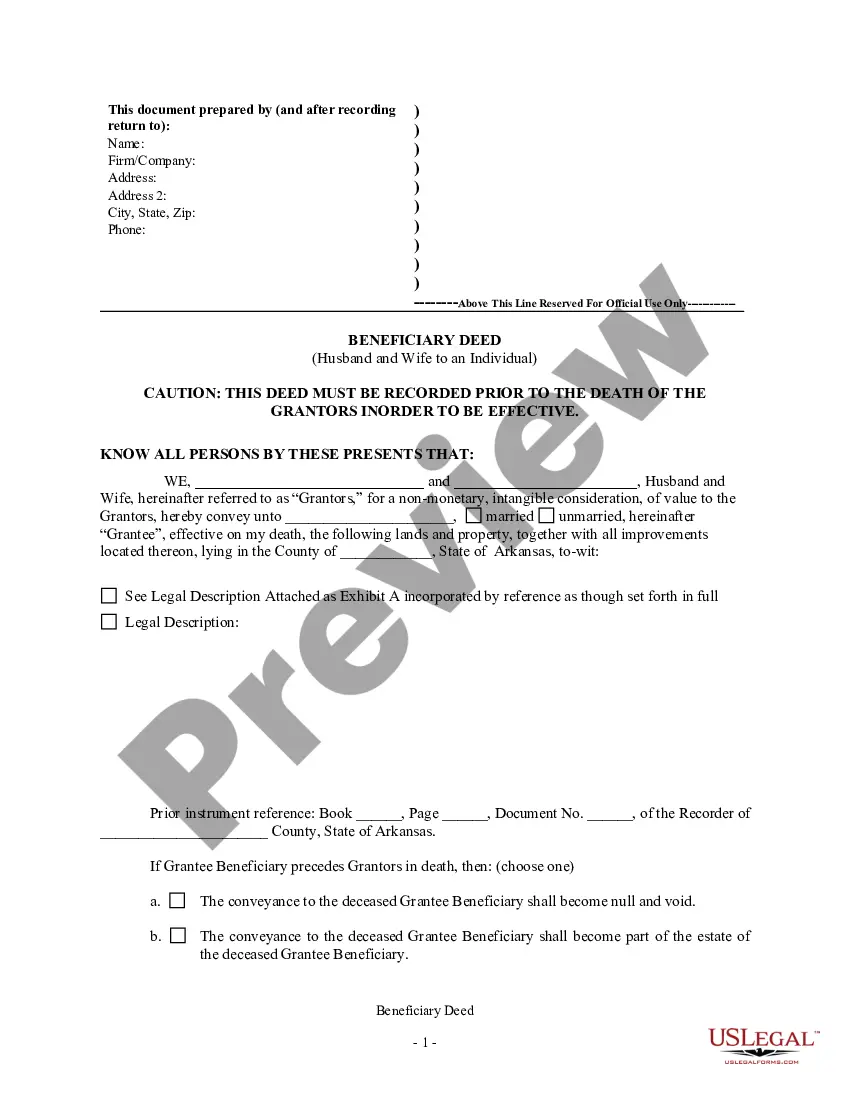

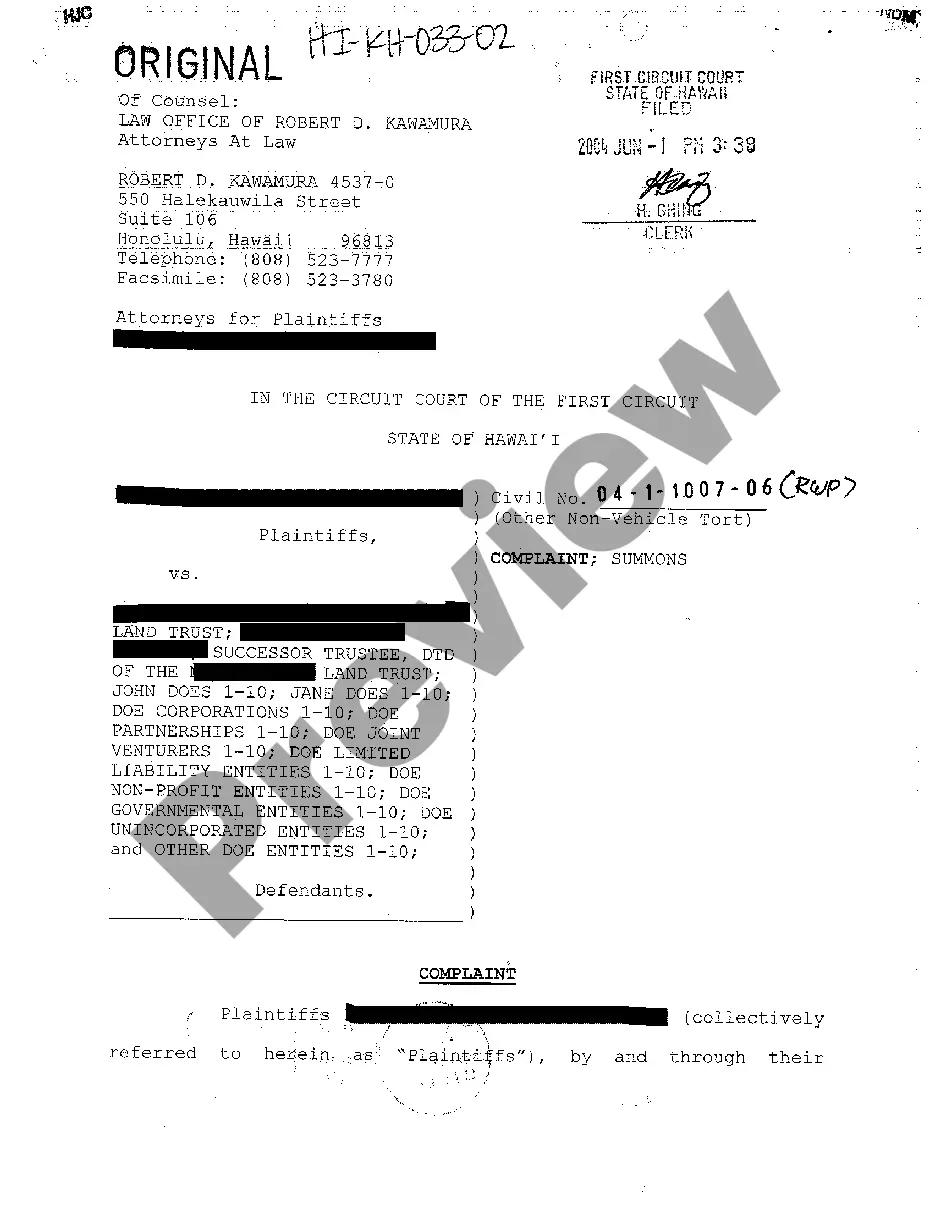

This form is a Transfer on Death Deed, or Beneficiary Deed, where the grantors are husband and wife and the grantee an individual. If grantee fails to survive the grantors their interest goes to their estate or the transfer is null and void. This transfer is revocable by Grantors until death and effective only if filed prior to grantor's deaths. This deed complies with all state statutory laws.

Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual

Description

How to fill out Arkansas Transfer On Death Deed Or TOD - Beneficiary Deed For Husband And Wife To Individual?

Utilizing Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Couples to Individual templates crafted by expert attorneys helps you avoid complications when completing paperwork.

Simply download the document from our site, fill it out, and have legal counsel verify it.

This can save you significantly more time and effort than having an attorney draft a document entirely from the beginning for you.

Utilize the Preview option and read the description (if available) to determine if you need this specific sample, and if so, click Buy Now. Search for another file using the Search field if needed. Choose a subscription that meets your needs. Begin with your credit card or PayPal. Select a file format and download your document. Once you have completed all these steps, you will be able to fill out, print, and sign the Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Couples to Individual template. Remember to verify all entered information for accuracy before submitting or mailing it out. Minimize the time spent on document creation with US Legal Forms!

- If you currently possess a US Legal Forms subscription, simply Log In to your account and return to the form section.

- Locate the Download button adjacent to the templates you are reviewing.

- After downloading a template, your saved samples will be available in the My documents tab.

- If you lack a subscription, that's not an issue.

- Simply follow the instructions below to register for an account online, obtain, and complete your Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Couples to Individual template.

- Verify that you're downloading the correct state-specific document.

Form popularity

FAQ

Yes, Arkansas does allow a transfer-on-death deed. This legal option enables property owners to transfer their property directly to designated beneficiaries upon their death without the need for probate. It simplifies the inheritance process for beneficiaries, making it an attractive choice for many individuals.

A beneficiary deed, such as the Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual, may help defer capital gains tax until the property is sold. When the beneficiary inherits the property, they receive a 'step-up' in basis, which can significantly reduce taxable gains when selling. However, it's advisable to consult a tax professional to understand the implications fully.

Yes, an Arkansas Transfer on Death Deed or TOD is often referred to as a beneficiary deed. This legal instrument allows property owners to designate beneficiaries who will inherit their property upon their death, avoiding probate. Both terms describe the same concept and serve the same purpose in estate planning.

