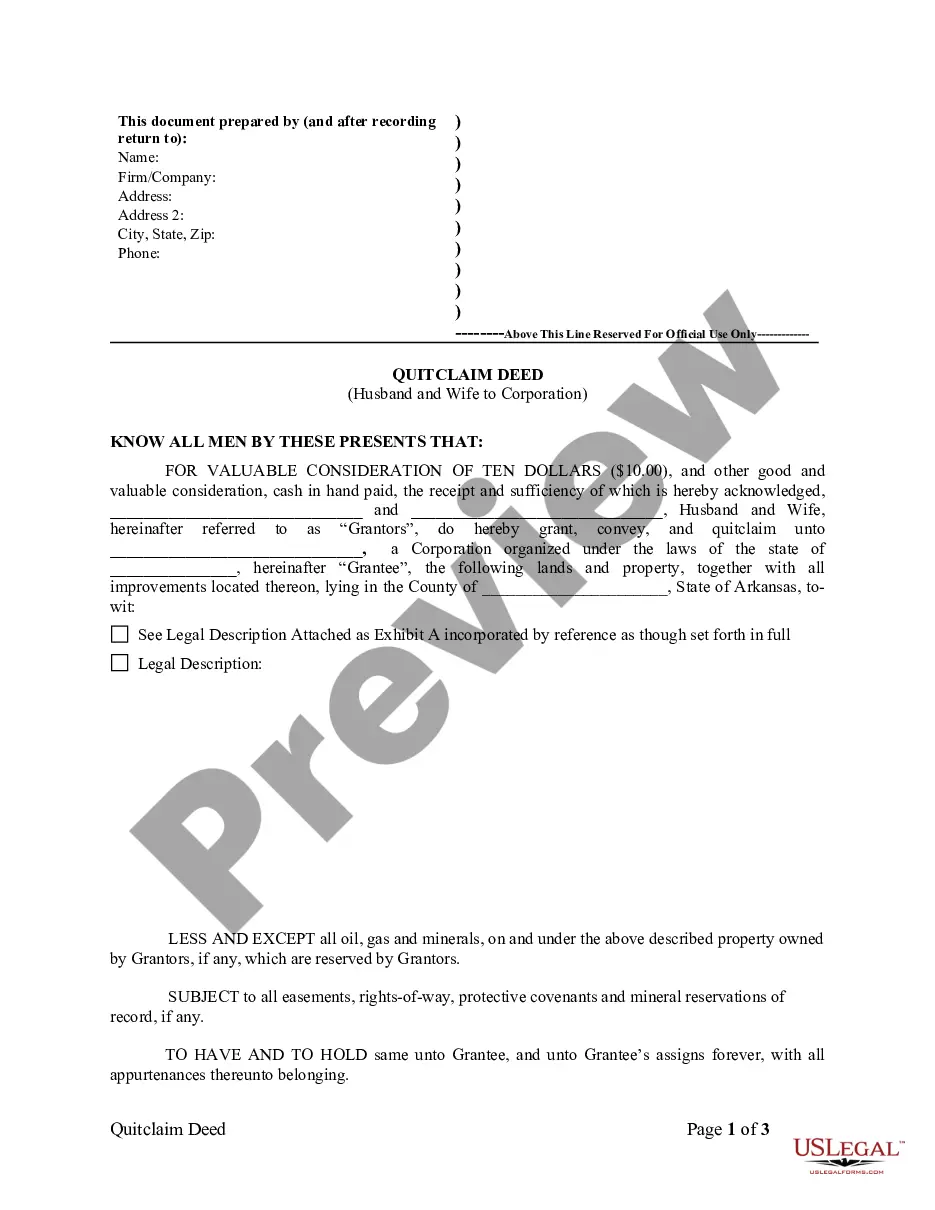

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

Arkansas Quitclaim Deed from Husband and Wife to Corporation

Description

Key Concepts & Definitions

Quitclaim Deed: A legal instrument used to transfer interest in real property. The grantor (transferor) terminates their right and claim to the property, thereby allowing the transfer of ownership to the grantee (receiver) without any warranty. Particularly implicated in this context is the "quitclaim deed from husband and wife to" another party, which involves a couple transferring their ownership rights.

