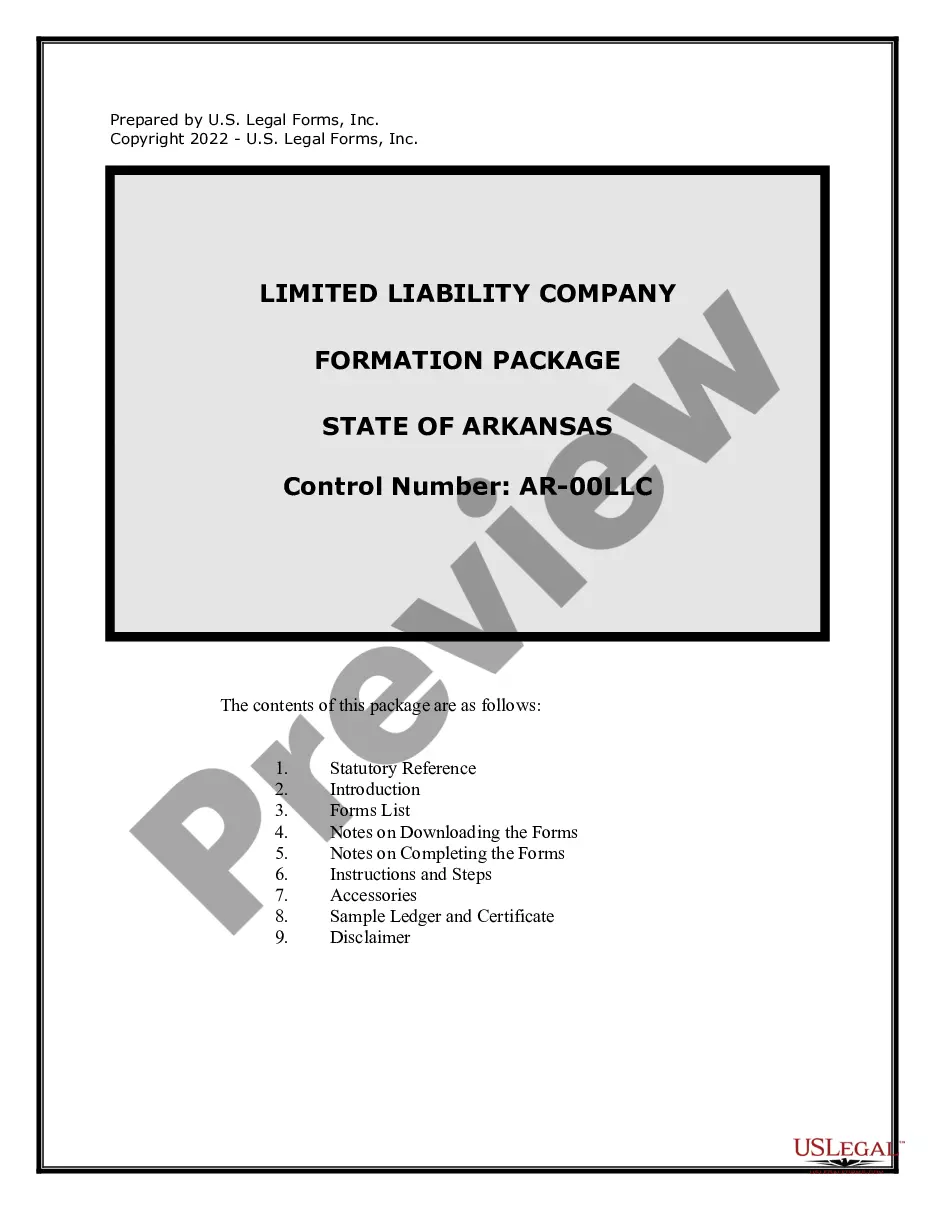

This dissolution package contains all forms to dissolve a LLC or PLLC in Arkansas, step by step instructions, addresses, transmittal letters, and other information.

Arkansas Dissolution Package to Dissolve Limited Liability Company LLC

Description Limited Liability Company

How to fill out Ar Dissolution Llc?

Utilizing the Arkansas Dissolution Package to Terminate Limited Liability Company LLC examples prepared by skilled attorneys helps you avert complications during document submission.

Simply download the template from our site, complete it, and have an attorney review it.

This approach can conserve you significantly more time and energy than having a legal expert create a document from scratch for you.

Use the Preview option and read the description (if available) to determine if you need this specific template, and if so, just click Buy Now. Find another template using the Search field if needed. Choose a subscription that suits your requirements. Start using your credit card or PayPal. Select a file format and download your document. Once you have completed all the steps above, you will be able to fill out, print, and sign the Arkansas Dissolution Package to Terminate Limited Liability Company LLC template. Remember to verify all entered information for accuracy before submitting it or sending it out. Minimize the time you spend on document creation with US Legal Forms!