While an Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual offers a simple transfer of property upon death, it may not provide the same level of protection as a trust. Trusts can manage complex assets and offer more comprehensive control over inheritance. Ultimately, the best choice depends on your specific needs and circumstances.

Being a beneficiary has advantages, but there are potential downsides. For instance, a beneficiary may inherit the property but also assume certain responsibilities, such as maintenance and taxes. Moreover, if the original owner incurs debt before passing, a creditor may pursue the inherited property. Therefore, understanding the implications is essential.

You do not necessarily need a lawyer to create an Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual. However, consulting with a lawyer can help ensure that your deed meets all legal requirements and is properly executed. Having professional guidance can also help you navigate potential complexities, especially if your estate has unique circumstances.

An Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual is not proof of ownership until it is recorded with the county clerk's office. This recording serves as legal evidence of the beneficiaries’ rights upon the owner’s death. Therefore, it is vital to properly file the deed to secure these rights.

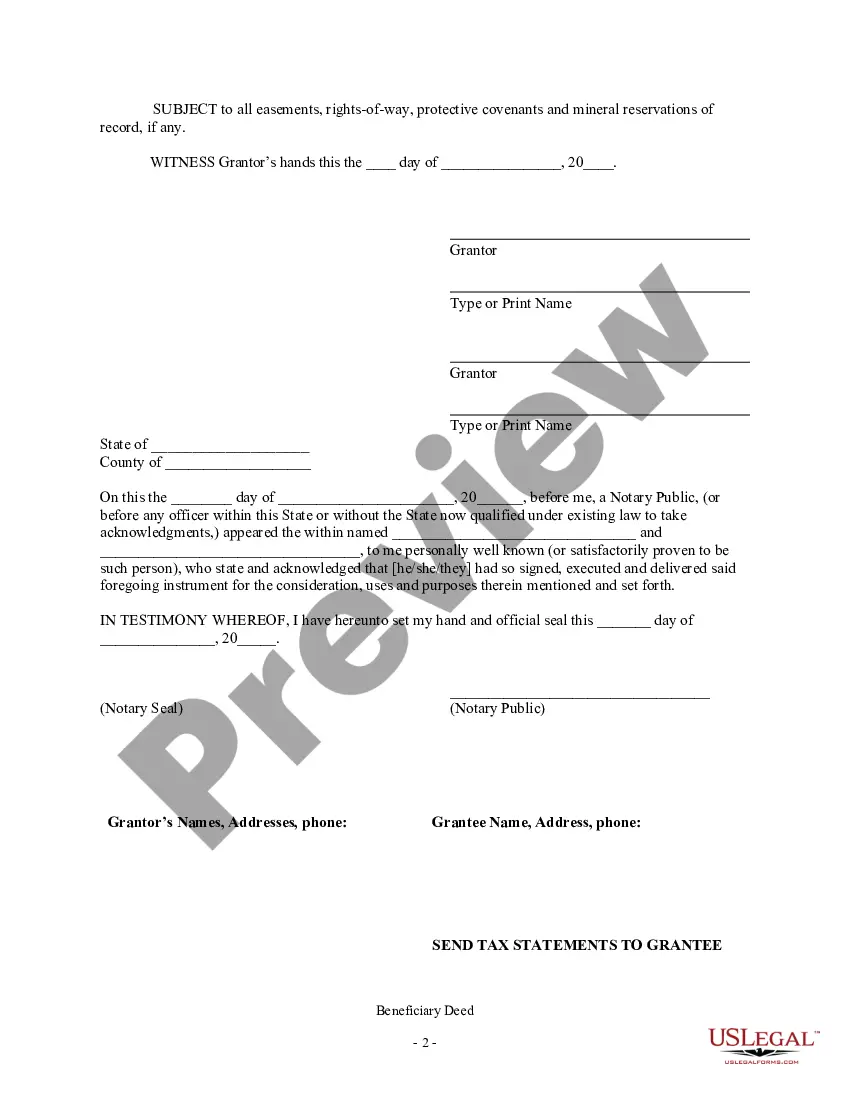

To write an effective Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual, start with the proper legal form, which must include the property description and beneficiaries' names. Ensure that both spouses sign the deed in front of a notary public. After signing, you must file the deed with the county clerk’s office to finalize the process.

You do not necessarily need a lawyer to create an Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual, but working with one can simplify the process. An attorney can help ensure the deed is correctly filled out and meet all Arkansas laws. They also provide helpful advice, especially for unique situations.

An Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual generally overrides a will when it comes to the specific property covered by the deed. This means that if there is a conflict between the will and the deed, the beneficiary deed takes precedence. Understanding this hierarchy is crucial for effective estate planning.