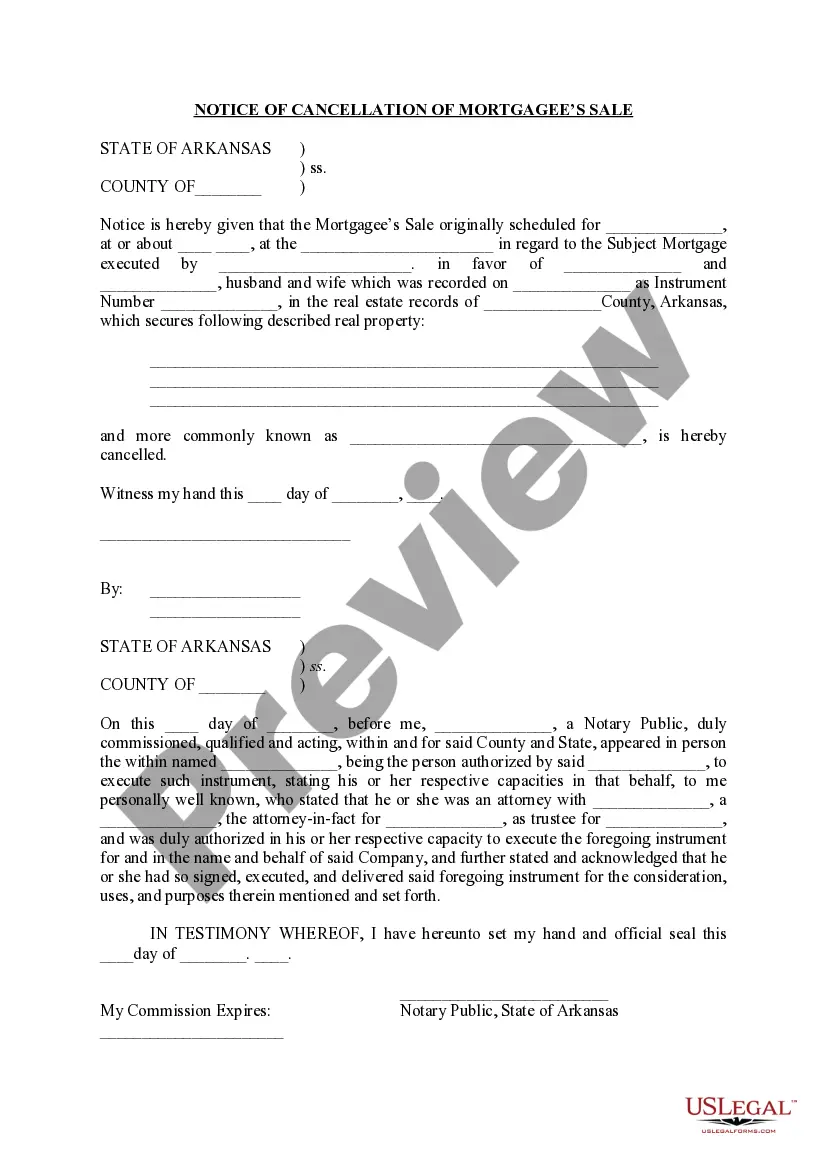

Arkansas Notice of Cancellation of Mortgagee's Sale

Description

How to fill out Arkansas Notice Of Cancellation Of Mortgagee's Sale?

Utilizing Arkansas Notification of Termination of Mortgagee's Sale templates designed by proficient lawyers enables you to avoid complications when filling out paperwork.

Simply download the template from our site, complete it, and ask a lawyer to review it.

This can assist you in conserving considerably more time and effort than seeking legal assistance to draft a document independently tailored to your requirements would.

Utilize the Preview feature and read the details (if available) to determine if you need this specific example, and if you do, simply click Buy Now. Explore further templates using the Search bar if required. Choose a subscription that fits your needs. Start using your credit card or PayPal. Pick a file format and download your document. After completing all the steps mentioned above, you will be able to fill out, print, and sign the Arkansas Notification of Termination of Mortgagee's Sale template. Remember to double-check all entered information for accuracy before submitting or mailing it. Reduce the time spent on document creation with US Legal Forms!

