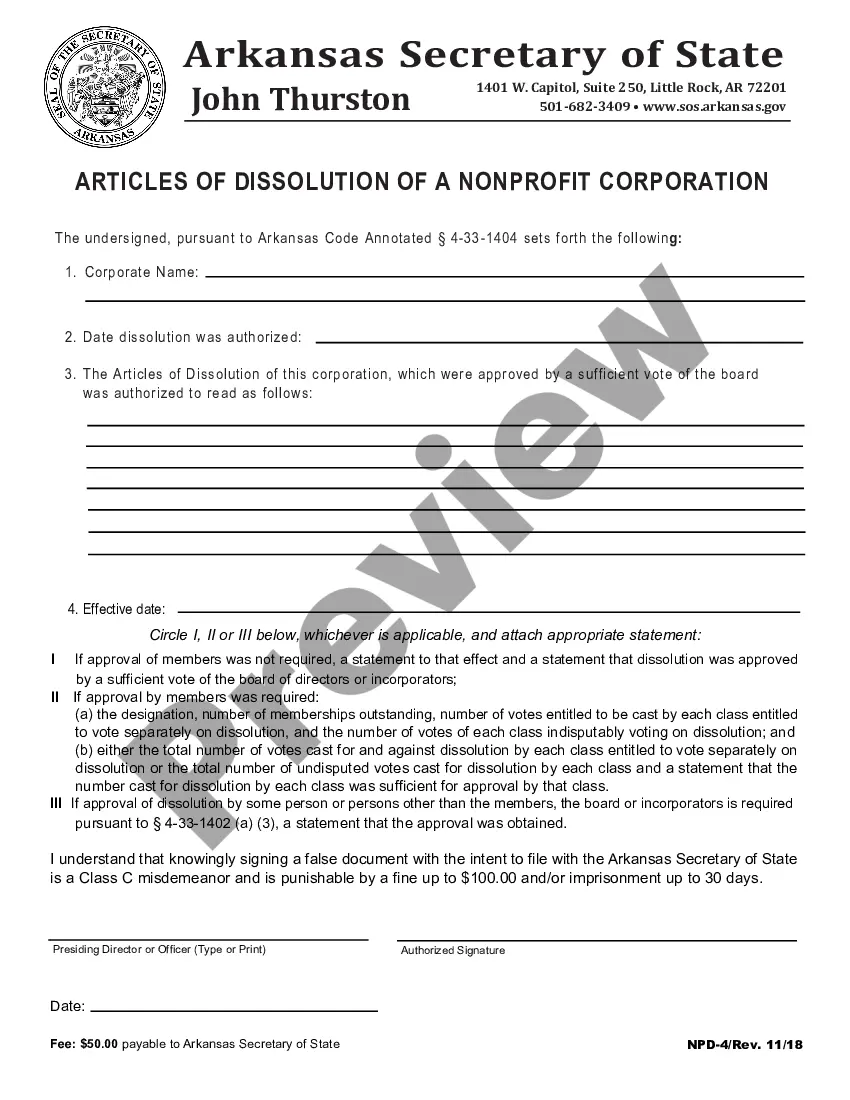

The Arkansas Certificate of Dissolution of a Non-Profit Corporation is a document that is filed with the Arkansas Secretary of State by non-profit corporations in the state of Arkansas in order to officially dissolve the organization. There are two types of Arkansas Certificate of Dissolution of a Non-Profit Corporation: the Standard Certificate of Dissolution, and the Short Form Certificate of Dissolution. The Standard Certificate of Dissolution requires the non-profit to provide information about the organization, including the name of the corporation, the date of the dissolution, and the address of the registered agent. The non-profit must also provide a statement of dissolution, signed by the president or vice president of the corporation. The Short Form Certificate of Dissolution is a shorter document than the Standard Certificate, but still requires the same information. The Short Form Certificate of Dissolution also requires the non-profit to provide a statement of dissolution, signed by the president or vice president of the corporation. Both the Standard and Short Form Certificates of Dissolution must be filed with the Arkansas Secretary of State in order for the dissolution of the non-profit to be official.

