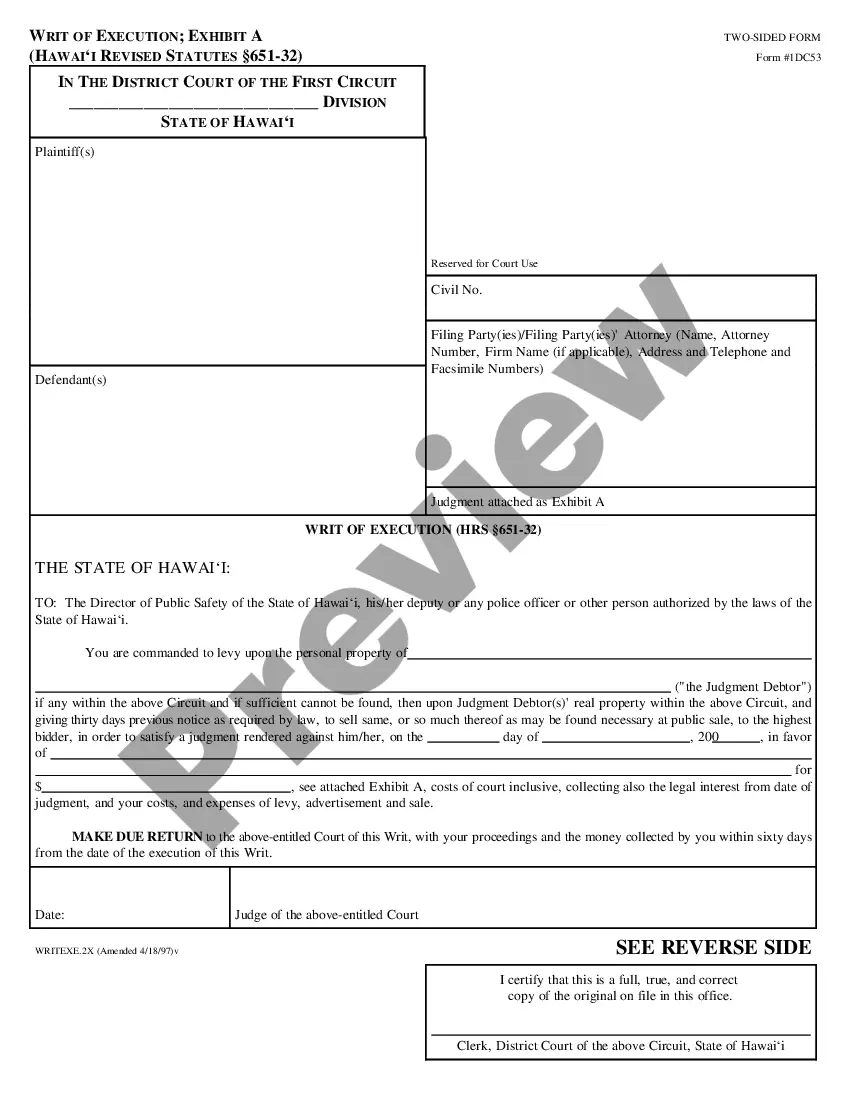

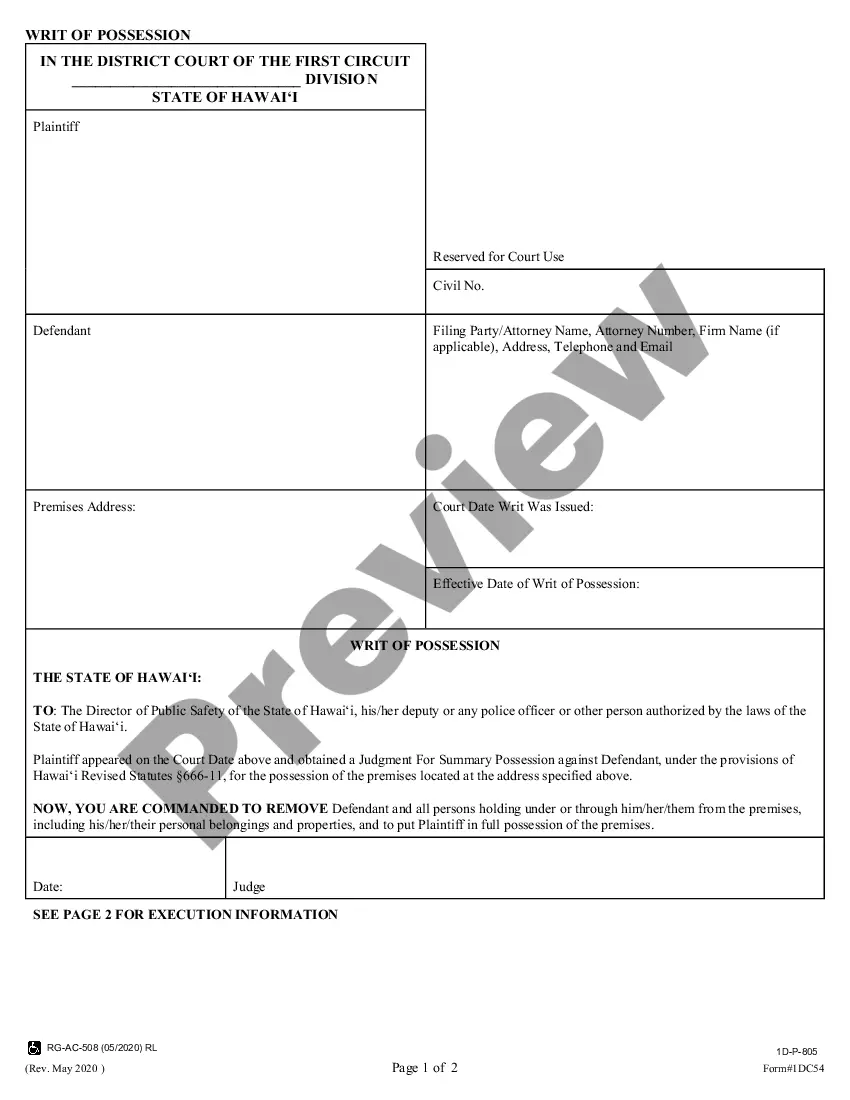

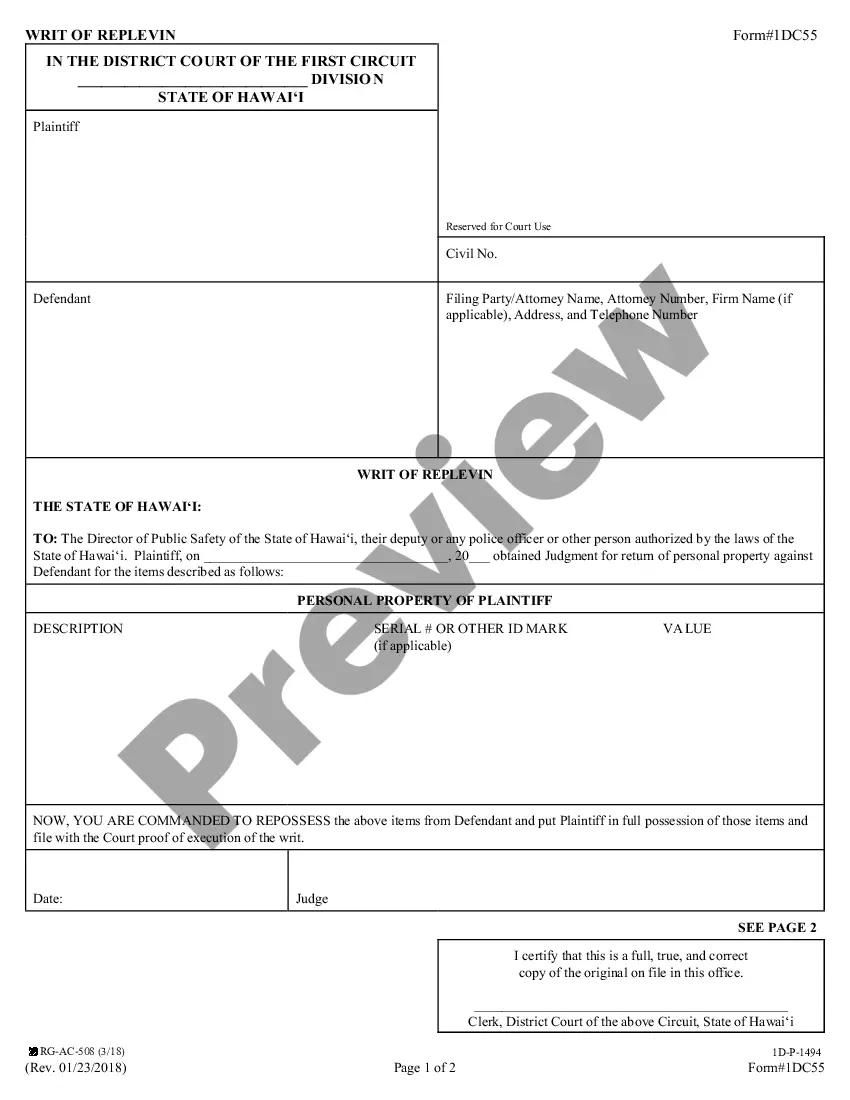

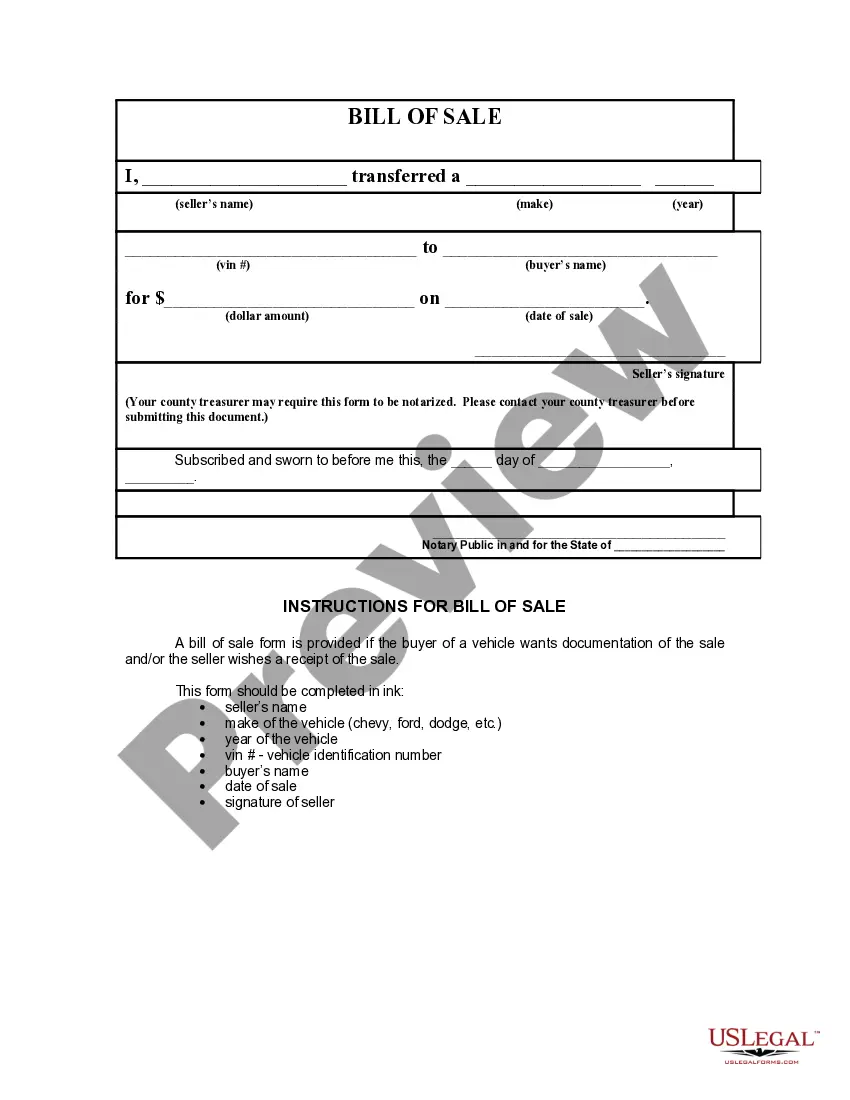

Inventory of Estate by Personal Representative. This official probate court form is submitted by the personal representative to the court to document the assets and liabilities that are part of the decedent's estate.

Arkansas Inventory of Estate by Personal Representative

Description

How to fill out Arkansas Inventory Of Estate By Personal Representative?

Utilizing Arkansas Inventory of Estate by Personal Representative templates developed by experienced attorneys allows you to avoid complications while completing documents.

Simply download the form from our site, fill it out, and seek legal advice to review it.

This approach will conserve significantly more time and energy than trying to find legal assistance to create a document from scratch for you.