- If you have already obtained a US Legal Forms subscription, simply Log In to your profile and navigate back to the document section.

- Look for the Download button adjacent to the template you're examining.

- Once you download a document, all your stored samples will be accessible in the My documents tab.

- If you do not have a subscription, it is not a significant issue.

- Just follow the steps below to register for your online account, acquire, and complete your Arkansas Notification of Termination of Mortgagee's Sale template.

- Verify and make sure that you are obtaining the correct state-specific document.

Form popularity

FAQ

The redemption period in Arkansas is typically one year from the date of the foreclosure sale. During this time, you have the right to reclaim your property by paying off the total amount owed, including fees and costs. If you have filed an Arkansas Notice of Cancellation of Mortgagee's Sale, this period may also provide you some additional leverage. Understanding this timeframe aids you in planning your next steps.

In Arkansas, once a foreclosure is completed, you typically have 10 days to vacate the property. During this period, it's important to understand your rights and options, including filing an Arkansas Notice of Cancellation of Mortgagee's Sale if applicable. Staying informed can help you navigate this difficult time effectively. Always consider seeking legal advice to explore all possible avenues.

Typically, you can miss about three to four mortgage payments before facing foreclosure in Arkansas. Once you start missing payments, the lender may initiate the foreclosure process if the situation is not addressed. An Arkansas Notice of Cancellation of Mortgagee's Sale may help if you find yourself in this situation, allowing for potential solutions to avoid losing your home. It's wise to act quickly and consult with professionals to explore viable paths.

The 37-day foreclosure rule in Arkansas refers to the required notice period before a mortgagee's sale can occur. Lenders must inform homeowners about the impending sale at least 37 days prior, allowing them time to respond or seek assistance. This rule is critical for understanding how an Arkansas Notice of Cancellation of Mortgagee's Sale can play a role in your situation, as it provides an opportunity to navigate your options.

In Arkansas, the foreclosure process generally takes about six months. It begins with the lender sending a notice of default and progresses through various legal steps. Understanding the timeline is essential, especially if you are considering an Arkansas Notice of Cancellation of Mortgagee's Sale. You may want to explore options for postponing foreclosure to protect your investment and finances.

After redemption, which allows homeowners to reclaim their property by paying the full amount owed, several outcomes can occur. If the homeowner successfully redeems the property, they retain ownership and can continue residing there. However, if redemption does not happen within the designated period, the property may be sold at auction. It’s important to know about the Arkansas Notice of Cancellation of Mortgagee's Sale, as it can play a crucial role in this process.

Yes, Arkansas allows a redemption period after foreclosure, generally lasting one year. This means that homeowners can reclaim their property by paying the full amount of the mortgage plus costs. Knowledge of the Arkansas Notice of Cancellation of Mortgagee's Sale can be invaluable during this redemption period. It's wise to consult with legal or financial advisors to help navigate this process and explore all available options.

In a foreclosure, homeowners typically suffer the most due to the loss of their property and the associated emotional stress. Additionally, families may face financial challenges, such as damaged credit scores and decreased future borrowing ability. Understanding the implications of the Arkansas Notice of Cancellation of Mortgagee's Sale can provide critical insights into your situation. Support from community programs can also ease the burden during this time.

Foreclosure laws in Arkansas require lenders to follow a judicial process, meaning they must obtain court approval before selling a property. Homeowners have specific rights throughout this process, including the right to receive notifications. Familiarizing yourself with the legal framework, including the Arkansas Notice of Cancellation of Mortgagee's Sale, can empower homeowners. Consulting with a knowledgeable attorney can also ensure you understand your legal standing.

The foreclosure process in Arkansas primarily involves a court procedure, often initiated after the borrower defaults on their mortgage. This begins with the lender filing a lawsuit, after which a judgment is made. Once the sale is approved, the property is auctioned to the highest bidder. Homeowners should be aware of the Arkansas Notice of Cancellation of Mortgagee's Sale during this journey, as it details important rights.