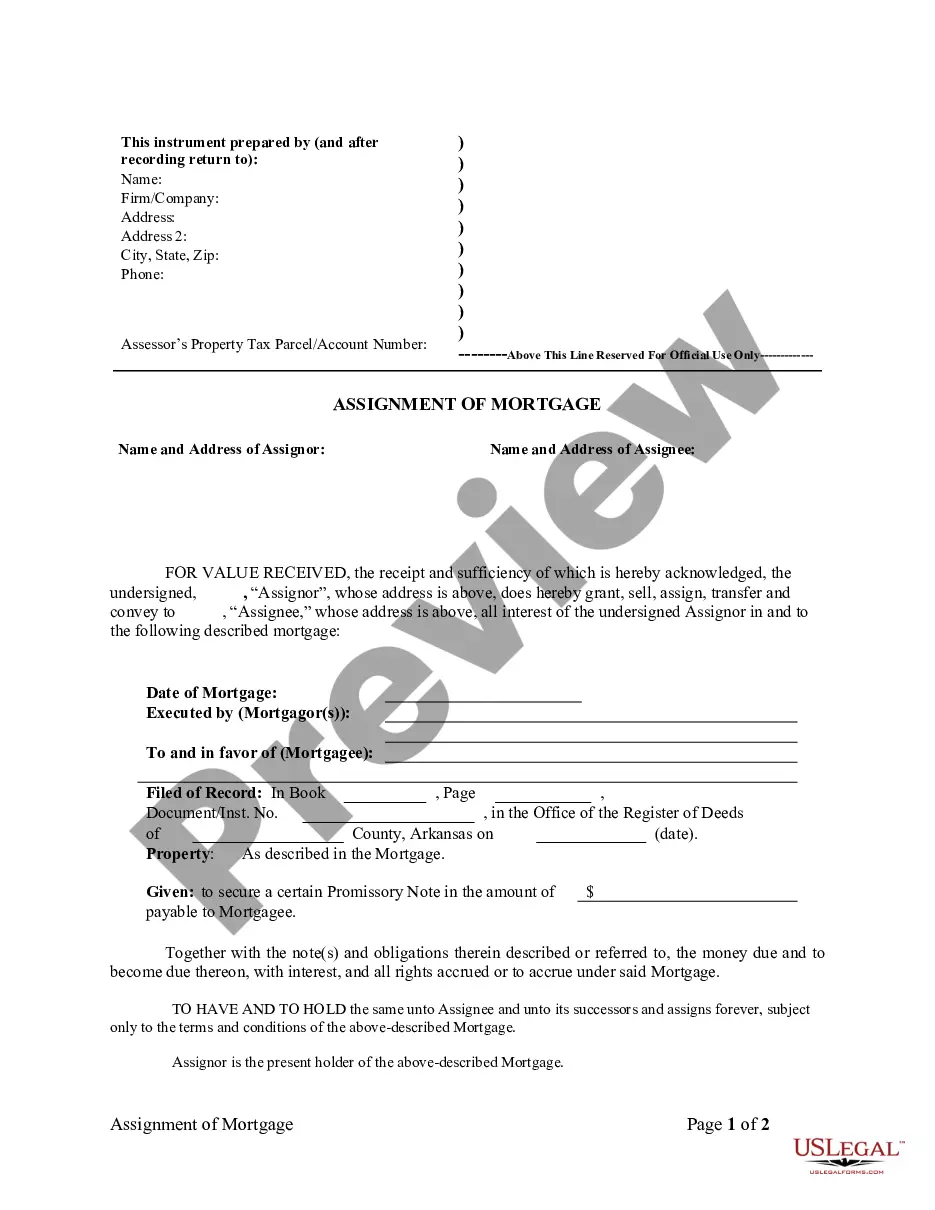

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Arkansas Assignment of Mortgage by Individual Mortgage Holder

Description

How to fill out Arkansas Assignment Of Mortgage By Individual Mortgage Holder?