Arkansas Certificate Of Dissolution Of A Non-Profit Corporation

Description

Key Concepts & Definitions

Certificate of Dissolution of a Non-Profit: A legal document indicating that a non-profit organization has been formally dissolved. Dissolution Process: A series of steps taken to formally disband a non-profit, legally ending its existence. Financial Liabilities: Financial obligations that the non-profit must settle before dissolution. Final Return Notice: A notification to the appropriate agencies that a non-profit is filing its last tax returns.

Step-by-Step Guide to Dissolving a Non-Profit in New York

- Board Members Authorization: Obtain a vote from the board members to authorize the dissolution.

- Plan Dissolution Process: Develop a comprehensive plan for dissolving, including settling financial liabilities and distributing assets.

- Contact Information Request: Notify all relevant parties about the dissolution through proper contact channels.

- Organization Filing Process: File the certificate of dissolution with the New York State Department of State.

- Required File Annual: Submit any required annual returns prior to dissolution.

- Final Return Notice: File the final tax return to the IRS and state tax agencies.

Risk Analysis of Non-Profit Dissolution

- Legal Risks: Incomplete documentation or failure to notify creditors can lead to legal challenges.

- Financial Risks: Insufficient handling of financial liabilities may result in debts being passed to board members.

- Reputational Risks: Poorly managed dissolution could damage the reputation of board members and associated parties.

Best Practices in Non-Profit Dissolution

- Complete Transparency: Maintain transparency with stakeholders throughout the dissolution process.

- Detailed Record-Keeping: Keep detailed records of all dissolution activities to avoid legal repercussions.

- Prioritize Compliance: Ensure all legal and financial obligations are met before finalizing the dissolution.

How to fill out Arkansas Certificate Of Dissolution Of A Non-Profit Corporation?

If you are searching for a method to properly prepare the Arkansas Certificate of Dissolution of a Non-Profit Corporation without employing a legal advisor, then you are in the perfect location.

US Legal Forms has established itself as the most comprehensive and dependable repository of official templates for every personal and commercial situation. Each document you discover on our online platform is created in accordance with federal and state regulations, so you can be assured that your paperwork is in good standing.

Another remarkable feature of US Legal Forms is that you never misplace the documents you obtained - you can access any of your downloaded templates in the My documents tab of your account whenever you require it.

