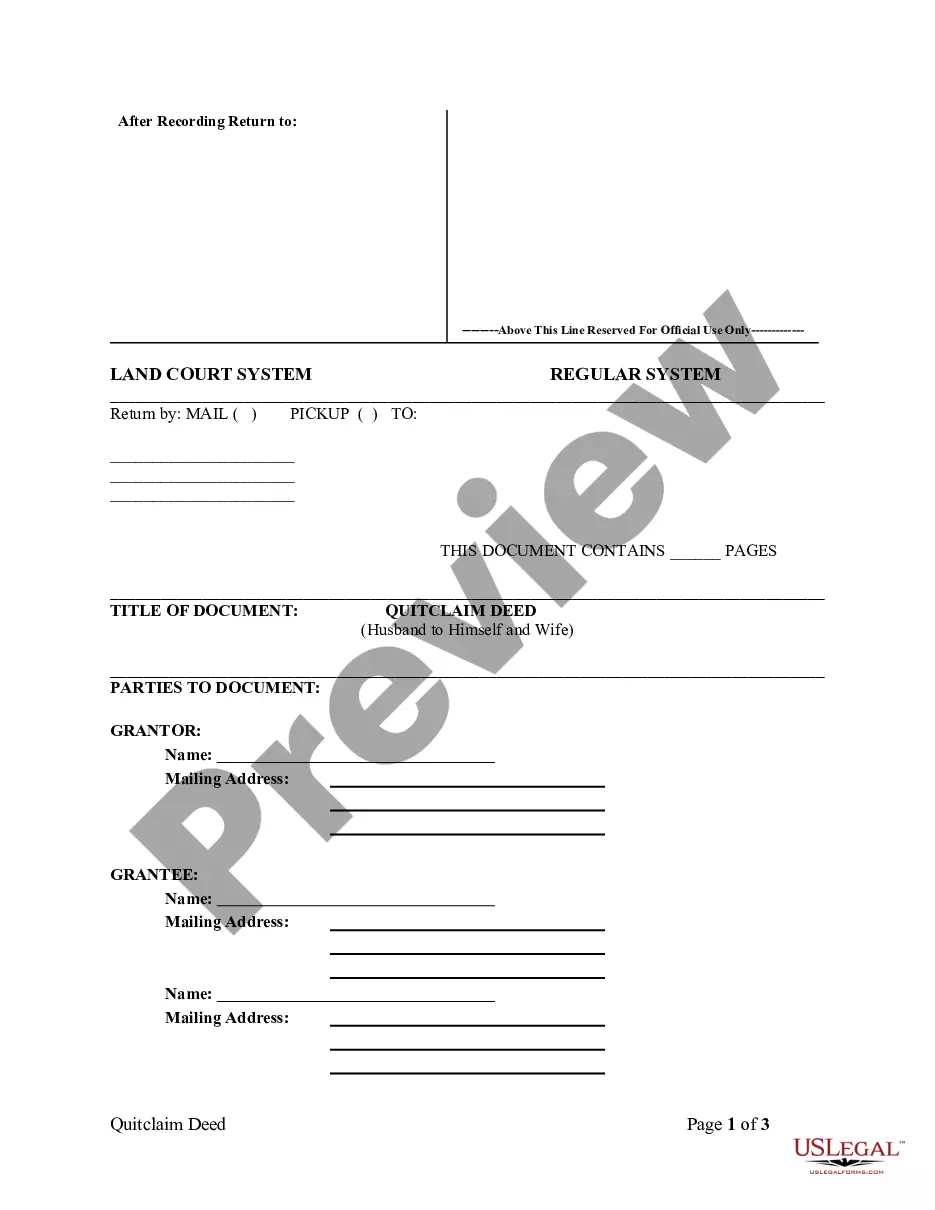

This form is a Transfer on Death Deed, or Beneficiary Deed, where the Grantor are two individuals or hsuband and wife and the Grantees are two individuals or husband and wife. If one Grantee Beneficiary fails to survive the Grantors their interest goes to their estate or the surviving Grantee Beneficiary. If neither Grantee Beneficiary survive the Grantors, the transfer fails and the deed is null and void. This transfer is revocable by Grantors until death and effective only if filed prior to the surving Grantor's death. This deed complies with all state statutory laws.