Step-by-Step Guide on Executing a Quitclaim Deed from Husband and Wife

- Determine the Need: Confirm that a quitclaim deed is the appropriate document for your situation. It is typically used between known parties and for straightforward property transfers.

- Prepare the Deed: Gather all necessary information, such as legal descriptions of the property, and names of the parties involved. Utilize state-specific forms if applicable.

- Sign the Deed: Both husband and wife must sign the deed in the presence of a notary public.

- File the Deed: Submit the signed deed to the local county recorders office. Filing fees may vary depending on location.

- Verify Transfer: Ensure that the deed has been recorded and that property records reflect the change in ownership.

Risk Analysis

- No Warranty: Quitclaim deeds do not guarantee clear title; existing claims or liens pass to the new owner. This can pose significant risks if not properly managed.

- Relationship Dynamics: Due to the involvement of close relationships, disputes or future claims can arise if the transaction was not equitable.

- Legal Challenges: Improper filing or incomplete information can lead to legal complications, potentially invalidating the transfer.

Best Practices

- Professional Advice: Consult with a real estate attorney to understand implications and ensure all legal criteria are met.

- Thorough Documentation: Ensure all documents are detailed and retain copies for future reference.

- Clear Communication: All parties involved should have a clear understanding of the terms and outcomes of the transfer.

Common Mistakes & How to Avoid Them

- Inaccurate Description: Ensure the property's legal description is accurate to avoid disputes. Double-check against existing property documents.

- Failing to Record: Always file the deed with appropriate local authorities to make the transaction official and publicly recorded.

- Neglecting Professional Help: Engage a lawyer to avoid overlooking critical aspects of the transfer that might lead to future legal issues.

FAQ

Can a quitclaim deed from husband and wife to a child be reversed? Once a quitclaim deed is executed and recorded, it generally cannot be reversed unless all parties agree, or if fraud or undue influence is proven.

What are the tax implications of transferring property via a quitclaim deed? Tax implications can vary. Typically, if no money is exchanged, there might not be immediate tax implications, but other taxes, like estate or inheritance taxes, could apply. Consulting a tax professional is advisable.

How to fill out Arkansas Quitclaim Deed From Husband And Wife To Corporation?

Employing Arkansas Quitclaim Deed from Spouses to Corporation templates crafted by expert attorneys provides you the chance to evade complications when completing paperwork.

Simply download the model from our site, fill it in, and request a lawyer to validate it.

This approach will conserve you considerably more time and energy than asking legal assistance to create a document entirely from the ground up tailored to your requirements would.

Once you’ve completed all the steps above, you'll have the opportunity to finish, print, and sign the Arkansas Quitclaim Deed from Spouses to Corporation template. Remember to meticulously verify all entered information for accuracy before submitting or mailing it. Reduce the time spent on document creation with US Legal Forms!

- Reconfirm and ensure that you are acquiring the correct state-specific form.

- Utilize the Preview option and review the description (if provided) to determine if you need this particular template; if so, just click Buy Now.

- If needed, locate another template using the Search bar.

- Select a subscription that fulfills your needs.

- Initiate the process using your credit card or PayPal.

- Select a file format and download your document.

Form popularity

FAQ

Step 1: Find and download the Arkansas quitclaim deed form. Step 2: Record the name and address of the person who prepares the form. Step 3: After State of Arkansas, record the property's county.

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.

It is also crucial that a spouse know about the loan, even if he or she is not on the mortgage. In general, the spouse must sign a deed of trust, the Truth in Lending and Right to Cancel documents. By signing these documents, they are simply acknowledging the existence of the mortgage.

If you sign a quitclaim deed to release yourself from ownership of the property or a claim to the title, then that doesn't mean you are no longer held accountable for the mortgage payment.Otherwise, you may be held responsible for unpaid payments despite no longer having a claim to the title.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

A quitclaim deed affects ownership and the name on the deed, not the mortgage. Because quitclaim deeds expose the grantee to certain risks, they are most often used between family members and where there is no exchange of money.Quitclaim deeds transfer title but do not affect mortgages.

In states like California and Florida, the spouses may use a quitclaim deed to transfer the property without warranting title. Other stateslike Texasrecognize a similar type of deed called a deed without warranty.