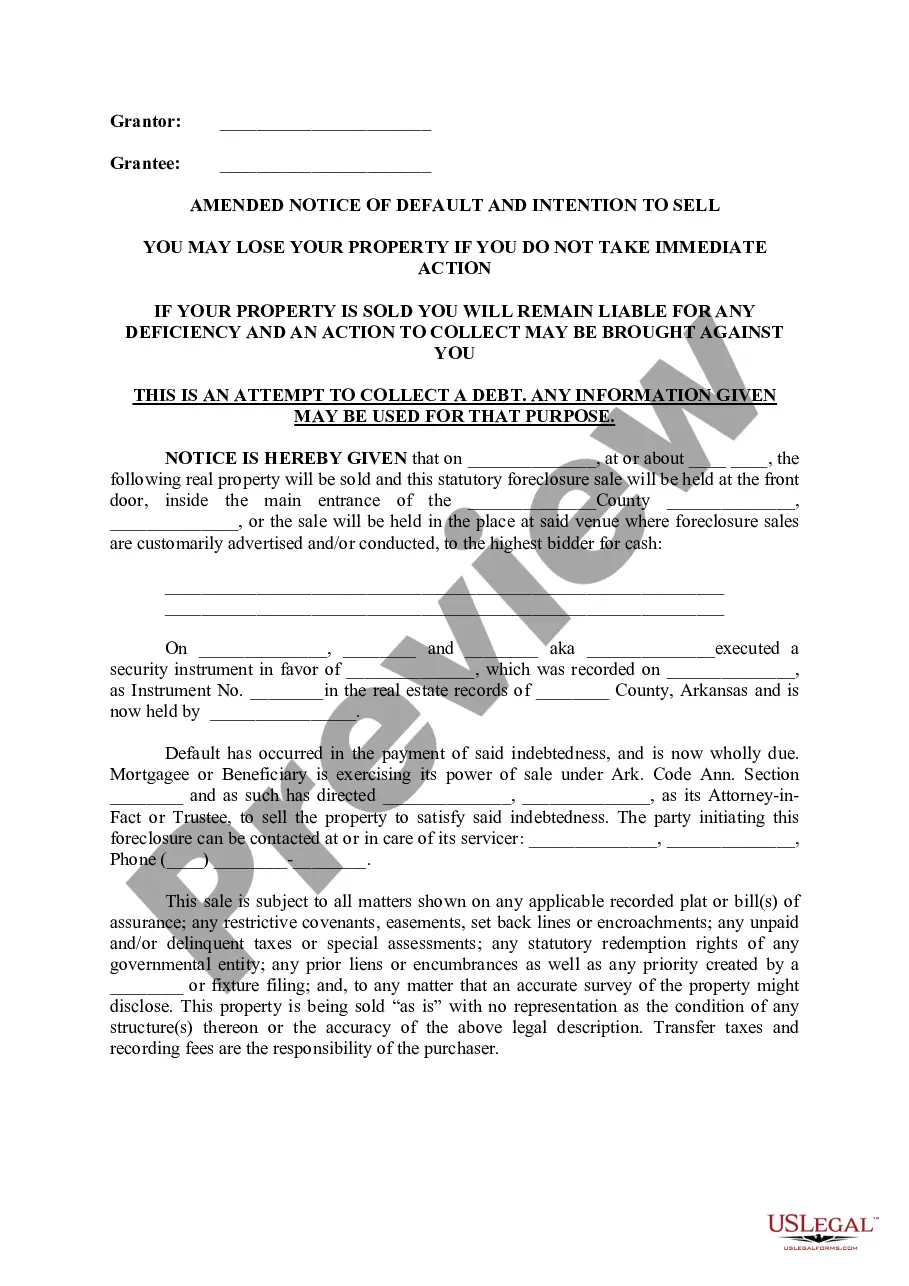

Arkansas Amended Notice of Default

Description

How to fill out Arkansas Amended Notice Of Default?

