Arkansas Annual Report Limited Partnership Or Limited Liability Limited Partnership (2013 And Before)

Description

How to fill out Arkansas Annual Report Limited Partnership Or Limited Liability Limited Partnership (2013 And Before)?

How much time and resources do you generally allocate for creating formal documents? There’s a more efficient method to obtain such forms than employing legal professionals or spending countless hours searching the internet for a suitable blank.

US Legal Forms is the leading online repository that offers expertly composed and verified state-specific legal documents for any purpose, such as the Arkansas Annual Report Limited Partnership Or Limited Liability Limited Partnership (2013 And Before).

Another benefit of our service is that you can access previously acquired documents that you securely save in your profile under the My documents tab. Retrieve them at any time and redo your paperwork as often as necessary.

Conserve time and effort preparing legal documents with US Legal Forms, one of the most dependable online services. Register with us today!

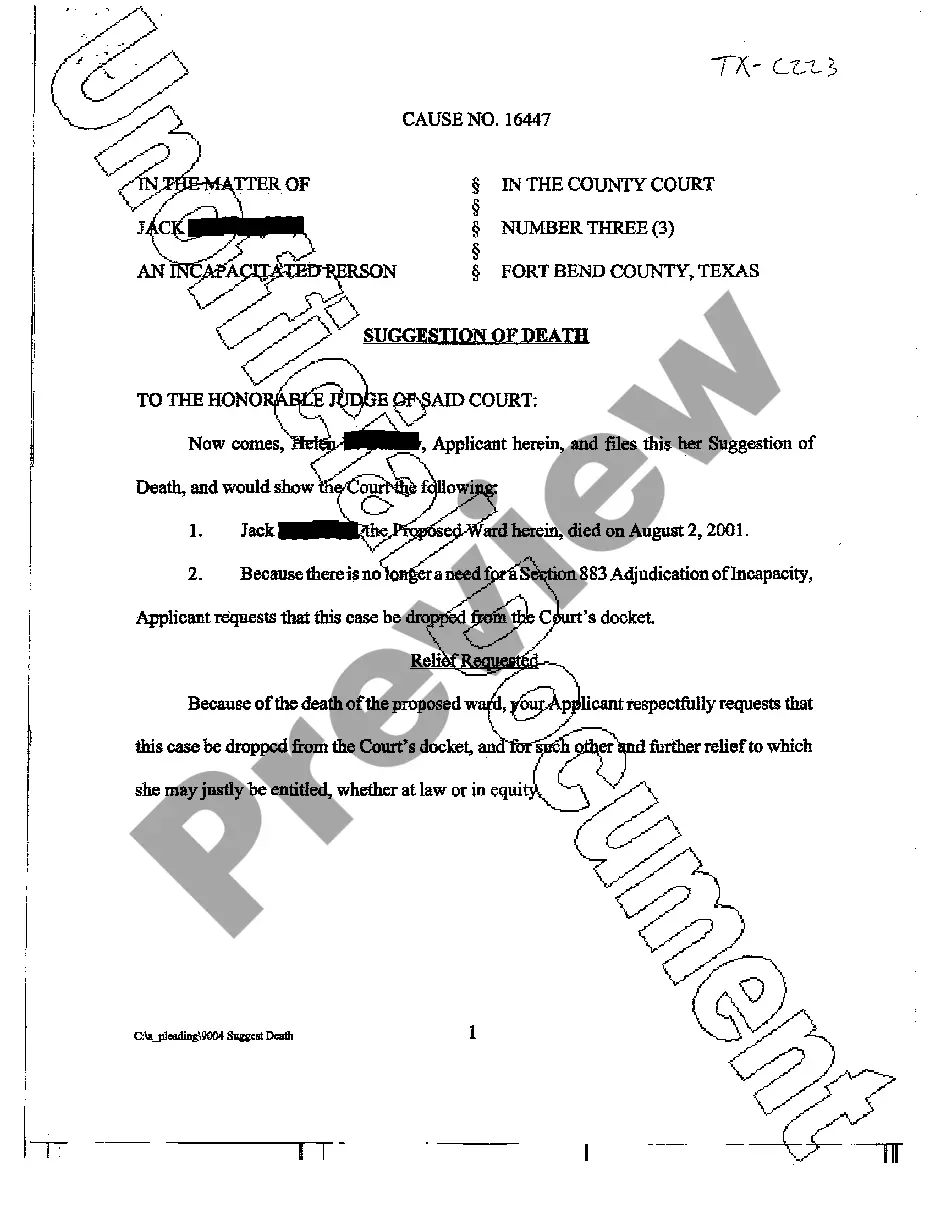

- Browse the form content to ensure it meets your state requirements. To do this, review the form description or utilize the Preview option.

- If your legal template doesn’t meet your criteria, locate an alternative using the search tab at the top of the page.

- If you already possess an account with us, Log In to download the Arkansas Annual Report Limited Partnership Or Limited Liability Limited Partnership (2013 And Before). If not, continue to the subsequent steps.

- Press Buy now once you identify the appropriate document. Select the subscription plan that best fits your needs to access our library’s complete features.

- Register for an account and pay for your subscription. Payments can be made via credit card or PayPal - our service guarantees complete security for that.

- Download your Arkansas Annual Report Limited Partnership Or Limited Liability Limited Partnership (2013 And Before) onto your device and complete it on a printed hard copy or electronically.

Form popularity

FAQ

Will I be assessed late fees if I don't file an Arkansas Franchise Tax or Annual Report? The state will charge your Arkansas LLC or corporation (with and without stock) a $25 late fee.

All Arkansas LLCs need to pay $150 per year for the Annual Franchise Tax. These state fees are paid to the Secretary of State. Other than the Annual Franchise Tax Reports fee, there are no other state-required annual Arkansas LLC fees.

Benefits of Forming an LLC in Arkansas Avoiding double taxation because the LLC is not taxed separately. Simpler tax reporting because all the profits and losses are ?passed through? to the owner(s) or members of the LLC, making it easier to comply with tax liabilities.

All LLCs operating in Arkansas must file an annual report and pay a flat-rate tax of $150 each year. The $150 tax and the annual report together are known as the Annual LLC Franchise Tax Report.

Arkansas LLC Annual Franchise Tax Report Fee ($150/year) The Arkansas LLC Annual Franchise Tax costs $150 per year. This fee is paid every year for the life of your LLC.

Arkansas does not legally require an operating agreement for an LLC, but it makes sense to have one in place if your LLC has more than one member. This agreement details the ownership and procedures of the business. These are recognized as legally binding governing documents by the state.

In the state of Arkansas, every business entity is required to complete an annual report filing. Arkansas requires that you file by May 1st of each year, otherwise you may fall into noncompliance and face fees and penalties.