- If you already possess a US Legal Forms membership, just Log In to your account and return to the sample page.

- Locate the Download button next to the templates you're examining.

- After downloading a document, all of your saved templates can be found in the My documents section.

- If you don't have a subscription, that's not an issue.

- Just follow the instructions below to register for your online account, obtain, and complete your Arkansas Dissolution Package to Terminate Limited Liability Company LLC template.

- Verify and ensure that you’re downloading the correct state-specific form.

Arkansas Dissolve Llc Form popularity

Arkansas Dissolve Company Other Form Names

Ar Dissolve Llc FAQ

The Effect of Dissolution After you close your LLC in California, that LLC shall be canceled, and its powers, rights, and privileges shall end upon the filing of the Certificate of Cancellation. This means you can no longer conduct business using that LLC.

Step 1: Follow Your Arkansas LLC Operating Agreement. Step 2: Close Your Business Tax Accounts. Step 3: File Articles of Dissolution.

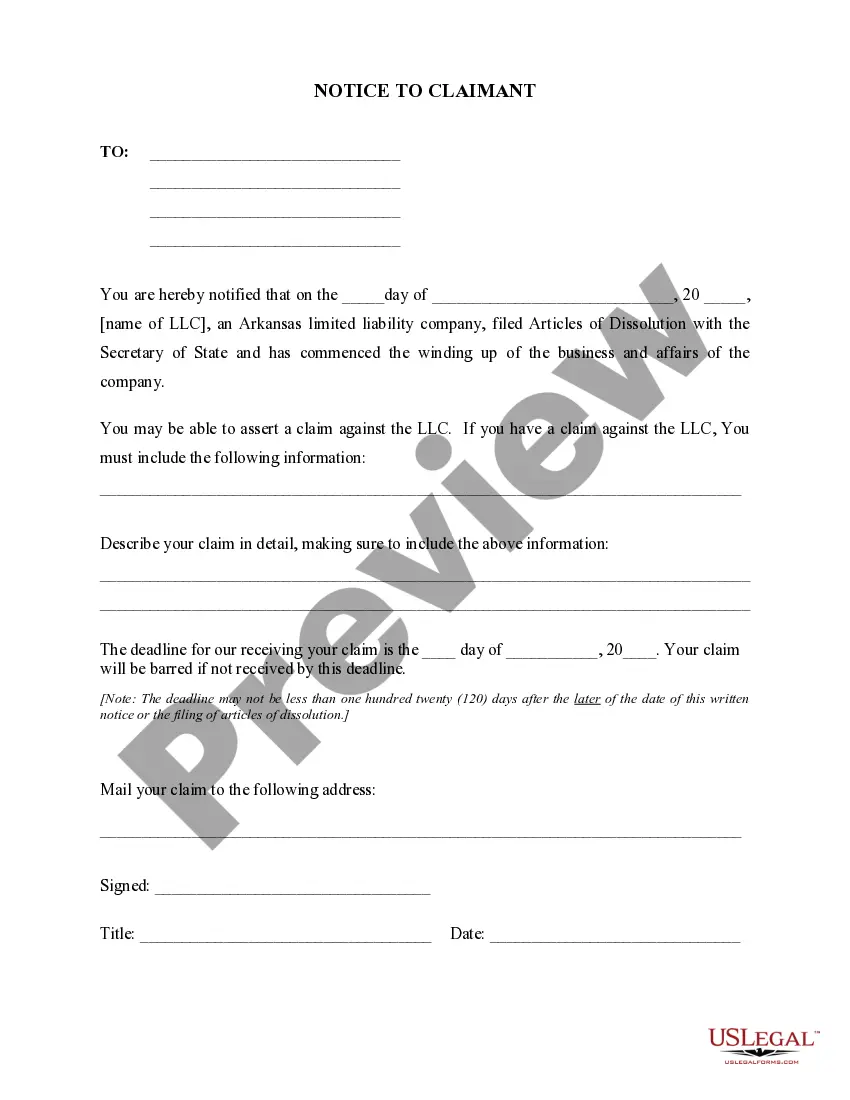

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office.

Hold a Members meeting and record a resolution to Dissolve the Arkansas LLC. File all required Annual Franchise Tax Reports with the Arkansas Secretary of State. Clear up any business debt. Pay all taxes and administrative fees owed by the Arkansas LLC.

Method 1: You can voluntarily dissolve your LLC. This requires a majority vote from all members or a certain percentage of votes as required per your operating agreement. With the required votes, you can move forward with the dissolution.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office. It can take the SOS many weeks to process a certificate. However, expedited service is available for an additional fee.