Making use of Arkansas Assignment of Mortgage by Individual Mortgage Holder samples created by professional attorneys allows you to avoid stress when completing paperwork.

Simply download the template from our site, fill it in, and ask a legal expert to review it.

This approach will save you far more time and effort than asking a legal expert to draft a document from scratch to meet your requirements.

Remember to verify all entered information for accuracy before submitting it or sending it out. Minimize the time you spend on document creation with US Legal Forms!

- If you’ve already purchased a US Legal Forms subscription, just Log In to your account and return to the sample page.

- Locate the Download button close to the templates you’re reviewing.

- After you download a file, all of your saved samples can be found in the My documents section.

- If you lack a subscription, don't worry.

- Just follow the instructions below to register for your online account, acquire, and complete your Arkansas Assignment of Mortgage by Individual Mortgage Holder template.

- Ensure you are downloading the correct state-specific form.

Form popularity

FAQ

In an Arkansas Assignment of Mortgage by Individual Mortgage Holder, the assignment of lien is signed by the individual or entity holding the lien—usually the original mortgage lender. This process legally transfers the lien to the new mortgage holder, solidifying their interest in the property. Whether you are a lender or borrower, knowing the parties involved equips you with the knowledge to navigate the transaction seamlessly. Utilizing platforms like uslegalforms can offer essential documentation and guidance throughout this process.

