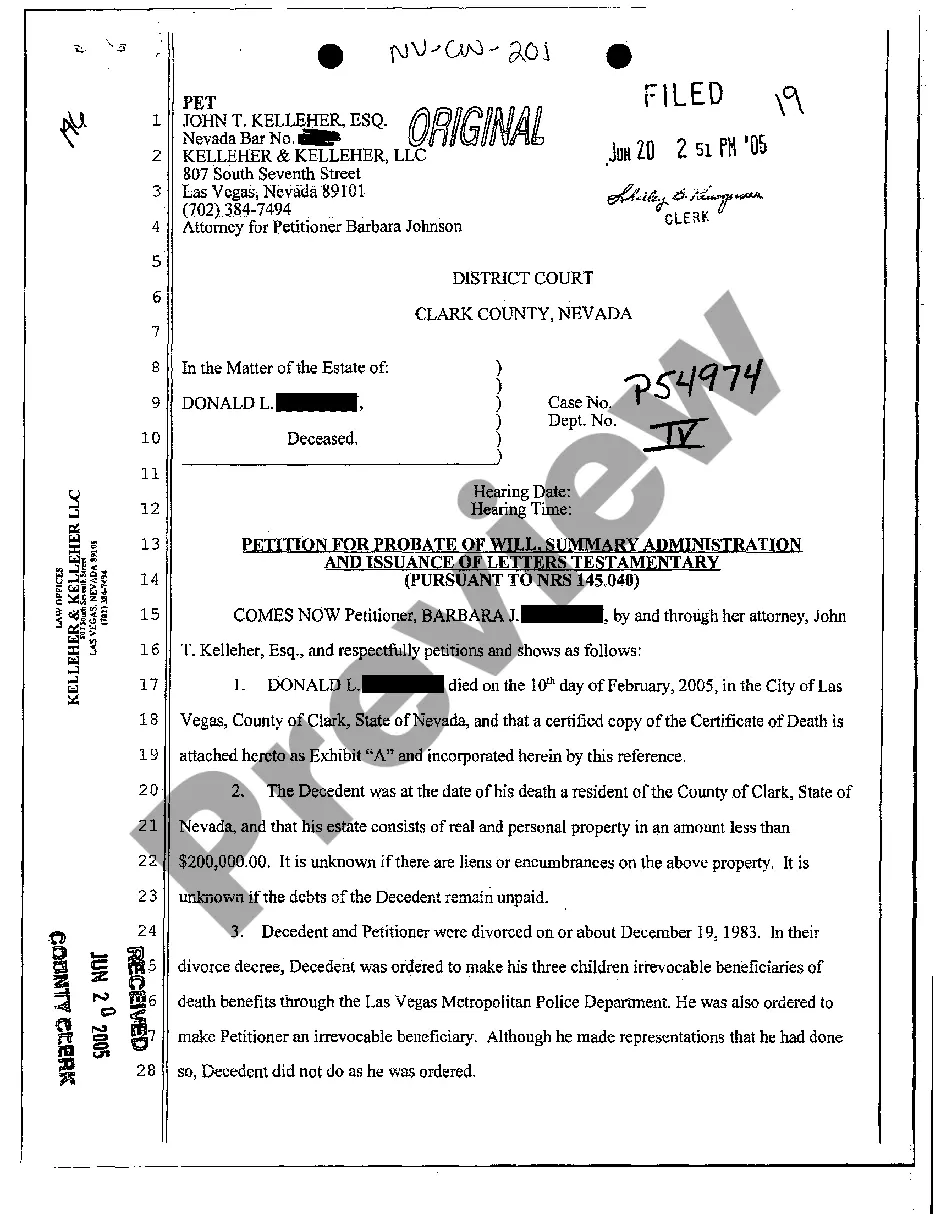

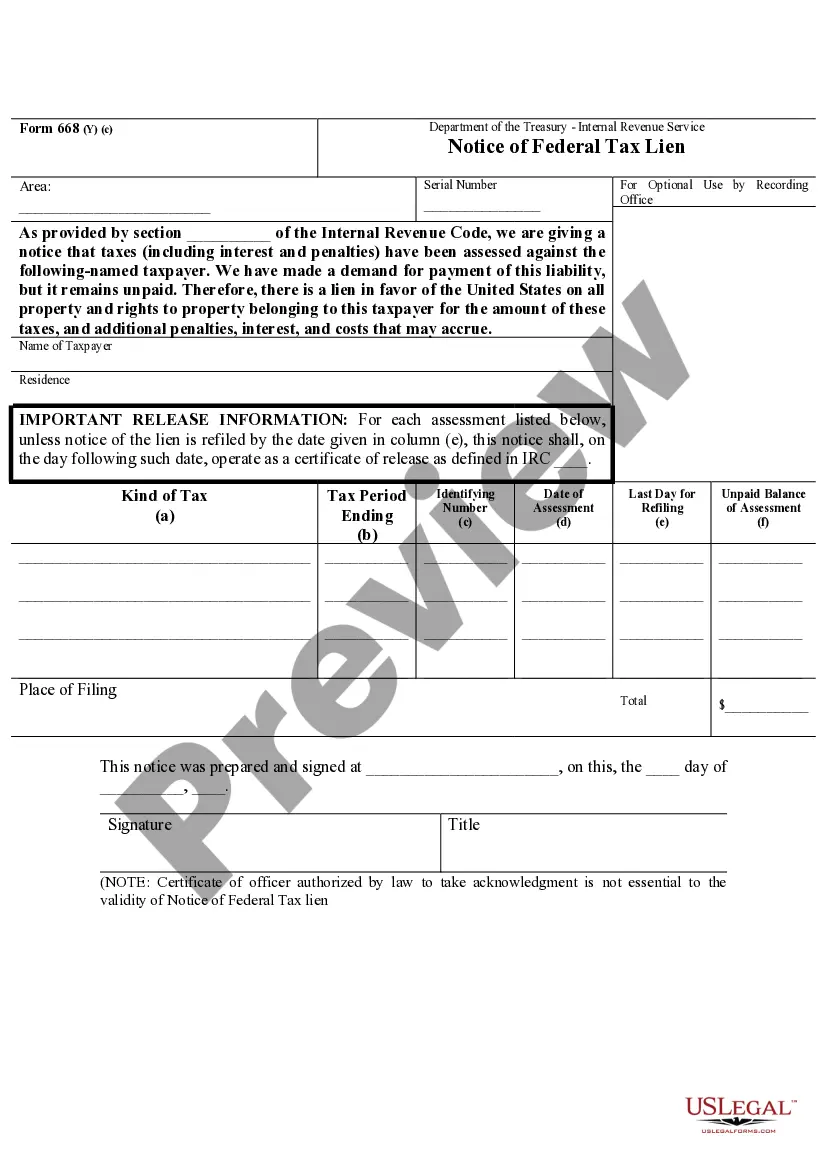

Arkansas Department of the Treasury -Internal Revenue Service Notice of Federal Tax Lien

Description

to taxpayer for taxes, and additional penalties, interest, and costs that may accrue.

How to fill out Arkansas Department Of The Treasury -Internal Revenue Service Notice Of Federal Tax Lien?

Using examples from the Arkansas Department of the Treasury - Internal Revenue Service crafted by experienced lawyers helps you avoid issues when filing documents.

Just download the template from our site, complete it, and ask a legal expert to review it.

This can assist you in saving significantly more time and energy compared to seeking legal advice to create a document entirely from the beginning according to your needs.

Utilize the Preview option and read the description (if available) to determine if this particular template is needed; if so, just click Buy Now.

- If you’ve already purchased a US Legal Forms subscription, just Log In/">Log In to your account and revisit the sample page.

- Locate the Download button next to the templates you are browsing.

- After downloading a template, you will find all your saved examples in the My documents tab.

- If you do not have a subscription, it’s not an issue.

- Just follow the steps below to create an account online, acquire, and complete your Arkansas Department of the Treasury - Internal Revenue Service template.

- Verify and ensure that you are downloading the appropriate state-specific form.

Form popularity

FAQ

Sometimes an owner dies and his or her heirs fail to claim assets left to them because they don't know about the inheritance. To search for these assets, go to www.missingmoney.com, which you can also reach by typing www.unclaimed.org and clicking on the MissingMoney.com link.

