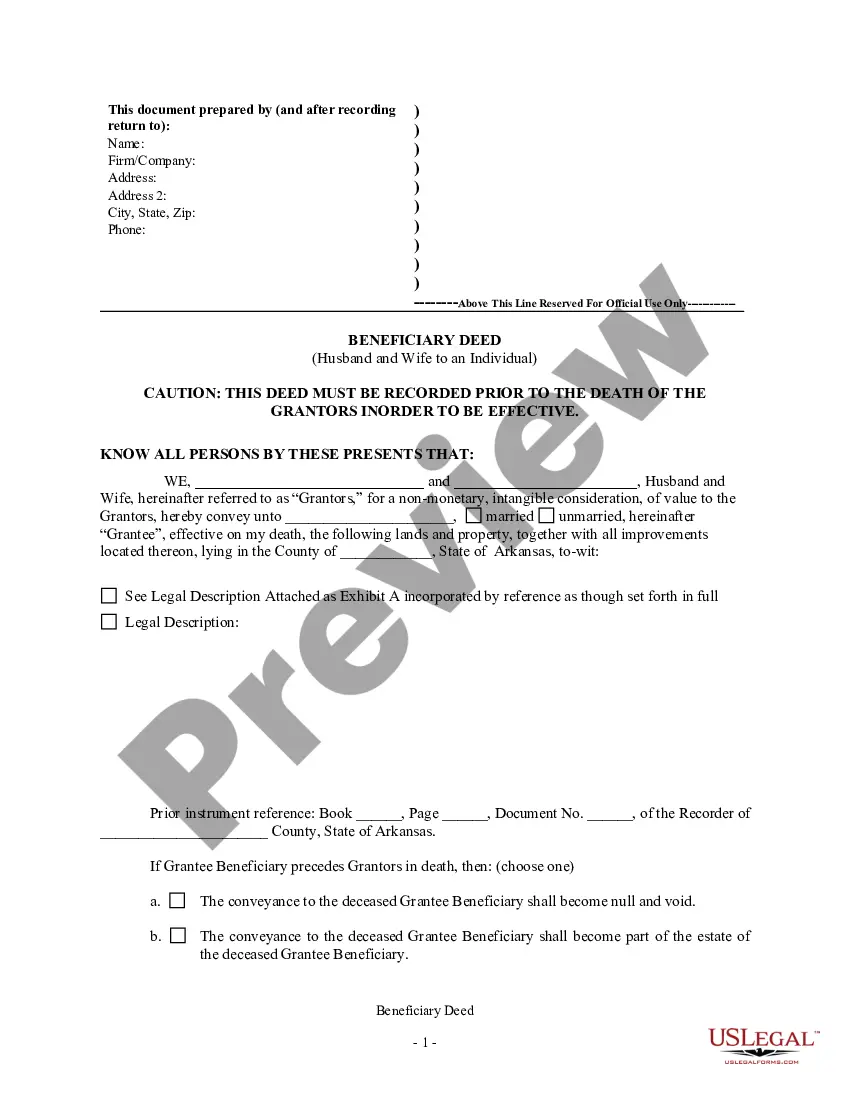

This form is a Transfer on Death Deed, or Beneficiary Deed, where the grantors are husband and wife and the grantee an individual. If grantee fails to survive the grantors their interest goes to their estate or the transfer is null and void. This transfer is revocable by Grantors until death and effective only if filed prior to grantor's deaths. This deed complies with all state statutory laws.

Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Husband and Wife to Individual

Description Death Tod Wife

How to fill out Arkansas Beneficiary?

Utilizing Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Couples to Individual templates crafted by expert attorneys helps you avoid complications when completing paperwork.

Simply download the document from our site, fill it out, and have legal counsel verify it.

This can save you significantly more time and effort than having an attorney draft a document entirely from the beginning for you.

Utilize the Preview option and read the description (if available) to determine if you need this specific sample, and if so, click Buy Now. Search for another file using the Search field if needed. Choose a subscription that meets your needs. Begin with your credit card or PayPal. Select a file format and download your document. Once you have completed all these steps, you will be able to fill out, print, and sign the Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Couples to Individual template. Remember to verify all entered information for accuracy before submitting or mailing it out. Minimize the time spent on document creation with US Legal Forms!

- If you currently possess a US Legal Forms subscription, simply Log In to your account and return to the form section.

- Locate the Download button adjacent to the templates you are reviewing.

- After downloading a template, your saved samples will be available in the My documents tab.

- If you lack a subscription, that's not an issue.

- Simply follow the instructions below to register for an account online, obtain, and complete your Arkansas Transfer on Death Deed or TOD - Beneficiary Deed for Couples to Individual template.

- Verify that you're downloading the correct state-specific document.