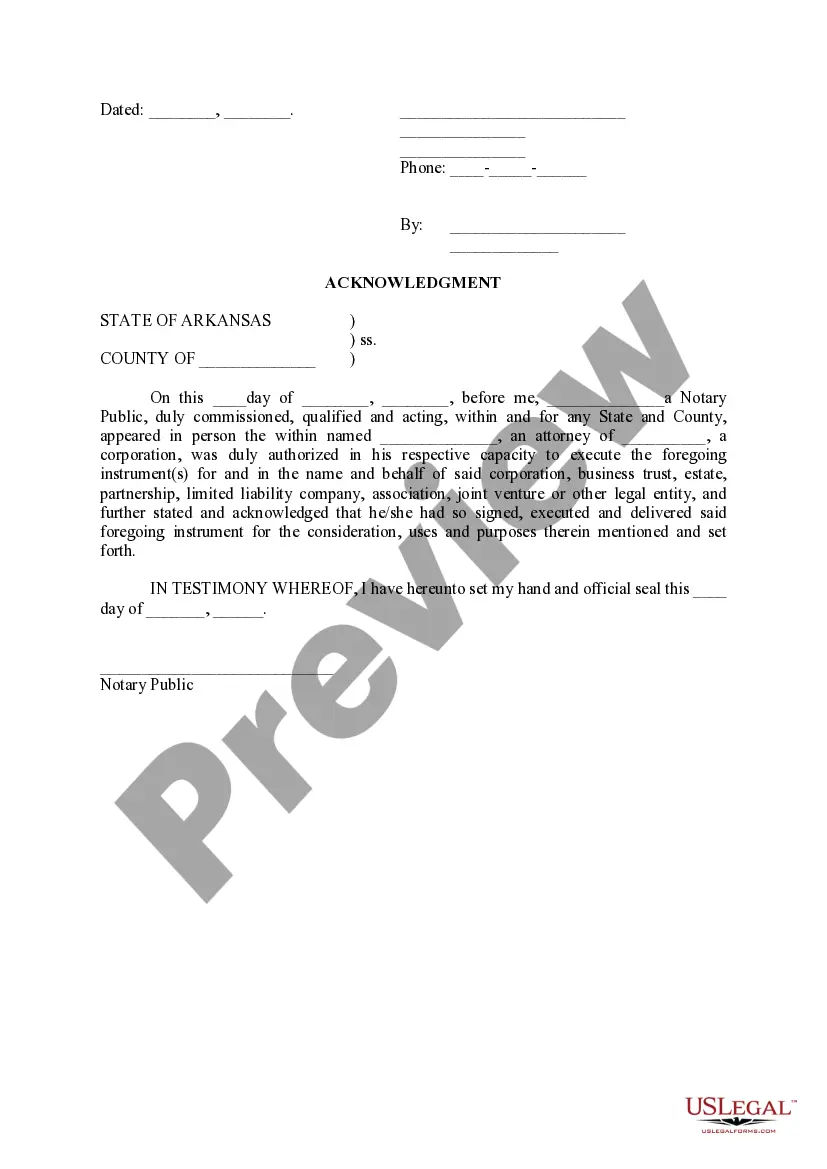

Utilizing Arkansas Amended Notice of Default samples crafted by professional attorneys helps you evade complications when filling out documents.

Simply download the template from our site, complete it, and request a lawyer to confirm it.

By doing this, you can conserve a lot more time and effort than seeking legal assistance to design a document entirely from scratch to meet your requirements.

Use the Preview function and examine the description (if available) to determine if you require this particular sample; if so, click Buy Now.

- If you’ve already purchased a US Legal Forms membership, just Log In/">Log In to your account and navigate back to the sample page.

- Locate the Download button next to the templates you are reviewing.

- After downloading a template, all your stored samples will be available in the My documents section.

- If you don’t have a subscription, it’s not a significant issue.

- Just follow these steps below to register for an account online, obtain, and complete your Arkansas Amended Notice of Default template.

- Confirm that you are downloading the correct state-specific form.

Form popularity

FAQ

Rule 55 C in Arkansas deals with default judgments and the process for vacating them. Under this rule, a party can request relief if they were not properly notified or if they can show good cause for their failure to respond. If you find yourself dealing with an Arkansas Amended Notice of Default, understanding Rule 55 C can provide options for reclaiming your standing in court.

In Arkansas, you typically have 30 days to respond to an amended complaint after it is served. This response period is crucial to ensure that you can contest any claims made against you. If you are facing an Arkansas Amended Notice of Default, it's important to adhere to this timeline to protect your legal position.

Rule 59 in Arkansas governs the motion for a new trial or to alter or amend a judgment. This rule is significant for parties who believe there has been an error during their trial. If you are working through an Arkansas Amended Notice of Default, this rule can offer a pathway to challenge the outcome based on perceived mistakes in the process.

Rule 60 in Arkansas provides grounds for relief from a judgment or order. It allows a party to seek to set aside a judgment due to reasons such as mistake, inadvertence, or fraud. When facing an Arkansas Amended Notice of Default, knowing Rule 60 can be crucial for contesting or navigating legal judgments effectively.

Rule 65 in Arkansas pertains to injunctions and restraining orders. It outlines the procedures for requesting these legal remedies in situations where a party needs immediate relief from harm. If you're dealing with an Arkansas Amended Notice of Default, understanding Rule 65 can help protect your rights during the legal process.

For sending your Arkansas income tax payment, you generally need to address it to the Revenue Division of the Arkansas Department of Finance and Administration. Always include your payment details and personal information to guarantee proper credit. If you are dealing with an Arkansas Amended Notice of Default, prompt payment can help you resolve any discrepancies swiftly and efficiently.

Yes, Arkansas accepts federal extensions for individuals; however, you must still file your state tax return by the extended due date. Ensure you submit any additional payments if necessary. In cases involving an Arkansas Amended Notice of Default, confirming your extension status can help clarify your obligations and prevent further issues.

Absolutely, you can e-file an amended return in Arkansas using authorized tax preparation software. E-filing simplifies the process and can lead to faster processing of your return. If you need to respond to an Arkansas Amended Notice of Default, using e-filing may provide you with quicker resolutions and confirmations.

Yes, if you meet the income thresholds set by the Arkansas Department of Finance and Administration, you will need to file a state tax return. Keep in mind that filing correctly helps you avoid complications, such as receiving an Arkansas Amended Notice of Default. Always check for the most current guidelines to ensure that you fulfill your obligations in Arkansas.

When mailing your 1099 form in Arkansas, it’s important to send it to the location outlined in the Arkansas tax filing instructions. Generally, you’ll need to address it to the Arkansas Department of Finance and Administration. Should you encounter an Arkansas Amended Notice of Default related to your 1099, it's best to consult the guidelines on what documents to include with your response.