Use the Preview feature and examine the description (if available) to determine if you need this particular template, and if you do, simply click Buy Now. Find another template using the Search field if needed. Choose a subscription that suits your requirements. Begin the process using your credit card or PayPal. Select a file format and download your document. Once you have completed all the above steps, you will be able to fill out, print, and sign the Arkansas Inventory of Estate by Personal Representative template. Remember to verify all entered information for accuracy before submitting it or sending it out. Reduce the time spent on document creation with US Legal Forms!

- If you’ve already obtained a US Legal Forms subscription, just Log In to your account and revisit the sample page.

- Locate the Download button adjacent to the templates you’re browsing.

- After downloading a file, you will find your saved examples in the My documents section.

- If you do not have a subscription, that is not an issue.

- Simply adhere to the step-by-step instructions below to register for an account online, acquire, and fill out your Arkansas Inventory of Estate by Personal Representative template.

- Make sure to verify that you are downloading the correct state-specific form.

Form popularity

FAQ

Examples could include: If unknown/unspecified debtors arise, the executor can delay settlement for up to six months, whilst the debtor is settled.

In Arkansas, you can use the small estate procedure if the total value of all personal property does not exceed the amount to which the surviving spouse and children are entitled to by law or the value of the property is $100,000 or less, not counting the homestead and the statutory allowance for the benefit of a

How Long Do You Have to File Probate After Death in Arkansas? According to the Arkansas Code, a will must be submitted to the courts within five years of the person's death. The will cannot be used as proof for transfer of title until it has been probated.

A simple estate with just a few, easy-to-find assets may be all wrapped up in six to eight months. A more complicated affair may take three years or more to fully settle.

This fiduciary serves under supervision of the court for period of at least 6 months. It takes about 1 to 4 weeks to get someone appointed, so as a practical matter, it will take around 7 months to probate an estate in Arkansas in a best case scenario.

When a person dies, his or her property must be collected by the personal representative. After debts, taxes, and expenses are paid, the remaining assets are distributed to the decedent's beneficiaries.

Arkansas law holds that the executor fee should be reasonable, and not exceed certain percentages of the personal property the executor administers: 10% on the first $1,000. 5% on the next $4,000. 3% on the rest.

In Arkansas, the probate process is mandatory for any contested estate, if there are creditors (including a mortgage) and for any estate larger than $100,000. If a person provides written grounds for contest to the court, the will goes through the probate process.