Deed Beneficiary Wife Form popularity

Death Tod Husband Other Form Names

Transfer Death Deed Blank FAQ

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.

All you need to do is fill out a simple form, provided by the bank, naming the person you want to inherit the money in the account at your death. As long as you are alive, the person you named to inherit the money in a payable-on-death (POD) account has no rights to it.

Get a Deed Form or Prepare Your Own. You can buy a state-specific TOD deed form for your state or type up your own document. Name the Beneficiary. Describe the Property. Sign the Deed. Record the Deed.

A transfer on death (TOD) account automatically transfers its assets to a named beneficiary when the holder dies For example, if you have a savings account with $100,000 in it and name your son as its beneficiary, that account would transfer to him upon your death.

The California TOD deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

All you need to do is fill out a simple form, provided by the bank, naming the person you want to inherit the money in the account at your death. As long as you are alive, the person you named to inherit the money in a payable-on-death (POD) account has no rights to it.

Use this form to leave your Arkansas real estate without probate. You retain ownership, responsibility, and control over the property during your life. After your death, ownership transfers to the beneficiary you name.

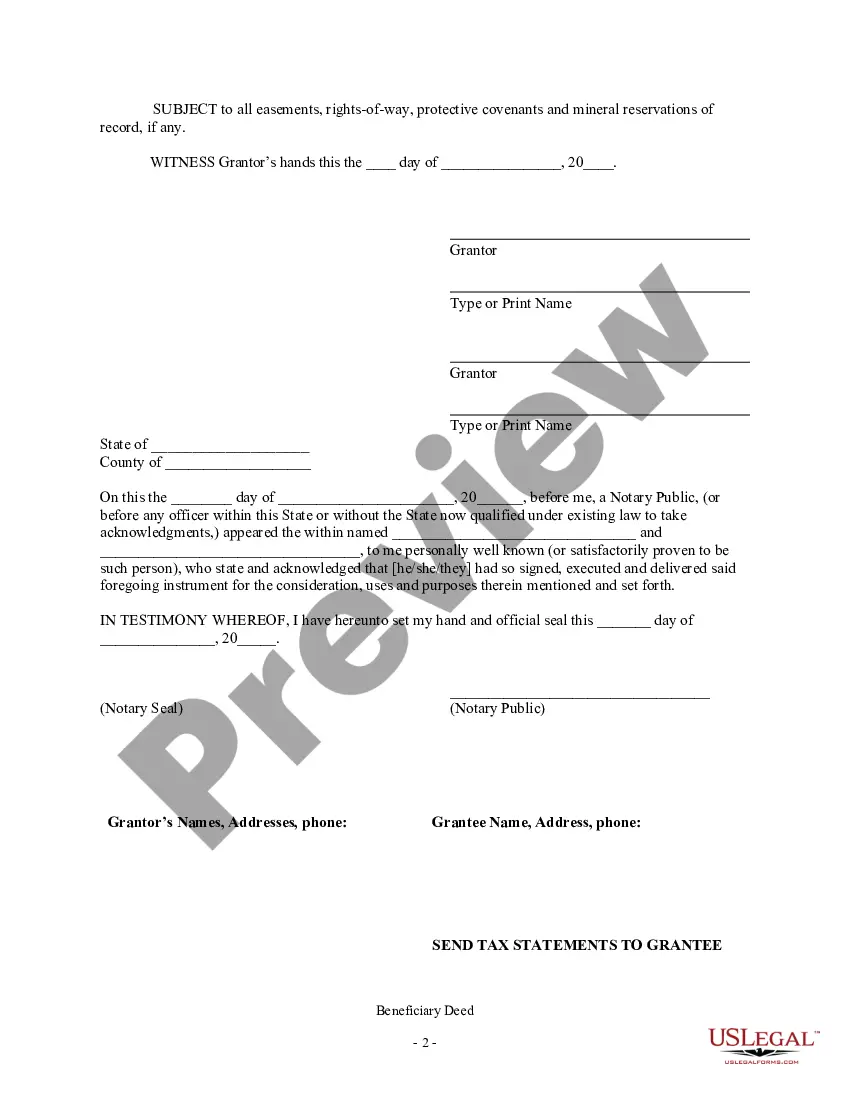

In most cases, the surviving owner or heir obtains the title to the home, the former owner's death certificate, a notarized affidavit of death, and a preliminary change of ownership report form. When all these are gathered, the transfer gets recorded, the fees are paid, and the county issues a new title deed.

In most cases, the surviving owner or heir obtains the title to the home, the former owner's death certificate, a notarized affidavit of death, and a preliminary change of ownership report form. When all these are gathered, the transfer gets recorded, the fees are paid, and the county issues a new title deed.