Arkansas Beneficiary or Transfer on Death Deed or TOD - Husband and Wife or Two Individuals to Husband and Wife or Two Individuals

Description Beneficiary Deed Form

How to fill out Beneficiary Death Deed?

Employing Arkansas Beneficiary or Transfer on Death Deed or TOD - Spouses or Two Parties examples crafted by professional attorneys offers you the chance to sidestep complications during document completion. Simply download the template from our site, fill it in, and have a lawyer review it. Doing so can save you significantly more time and energy than requesting a legal professional to draft a document from scratch to meet your requirements.

If you already possess a US Legal Forms membership, just Log In to your account and navigate back to the sample page. Locate the Download button near the templates you are examining. After downloading a template, you will find all your saved documents in the My documents section.

If you lack a subscription, there’s no need to worry. Simply follow these steps to register for your account online, obtain, and complete your Arkansas Beneficiary or Transfer on Death Deed or TOD - Spouses or Two Parties template.

Once you’ve completed all the aforementioned steps, you will be able to fill out, print, and sign the Arkansas Beneficiary or Transfer on Death Deed or TOD - Spouses or Two Parties template. Ensure to double-check all entered information for accuracy before submitting or mailing it. Minimize the time spent on document completion with US Legal Forms!

- Confirm that you are downloading the correct state-oriented form.

- Utilize the Preview option and read the description (if provided) to see if this specific template is what you need, and if so, click Buy Now.

- Search for another template using the Search bar if necessary.

- Select a subscription that aligns with your needs.

- Begin with your credit card or PayPal.

- Select a file format and download your document.

Arkansas Beneficiary Deed Template Form popularity

Arkansas Beneficiary Deed Other Form Names

Beneficiary Tod FAQ

Use this form to leave your Arkansas real estate without probate. You retain ownership, responsibility, and control over the property during your life. After your death, ownership transfers to the beneficiary you name.

If the property is to be transferred to a beneficiary the Executor or Administrator will need to submit a document called an 'Assent' to the Land Registry, with a copy of the Grant of Representation. The Land Registry will then transfer the property into the name of the new owner.

A beneficiary form states who will directly inherit the asset at your death. Under a TOD arrangement, you keep full control of the asset during your lifetime and pay taxes on any income the asset generates as you own it outright. TOD arrangements require minimal paperwork to establish.

You may name one person or multiple persons. Each of them is referred to as a beneficiary.If you designate more than one person to inherit your home, each individual will inherit an undivided interest in it. Therefore, they must decide what to do with the house keep it or sell it.

When someone marries their partner, they may want to add them to the deeds of the property they already owned. Transferring equity, regardless of whether money changes hands, requires a solicitor to make the appropriate changes to the paperwork, and to change the name on the deeds to your property.

In California, a grant deed conveys ownership. If you want to add someone to your mortgage, you need to refinance the loan naming the other person a co-borrower. Beneficiary deeds are not used in the state; however, you ensure your beneficiary receives the property by naming him an owner with rights of survivorship.

A transfer on death (TOD) account automatically transfers its assets to a named beneficiary when the holder dies For example, if you have a savings account with $100,000 in it and name your son as its beneficiary, that account would transfer to him upon your death.

Once you obtain a transfer-on-death deed, complete the form to name a beneficiary. The transfer deed will ask you to name the person(s) you wish to inherit your property. You can name multiple people as the beneficiary, as well as an organization. List the beneficiary's complete name and avoid titles.

All you need to do is fill out a simple form, provided by the bank, naming the person you want to inherit the money in the account at your death. As long as you are alive, the person you named to inherit the money in a payable-on-death (POD) account has no rights to it.