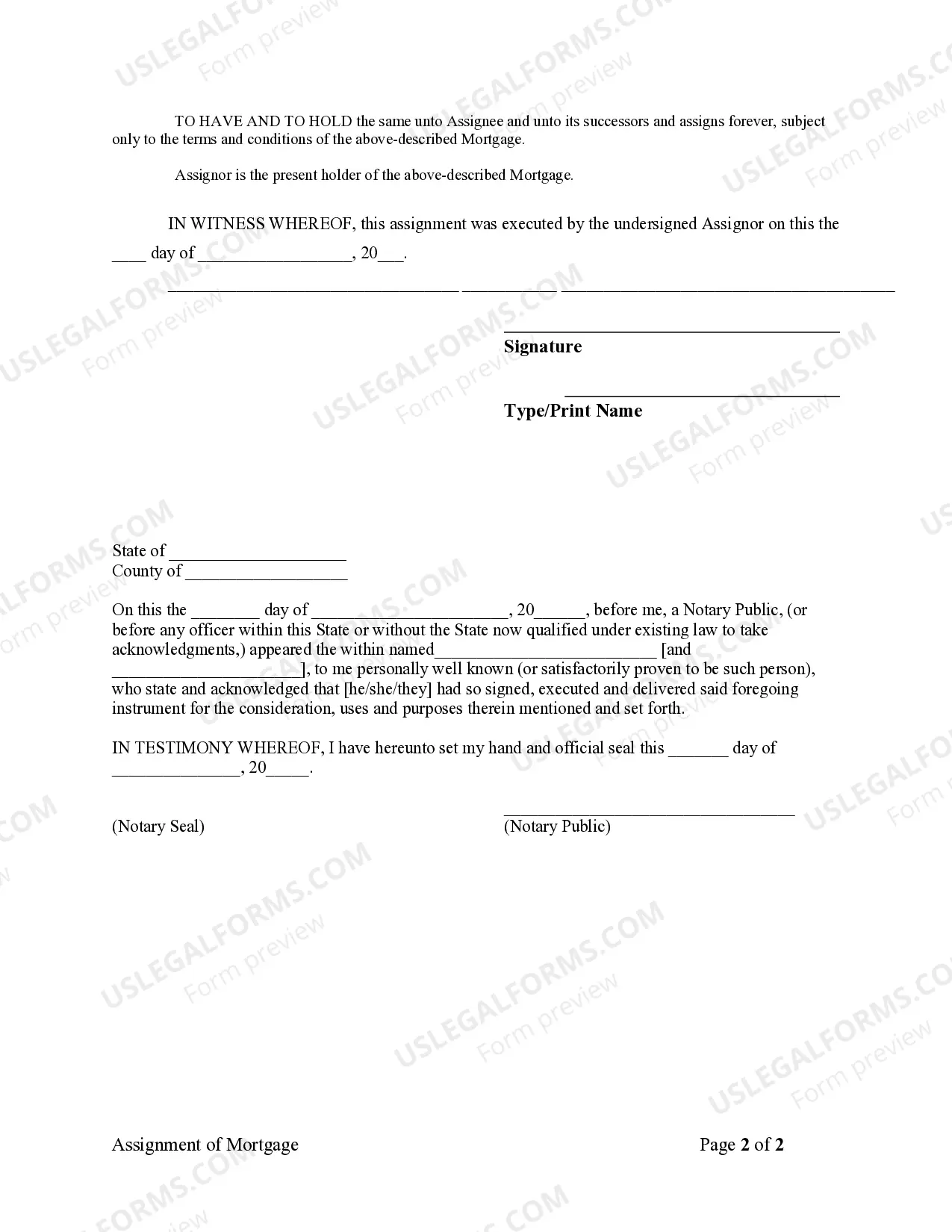

Typically, the assignment is signed by the current mortgage holder or grantor who is transferring the mortgage rights. This includes individual mortgage holders or institutions, depending on the situation. By signing the assignment, they formally transfer their rights to the mortgage, ensuring that the recipient can enforce them. Understanding who signs the assignment provides clarity for all involved parties in the transaction.

An example of an Arkansas Assignment of Mortgage by Individual Mortgage Holder occurs when a homeowner sells their property while their mortgage is still active. In this case, the original lender may assign the mortgage to a new lender or buyer. This transfer involves legal documentation that establishes the new lender's rights to collect payments and foreclose if necessary. Such assignments simplify transactions and maintain the mortgage's enforceability.

The grantor in an Arkansas Assignment of Mortgage by Individual Mortgage Holder is the original mortgage holder who transfers their rights to another party. This can often be a lender or an investor who acquires the mortgage. By executing the assignment, the grantor effectively relinquishes their claims under the mortgage agreement. Understanding this role is crucial for anyone involved in the mortgage transfer process.

Yes, recording an assignment of mortgage is generally necessary for it to be legally recognized. An official record protects the interests of the new mortgage holder and updates public records. In Arkansas, you should file the assignment with the local county recorder's office. This step ensures that all parties have clear ownership and rights concerning the mortgage, providing legal security.

Completing an assignment of mortgage requires filling out the necessary documents accurately. Start by including the original mortgage details, names of the parties involved, and any terms related to the assignment. After signing, the assignment must often be notarized and filed with the appropriate county office. Utilizing the USLegalForms platform can streamline this process with templates and guidance tailored for Arkansas assignments.

An assignment of a mortgage functions as a legal transfer of the mortgage and its associated rights from one party to another. In the context of an Arkansas Assignment of Mortgage by Individual Mortgage Holder, the original holder formally assigns the mortgage to the new holder. This process involves documenting the transfer and ensuring all parties are informed. The new holder then assumes all rights and responsibilities related to the mortgage.

Releasing an assignment of a mortgage involves preparing a release document, which indicates that the previous mortgage holder no longer holds rights to the mortgage. This release should include relevant details about the original mortgage and the parties involved. Once completed, the document should be signed by the original mortgage holder and submitted to the local recording office to update public records.

To assign a mortgage to someone else in Arkansas, begin by completing an assignment of mortgage document. You will need to include specific details, such as the original mortgage, the parties involved, and the terms of the transfer. After drafting this document, the mortgage holder should sign it. Finally, delivering the assignment to the new mortgage holder finalizes the process.

In an Arkansas Assignment of Mortgage by Individual Mortgage Holder, the mortgage holder typically signs the assignment. This individual must be the original lender or the current holder of the mortgage note. Their signature affirms that they agree to transfer their rights to another party. Therefore, it is crucial for the mortgage holder to ensure all legal requirements are met.