Website: www.sos.arkansas.gov/BCS. Phone: (501) 682-3409 and 1-888-233-0325. Email: corprequest@sos.arkansas.gov. Hours: 8am 5pm, Monday Friday.

You can file a Doing Business Under an Assumed Name Certificate at any local county clerk office. In addition to registering with the county clerk, domestic corporations must also register fictitious names with the Arkansas Secretary of State.

The National Association of Unclaimed Property Administrators' website www.unclaimed.org is an excellent resource. This association consists of state officials charged with the responsibility of reuniting lost owners with their unclaimed property.

Search For Unclaimed Money in Your State Start your search for unclaimed money with your state's unclaimed property office. Search for unclaimed money using a multi-state database. Perform your search using your name, especially if you've moved to another state. Verify how to claim your money.

For more information on Arkansas unclaimed money, and to do your own search, please go to the Arkansas Unclaimed Money website.

How much does it cost to form an LLC in Arkansas? The Arkansas Secretary of State charges a $45 fee to file the Articles of Organization online and $50 if filed by mail. You can reserve your LLC name with the Arkansas SOS for $25 if filed by mail or $22.50 if filed online.

In Arkansas most property types are presumed abandoned or unclaimed if there has been no account activity for three years.

Make payable to Arkansas Secretary of State Mail the form and payment to: Arkansas Secretary of State, Business and Commercial Services Division, PO Box 8014, Little Rock, AR 72203-8014.