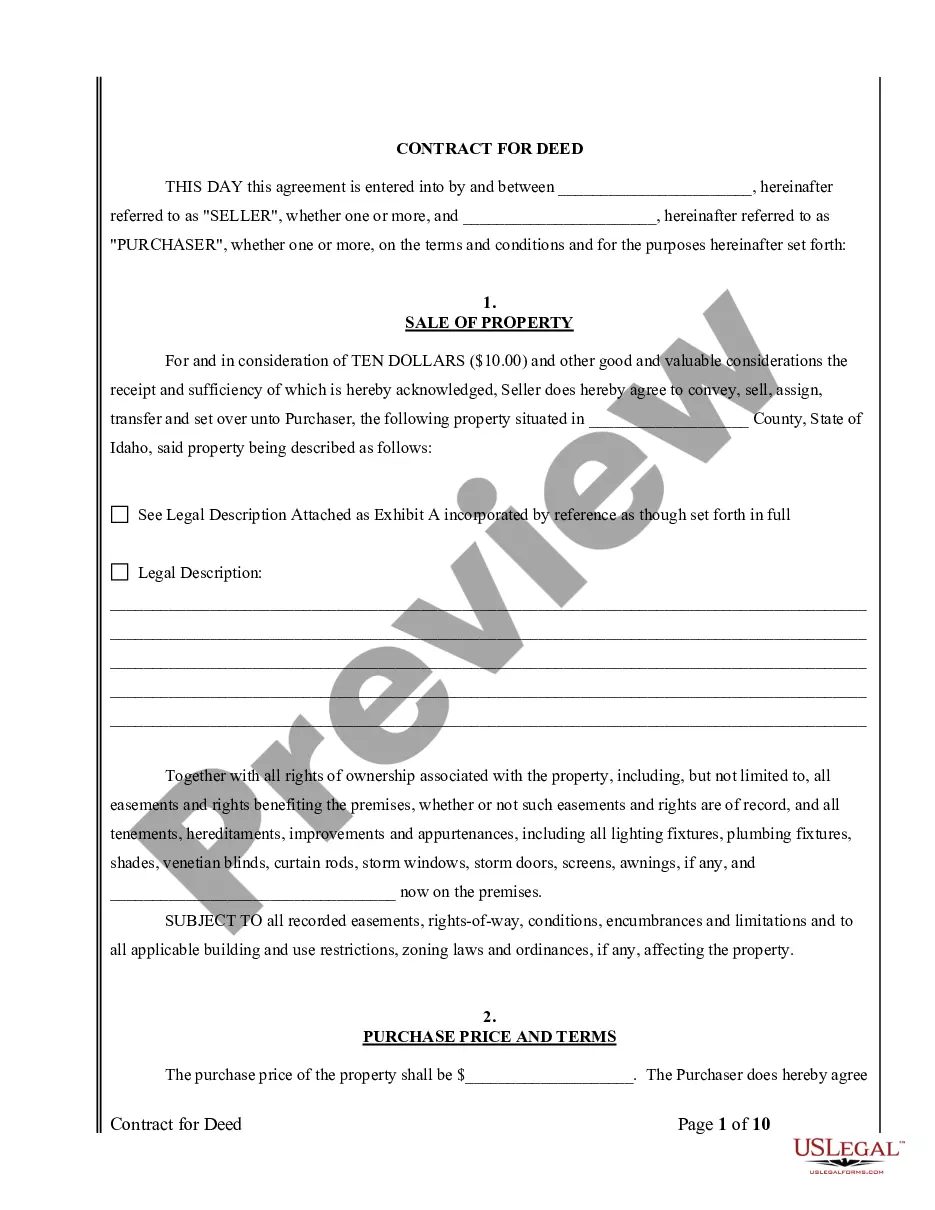

- Ensure the document displayed on the page aligns with your legal circumstances and state regulations by reviewing its textual description or examining the Preview mode.

- Input the form title into the Search tab at the top of the page and choose your state from the dropdown to find an alternative template if there are any discrepancies.

- Repeat the content verification and click Buy now when you are confident that the documentation meets all requirements.

- Sign in to your account and click Download. Register for the service and select a subscription plan if you do not have one yet.

- Utilize your credit card or the PayPal option to acquire your US Legal Forms subscription. The document will be accessible for download immediately after.

- Select the format you wish to receive your Arkansas Certificate of Dissolution of a Non-Profit Corporation in and download it by clicking the relevant button.

- Upload your template to an online editor for quick completion and signing or print it out to manually prepare your physical copy.

Form popularity

FAQ

The Arkansas Nonprofit Corporation Act of 19931 (hereinafter the "Act") creates a comprehensive corporate code which applies to all Arkansas nonprofit corporations incorporated after 1993.2 Nonprofits chartered before 1994 may elect to become subject to the provisions of the Act by amending their articles of

For federal tax purposes, you'll need to file IRS Form 990 or IRS Form 990-EZ. You must include a completed Schedule N (Liquidation, Termination, Dissolution, or Significant Disposition of Assets), as well as copies of your articles of dissolution, resolution to dissolve, and plan of dissolution.

Reinstatement / Revival for Corporations: Reinstating a corporation in Arkansas requires filing a reinstatement application with the Arkansas Secretary of State - Business and Commercial Services Division (BCS) and may require payment of penalty fees.

To dissolve your Arkansas corporation, submit a completed dissolution form to the Arkansas Secretary of State, Business and Commercial Services (BCS) by mail or in person. You cannot file Arkansas articles of dissolution online.

The Arkansas Nonprofit Corporation Act of 1993 governs nonprofit corporations incorporated on or after January 1, 1994 or those incorporated prior to that date that have elected to be governed under the 1993 Act in amendments to their articles of incorporations.

Choose who will be on the founding board of directors for your nonprofit corporation. In Arkansas, your nonprofit corporation must have three or more directors.

The 1987 Act establishes simple and flexible corporate character- istics and requires the affirmative election of restrictive characteris- tics. The 1965 Act is considerably more prescriptive as to corporate characteristics.

How To Start A Nonprofit In Arkansas Choose your AR nonprofit filing option. Complete the AR Articles of Incorporation. Get a Federal EIN from the IRS. Adopt your AR nonprofit's bylaws. Seek federal and/or state tax exemptions. Register for AR state tax accounts and licenses. Open a bank account for your AR nonprofit.